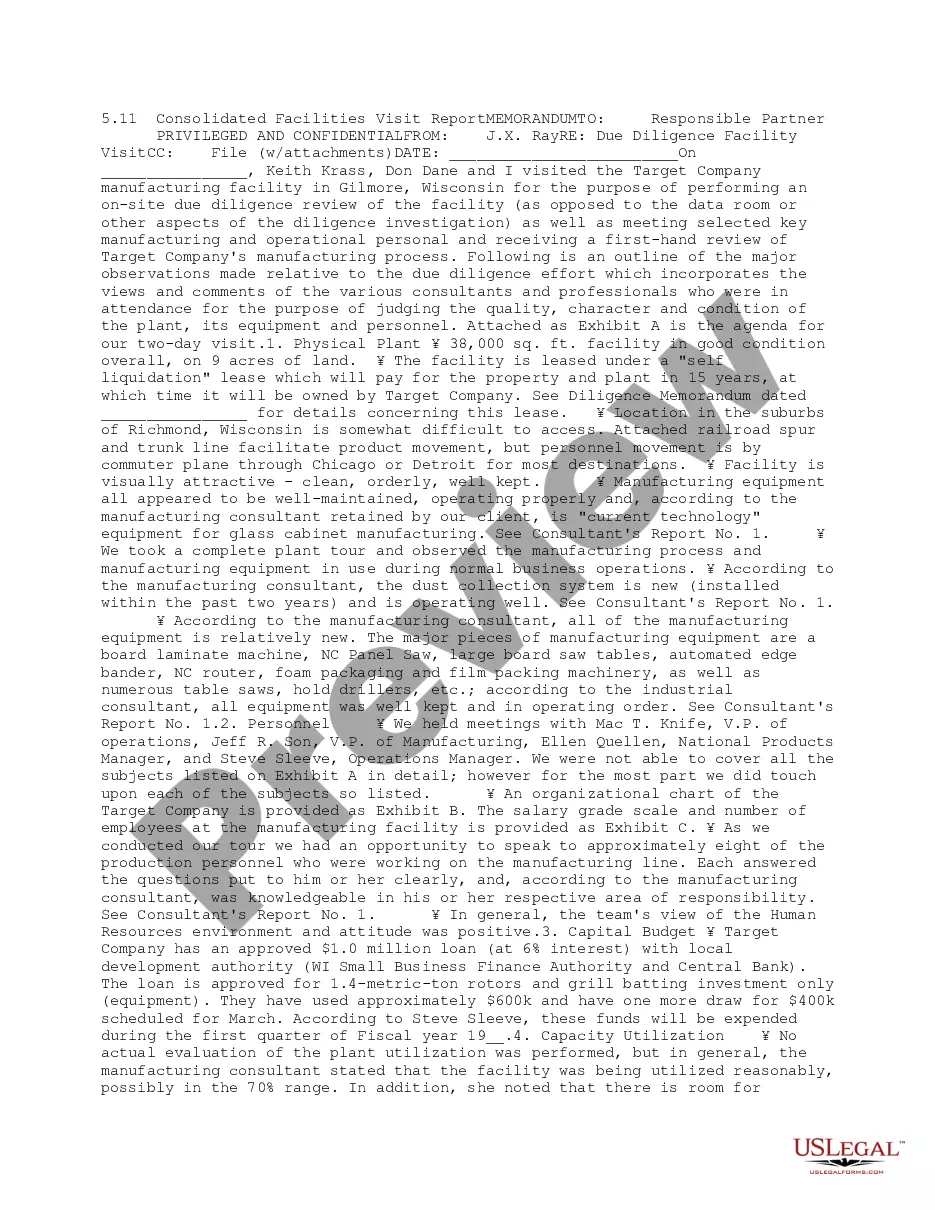

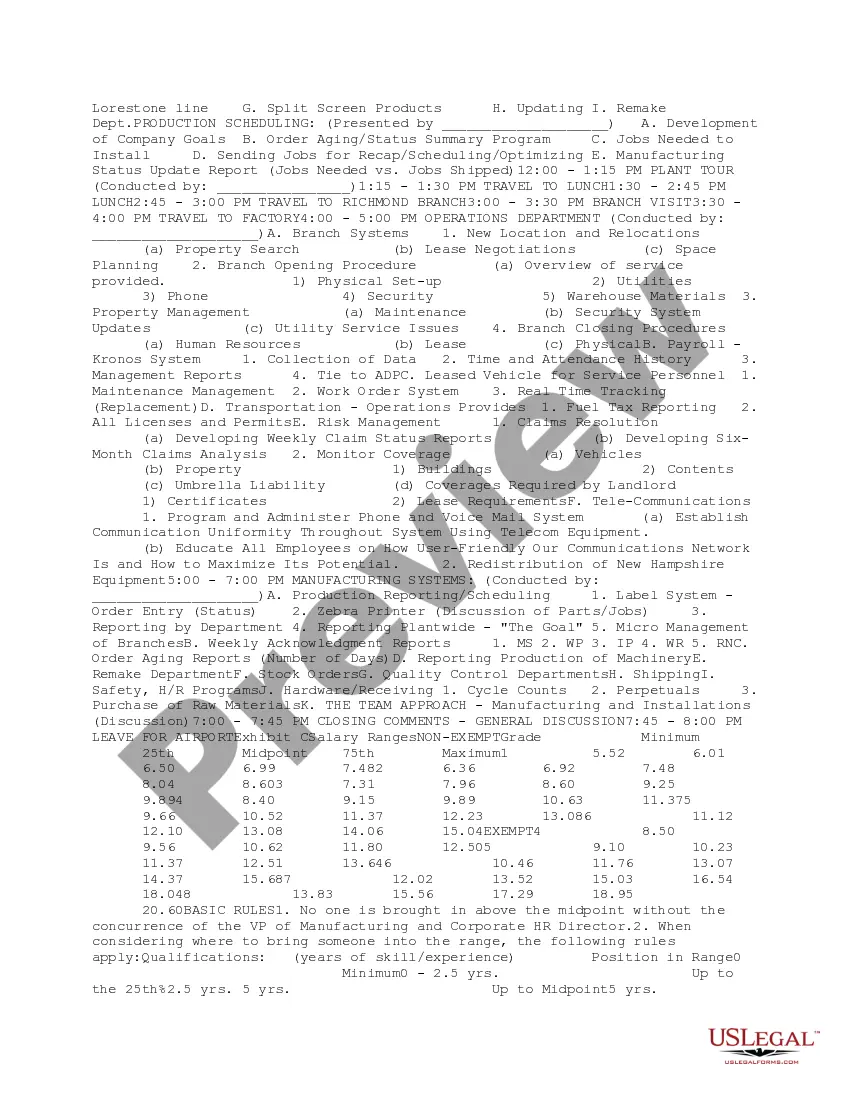

This due diligence form is used to report the relative observations made from an on-site due diligence review relating to the possible acquisition of a facility.

New Mexico Consolidated Facilities Visit Report

Description

How to fill out New Mexico Consolidated Facilities Visit Report?

Choosing the right legal papers format can be a battle. Of course, there are a lot of web templates available on the Internet, but how can you discover the legal form you need? Take advantage of the US Legal Forms website. The support delivers a large number of web templates, like the New Mexico Consolidated Facilities Visit Report, which can be used for company and personal needs. All the types are examined by specialists and fulfill state and federal specifications.

When you are already signed up, log in in your profile and click on the Acquire key to find the New Mexico Consolidated Facilities Visit Report. Use your profile to search throughout the legal types you may have bought formerly. Proceed to the My Forms tab of your respective profile and get one more duplicate from the papers you need.

When you are a new consumer of US Legal Forms, listed here are basic guidelines so that you can stick to:

- Initial, make sure you have chosen the appropriate form for your personal town/county. You may examine the shape using the Review key and browse the shape outline to ensure it will be the right one for you.

- In the event the form is not going to fulfill your expectations, make use of the Seach area to obtain the proper form.

- When you are certain the shape is suitable, click the Acquire now key to find the form.

- Opt for the pricing strategy you desire and enter the necessary information and facts. Create your profile and pay for the transaction with your PayPal profile or bank card.

- Select the file structure and acquire the legal papers format in your system.

- Comprehensive, revise and produce and indicator the received New Mexico Consolidated Facilities Visit Report.

US Legal Forms is the largest library of legal types where you can see various papers web templates. Take advantage of the company to acquire professionally-made papers that stick to state specifications.

Form popularity

FAQ

On July 1, 2021, new rules for the New Mexico gross receipts tax came into effect, switching to destination-based sourcing for both New Mexico in-state and out of state sellers.

