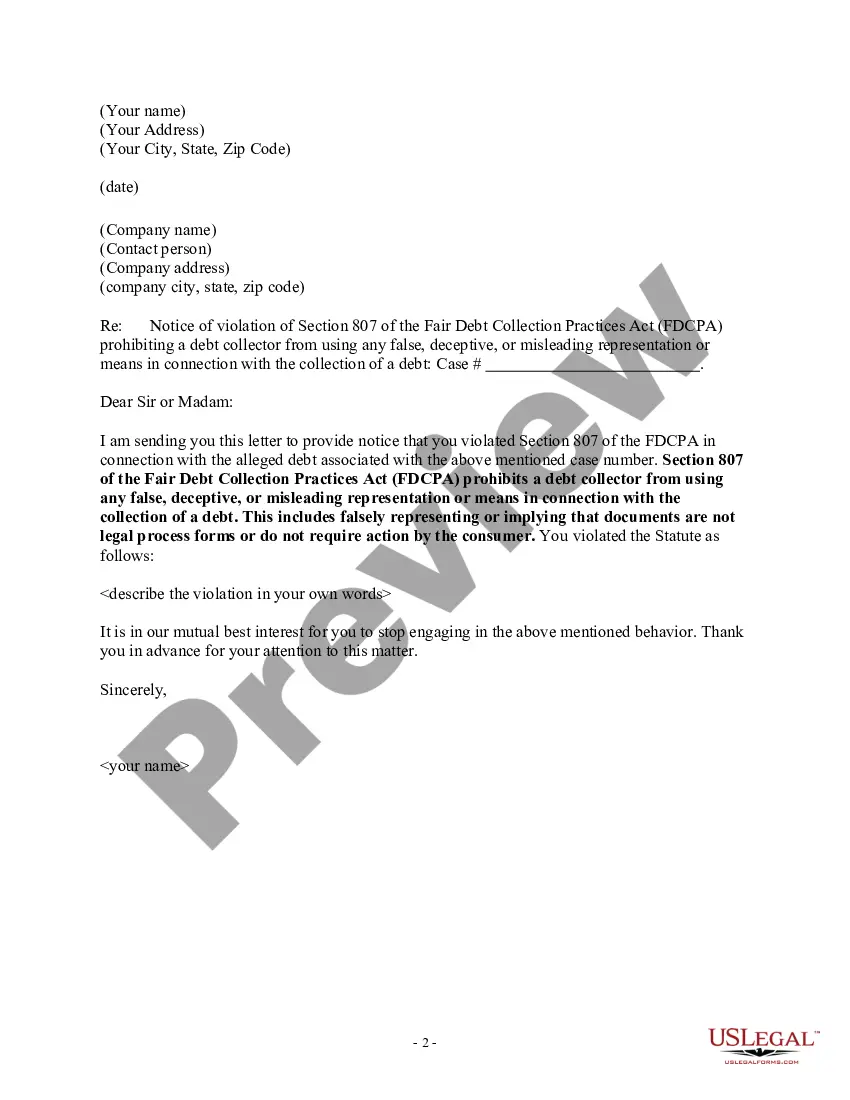

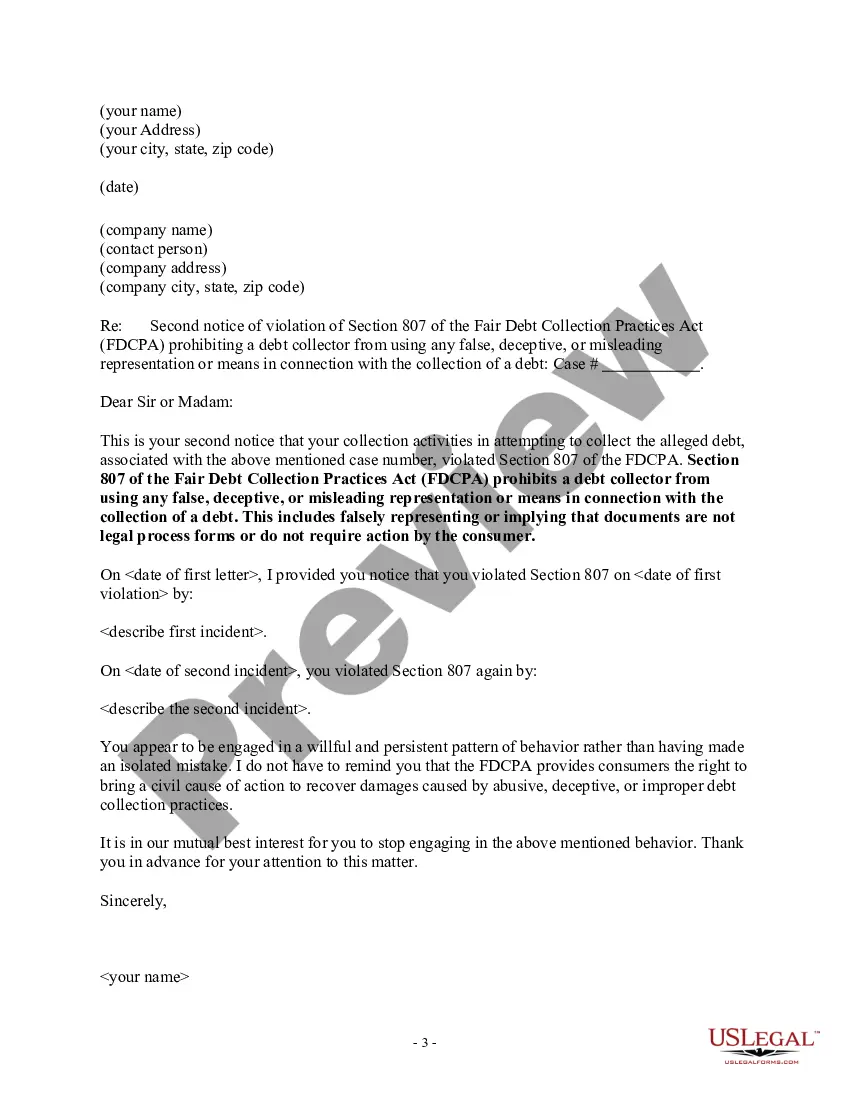

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

New Mexico Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

How to fill out New Mexico Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

Discovering the right legal record template can be a battle. Obviously, there are a lot of web templates available on the Internet, but how do you get the legal form you require? Take advantage of the US Legal Forms site. The assistance delivers a large number of web templates, for example the New Mexico Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action, that can be used for company and personal demands. All of the varieties are inspected by experts and meet up with state and federal specifications.

If you are currently signed up, log in to the profile and click the Acquire option to get the New Mexico Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action. Utilize your profile to check from the legal varieties you may have acquired in the past. Go to the My Forms tab of your own profile and get another version of your record you require.

If you are a whole new consumer of US Legal Forms, listed below are straightforward recommendations that you can stick to:

- Very first, make sure you have chosen the right form for your town/area. It is possible to look over the shape using the Review option and read the shape explanation to ensure it is the right one for you.

- In the event the form does not meet up with your expectations, use the Seach discipline to find the appropriate form.

