New Mexico Payroll Deduction - Special Services

Description

How to fill out Payroll Deduction - Special Services?

Are you currently in a position where you require documents for either business or personal use almost every day.

There are numerous legitimate document templates available online, but finding ones you can trust is not straightforward.

US Legal Forms provides thousands of form templates, such as the New Mexico Payroll Deduction - Special Services, which are designed to comply with federal and state regulations.

Access all the document templates you have purchased from the My documents section.

You can download another copy of the New Mexico Payroll Deduction - Special Services at any time, simply select the desired form to obtain or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Mexico Payroll Deduction - Special Services template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

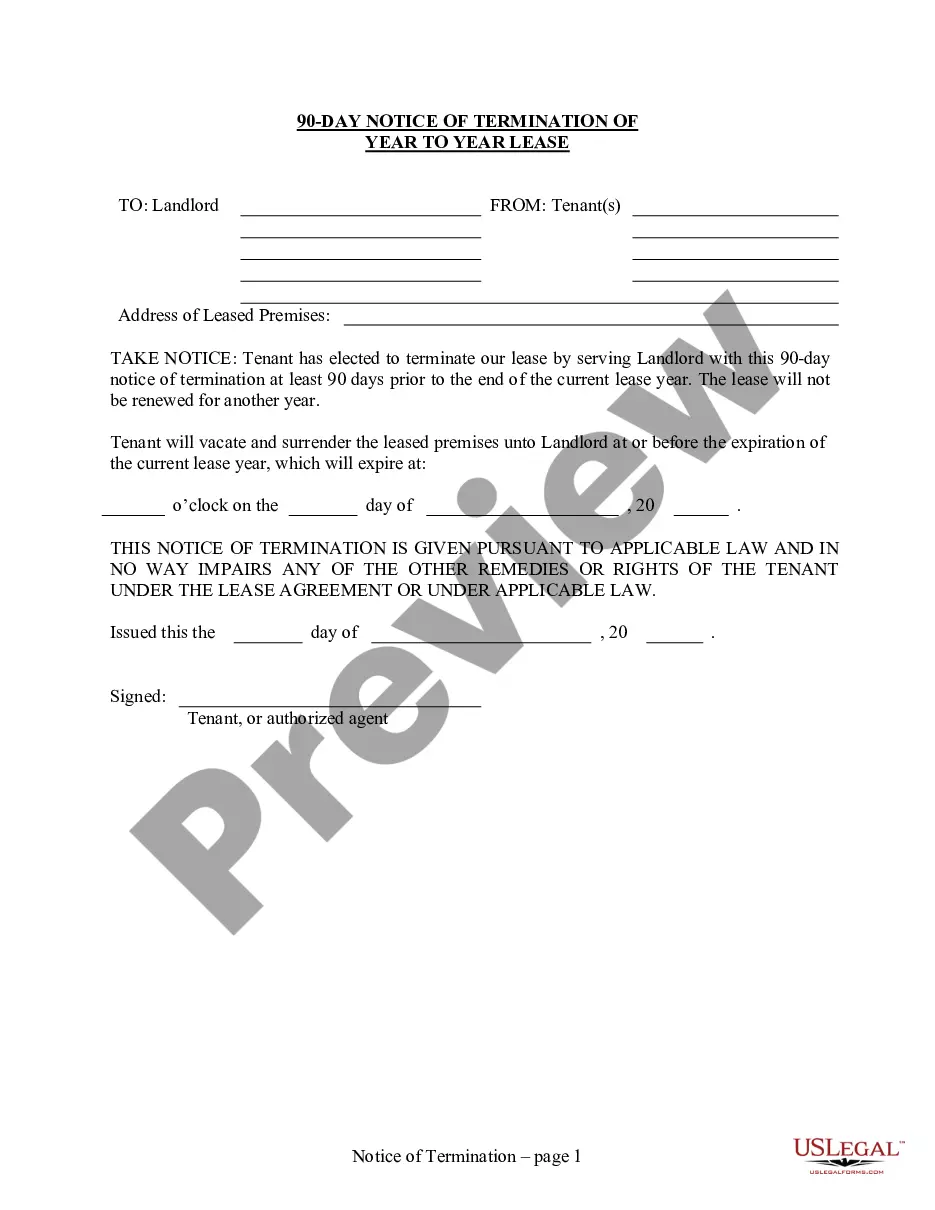

- Use the Preview option to review the form.

- Check the description to ensure you have selected the correct template.

- If the form is not what you are looking for, utilize the Search field to find the form that fits your needs.

- Once you find the correct form, click Get now.

- Choose the pricing plan you want, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- Select a preferred file format and download your copy.

Form popularity

FAQ

When the service is performed in New Mexico, it is taxable. In general, maintenance contracts are either taxable at the time of sale or taxable at the time of service.

Unlike many other states, sales and performances of most services are taxable in New Mexico.

Yes. Retail sales tax applies to a service contract or warranty sold to a consumer (WAC 458-20-257).

Sales of are subject to sales tax in New Mexico. Sales of parts purchased for use in performing service under optional maintenance contracts are exempt from the sales tax in New Mexico.

The tax is imposed on the gross receipts of businesses or people who sell property, perform services, lease or license property or license a franchise in New Mexico. The same goes for those who sell research and development services performed outside New Mexico when the resulting product is initially used here.

Traditional Goods or ServicesPrescription medicine, groceries, and gasoline are all tax-exempt. New Mexico is unique in the fact that the state requires gross receipts tax to be paid on all services.

Unlike many other states, sales and performances of most services are taxable in New Mexico.

Receipts subject to one of the following taxes are exempt from governmental gross receipts tax: gross receipts tax; compensating tax; motor vehicle excise tax; gasoline tax; special fuel supplier's tax; the oil and gas emergency school, severance, conservation and ad valorem taxes; resources tax; processors tax;