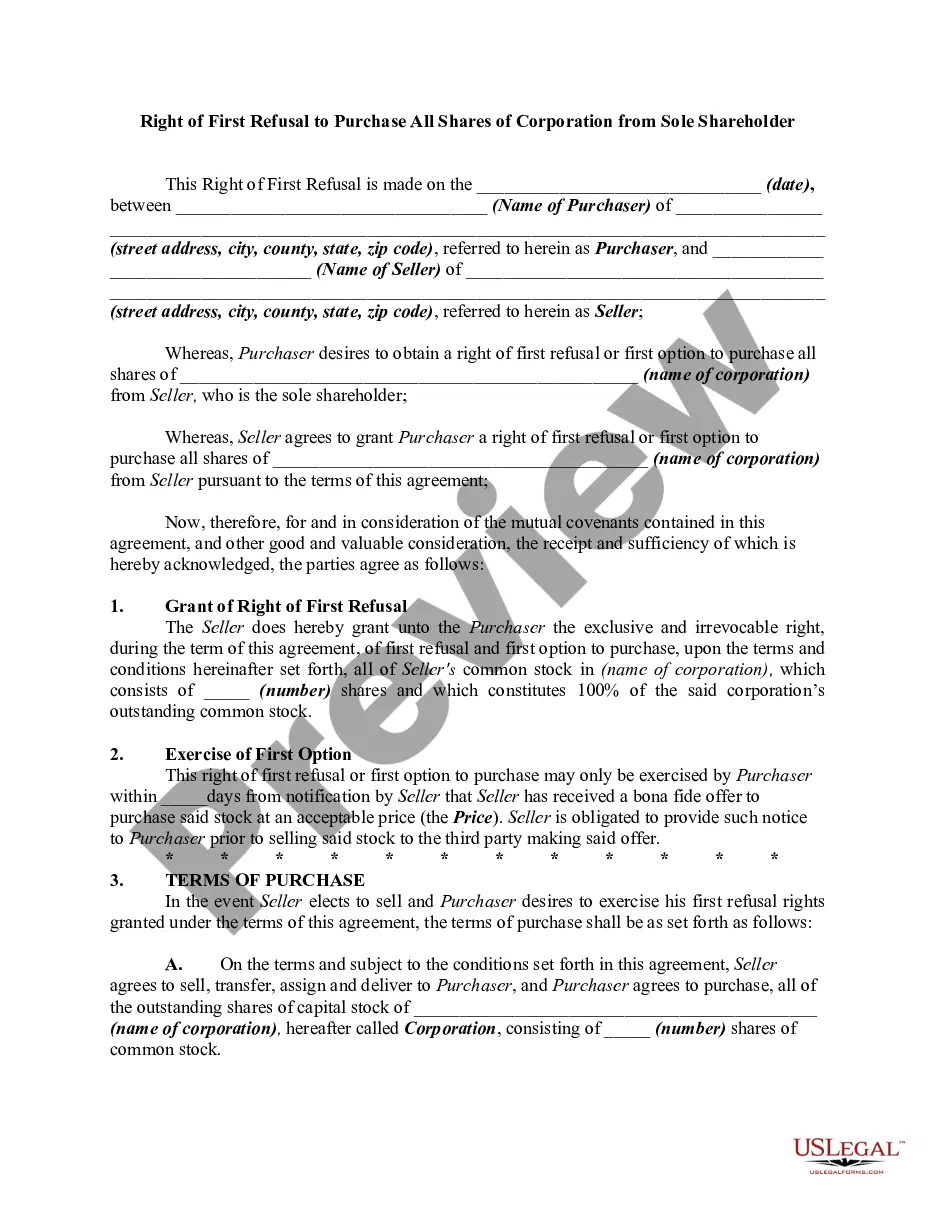

New Mexico Equity Compensation Plan: A Comprehensive Overview and Classification Keywords: New Mexico, Equity Compensation Plan, employee stock options, restricted stock units, performance shares, stock appreciation rights, vesting schedule, share ownership, retirement benefits, tax advantages Introduction: The New Mexico Equity Compensation Plan refers to a legally binding arrangement offered by employers situated in New Mexico, which aims to incentivize, reward, and retain talented employees by providing them with an opportunity to own a stake in the company. This compensation arrangement offers employees various forms of equity-based incentives, such as stock options, restricted stock units (RSS), performance shares, and stock appreciation rights (SARS), thereby aligning their interests with the long-term success and profitability of the company. Types of New Mexico Equity Compensation Plans: 1. Employee Stock Options: Employee stock options form a significant component of New Mexico Equity Compensation Plans. These options enable employees to purchase a specified number of shares at a predetermined price, known as the exercise price, within a specific time frame. By granting stock options, employers allow employees to participate in the company's growth and build long-term wealth. These options usually have a vesting period, ensuring employees meet certain service requirements before becoming eligible to exercise the options. 2. Restricted Stock Units (RSS): New Mexico Equity Compensation Plans may also include RSS. RSS represents the right to receive shares of company stock, which are typically subject to various vesting conditions. When the RSS vest, employees receive the underlying shares, becoming shareholders with full ownership rights. RSS offer employees the opportunity to share in the company's success without the burden of purchasing the shares upfront. 