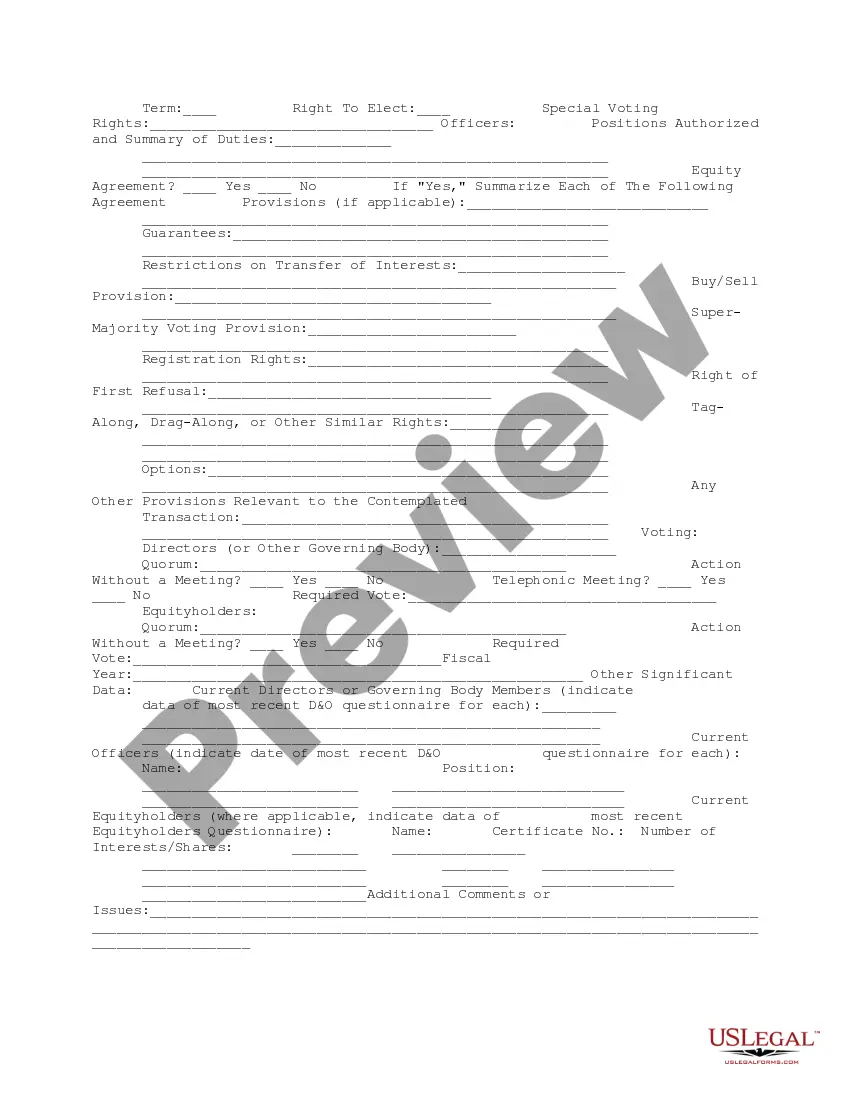

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

New Mexico Company Data Summary

Description

How to fill out New Mexico Company Data Summary?

You can commit time online attempting to find the legal papers format that suits the state and federal demands you want. US Legal Forms supplies a huge number of legal varieties which are analyzed by professionals. You can actually acquire or produce the New Mexico Company Data Summary from my service.

If you already have a US Legal Forms profile, you are able to log in and click on the Download button. Afterward, you are able to full, modify, produce, or signal the New Mexico Company Data Summary. Every single legal papers format you buy is the one you have permanently. To acquire yet another copy of the acquired kind, proceed to the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms web site the very first time, adhere to the basic guidelines listed below:

- Very first, be sure that you have chosen the correct papers format for that state/area of your choosing. Look at the kind outline to ensure you have selected the right kind. If readily available, utilize the Review button to check with the papers format too.

- If you want to get yet another variation in the kind, utilize the Search field to obtain the format that meets your requirements and demands.

- Upon having found the format you need, simply click Buy now to proceed.

- Select the pricing plan you need, type in your references, and register for a free account on US Legal Forms.

- Complete the purchase. You may use your Visa or Mastercard or PayPal profile to pay for the legal kind.

- Select the formatting in the papers and acquire it in your system.

- Make changes in your papers if possible. You can full, modify and signal and produce New Mexico Company Data Summary.

Download and produce a huge number of papers layouts making use of the US Legal Forms website, which provides the largest selection of legal varieties. Use specialist and express-particular layouts to tackle your business or individual requires.

Form popularity

FAQ

During registration, each business will be provided with a State Tax ID number, also known as a Combined Reporting System (CRS) ID Number. This registration it is used to report and pay tax collected on gross receipts from business conducted in New Mexico.

There is not a composite return for New Mexico Subchapter S Corporations, however, the NM income tax withheld is reported on line 13 of NM form PTE.

After experimenting with mandatory unitary combined reporting for select taxpayers (i.e. large retailers), New Mexico now has adopted mandatory worldwide unitary combined reporting as the default filing method for all corporate taxpayers effective for taxable years beginning on or after January 1, 2020.

You may expect your CRS identification within one to two weeks when you return the application by mail. You may also obtain an application at many city, village, and town halls around the state. These offices can assign your CRS identification number immediately when you apply in person.

2) All owners of New Mexico businesses registered as a Partnership, Limited Liability Company or CORPORATION must obtain a New Mexico CRS Tax ID number. Select the GET STATE CRS NUMBER link to obtain a New Mexico Combined Reporting System (CRS) number. If you are a construction contractor, your contractor number.

CRS number means the New Mexico tax identification number issued by the New Mexico taxation and revenue department that is used for reporting gross receipts, compensating, and withholding tax.

If you need assistance, call 1-866-809-2335. Once you're online filing your return, you can also pay online. For no additional charge, you may pay using an electronic check that authorizes the Department to debit your checking account in the amount and on the date you specify.

RPD-41072 Rev. 09/25/2012 State of New Mexico - Taxation and Revenue Department ANNUAL SUMMARY OF WITHHOLDING TAX FOR CRS-1 FILERS Who Must Complete This Form: Employers, payers and gambling establishment.

Today, 24 states (including Connecticut starting in tax year 2016) and the District of Columbia require combined reporting. These include Illinois (1982), Maine (1986), Massachusetts (2008), New Hampshire (1981), New York (2007), Rhode Island (2014), Vermont (2004), and Wisconsin (2009).

After experimenting with mandatory unitary combined reporting for select taxpayers (i.e. large retailers), New Mexico now has adopted mandatory worldwide unitary combined reporting as the default filing method for all corporate taxpayers effective for taxable years beginning on or after January 1, 2020.