New Mexico Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders A stock transfer agreement is a legally binding contract that outlines the transfer of shares from one entity to another. In the case of the New Mexico Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders, it specifically relates to stock transfers occurring in the state of New Mexico. EMC Corp., a renowned technology company, is involved in a merger with Eagle Merger Corp., with shareholders of both companies being affected. This agreement governs the transfer of stocks in relation to this merger. Key elements of the New Mexico Stock Transfer Agreement include: 1. Parties involved: The agreement details the involved parties, including EMC Corp., Eagle Merger Corp., and the respective shareholders affected by the merger. 2. Purpose: It outlines the purpose of the agreement, which is the transfer of shares from EMC Corp. to Eagle Merger Corp. in accordance with the merger arrangement. 3. Stock transfer process: The agreement describes the procedures and regulations for transferring the stocks from EMC Corp. to the acquiring company, Eagle Merger Corp. It includes details on the timeline, methods of transfer, and any required documentation. 4. Consideration: The agreement specifies the consideration to be provided by Eagle Merger Corp. to the shareholders in exchange for the transferred shares. This can include cash, stock options, or a combination of both. 5. Representations and warranties: It outlines the representations and warranties made by both EMC Corp. and Eagle Merger Corp. to ensure the legitimacy and accuracy of the stock transfer process. This protects the shareholders' interests and safeguards against any potential misrepresentation. 6. Confidentiality: The agreement may include a confidentiality clause, ensuring that all parties maintain the confidentiality of sensitive information disclosed during the transfer process. Types of New Mexico Stock Transfer Agreements: While there are no specific types of New Mexico Stock Transfer Agreements, different variations can exist depending on the specific terms and conditions agreed upon by the involved parties. Some examples may include variations in the consideration provided, transfer methods, or provisions specific to the particular merger or acquisition. In conclusion, the New Mexico Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders is a comprehensive document that governs the transfer of stocks in relation to the merger. It ensures a smooth and legally compliant transfer process, protecting the rights and interests of all parties involved.

New Mexico Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders

Description

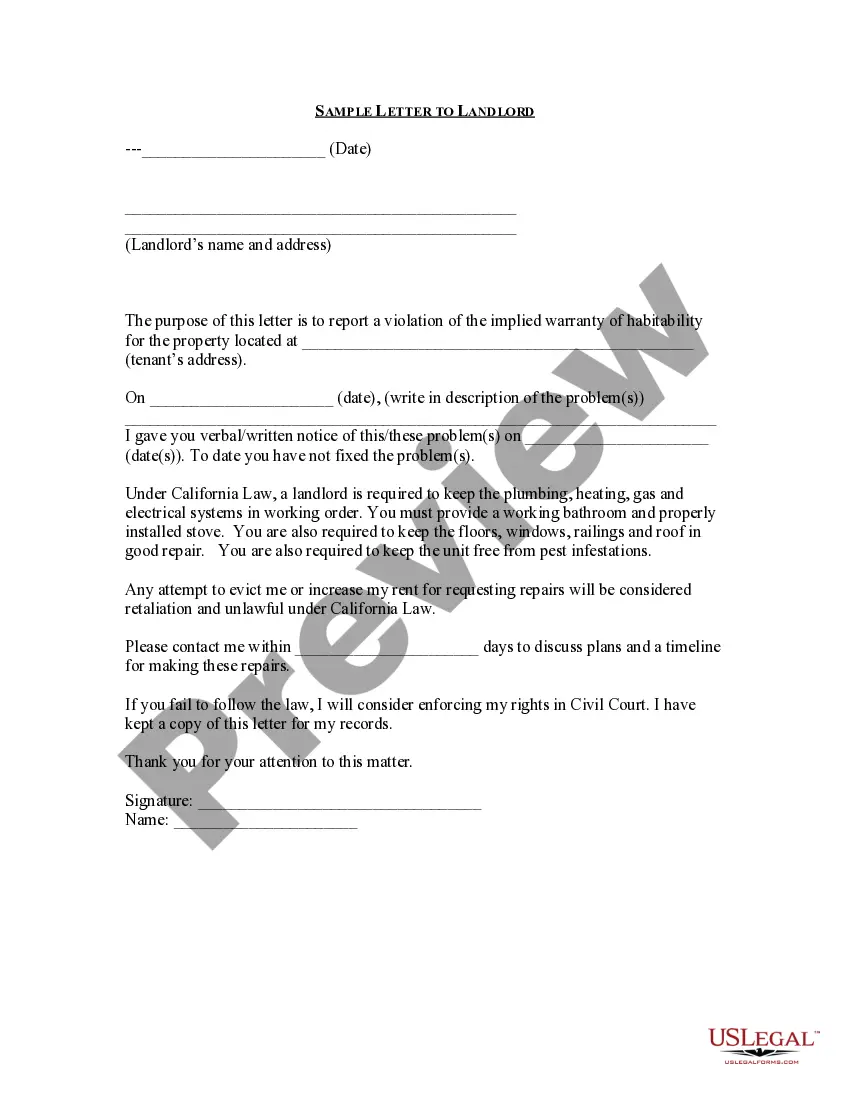

How to fill out New Mexico Stock Transfer Agreement Between EMC Corp., Eagle Merger Corp., And Shareholders?

US Legal Forms - among the largest libraries of lawful types in America - gives an array of lawful record themes you are able to obtain or produce. Utilizing the internet site, you will get a huge number of types for business and person reasons, categorized by groups, suggests, or search phrases.You will find the newest models of types like the New Mexico Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders in seconds.

If you already have a membership, log in and obtain New Mexico Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders in the US Legal Forms library. The Obtain button will appear on each develop you perspective. You have accessibility to all earlier saved types inside the My Forms tab of your profile.

In order to use US Legal Forms for the first time, listed here are easy guidelines to help you get started off:

- Be sure to have selected the right develop to your town/area. Go through the Review button to analyze the form`s content. Look at the develop outline to ensure that you have selected the correct develop.

- In case the develop does not satisfy your requirements, take advantage of the Search discipline towards the top of the display to obtain the one that does.

- When you are satisfied with the shape, verify your decision by clicking on the Acquire now button. Then, pick the prices plan you want and offer your accreditations to register to have an profile.

- Process the purchase. Make use of your bank card or PayPal profile to finish the purchase.

- Pick the format and obtain the shape in your device.

- Make changes. Fill up, revise and produce and indication the saved New Mexico Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders.

Every single format you put into your account lacks an expiration particular date and it is yours for a long time. So, in order to obtain or produce yet another duplicate, just check out the My Forms portion and then click about the develop you require.

Obtain access to the New Mexico Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders with US Legal Forms, probably the most substantial library of lawful record themes. Use a huge number of professional and state-distinct themes that satisfy your small business or person requirements and requirements.