Introduction: The New Mexico Loan Agreement is a legally binding contract between Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston. This agreement outlines the terms, conditions, and obligations regarding a loan transaction conducted in the state of New Mexico. It is important to note that there may be different types of loan agreements within this framework. Let's explore some of these variations below: 1. New Mexico Loan Agreement for Infrastructure Development: This type of loan agreement focuses on financing infrastructure development projects in New Mexico. It enables Lacked Gas Co. to secure funds from Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston for initiatives such as the construction or renovation of gas pipelines, storage facilities, or distribution networks in the state. 2. New Mexico Loan Agreement for Renewable Energy Projects: This variation of the loan agreement pertains specifically to funding renewable energy initiatives in New Mexico. Lacked Gas Co. may seek financial support from the participating banks to invest in projects like solar or wind farms, biofuel production facilities, or geothermal energy projects within the state. 3. New Mexico Loan Agreement for Economic Development: In this type of loan agreement, the emphasis is on providing financial assistance to stimulate economic growth and development in New Mexico. Lacked Gas Co. could use the loan obtained from Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston to initiate or expand business operations, promote job creation, or support local entrepreneurship in the state. 4. New Mexico Loan Agreement for Environmental Conservation: This loan agreement variant aims to support environmental conservation efforts in New Mexico. Lacked Gas Co. may secure funding to invest in projects focused on reducing greenhouse gas emissions, preserving biodiversity, promoting sustainable land management, or improving water resource management within the state. Key elements of the New Mexico Loan Agreement: 1. Loan Amount: Specifies the total sum of money that Lacked Gas Co. is borrowing from the participating banks. 2. Interest Rates: Outlines the interest rates applicable to the loan and any provisions for adjustments over time. 3. Loan Repayment Terms: Establishes the schedule and structure for repaying the loan amount, including installment amounts, frequency, and duration. 4. Collateral and Security: Identifies any assets or guarantees provided by Lacked Gas Co. to secure the loan, such as property, equipment, or accounts receivable. 5. Covenants and Conditions: Describes the various obligations, restrictions, and requirements that all parties must adhere to throughout the duration of the loan agreement. 6. Default and Remedies: Outlines the consequences of defaulting on the loan, including potential penalties, legal actions, or seizure of collateral. 7. Governing Law and Dispute Resolution: Specifies that the loan agreement is subject to the laws of New Mexico and outlines the agreed-upon procedures for resolving any disputes that may arise. Conclusion: The New Mexico Loan Agreement between Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston serves as a comprehensive framework for financial transactions between these entities. Whether it pertains to infrastructure, renewable energy, economic development, or environmental conservation, this agreement facilitates the funding necessary to drive growth and progress in New Mexico.

New Mexico Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston

Description

How to fill out New Mexico Loan Agreement Between Laclede Gas Co., Mercantile Bank National Assoc., Bank Of America And Credit Suisse First Boston?

