New Mexico Option to Purchase Common Stock

Description

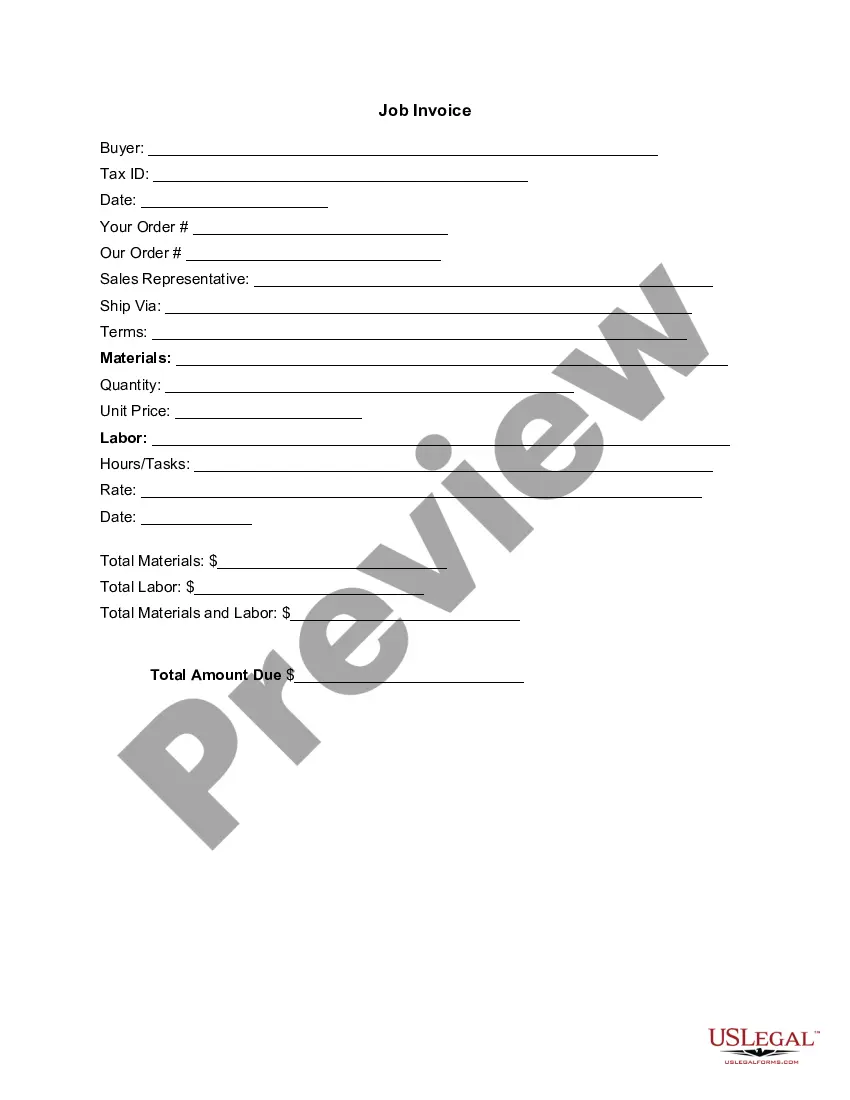

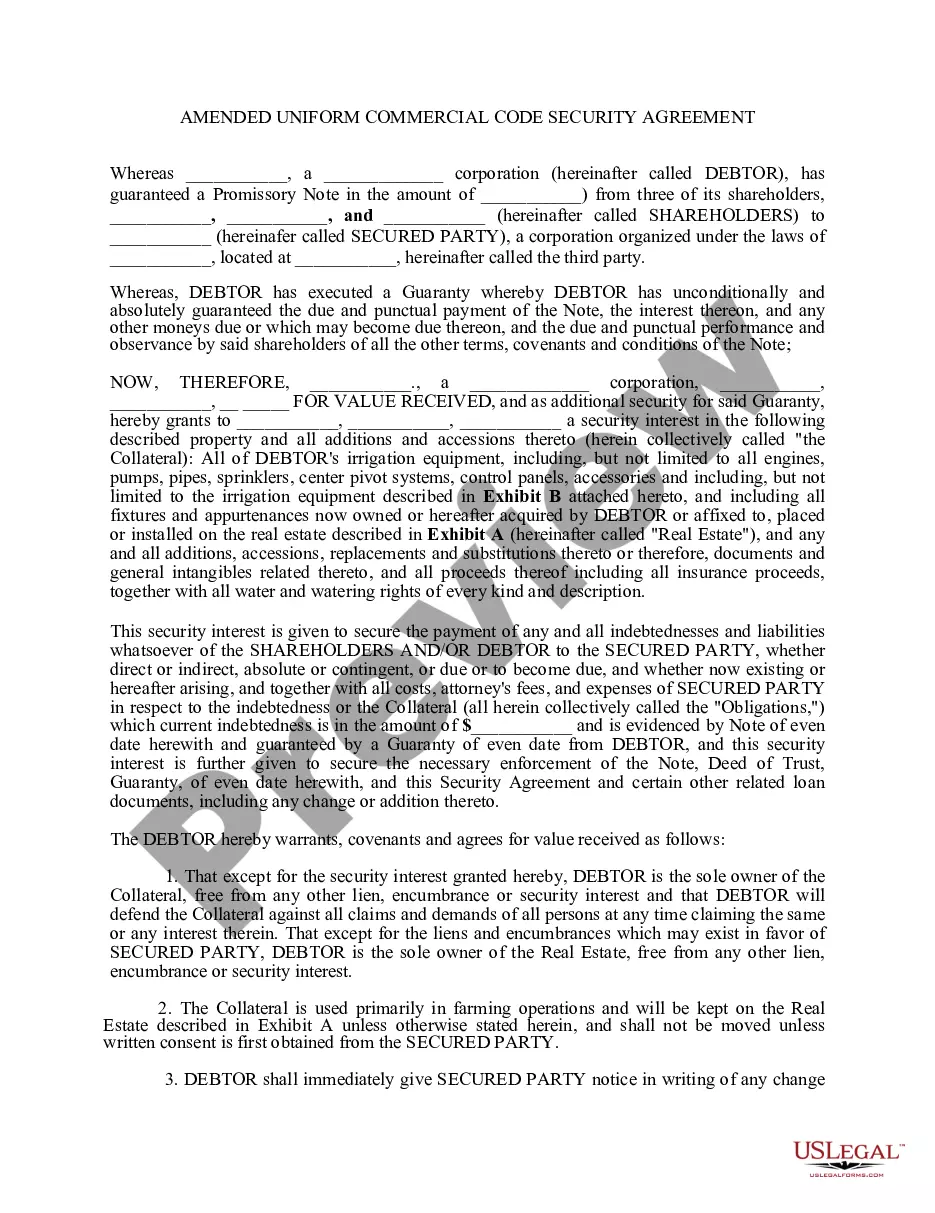

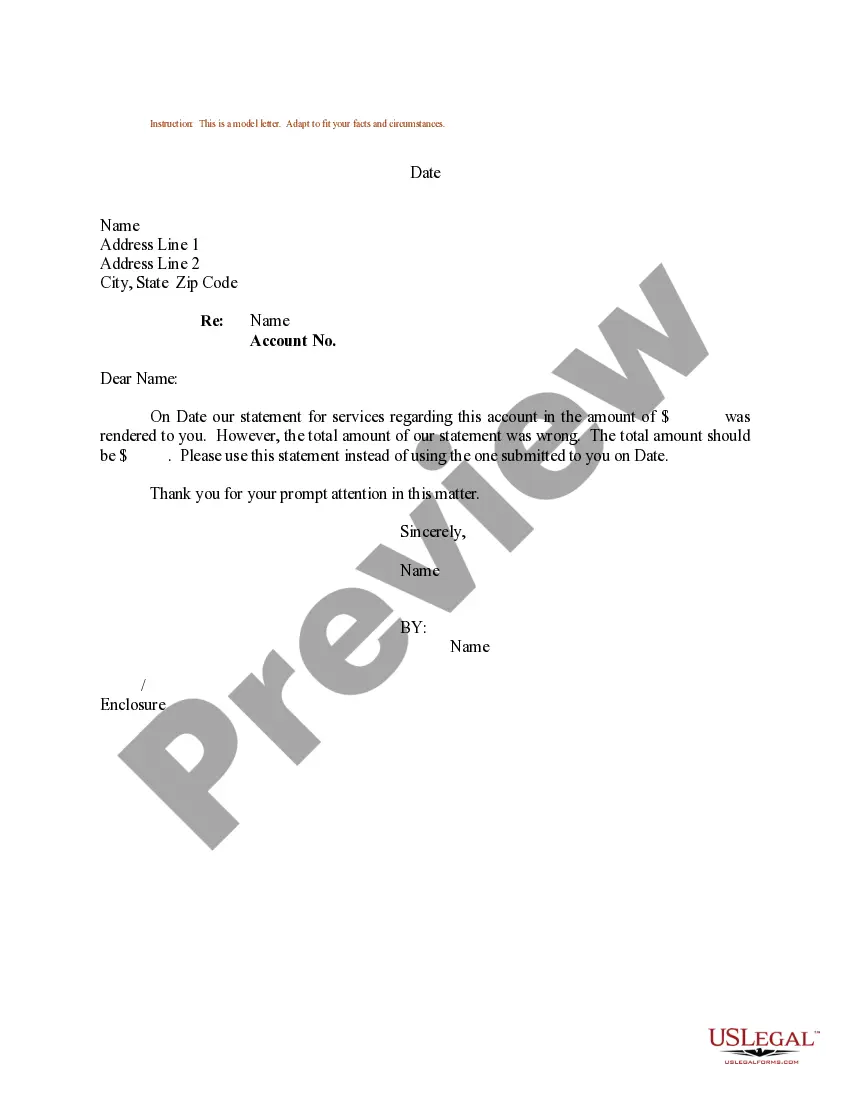

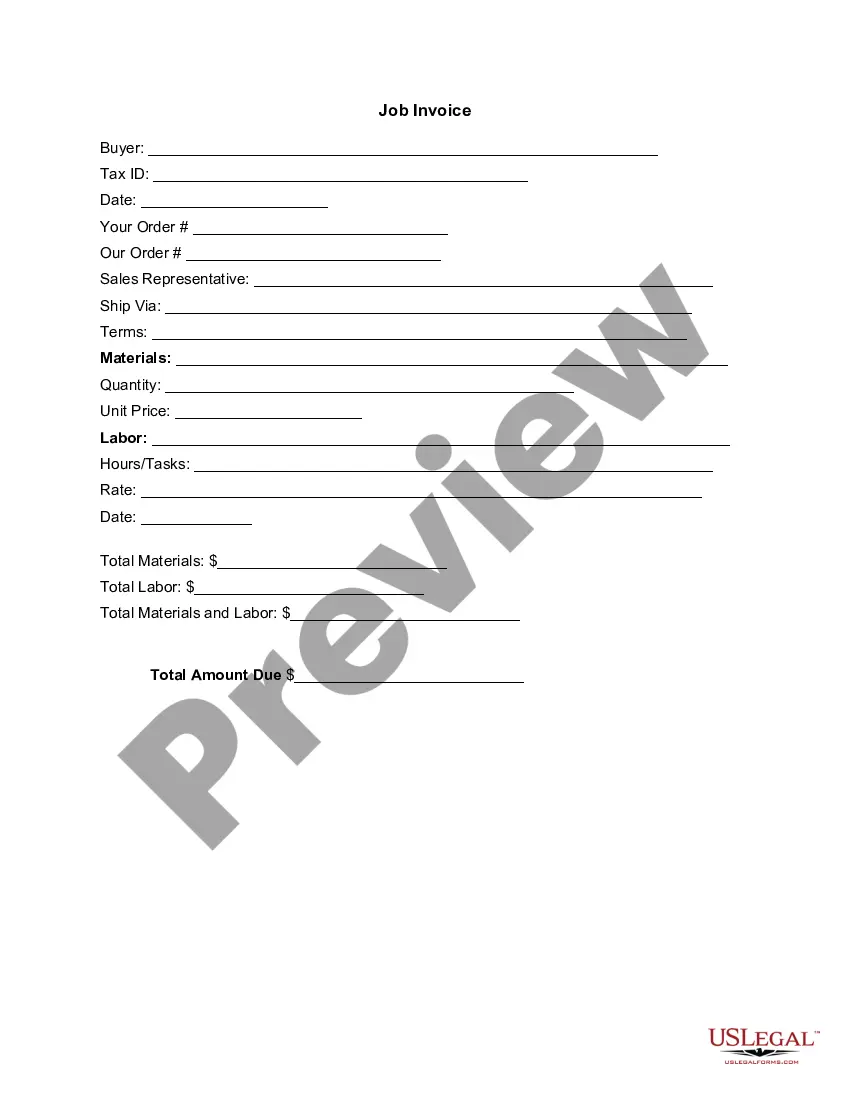

How to fill out Option To Purchase Common Stock?

US Legal Forms - among the biggest libraries of legal forms in the USA - gives an array of legal record layouts you are able to acquire or print out. Utilizing the website, you will get a large number of forms for enterprise and personal uses, categorized by classes, claims, or search phrases.You can get the most up-to-date variations of forms much like the New Mexico Option to Purchase Common Stock in seconds.

If you have a monthly subscription, log in and acquire New Mexico Option to Purchase Common Stock through the US Legal Forms library. The Download option can look