New Mexico Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

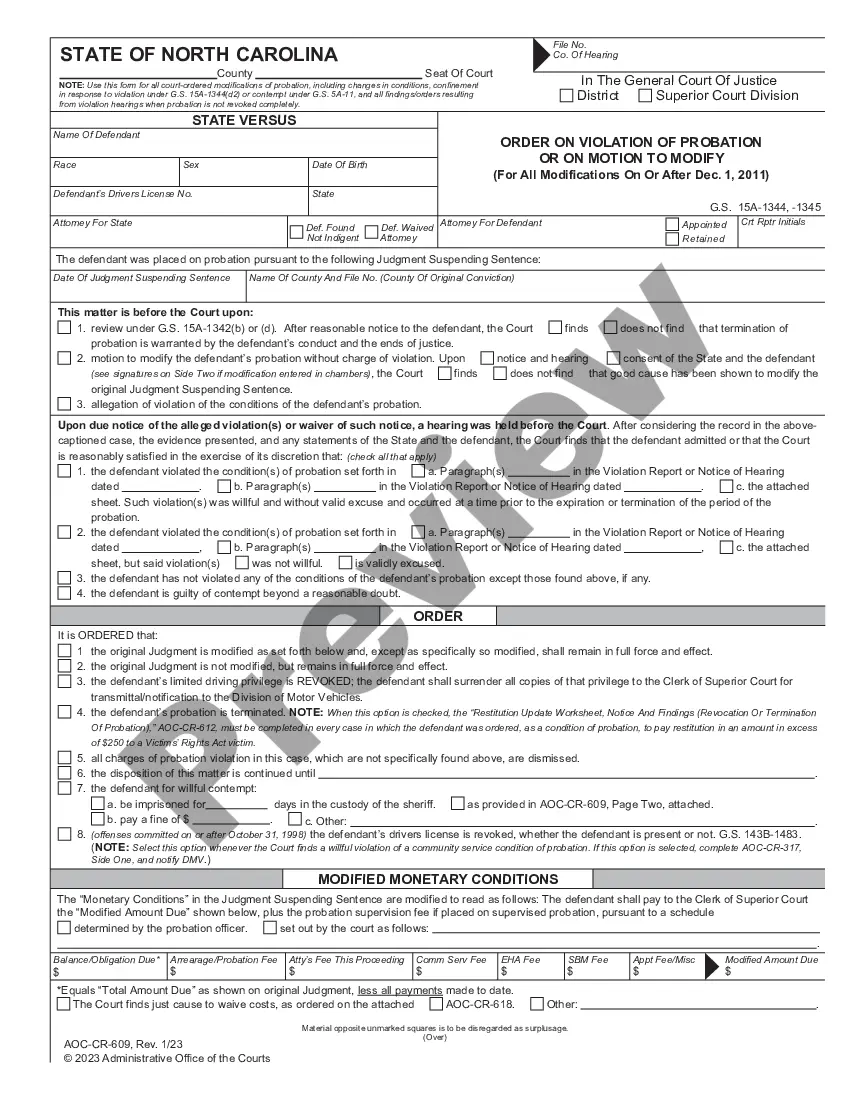

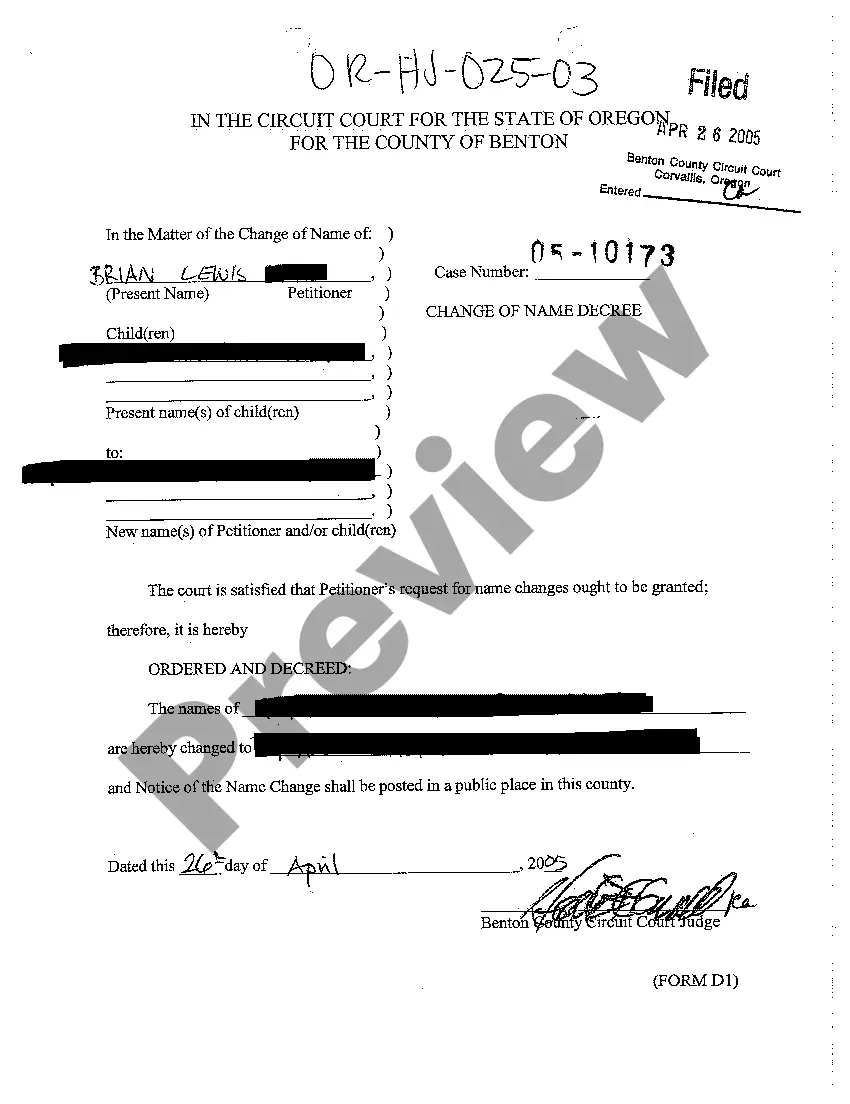

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

US Legal Forms - one of many largest libraries of legitimate kinds in America - gives a wide array of legitimate document web templates you can down load or printing. Making use of the web site, you may get 1000s of kinds for company and specific purposes, sorted by groups, suggests, or key phrases.You will discover the most up-to-date versions of kinds such as the New Mexico Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 within minutes.

If you currently have a monthly subscription, log in and down load New Mexico Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 in the US Legal Forms catalogue. The Obtain switch will show up on every single form you perspective. You have access to all in the past downloaded kinds within the My Forms tab of your accounts.

If you would like use US Legal Forms the very first time, here are easy recommendations to get you started off:

- Make sure you have chosen the correct form for the city/state. Click on the Preview switch to examine the form`s articles. See the form information to ensure that you have chosen the appropriate form.

- If the form does not satisfy your demands, make use of the Search area near the top of the display to find the one who does.

- In case you are happy with the form, validate your selection by simply clicking the Get now switch. Then, choose the costs strategy you like and give your accreditations to sign up to have an accounts.

- Procedure the transaction. Use your Visa or Mastercard or PayPal accounts to perform the transaction.

- Select the structure and down load the form on your system.

- Make changes. Load, edit and printing and sign the downloaded New Mexico Property Claimed as Exempt - Schedule C - Form 6C - Post 2005.

Every design you included with your bank account lacks an expiry particular date and it is your own property forever. So, if you wish to down load or printing yet another copy, just proceed to the My Forms portion and click on on the form you will need.

Gain access to the New Mexico Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 with US Legal Forms, the most considerable catalogue of legitimate document web templates. Use 1000s of skilled and express-particular web templates that satisfy your business or specific demands and demands.

Form popularity

FAQ

(Official Form 106C) lists the property that you believe you are entitled to keep. If you do not claim the property on this form, it will not be exempted, despite your rights under the law. Before filling out this form, you have to decide whether you will use your state exemptions or the federal exemptions.