New Mexico Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out New Mexico Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

Are you presently inside a position that you will need documents for possibly company or individual functions almost every day? There are a lot of lawful document layouts available online, but finding kinds you can rely on isn`t straightforward. US Legal Forms provides 1000s of type layouts, like the New Mexico Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself, that are published to meet federal and state specifications.

When you are previously acquainted with US Legal Forms website and get an account, merely log in. After that, it is possible to acquire the New Mexico Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself design.

Should you not come with an bank account and wish to start using US Legal Forms, adopt these measures:

- Get the type you need and ensure it is for that appropriate city/state.

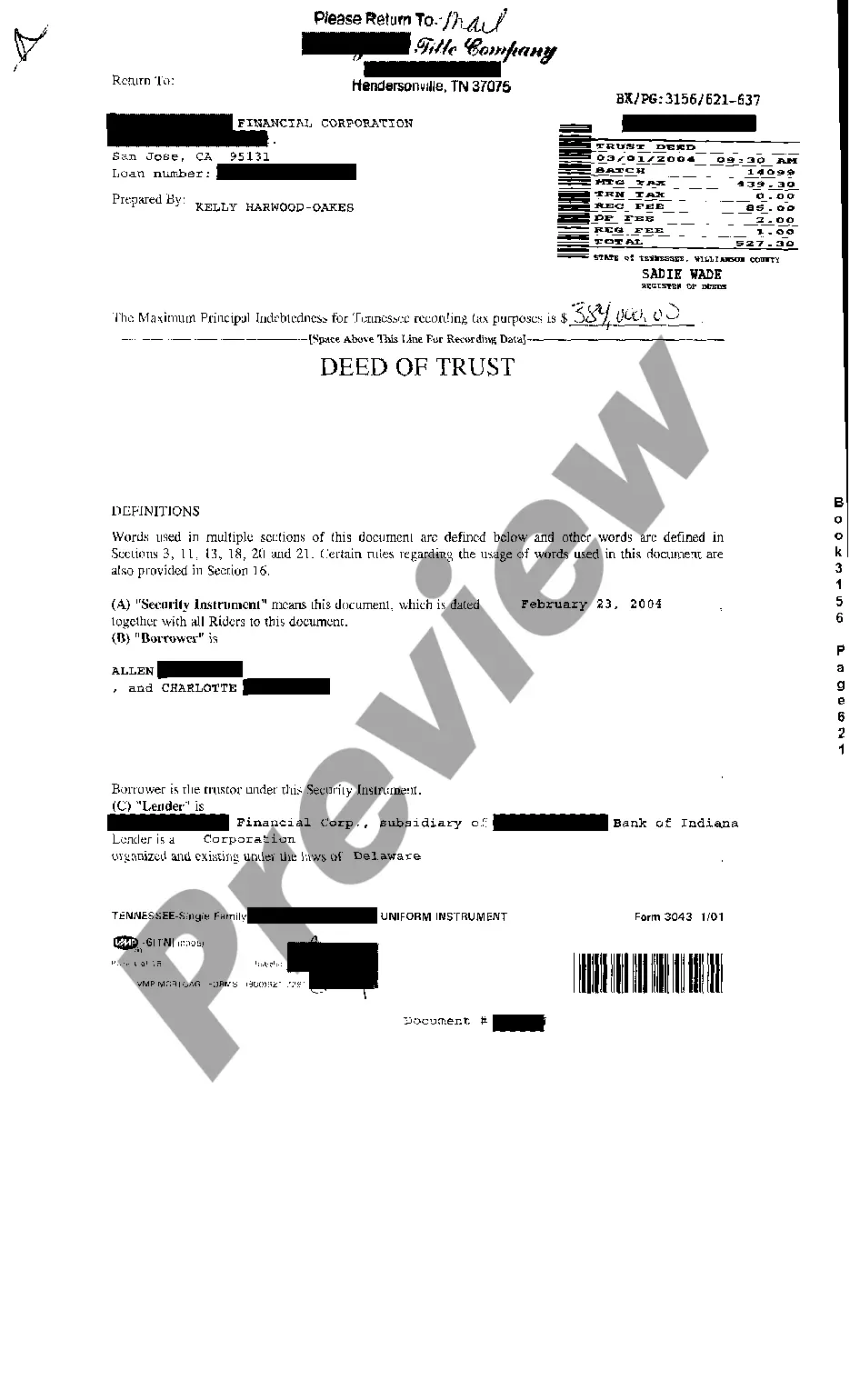

- Take advantage of the Preview option to examine the shape.

- Read the information to ensure that you have chosen the correct type.

- In case the type isn`t what you`re looking for, make use of the Research area to discover the type that fits your needs and specifications.

- Whenever you get the appropriate type, click Acquire now.

- Pick the costs plan you want, fill out the specified details to create your money, and purchase an order making use of your PayPal or bank card.

- Pick a handy paper format and acquire your copy.

Find all the document layouts you possess purchased in the My Forms menus. You can aquire a more copy of New Mexico Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself whenever, if necessary. Just go through the required type to acquire or print out the document design.

Use US Legal Forms, the most substantial collection of lawful varieties, to save lots of time as well as steer clear of mistakes. The services provides professionally manufactured lawful document layouts that can be used for a range of functions. Create an account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

Yes, but the collector must first sue you to get a court order called a garnishment that says it can take money from your paycheck to pay your debts. A collector also can seek a court order to take money from your bank account.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

One is to report them to the Financial Consumer Protection Department of the BSP (i.e. email consumeraffairs@bsp.gov.ph or call 632-708-7087). Be sure to document all communications with your debt collectors including text messages and e-mails. If you can, record your conversation with their consent.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.