New Mexico Approval of Option Grant The New Mexico Approval of Option Grant refers to the process by which the state of New Mexico grants approval for companies or individuals to offer stock options to their employees or other individuals. This approval is an essential step in ensuring compliance with the state's laws and regulations regarding stock options. There are two main types of New Mexico Approval of Option Grant: 1. Employee Stock Option Plans (ESOP): Sops are a type of employee benefit plan that grants employees the right to purchase company stock at a predetermined price within a specific time frame. The New Mexico Approval of ESOP grants permission to administer such employee stock option plans within the state. 2. Non-Employee Stock Option Plans: These are stock option plans offered to non-employees, such as consultants, contractors, or advisors. The New Mexico Approval of Non-Employee Stock Option Grants allows companies to offer stock options to these individuals in compliance with state regulations. To obtain New Mexico Approval of Option Grant, companies or individuals seeking to offer stock options must go through a thorough application process. This process typically involves submitting detailed information about the stock option plan, including the terms, conditions, and underlying securities, to the appropriate regulatory authority in New Mexico. The application for New Mexico Approval of Option Grant may require the following information: 1. Company Information: Details about the company offering the stock options, including its legal name, contact information, and identification numbers. 2. Stock Option Plan Documentation: Comprehensive documentation describing the stock option plan, including the plan's purpose, eligibility criteria, vesting schedule, exercise price, expiration date, and other plan details. 3. Financial Information: Financial statements, such as balance sheets and income statements, may be required to ensure the financial stability of the company offering the stock options. 4. Securities Compliance: Compliance with federal and state securities laws and regulations, including filing appropriate forms with the Securities and Exchange Commission (SEC) and any necessary state agencies. 5. Legal Compliance: Demonstrating compliance with applicable employment laws, tax laws, and regulations regarding stock option plans within New Mexico. Once the application is submitted, the regulatory authority will review the materials and evaluate the proposed stock option plan. The approval process may involve clarifications, additional documentation requests, or negotiations to ensure compliance with state laws. It is crucial for companies or individuals seeking New Mexico Approval of Option Grant to consult legal and tax professionals with expertise in stock option regulation to navigate the complex application process smoothly. Failing to obtain the necessary approval for offering stock options could result in penalties, legal complications, and potential disruption to business operations in New Mexico.

