New Mexico Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation

Description

How to fill out Agreement Of Merger Between Barber Oil Corporation And Stock Transfer Restriction Corporation?

Are you currently in a situation the place you need to have papers for possibly business or individual functions just about every working day? There are plenty of legal document templates available online, but locating versions you can trust is not easy. US Legal Forms gives a large number of type templates, like the New Mexico Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation, which can be published to satisfy federal and state needs.

In case you are previously familiar with US Legal Forms website and also have an account, basically log in. Next, you are able to download the New Mexico Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation design.

Should you not offer an account and would like to begin using US Legal Forms, abide by these steps:

- Find the type you want and make sure it is for that appropriate metropolis/state.

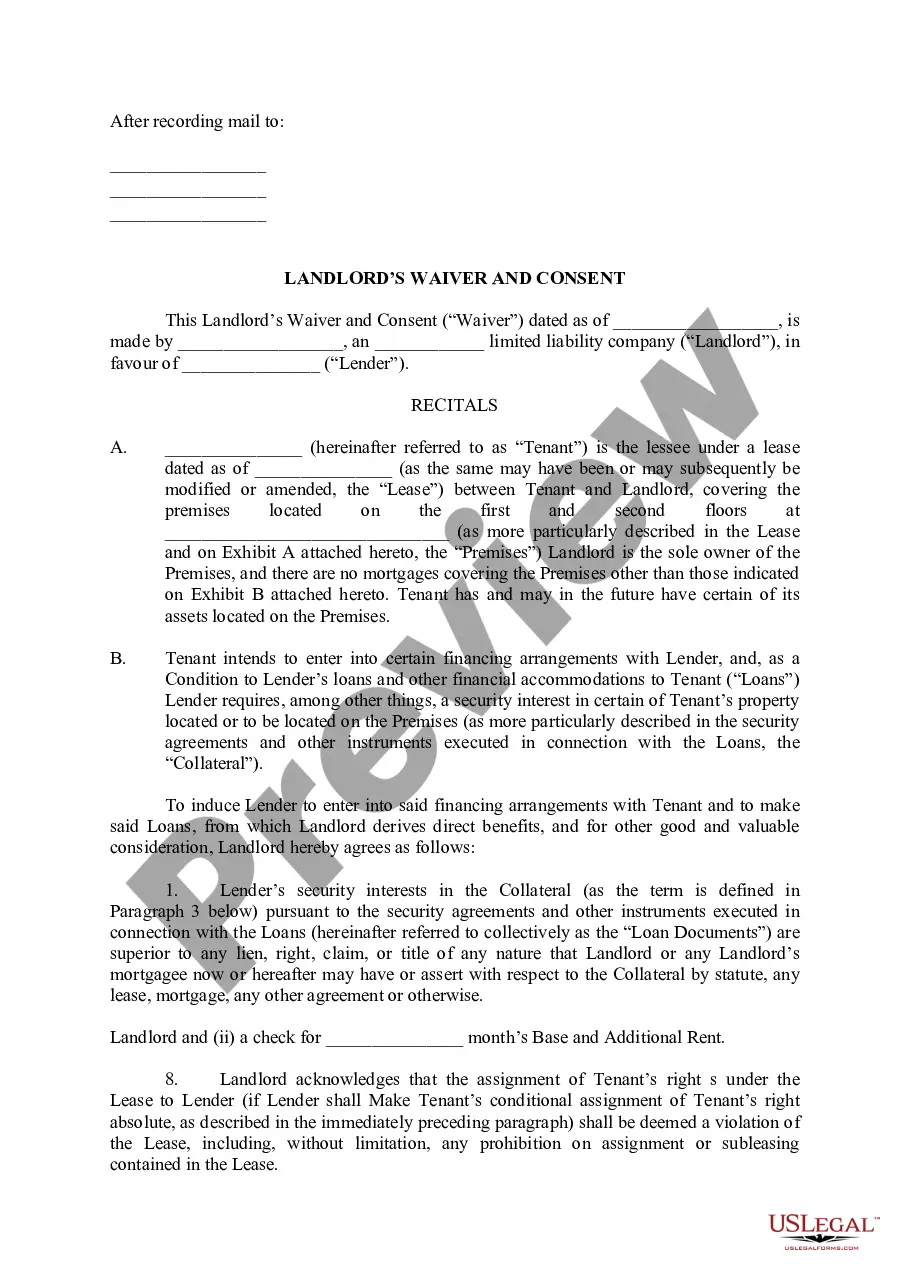

- Make use of the Review option to review the form.

- Browse the description to actually have chosen the correct type.

- In the event the type is not what you are looking for, take advantage of the Lookup area to find the type that fits your needs and needs.

- When you obtain the appropriate type, click on Get now.

- Select the costs plan you would like, submit the desired information and facts to create your money, and pay money for your order utilizing your PayPal or charge card.

- Decide on a practical file format and download your version.

Locate all of the document templates you have bought in the My Forms menu. You can obtain a additional version of New Mexico Agreement of Merger between Barber Oil Corporation and Stock Transfer Restriction Corporation at any time, if required. Just click the essential type to download or produce the document design.

Use US Legal Forms, the most comprehensive collection of legal forms, to conserve efforts and prevent faults. The services gives appropriately manufactured legal document templates which you can use for an array of functions. Produce an account on US Legal Forms and start creating your lifestyle easier.