New Mexico Retirement Benefits Plan

Description

How to fill out Retirement Benefits Plan?

Have you been inside a situation in which you require papers for possibly organization or specific reasons virtually every time? There are a lot of legal file templates available on the Internet, but getting types you can trust isn`t easy. US Legal Forms offers a large number of form templates, such as the New Mexico Retirement Benefits Plan, that are created in order to meet state and federal requirements.

If you are previously informed about US Legal Forms site and also have your account, just log in. Next, you may obtain the New Mexico Retirement Benefits Plan web template.

Should you not come with an accounts and want to start using US Legal Forms, adopt these measures:

- Obtain the form you require and make sure it is for the appropriate town/area.

- Use the Review switch to check the form.

- See the information to actually have selected the appropriate form.

- In the event the form isn`t what you are trying to find, utilize the Look for discipline to find the form that suits you and requirements.

- If you discover the appropriate form, simply click Get now.

- Pick the pricing plan you would like, fill in the required info to produce your account, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Choose a handy document formatting and obtain your duplicate.

Discover all of the file templates you may have purchased in the My Forms menu. You may get a extra duplicate of New Mexico Retirement Benefits Plan anytime, if needed. Just select the necessary form to obtain or print the file web template.

Use US Legal Forms, one of the most considerable variety of legal varieties, to save lots of time as well as prevent blunders. The services offers skillfully created legal file templates that you can use for an array of reasons. Make your account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

Age 62 or older with 14 or more years of service credit; or. Age 63 or older with 11 or more years of service credit; or. Age 64 or older with 8 or more years of service credit; or. Age 65 with 5 or more years of service credit.

You are vested in PERA after 36 months of public service (60 months for members hired after June 2010). Being vested means you qualify for benefits at the minimum allowable age.

PERA is a 401(a) qualified government plan governed by the New Mexico Public Employees Retirement Act. A public employer affiliated with PERA must deduct employee contributions each pay period from the employee's wages. These contributions are paid into the PERA member contribution fund.

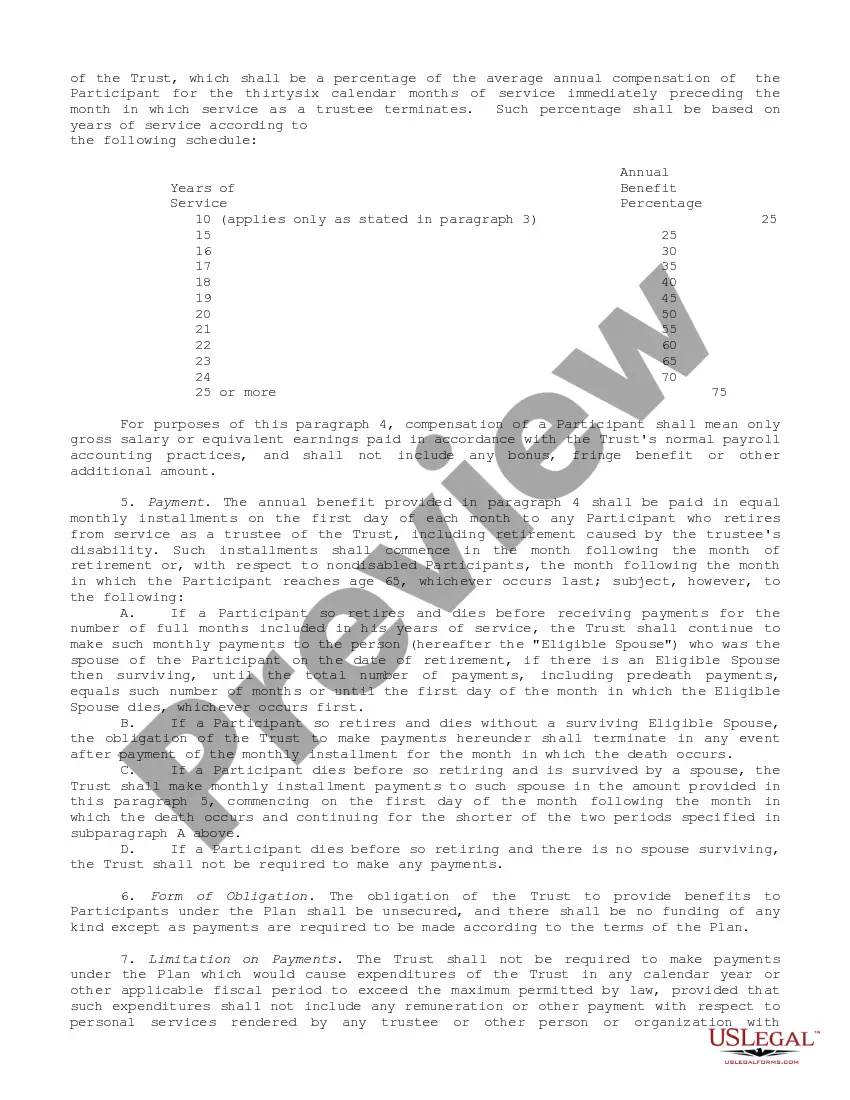

With the PERA Defined Benefit (DB) Plan, you'll receive income in retirement that you can't outlive. The amount you'll receive each month depends on three important factors: Your highest average salary, the amount of service credit you have accrued, and your age at retirement.

The option of the single-life benefit is paid during the member's lifetime only; no monthly payments will be made to any person after the member's death. However, any balance of the employee contributions at the time of death will be paid in a lump-sum payment.

New Mexico has become a popular retirement destination, and it's easy to see why. The state has plenty of characteristics that attract retirees, including its low cost of living, warm climate, rich culture, and many amenities. If you're considering retiring to New Mexico, we can help.

The statutory Cost Of Living Adjustment (COLA) for eligible retirees as of July 1, 2023 is: 3.60% for retirees with 25 or more years of service credit and whose monthly benefit is less than or equal to the median benefit of $1,720.56 as of June 30, 2022. 3.20% for all other eligible retirees.

If you are at least 67 years old and have five or more years of earned service credit, you are eligible for retirement.