New Mexico Information Statement - Common Stock

Description

How to fill out Information Statement - Common Stock?

You can devote several hours online searching for the authorized document format which fits the state and federal demands you need. US Legal Forms offers a large number of authorized kinds that happen to be reviewed by pros. You can actually download or produce the New Mexico Information Statement - Common Stock from the services.

If you currently have a US Legal Forms account, you are able to log in and click the Acquire option. Afterward, you are able to total, edit, produce, or sign the New Mexico Information Statement - Common Stock. Each and every authorized document format you buy is the one you have forever. To acquire one more duplicate for any bought kind, check out the My Forms tab and click the corresponding option.

If you are using the US Legal Forms internet site for the first time, follow the easy directions listed below:

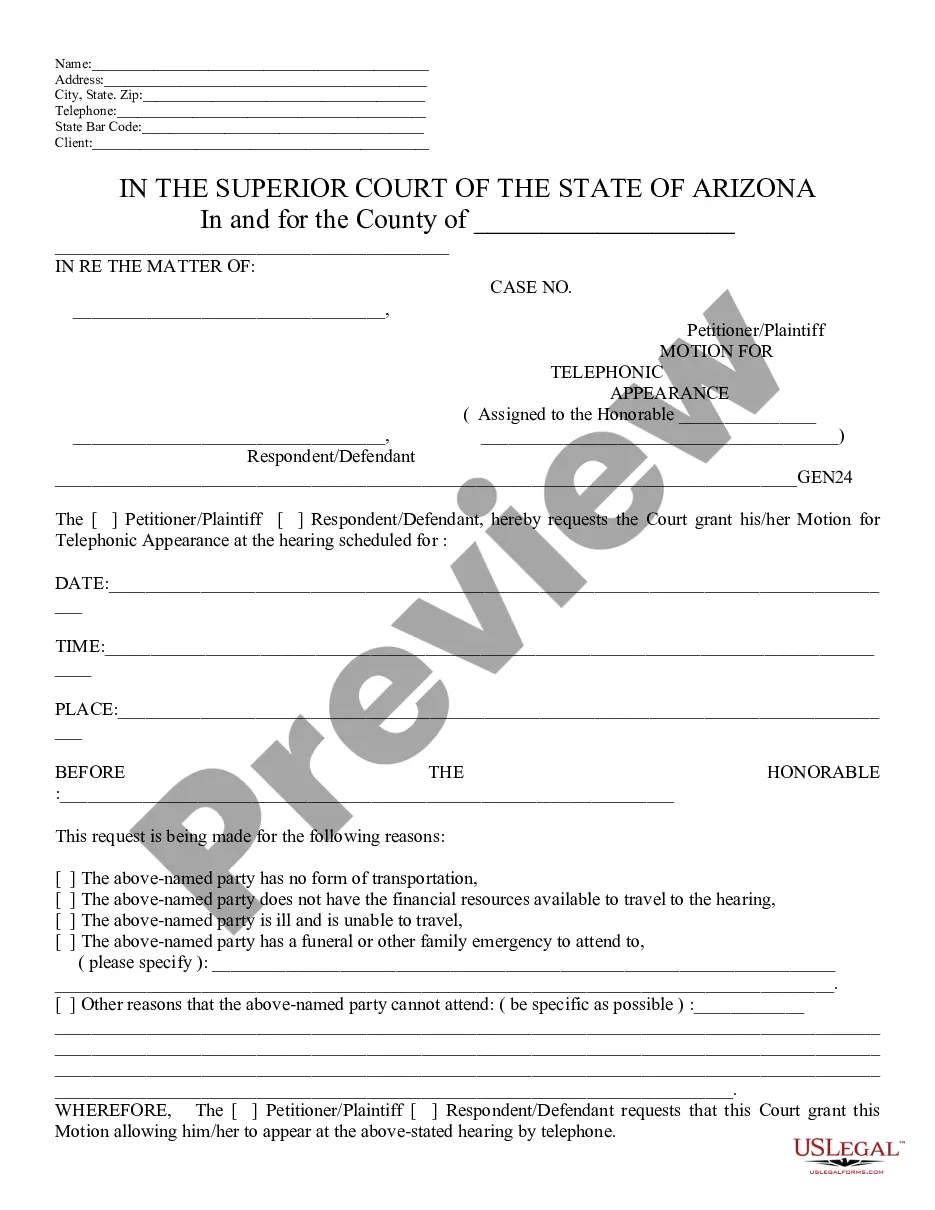

- Very first, make certain you have selected the best document format to the region/town that you pick. See the kind description to make sure you have selected the right kind. If offered, take advantage of the Review option to look with the document format at the same time.

- If you would like discover one more model from the kind, take advantage of the Search area to find the format that meets your needs and demands.

- When you have located the format you would like, click Get now to continue.

- Choose the costs plan you would like, type in your accreditations, and register for your account on US Legal Forms.

- Full the deal. You can utilize your credit card or PayPal account to cover the authorized kind.

- Choose the format from the document and download it to your device.

- Make adjustments to your document if necessary. You can total, edit and sign and produce New Mexico Information Statement - Common Stock.

Acquire and produce a large number of document themes using the US Legal Forms site, that offers the biggest collection of authorized kinds. Use skilled and status-particular themes to deal with your small business or personal requirements.

Form popularity

FAQ

When requesting a refund, attach Form RPD-41373, Application for Refund of Tax Withheld From Pass-Through Entities, to the PTE return. To receive proper credit for withholding, all annual statements of income and withholding must be issued to the entity filing the New Mexico return.

It is easy to sign up for an account just visit Taxpayer Access Point (TAP) and click on Create a Logon. Our Forms & Publications page provides tax return forms, tax return instructions, FYIs, bulletins, and other required forms needed for filing your return.

New Mexico imposes a tax on the net income of every resident and on the net income of every nonresident employed or engaged in business in, into or from this state or deriving any income from any property or employment within this state. The personal income tax is filed using Form PIT-1, Personal Income Tax Return.

Complete form RPD-41071, Application for Tax Refund to request a refund. If it appears that the notice is not correct and an overpayment has not been made, or the amount of the overpayment in the notice is not correct, you should follow the instructions on the notice to make the correction.

Effective July 1, 2021, the Combined Reporting System (CRS) number will be referred to as the New Mexico Business Tax Identification Number (NMBTIN). Many of the documents have been updated to reflect this change. Note: This is the same 11-digit tax identification number.