- Once you are certain the shape is suitable, click on the Get now option to get the form.

- Opt for the prices program you desire and enter in the required details. Build your profile and pay for an order with your PayPal profile or charge card.

- Pick the data file file format and obtain the legal record template to the gadget.

- Complete, edit and print out and signal the acquired New Mexico Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

US Legal Forms is definitely the greatest library of legal varieties for which you will find a variety of record web templates. Take advantage of the company to obtain skillfully-made papers that stick to condition specifications.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

If a bill collector violates the Fair Debt Collection Practices Act, you might be able to sue and recover money and other damages. The Fair Debt Collection Practices Act (FDCPA) protects debtors from debt collector harassment; debt collectors who take certain actions violate this law.

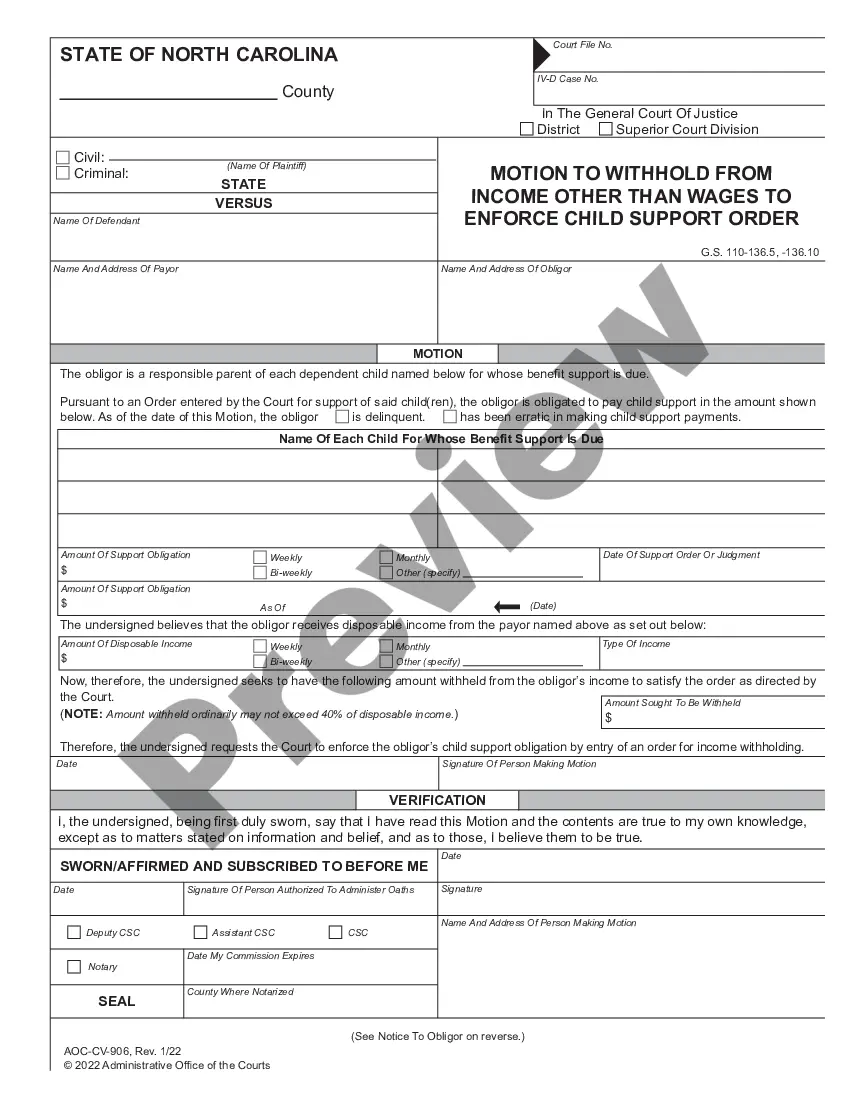

Debts that may not be covered are those that are not incurred voluntarily, such as income taxes, parking and speeding tickets, and domestic support obligations like child support and alimony, or spousal support.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

One is to report them to the Financial Consumer Protection Department of the BSP (i.e. email consumeraffairs@bsp.gov.ph or call 632-708-7087). Be sure to document all communications with your debt collectors including text messages and e-mails. If you can, record your conversation with their consent.

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.