Title: Understanding New Mexico Ratification of Stock Bonus Plan of First West Chester Corp. Keywords: New Mexico, ratification, stock bonus plan, First West Chester Corp., types Introduction: In New Mexico, the ratification of stock bonus plans by companies such as First West Chester Corp. carries significant importance for both employees and employers. These plans enable companies to reward their employees with company stocks, offering them a stake in the firm's success. This article explores the details of New Mexico's ratification process for stock bonus plans, focusing on First West Chester Corp. and highlighting potential variations in such plans. 1. The Importance of Ratification: Under New Mexico law, companies like First West Chester Corp. must go through a formal ratification process when implementing stock bonus plans. Ratification provides legal confirmation and protection for both parties involved, ensuring compliance with state regulations and verifying the plan's terms and conditions. 2. Stock Bonus Plans Explained: Stock bonus plans, also known as employee stock bonus schemes, allow companies to distribute company stocks to their employees as a form of compensation or incentive. These plans foster employee loyalty, incentivize performance, and align employees' interests with those of the company. By offering employees a tangible share in the company's growth, stock bonus plans can boost morale and productivity. 3. Procedure for Ratification: To ratify a stock bonus plan in New Mexico, First West Chester Corp. or any other company must follow a specific procedure. This usually involves obtaining necessary board approvals, drafting a formal plan document in compliance with state laws, and seeking approval from shareholders. The plan document should outline the eligibility criteria, vesting schedule, valuation methods, and any imposed restrictions. 4. Importance of Compliance: Compliance with New Mexico's regulations is vital for the successful ratification and execution of the stock bonus plan. The plan must adhere to state and federal securities laws, anti-discrimination laws, and tax requirements to prevent any legal issues or penalties. 5. Vesting and Distribution Options: First West Chester Corp. may consider different variations of stock bonus plans when ratifying, depending on its objectives, business structure, and employee demographics. Common types include immediate vesting plans, graded vesting plans, and cliff vesting plans. Companies have the flexibility to choose the best option that suits their specific circumstances. 6. Tax Considerations: When implementing a stock bonus plan, New Mexico employers must consider tax implications for both the company and the employees. Employees receiving stock bonuses may be subject to tax liabilities upon receipt, while the company could face tax deductions or other benefits. Consulting with legal and tax professionals is crucial to ensure compliance and understand the financial impact of the plan. Conclusion: The ratification of stock bonus plans in New Mexico, including those of First West Chester Corp., provides opportunities for companies to motivate their employees, foster loyalty, and align interests. Understanding the intricacies of New Mexico's ratification process and considering variations in stock bonus plan types can help companies strategize the most effective program to enhance their workforce's commitment and engagement.

New Mexico Ratification of stock bonus plan of First West Chester Corp.

Description

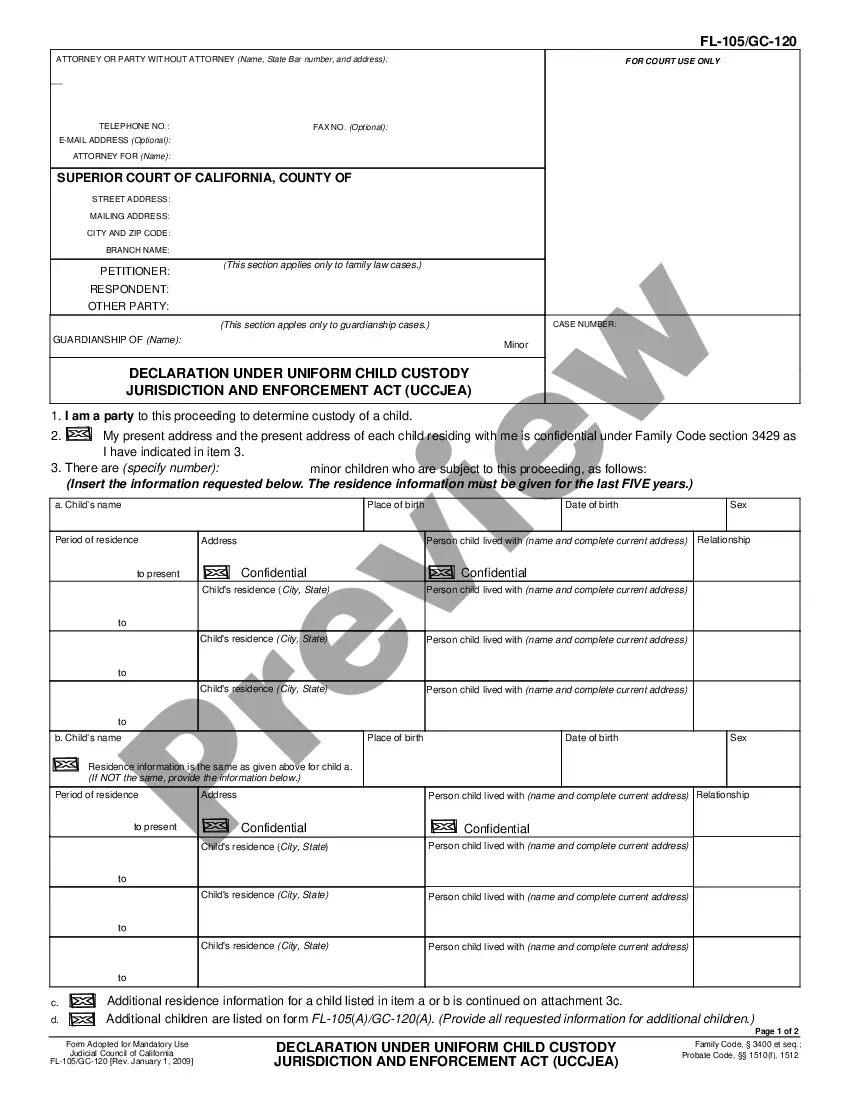

How to fill out New Mexico Ratification Of Stock Bonus Plan Of First West Chester Corp.?

You are able to commit several hours on the Internet trying to find the legitimate papers design that suits the federal and state specifications you will need. US Legal Forms offers thousands of legitimate forms that are analyzed by experts. You can actually obtain or produce the New Mexico Ratification of stock bonus plan of First West Chester Corp. from the support.

If you currently have a US Legal Forms account, it is possible to log in and click on the Download key. Following that, it is possible to complete, modify, produce, or signal the New Mexico Ratification of stock bonus plan of First West Chester Corp.. Each and every legitimate papers design you buy is the one you have for a long time. To get yet another copy of any obtained develop, proceed to the My Forms tab and click on the corresponding key.

If you work with the US Legal Forms internet site for the first time, adhere to the simple recommendations listed below:

- Very first, ensure that you have selected the right papers design to the region/city of your choice. Browse the develop outline to make sure you have selected the correct develop. If available, make use of the Preview key to search with the papers design also.

- If you wish to locate yet another edition in the develop, make use of the Lookup discipline to obtain the design that fits your needs and specifications.

- Upon having identified the design you desire, click Get now to move forward.

- Select the costs prepare you desire, enter your credentials, and sign up for a free account on US Legal Forms.

- Total the deal. You may use your Visa or Mastercard or PayPal account to purchase the legitimate develop.

- Select the structure in the papers and obtain it to the product.

- Make changes to the papers if required. You are able to complete, modify and signal and produce New Mexico Ratification of stock bonus plan of First West Chester Corp..

Download and produce thousands of papers templates while using US Legal Forms Internet site, that provides the biggest selection of legitimate forms. Use specialist and condition-distinct templates to tackle your company or personal needs.