The New Mexico Charitable Contribution Payroll Deduction Form is a document used by employees in the state of New Mexico to make voluntary contributions to eligible charities through their payroll. This form allows employees to easily allocate a portion of their salary to support charitable organizations of their choice. By submitting this form, individuals can authorize their employer to deduct a specific amount from their paycheck on a regular basis, typically on a monthly or quarterly basis, to be donated directly to the charity or charities they specify. The New Mexico Charitable Contribution Payroll Deduction Form provides a convenient and efficient way for employees to contribute to a cause they care about. It streamlines the giving process by automating deductions, ensuring a consistent contribution schedule, and facilitating tax benefits for those who qualify. Different types of New Mexico Charitable Contribution Payroll Deduction Forms may include specific variations based on the type of charity or the specific campaign the employee wishes to contribute to. These forms may provide options for employees to donate to health-related charities, educational institutions, environmental organizations, social services agencies, or other eligible nonprofits operating within the state. By utilizing the New Mexico Charitable Contribution Payroll Deduction Form, employees can make a positive impact on their community and support causes that align with their values. This form encourages philanthropy and empowers individuals to contribute to organizations that tackle pressing societal issues, thereby fostering a culture of giving and social responsibility within the state.

New Mexico Charitable Contribution Payroll Deduction Form

Description

How to fill out New Mexico Charitable Contribution Payroll Deduction Form?

Are you inside a place where you need to have files for possibly enterprise or personal uses nearly every day? There are tons of legal record templates available on the net, but getting versions you can depend on is not straightforward. US Legal Forms provides 1000s of kind templates, just like the New Mexico Charitable Contribution Payroll Deduction Form, which are composed in order to meet state and federal demands.

If you are currently informed about US Legal Forms website and get your account, simply log in. Following that, you may acquire the New Mexico Charitable Contribution Payroll Deduction Form template.

Unless you come with an bank account and wish to begin using US Legal Forms, abide by these steps:

- Get the kind you need and make sure it is for the right city/region.

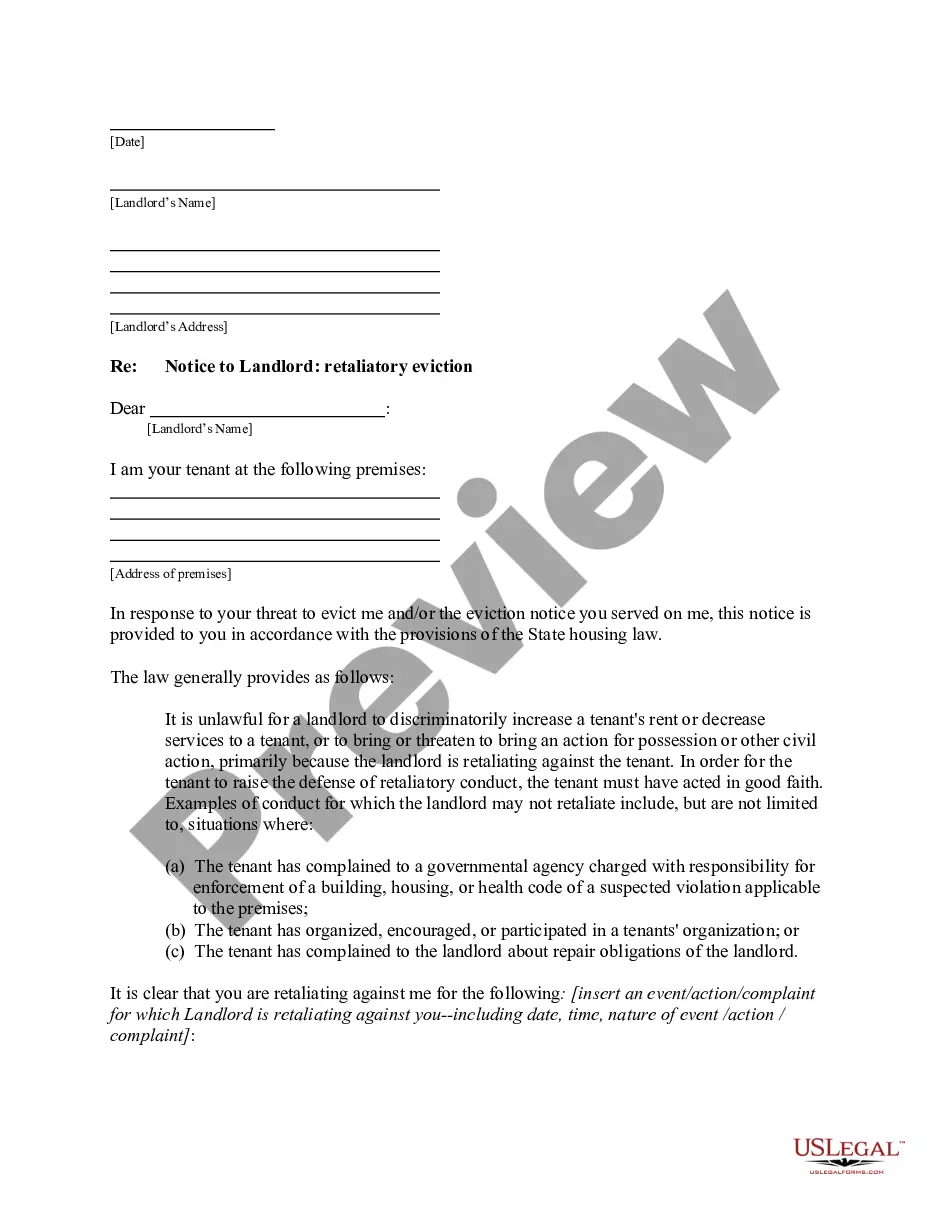

- Make use of the Review switch to examine the form.

- Browse the explanation to actually have selected the proper kind.

- If the kind is not what you`re looking for, use the Search area to discover the kind that suits you and demands.

- Whenever you find the right kind, click on Acquire now.

- Pick the rates strategy you need, submit the desired info to make your money, and pay money for an order with your PayPal or bank card.

- Pick a convenient file structure and acquire your version.

Locate every one of the record templates you have purchased in the My Forms food list. You can aquire a extra version of New Mexico Charitable Contribution Payroll Deduction Form whenever, if necessary. Just click the essential kind to acquire or print out the record template.

Use US Legal Forms, by far the most comprehensive variety of legal kinds, to save lots of some time and prevent mistakes. The services provides professionally produced legal record templates which you can use for a variety of uses. Make your account on US Legal Forms and initiate producing your life a little easier.