3. Performance Shares: Performance shares are a type of equity compensation granted to employees based on the company's performance against predetermined performance metrics. These metrics may include financial targets, stock price appreciation, or revenue growth. Performance shares provide additional incentives for employees to contribute to the company's growth, as the number of shares granted is directly tied to performance achievements. 4. Stock Appreciation Rights (SARS): Another form of equity compensation offered in New Mexico Equity Compensation Plans is SARS. SARS grant employees the right to receive the appreciation in the company's stock value over a specified period. Upon exercising the SARS, employees can either receive the difference in cash or in company stock. SARS provide employees with the potential benefit of stock price appreciation without the requirement of purchasing the stock outright. Considerations and Benefits: New Mexico Equity Compensation Plans offer several advantages to both employees and employers. For employees, participating in these plans allows them to own a stake in the company, fostering a sense of loyalty, motivation, and alignment with the company's objectives. Equity-based compensation plans can contribute significantly to an employee's overall compensation package, providing potential long-term financial rewards. These plans also offer tax advantages, with some types of equity compensation receiving preferential tax treatment. Conclusion: The New Mexico Equity Compensation Plan offers a range of equity-based incentives to employees, such as stock options, RSS, performance shares, and SARS. Each type of compensation plan serves a unique purpose in aligning employee interests with company success. By implementing these plans, companies in New Mexico can attract, retain, and motivate employees, reinforcing a commitment to financial growth, shareholder value, and employee ownership.