After experimenting with mandatory unitary combined reporting for select taxpayers (i.e. large retailers), New Mexico now has adopted mandatory worldwide unitary combined reporting as the default filing method for all corporate taxpayers effective for taxable years beginning on or after January 1, 2020.

According to the IRS: Generally, an S corporation is exempt from federal income tax other than tax on certain capital gains and passive income. It is treated in the same way as a partnership, in that generally taxes are not paid at the corporate level.

During registration, each business will be provided with a State Tax ID number, also known as a Combined Reporting System (CRS) ID Number. This registration it is used to report and pay tax collected on gross receipts from business conducted in New Mexico.

New Mexico's franchise tax is a flat annual fee of $50 that must be paid by all New Mexico corporations, including S corporations. Both the corporate income tax and the franchise tax are due on the 15th day of the fourth month after the close of a business's tax year.

Today, 24 states (including Connecticut starting in tax year 2016) and the District of Columbia require combined reporting. These include Illinois (1982), Maine (1986), Massachusetts (2008), New Hampshire (1981), New York (2007), Rhode Island (2014), Vermont (2004), and Wisconsin (2009).

There is not a composite return for New Mexico Subchapter S Corporations, however, the NM income tax withheld is reported on line 13 of NM form PTE.

Effective for tax years beginning on and after January 1, 2020, New Mexico adopts mandatory combined reporting for corporations that are part of a unitary group. New Mexico rules default to worldwide combination with an election to file on either a water's-edge 1 or consolidated-group basis.

New Mexico imposes its corporate income tax on the net income of every domestic corporation and every foreign corporation that: Is employed or engaged in the transaction of business in, into, or from this state, or. Has income from property or employment within this state.

New Mexico recognizes the federal S election, and New Mexico S corporations are not required to pay corporate income tax to the state; however, New Mexico S corporations are required to pay the $50 franchise tax. Also, an individual S corporation shareholder will owe tax on his or her share of the company's income.