The New Mexico Bylaws of Mitchell Hutchins Securities Trust is a set of governing rules and regulations that outline the operations, responsibilities, and procedures of the trust. These bylaws determine how the trust is managed and provide guidance for the trustees, beneficiaries, and interested parties involved. The New Mexico Bylaws of Mitchell Hutchins Securities Trust cover various aspects, including investment management, distributions, trustee powers, beneficiaries' rights, reporting requirements, and amendment procedures. These bylaws are designed to ensure transparency, accountability, and compliance with applicable laws and regulations. Under the New Mexico Bylaws of Mitchell Hutchins Securities Trust, there are typically two distinct types: 1. Investment Management Bylaws: These bylaws focus on the investment strategies, objectives, and guidelines for the trust. They detail the permitted types of investments, asset allocation policies, risk management practices, and the criteria for selecting and monitoring investment managers. The Investment Management Bylaws ensure that the trust's assets are prudently managed to maximize returns while considering the beneficiaries' best interests and the trust's long-term sustainability. 2. Governance Bylaws: The Governance Bylaws govern the administrative and operational aspects of the trust. They establish the roles and responsibilities of the trustees, including their appointment, term limits, fiduciary obligations, and voting procedures. These bylaws may also outline the procedures for holding trustee meetings, record-keeping requirements, conflicts of interest guidelines, and any special provisions relevant to the trust's administration. The New Mexico Bylaws of Mitchell Hutchins Securities Trust are crucial in maintaining the integrity and effective functioning of the trust. They provide a framework for decision-making, dispute resolution, and ensure compliance with legal and regulatory requirements. These bylaws are periodically reviewed and updated as necessary to adapt to changing market conditions, legal obligations, and evolving best practices in the investment management industry.

