New Mexico Amendment to the articles of incorporation to eliminate par value

Description

How to fill out Amendment To The Articles Of Incorporation To Eliminate Par Value?

US Legal Forms - one of the most significant libraries of authorized kinds in the United States - provides a wide range of authorized record layouts you may download or print out. While using internet site, you will get thousands of kinds for organization and specific uses, categorized by categories, states, or keywords and phrases.You can get the most up-to-date models of kinds much like the New Mexico Amendment to the articles of incorporation to eliminate par value within minutes.

If you have a membership, log in and download New Mexico Amendment to the articles of incorporation to eliminate par value from the US Legal Forms catalogue. The Acquire button will appear on each form you perspective. You get access to all previously downloaded kinds within the My Forms tab of your own profile.

If you wish to use US Legal Forms the first time, here are easy directions to obtain started out:

- Ensure you have picked out the right form to your city/region. Go through the Preview button to check the form`s content. Browse the form explanation to actually have chosen the proper form.

- In case the form doesn`t fit your specifications, use the Lookup area at the top of the display to get the one who does.

- If you are content with the form, validate your option by simply clicking the Buy now button. Then, choose the pricing prepare you favor and give your accreditations to register for the profile.

- Approach the purchase. Make use of your charge card or PayPal profile to perform the purchase.

- Choose the formatting and download the form on your system.

- Make alterations. Fill up, revise and print out and indicator the downloaded New Mexico Amendment to the articles of incorporation to eliminate par value.

Each format you included in your bank account does not have an expiry day and it is yours eternally. So, if you wish to download or print out yet another duplicate, just proceed to the My Forms segment and then click on the form you need.

Gain access to the New Mexico Amendment to the articles of incorporation to eliminate par value with US Legal Forms, probably the most considerable catalogue of authorized record layouts. Use thousands of professional and state-distinct layouts that fulfill your organization or specific requirements and specifications.

Form popularity

FAQ

The Articles of Amendment, also sometimes called a Certificate of Amendment, is a document filed with your state of incorporation (or any states in which your company has foreign qualified to transact business), to enact a specific change to the information included in your company's incorporation or qualification ...

Definition of Corporation It is an artificial being, created operation of law, having the right of succession and the powers, attributes, and properties expressly authorized by law or incident to its existence.

Articles of incorporation are the legal documents that a corporation files to establish itself as a legal business organization. These documents are important because they provide legal recognition, tax advantages, the ability to issue stock and reduced owner liability.

The names and addresses of the incorporators are not included in the Articles of Incorporation. One or more persons may form a corporation.

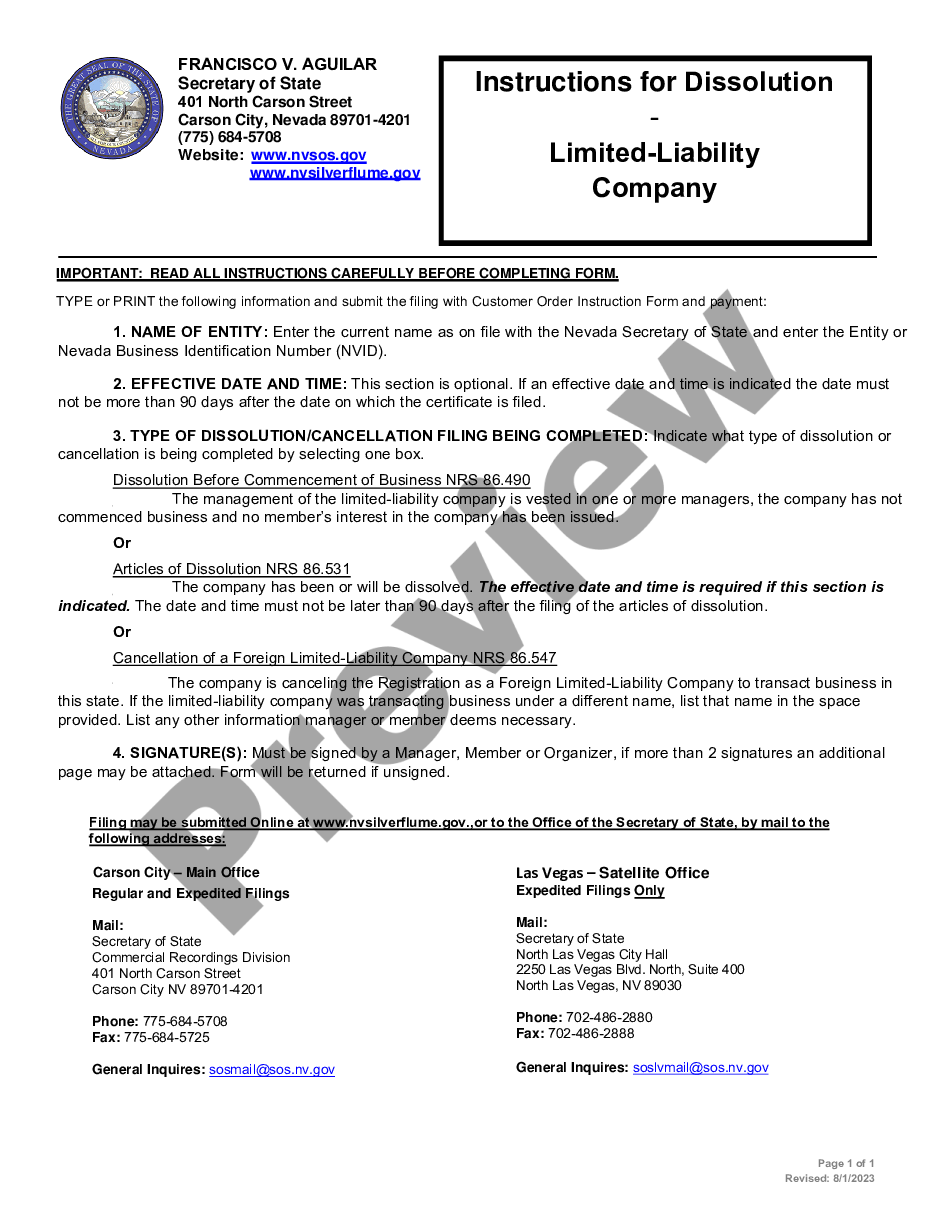

To file an amendment for your domestic New Mexico Corporation, submit Form DPR-AM, Articles of Amendment to the Articles of Incorporation and one duplicate copy to the New Mexico Public Regulation Commission (PRC). The form is available online (see link below).

What must be included in the articles of incorporation? the corporation's name and business address. the number of authorized shares and the par value (if any) of the shares. the name and address of the in-state registered agent. the names and addresses of its incorporators.

Articles of Incorporation refers to the highest governing document in a corporation. It is also known known as the corporate charter. The Articles of Incorporation generally include the purpose of the corporation, the type and number of shares, and the process of electing a board of directors.

Incorporation involves drafting "articles of incorporation," which lists the primary purpose of the business and its location, along with the number of shares and class of stock being issued if any. A closed corporation, for instance, would not issue stock. Companies are owned by their shareholders.