New Mexico Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

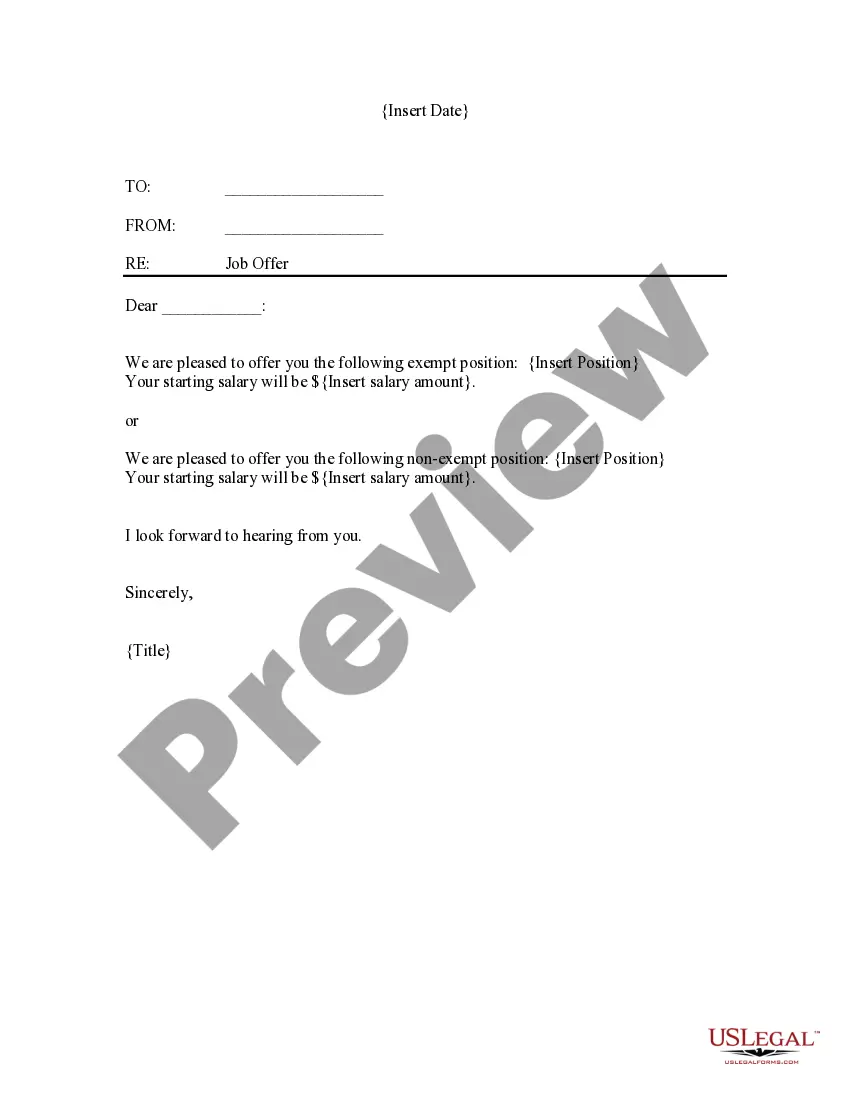

Choosing the right legal file design could be a have difficulties. Naturally, there are plenty of templates available on the Internet, but how do you discover the legal type you want? Make use of the US Legal Forms website. The assistance delivers a huge number of templates, for example the New Mexico Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights, which you can use for business and personal requires. All the varieties are checked out by experts and meet federal and state specifications.

Should you be presently signed up, log in to the account and click the Obtain key to find the New Mexico Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights. Utilize your account to search with the legal varieties you might have bought in the past. Proceed to the My Forms tab of your own account and have yet another backup of the file you want.

Should you be a fresh end user of US Legal Forms, listed below are basic recommendations so that you can comply with:

- Very first, ensure you have selected the proper type for your metropolis/state. It is possible to look over the shape utilizing the Review key and study the shape description to ensure it will be the best for you.

- When the type will not meet your needs, take advantage of the Seach discipline to discover the appropriate type.

- Once you are certain the shape is suitable, click the Purchase now key to find the type.

- Pick the prices prepare you desire and type in the required details. Make your account and purchase your order with your PayPal account or charge card.

- Select the document format and acquire the legal file design to the system.

- Complete, edit and print and indicator the acquired New Mexico Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights.

US Legal Forms is the greatest local library of legal varieties where you can discover a variety of file templates. Make use of the service to acquire appropriately-manufactured papers that comply with express specifications.