on each form you view. You gain access to all in the past acquired forms within the My Forms tab of your respective bank account.

If you want to use US Legal Forms the first time, listed below are easy recommendations to get you started off:

- Make sure you have picked out the best form for the city/region. Click the Preview option to examine the form`s content material. Read the form explanation to ensure that you have chosen the right form.

- In the event the form does not suit your specifications, utilize the Look for area near the top of the screen to obtain the one which does.

- If you are pleased with the shape, confirm your selection by clicking on the Purchase now option. Then, pick the pricing plan you like and give your accreditations to register on an bank account.

- Method the deal. Use your Visa or Mastercard or PayPal bank account to accomplish the deal.

- Select the structure and acquire the shape in your product.

- Make changes. Fill out, revise and print out and indication the acquired New Mexico Option to Purchase Common Stock.

Each and every design you put into your bank account lacks an expiration day and is also the one you have for a long time. So, if you wish to acquire or print out another duplicate, just visit the My Forms section and then click about the form you require.

Get access to the New Mexico Option to Purchase Common Stock with US Legal Forms, by far the most substantial library of legal record layouts. Use a large number of professional and state-distinct layouts that fulfill your organization or personal needs and specifications.

Form popularity

FAQ

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

Common stock options are merely options to purchase stock at a later date in time. Specifically, options are those sold by one party to another party that allow the potential purchaser to exercise the right to buy the options at a previously agreed price.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

How to trade options in four steps Open an options trading account. Before you can start trading options, you'll have to prove you know what you're doing. ... Pick which options to buy or sell. ... Predict the option strike price. ... Determine the option time frame.

Stock options aren't actual shares of stock?they're the right to buy a set number of company shares at a fixed price, usually called a grant price, strike price, or exercise price. Because your purchase price stays the same, if the value of the stock goes up, you could make money on the difference.