New Mexico Request for Vacation Extension

Description

How to fill out Request For Vacation Extension?

Are you presently within a position where you require documents for various company or specific reasons almost all the time.

Numerous legal form templates are accessible online, but finding ones you can trust isn't straightforward.

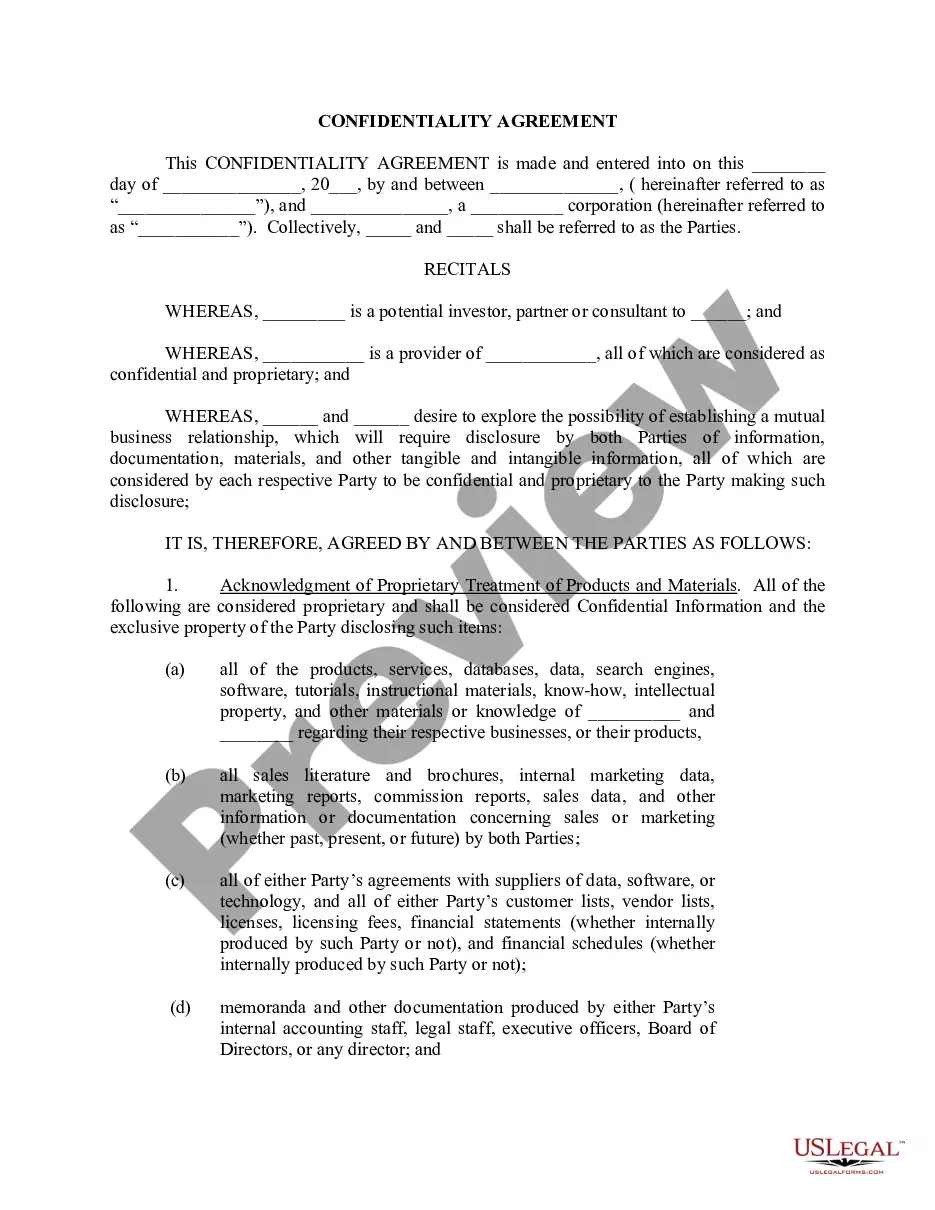

US Legal Forms provides thousands of form templates, including the New Mexico Request for Vacation Extension, which are designed to comply with federal and state regulations.

Once you find the right form, click on Buy now.

Choose your desired pricing plan, complete the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are familiar with the US Legal Forms website and already have an account, simply Log In.

- Afterward, you can obtain the New Mexico Request for Vacation Extension template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/county.

- Use the Review button to examine the form.

- Check the details to confirm that you have chosen the right form.

- If the form isn't what you are looking for, use the Search field to locate the form that meets your needs.

Form popularity

FAQ

New York does provide an automatic extension for taxpayers under certain conditions. While this extension allows additional time to file, it does not extend the deadline for paying any taxes owed. If you find yourself needing to manage multiple state tax deadlines, the New Mexico Request for Vacation Extension can help you navigate extensions correctly and avoid any late fees.

The qualifying eligibility categories for a 180-day automatic extension are A03, A05, A07, A08, A10, A17, A18, C08, C09, C10, C16, C20, C22, C24, C26, C31, and A12 or C19. The eligible categories are published on the USCIS; Automatic EAD Extension page.

The State of New Mexico recognizes the Federal personal tax extension (IRS Form 4868). Therefore, if you have a valid Federal extension, you will automatically be granted a corresponding New Mexico extension.

How to Receive an Additional Tax Extension for Your ReturnYou're a calendar year taxpayer, and.You complete and submit Form 4868. You can do this through a DIY tax software or online tax filing product, with a paper form, or with help from a tax professional.

It is not necessary to file a New Mexico Extension of time to file unless you need more time than the Federal Automatic Extension allows. If you wish to request an extension of time for filing a return, submit form RPD-41096, Application for Extension of Time to File.

If you cannot file on time, you can get a New Mexico tax extension. The State of New Mexico recognizes the Federal personal tax extension (IRS Form 4868). Therefore, if you have a valid Federal extension, you will automatically be granted a corresponding New Mexico extension.

If you have a 6-month Federal extension, New Mexico will automatically grant you a state tax extension for the same period of time which moves the New Mexico filing deadline to September 15 (for calendar year filers).

If you have a 6-month Federal extension, New Mexico will automatically grant you a state tax extension for the same period of time which moves the New Mexico filing deadline to September 15 (for calendar year filers).

Individual tax filers, regardless of income, can use Free File to electronically request an automatic tax-filing extension. Filing this form gives you until October 15 to file a return. If October 15 falls on a Saturday, Sunday, or legal holiday, the due date is delayed until the next business day.

It is not necessary to file a New Mexico Extension of time to file unless you need more time than the Federal Automatic Extension allows. An extension of time to file your return does NOT extend the time to pay. If tax is due, interest accrues from the original due date of the tax.