New Mexico Amendment to Agreement for the Purchase and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc.

Description

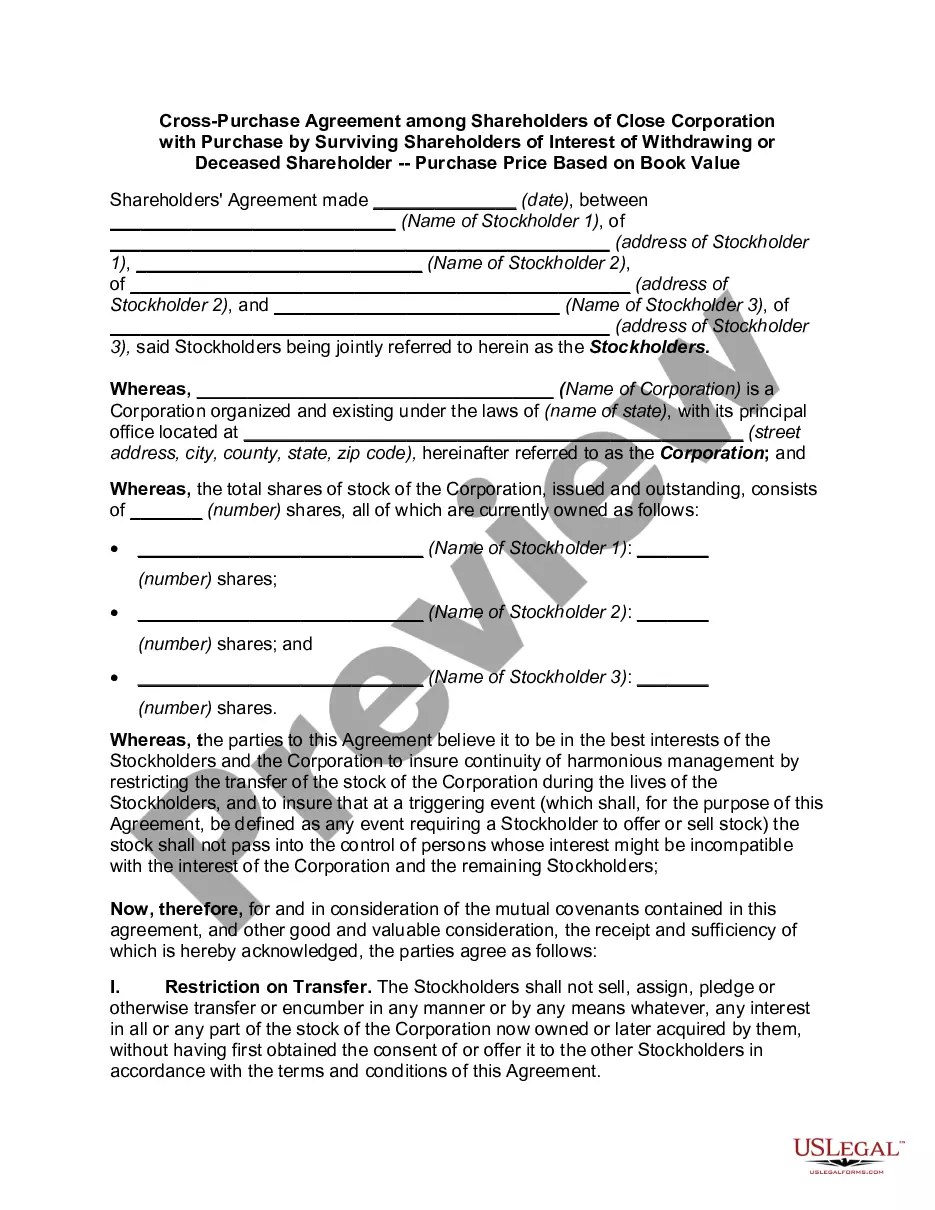

How to fill out Amendment To Agreement For The Purchase And Sale Of Assets Between Moore North America, Inc., Vista DMS, Inc. And Vista Information Solutions, Inc.?

If you want to complete, acquire, or print out lawful papers layouts, use US Legal Forms, the most important assortment of lawful varieties, which can be found on-line. Make use of the site`s simple and hassle-free search to discover the papers you need. A variety of layouts for organization and individual uses are categorized by groups and says, or key phrases. Use US Legal Forms to discover the New Mexico Amendment to Agreement for the Purchase and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc. with a number of mouse clicks.

Should you be presently a US Legal Forms buyer, log in for your account and then click the Acquire button to have the New Mexico Amendment to Agreement for the Purchase and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc.. Also you can entry varieties you earlier delivered electronically inside the My Forms tab of the account.

Should you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have selected the shape for your correct metropolis/nation.

- Step 2. Use the Preview method to look over the form`s content. Never overlook to learn the outline.

- Step 3. Should you be unsatisfied with all the kind, use the Search field near the top of the screen to discover other variations in the lawful kind design.

- Step 4. Upon having located the shape you need, click the Get now button. Select the pricing prepare you choose and include your references to sign up on an account.

- Step 5. Method the financial transaction. You should use your credit card or PayPal account to accomplish the financial transaction.

- Step 6. Choose the file format in the lawful kind and acquire it in your device.

- Step 7. Total, edit and print out or sign the New Mexico Amendment to Agreement for the Purchase and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc..

Every lawful papers design you acquire is your own property eternally. You have acces to every kind you delivered electronically within your acccount. Select the My Forms segment and pick a kind to print out or acquire once again.

Compete and acquire, and print out the New Mexico Amendment to Agreement for the Purchase and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc. with US Legal Forms. There are many professional and express-specific varieties you may use for your organization or individual needs.