New Mexico Approval of option grant

Description

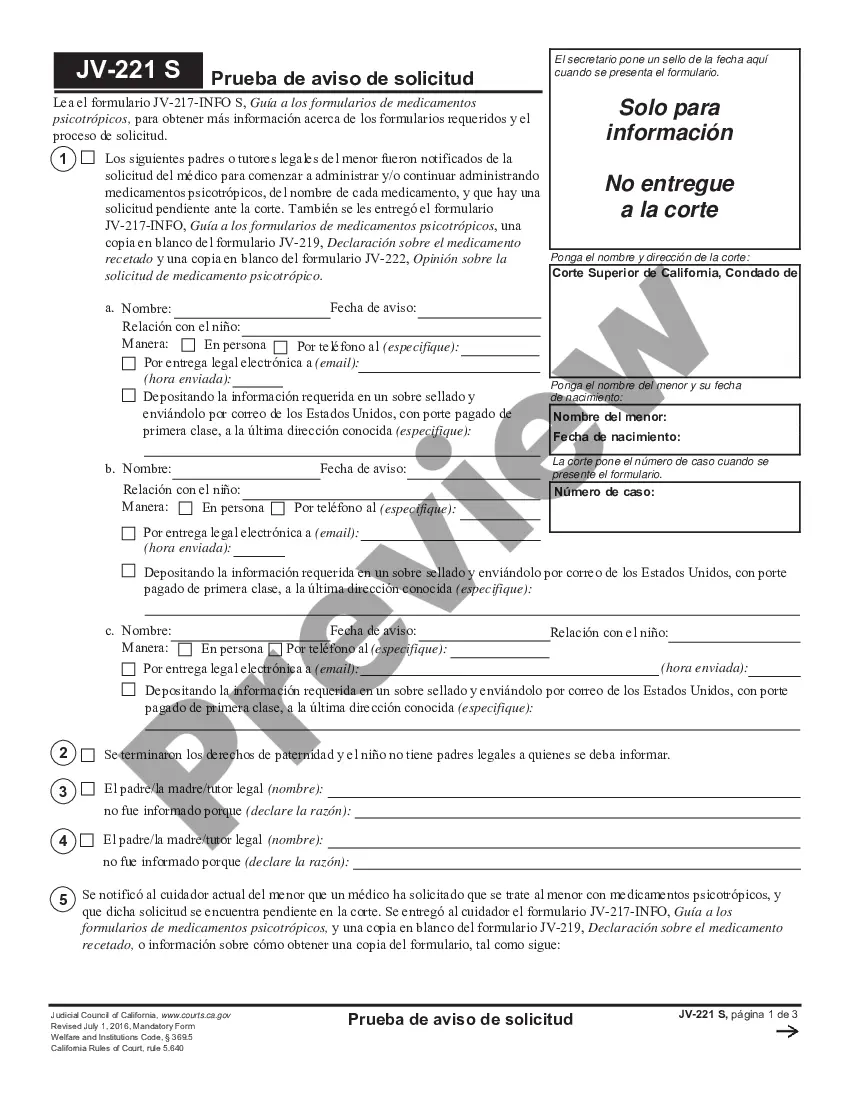

How to fill out New Mexico Approval Of Option Grant?

US Legal Forms - one of several greatest libraries of lawful varieties in the States - delivers an array of lawful record web templates you can acquire or print out. While using site, you can find 1000s of varieties for business and specific purposes, categorized by types, states, or keywords.You can find the most recent types of varieties such as the New Mexico Approval of option grant within minutes.

If you have a monthly subscription, log in and acquire New Mexico Approval of option grant from the US Legal Forms library. The Acquire button can look on every kind you view. You get access to all earlier acquired varieties from the My Forms tab of your profile.

If you wish to use US Legal Forms the very first time, listed here are straightforward guidelines to help you get started:

- Make sure you have selected the correct kind for your area/region. Go through the Preview button to check the form`s articles. Look at the kind explanation to ensure that you have chosen the appropriate kind.

- If the kind doesn`t satisfy your requirements, use the Research industry on top of the display to discover the one that does.

- If you are content with the form, affirm your option by clicking on the Purchase now button. Then, select the costs plan you prefer and supply your qualifications to register for an profile.

- Procedure the transaction. Make use of credit card or PayPal profile to accomplish the transaction.

- Select the file format and acquire the form on your system.

- Make alterations. Fill up, edit and print out and indication the acquired New Mexico Approval of option grant.

Each and every template you put into your account does not have an expiry time and is yours permanently. So, if you wish to acquire or print out another version, just go to the My Forms segment and then click around the kind you want.

Gain access to the New Mexico Approval of option grant with US Legal Forms, by far the most substantial library of lawful record web templates. Use 1000s of skilled and state-particular web templates that meet up with your organization or specific needs and requirements.

Form popularity

FAQ

To qualify for this financial payment individuals must be extremely low-income residents of New Mexico and are required to have a social security number or an Individual Tax Identification Number (ITIN). Payments were issued this week by the Taxation and Revenue Department via direct deposit or check.

While most New Mexicans received tax rebates and multiple economic relief payments between May and August this year, this latest program is only available for low-income households. ing to HSD, payments of up to $400 will be provided. The money will be prioritized for qualified households with the lowest income.

The state Taxation and Revenue Department will send $500 rebate checks to single filers and $1000 rebate checks to couples filing jointly. Who qualifies for a rebate? All New Mexico residents who filed a 2021 state income tax return and who were not declared as a dependent will receive the rebates automatically.

No application is required. Rebate checks will be printed and mailed at least through the end of June 2023. Those receiving direct deposits should receive them the week of June 19. Eligible residents have until to file the 2021 PIT return if they have not already done so.

Rebate checks will be printed and mailed to qualifiers through the end of June 2023, with those receiving direct deposits getting it by June 19. Relief payments of $500 or $1000 for New Mexicans who do not qualify for the above rebates has also been made available.

The New Mexico Homeowner Assistance Fund (HAF) program will provide housing grants to income-eligible households experiencing financial hardship associated with the COVID-19 health crisis.

State tax rebates are not uncommon and New Mexico is just one state sending so-called "stimulus" checks in 2023. For example, Minnesota recently approved tax rebates for eligible residents this year, and more than twenty states sent rebates and inflation relief payments to eligible residents last year.

Economic relief payments for low-income New Mexicans were approved by the Legislature and signed into law by Gov. Michelle Lujan Grisham during the 2023 legislative session. The one-time payment is for qualified New Mexico households who applied and have the lowest incomes.