Form popularity

FAQ

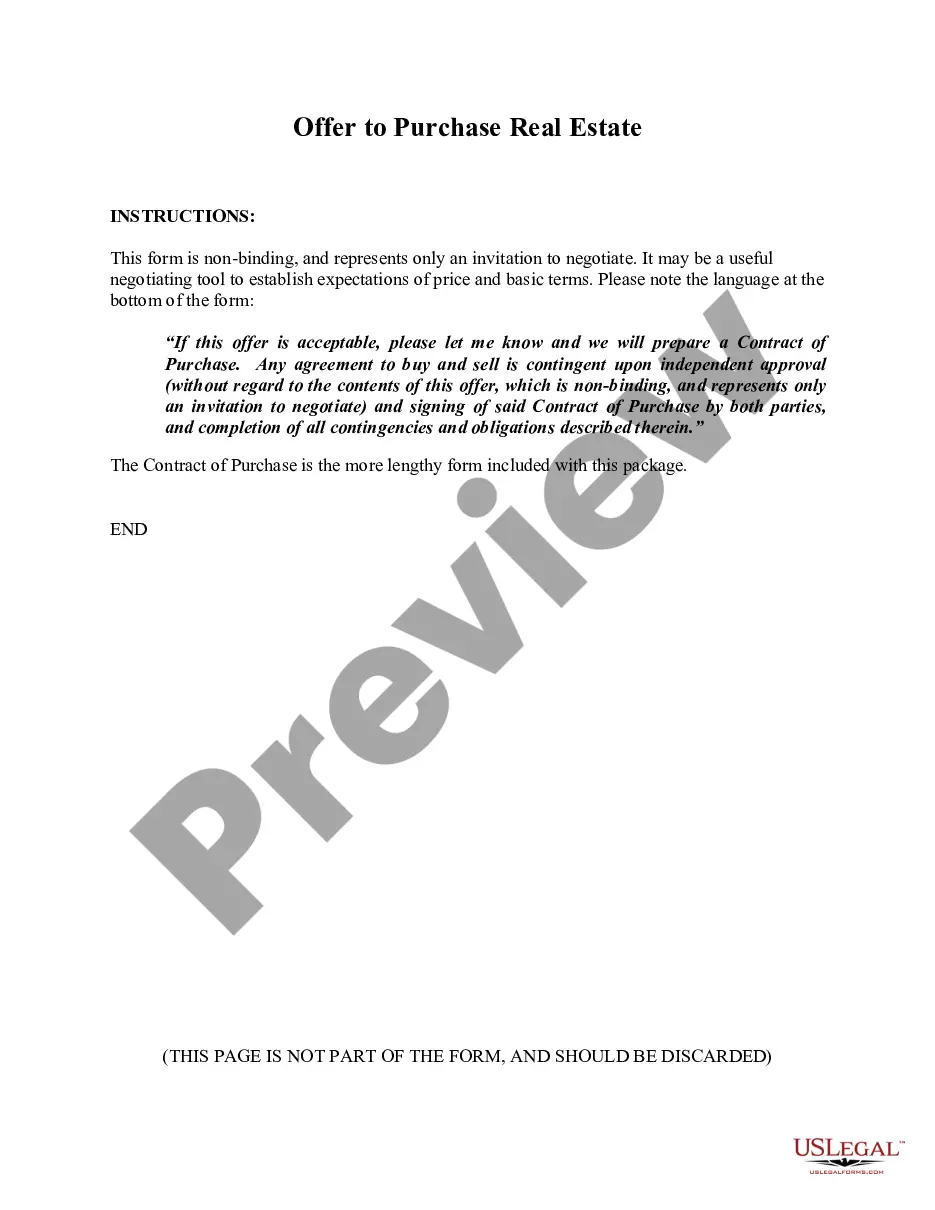

If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant. The earlier you understand your options and the financial implications of exercising, the sooner you can make smart financial decisions.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

Restricted stock awards represent actual ownership of stock and come with conditions on the timing of their sale. An employee benefits from stock options when they buy the stock at the exercise price and then sell it at a higher price.

qualified stock option (NSO) is a type of ESO that is taxed as ordinary income when exercised. In addition, some of the value of NSOs may be subject to earned income withholding tax as soon as they are exercised. 5 With ISOs, on the other hand, no reporting is necessary until the profit is realized.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

Incentive stock options, or ISOs, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain price, while receiving favorable tax treatment. ISOs are often awarded as part of an employee's hiring or promotion package.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

Those who receive stock grants can't sell their shares until a certain period of time, known as the vesting period. Shares that are received by using stock options can be resold at any time.