New Mexico Equity Compensation Plan

Description

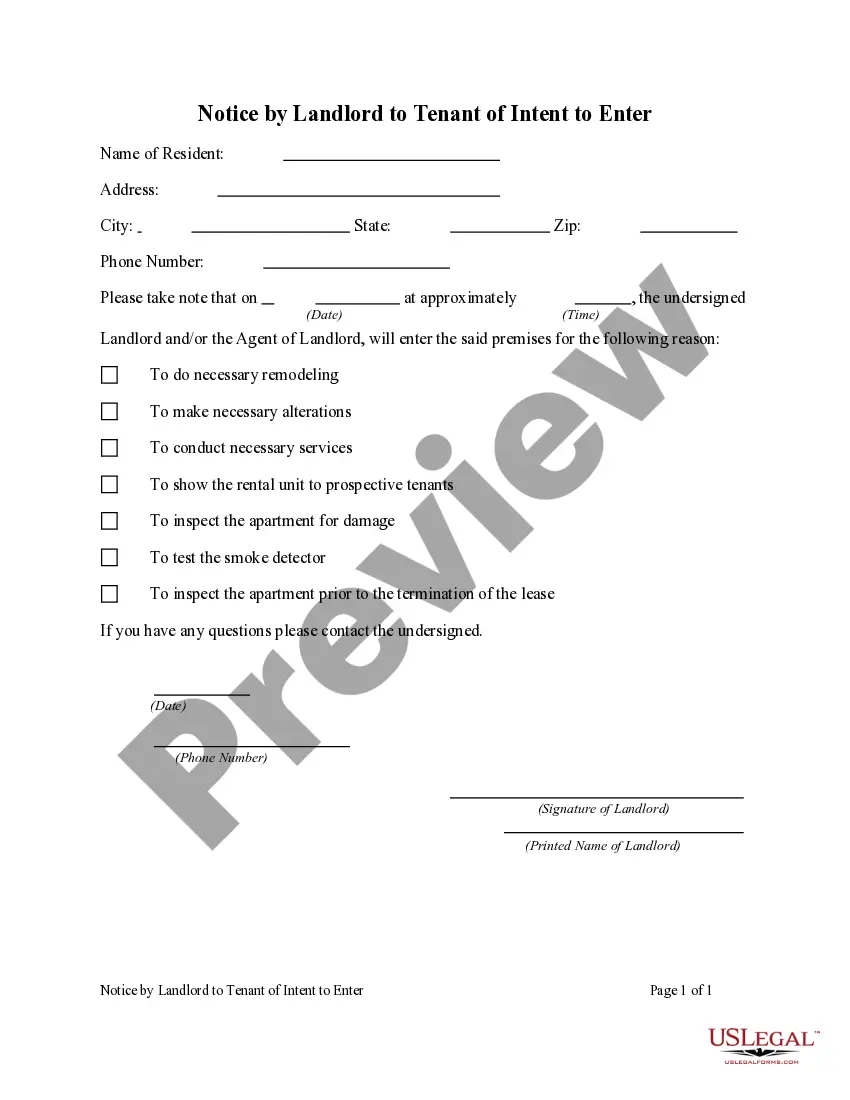

How to fill out New Mexico Equity Compensation Plan?

US Legal Forms - one of the biggest libraries of legitimate kinds in the United States - delivers a wide range of legitimate file templates you are able to obtain or produce. Utilizing the website, you may get thousands of kinds for enterprise and individual uses, sorted by groups, states, or search phrases.You can find the latest versions of kinds much like the New Mexico Equity Compensation Plan in seconds.

If you currently have a registration, log in and obtain New Mexico Equity Compensation Plan in the US Legal Forms collection. The Obtain switch can look on each develop you perspective. You gain access to all in the past acquired kinds within the My Forms tab of your respective accounts.

If you wish to use US Legal Forms for the first time, listed here are easy directions to help you started:

- Ensure you have picked out the correct develop for the town/county. Select the Review switch to examine the form`s content. Look at the develop outline to ensure that you have chosen the appropriate develop.

- When the develop does not fit your demands, take advantage of the Look for field at the top of the display to get the one that does.

- Should you be satisfied with the shape, verify your selection by simply clicking the Buy now switch. Then, pick the pricing prepare you favor and supply your references to sign up for an accounts.

- Procedure the transaction. Make use of bank card or PayPal accounts to finish the transaction.

- Pick the format and obtain the shape on the device.

- Make adjustments. Fill up, revise and produce and indication the acquired New Mexico Equity Compensation Plan.

Each format you included in your money does not have an expiration time which is the one you have eternally. So, in order to obtain or produce another duplicate, just check out the My Forms segment and click around the develop you need.

Obtain access to the New Mexico Equity Compensation Plan with US Legal Forms, by far the most comprehensive collection of legitimate file templates. Use thousands of specialist and state-distinct templates that satisfy your small business or individual requirements and demands.

Form popularity

FAQ

For TIER 1 members Final Average Salary (FAS) is the average of the highest 36 consecutive months of salary earned during your PERA career. For TIER 2 members Final Average Salary (FAS) is the average of the highest 60 consecutive months of salary earned during your PERA career.

What is the 457(b) retirement plan? Your Voluntary 457(b) retirement plan is offered through New Mexico Public Employees Retirement Association (PERA), and contributions are taken from your paycheck on a before-tax or after-tax (Roth) basis*.

PERA is a 401(a) qualified government plan governed by the New Mexico Public Employees Retirement Act. A public employer affiliated with PERA must deduct employee contributions each pay period from the employee's wages. These contributions are paid into the PERA member contribution fund.

Do you know what Total Compensation is? Total Compensation is the value of both the benefits and the salary you receive once employed by the State of New Mexico. Total Compensation simply means all forms of cash compensation and the dollar value of employer sponsored benefits.

On July 28, 2023 (payday for the first full pay period in July), State of New Mexico employees who have completed their probationary period and have received an overall final rating of ?Achieves Performance Standards? or higher on their last evaluation will get a 6% cost of living adjustment (COLA).

The State of New Mexico Deferred Compensation Plan is a 457(b) defined contribution plan. The Plan is administered by Nationwide Retirement Solutions and is available to eligible employees. It is a voluntary, supplemental, tax-deferred retirement program.

Yes, you may borrow a loan from your deferred comp balance.

The type of life insurance offered in your 457 Plan builds substantial cash values over a lifetime, but it is not an investment. The cash value is an added benefit.