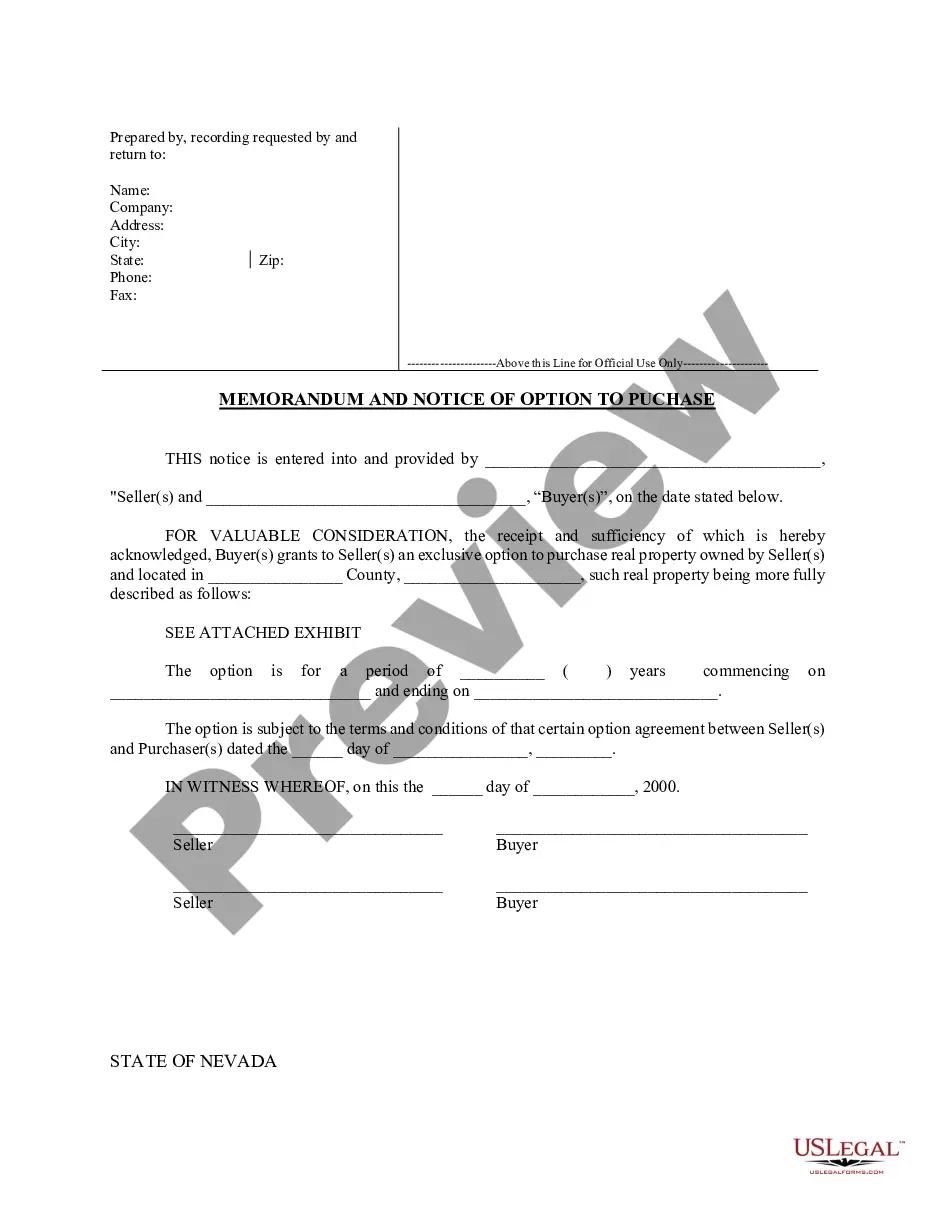

New Mexico Stock Option Agreement of VIA Internet, Inc.

Description

How to fill out Stock Option Agreement Of VIA Internet, Inc.?

It is possible to spend hours on-line looking for the legal papers design which fits the state and federal needs you want. US Legal Forms supplies a huge number of legal types that are analyzed by experts. It is simple to acquire or print out the New Mexico Stock Option Agreement of VIA Internet, Inc. from my services.

If you have a US Legal Forms accounts, you may log in and click on the Down load switch. Afterward, you may complete, change, print out, or signal the New Mexico Stock Option Agreement of VIA Internet, Inc.. Each legal papers design you get is your own eternally. To obtain yet another backup of any acquired kind, check out the My Forms tab and click on the corresponding switch.

Should you use the US Legal Forms site for the first time, follow the easy recommendations under:

- First, make certain you have selected the proper papers design for that region/metropolis of your choosing. Read the kind description to make sure you have selected the appropriate kind. If readily available, utilize the Review switch to look with the papers design at the same time.

- If you want to locate yet another edition of your kind, utilize the Search discipline to find the design that meets your requirements and needs.

- When you have discovered the design you desire, click on Acquire now to proceed.

- Choose the pricing strategy you desire, key in your credentials, and sign up for an account on US Legal Forms.

- Total the purchase. You can use your credit card or PayPal accounts to purchase the legal kind.

- Choose the formatting of your papers and acquire it to your system.

- Make alterations to your papers if necessary. It is possible to complete, change and signal and print out New Mexico Stock Option Agreement of VIA Internet, Inc..

Down load and print out a huge number of papers themes while using US Legal Forms Internet site, that provides the largest variety of legal types. Use professional and express-distinct themes to take on your business or individual needs.

Form popularity

FAQ

A stock option provides an employee with the opportunity to purchase a set number of shares of company stock at a certain price within a certain period of time. The price is called the ?grant price? or ?strike price.? This price is usually based on a discounted price of the stock at the time of hire.

Employee stock purchase plans tend to be viewed as a benefit while stock options are a form of compensation. From an employee perspective, there are some differences in operations, eligibility, and design.

An employee stock option agreement (sometimes known as a share option agreement) is a contract between an employer and employee that guarantees the employee's right to purchase stock in the employer's company at a specified price after a certain period of continuous employment.

RSAs vs. RSUs. Restricted stock awards (RSAs) and restricted stock units (RSUs) are two alternatives to stock options (such as ISOs and NSOs) that companies can use to compensate their employees. While stock options offer employees the ?option? to buy shares at a fixed price, RSAs and RSUs are grants of stock.

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

A stock purchase plan involves the actual purchase of the stock, and differs from an option, which is only the right to purchase stock.