New Mexico Bylaws of Mitchell Hutchins Securities Trust

Description

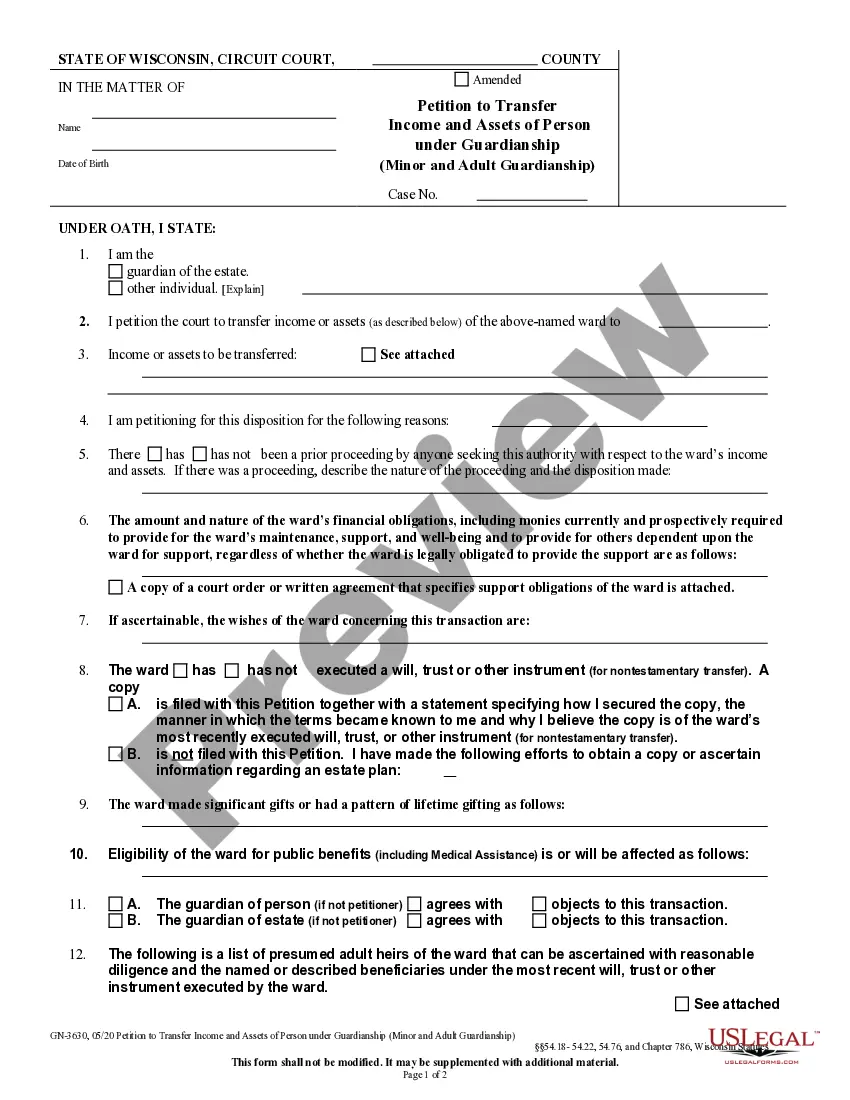

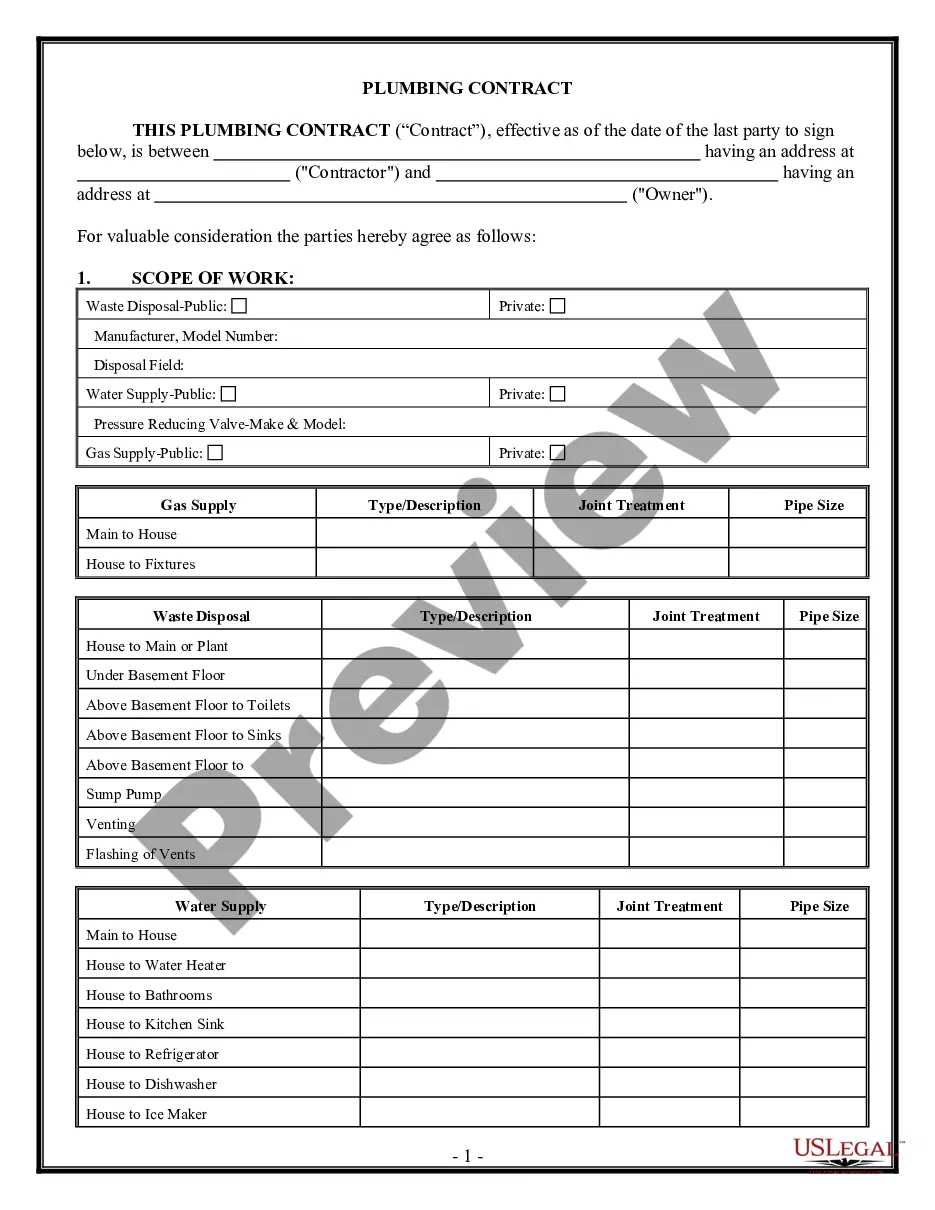

How to fill out New Mexico Bylaws Of Mitchell Hutchins Securities Trust?

You may invest hrs on-line trying to find the lawful record template that fits the state and federal demands you require. US Legal Forms supplies thousands of lawful types which can be analyzed by specialists. It is possible to download or print the New Mexico Bylaws of Mitchell Hutchins Securities Trust from the services.

If you already have a US Legal Forms profile, it is possible to log in and click the Download button. After that, it is possible to complete, modify, print, or sign the New Mexico Bylaws of Mitchell Hutchins Securities Trust. Each lawful record template you purchase is yours eternally. To obtain another copy of any obtained kind, proceed to the My Forms tab and click the corresponding button.

If you use the US Legal Forms web site the very first time, adhere to the basic guidelines beneath:

- Initially, ensure that you have chosen the right record template to the region/metropolis that you pick. See the kind description to make sure you have picked out the correct kind. If readily available, make use of the Preview button to appear through the record template at the same time.

- In order to discover another edition in the kind, make use of the Search field to obtain the template that meets your needs and demands.

- When you have identified the template you would like, click on Get now to move forward.

- Select the rates plan you would like, type your qualifications, and register for a free account on US Legal Forms.

- Total the transaction. You may use your credit card or PayPal profile to fund the lawful kind.

- Select the formatting in the record and download it for your product.

- Make adjustments for your record if required. You may complete, modify and sign and print New Mexico Bylaws of Mitchell Hutchins Securities Trust.

Download and print thousands of record templates while using US Legal Forms web site, that provides the greatest variety of lawful types. Use professional and status-particular templates to tackle your small business or specific requirements.