New Mexico Subsidiary Assumption Agreement

Description

How to fill out Subsidiary Assumption Agreement?

Are you currently within a placement the place you need documents for either organization or specific functions virtually every day time? There are plenty of lawful file templates accessible on the Internet, but getting types you can trust is not effortless. US Legal Forms gives a huge number of form templates, like the New Mexico Subsidiary Assumption Agreement, that are created to fulfill federal and state specifications.

Should you be currently informed about US Legal Forms web site and also have your account, merely log in. Next, you may acquire the New Mexico Subsidiary Assumption Agreement design.

Should you not come with an accounts and wish to start using US Legal Forms, adopt these measures:

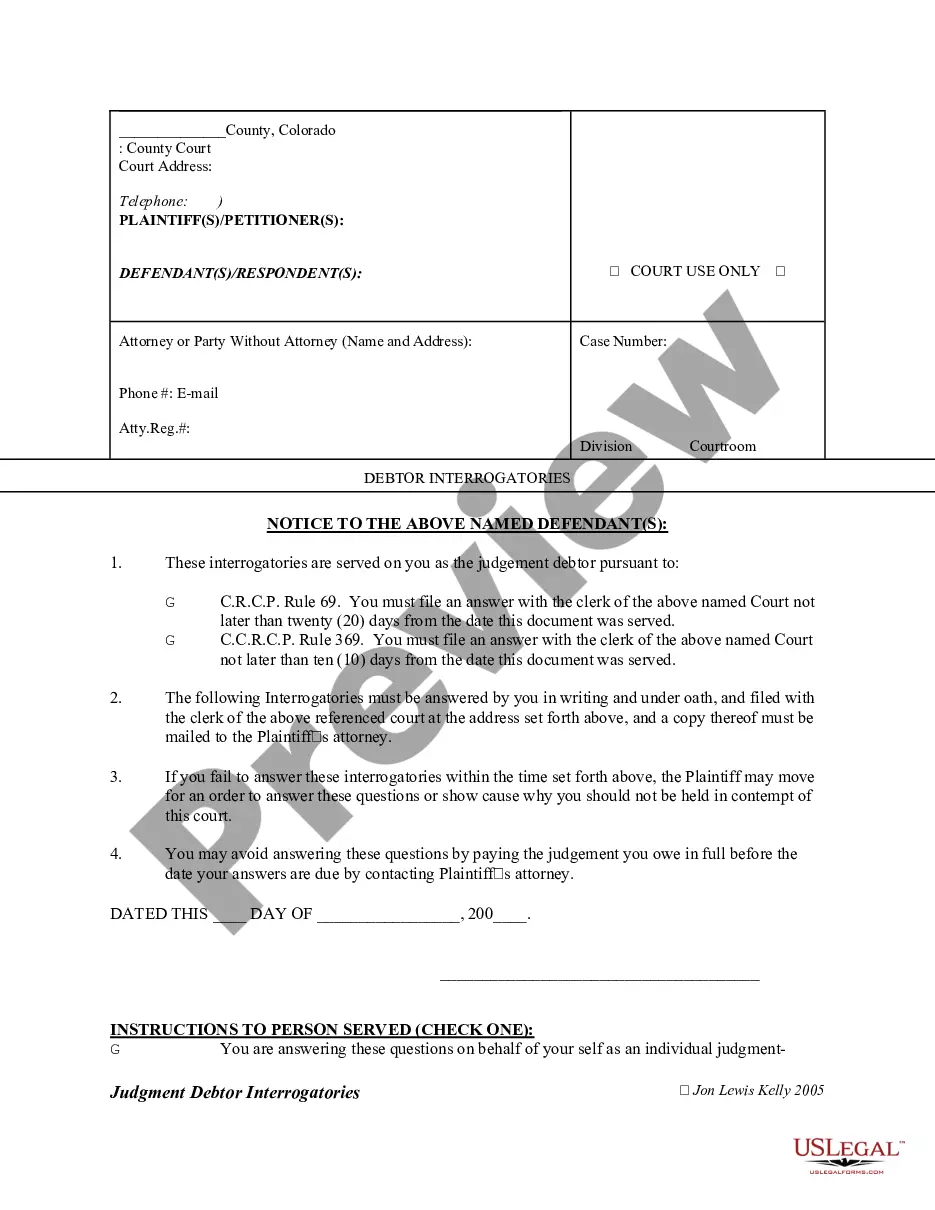

- Obtain the form you require and make sure it is for the proper area/county.

- Take advantage of the Review switch to examine the form.

- Look at the information to actually have chosen the appropriate form.

- When the form is not what you`re looking for, take advantage of the Research discipline to find the form that meets your requirements and specifications.

- When you get the proper form, just click Buy now.

- Pick the costs program you would like, fill in the necessary information to produce your money, and pay for the transaction making use of your PayPal or charge card.

- Select a hassle-free file format and acquire your copy.

Locate all of the file templates you have bought in the My Forms menu. You can get a additional copy of New Mexico Subsidiary Assumption Agreement at any time, if needed. Just select the necessary form to acquire or print the file design.

Use US Legal Forms, by far the most substantial collection of lawful varieties, to save time and stay away from errors. The services gives skillfully made lawful file templates which you can use for a range of functions. Make your account on US Legal Forms and start producing your way of life a little easier.

Form popularity

FAQ

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower.

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage and?along with it?ownership of the property that secures the loan.

Updated March 7, 2022. In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property. What is an assumption agreement? - Mansion Global mansionglobal.com ? library ? assumption-a... mansionglobal.com ? library ? assumption-a...

What Is a Basic Assumption? A basic assumption is an assumption that relates directly to a material fact included in the agreement. In the event of a mistaken belief, the mistake must involve a basic assumption that will affect the contract to the degree that the contract would become unfair to one side.

Parties Involved: Typically, an assumption agreement includes two main parties: the assignor (let's say, Seller A) and the assignee (Buyer B). Seller A is looking to transfer their obligations, while Buyer B is ready to assume those obligations. Understanding Assumption Agreements: A Simple Guide legalgps.com ? contract-template-blogs ? un... legalgps.com ? contract-template-blogs ? un...