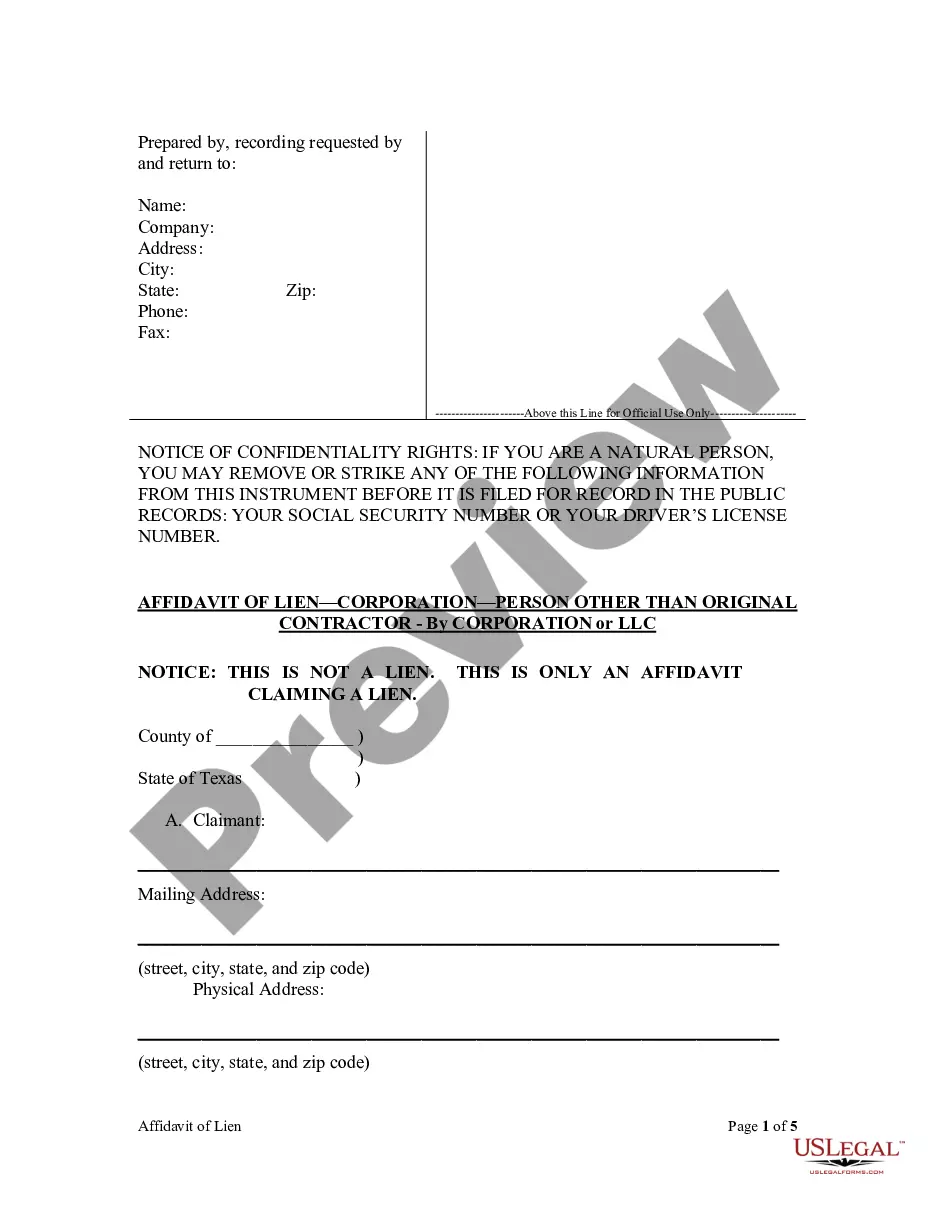

Discovering the right lawful file design can be a have a problem. Needless to say, there are tons of themes available on the net, but how can you find the lawful develop you want? Make use of the US Legal Forms website. The services gives a large number of themes, like the New Mexico Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston, that you can use for enterprise and personal needs. Each of the types are examined by pros and fulfill federal and state specifications.

If you are presently registered, log in in your account and click the Acquire key to get the New Mexico Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston. Make use of account to check throughout the lawful types you possess ordered in the past. Proceed to the My Forms tab of your account and get one more duplicate of the file you want.

If you are a new user of US Legal Forms, listed here are straightforward directions that you should adhere to:

- Very first, be sure you have selected the proper develop for the metropolis/state. You are able to check out the form utilizing the Preview key and read the form description to make certain this is basically the best for you.

- When the develop is not going to fulfill your requirements, use the Seach discipline to obtain the appropriate develop.

- Once you are certain that the form is suitable, click on the Acquire now key to get the develop.

- Select the rates plan you would like and enter the needed information and facts. Build your account and pay money for the transaction with your PayPal account or credit card.

- Pick the document format and down load the lawful file design in your product.

- Complete, modify and print out and sign the received New Mexico Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston.

US Legal Forms is definitely the largest library of lawful types that you can find numerous file themes. Make use of the company to down load professionally-created papers that adhere to condition specifications.