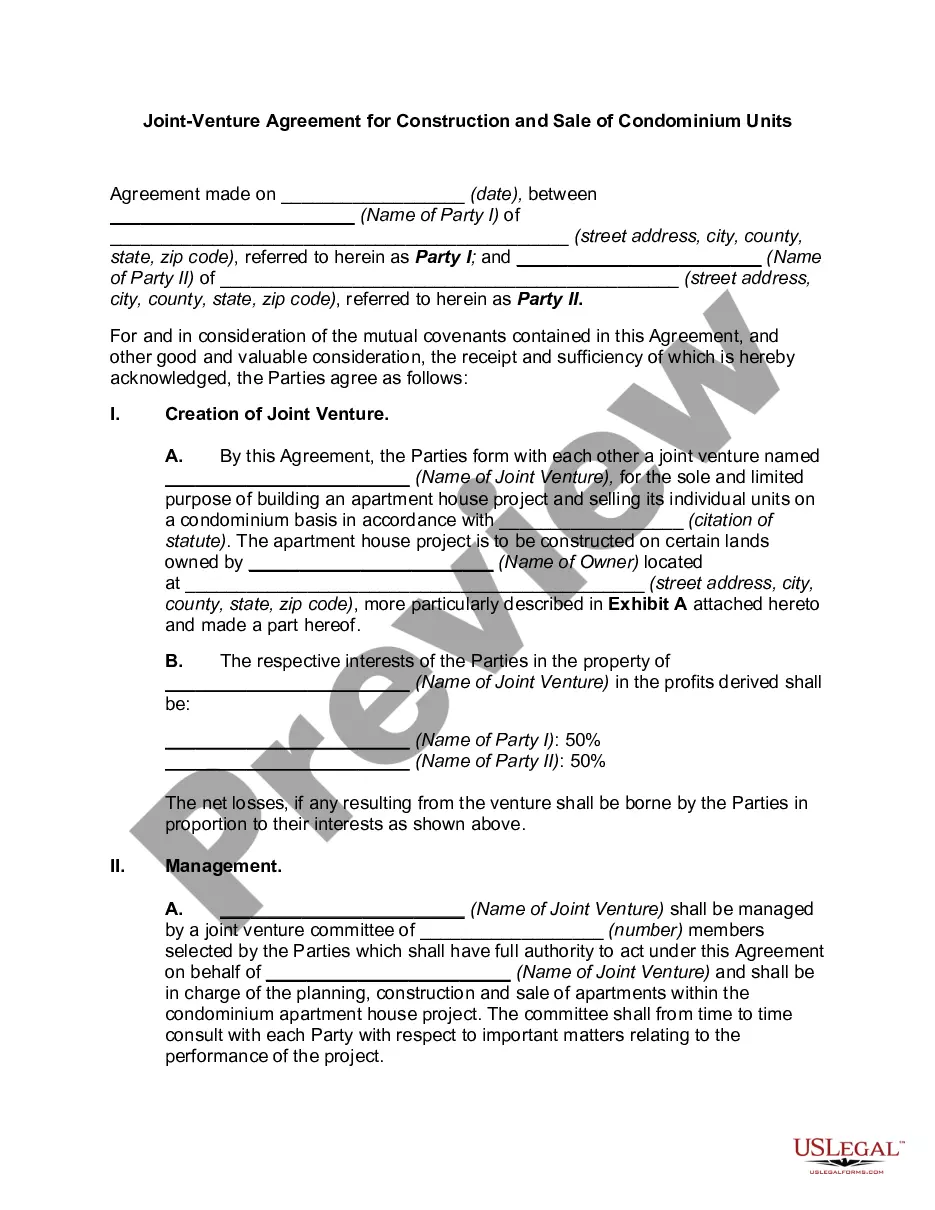

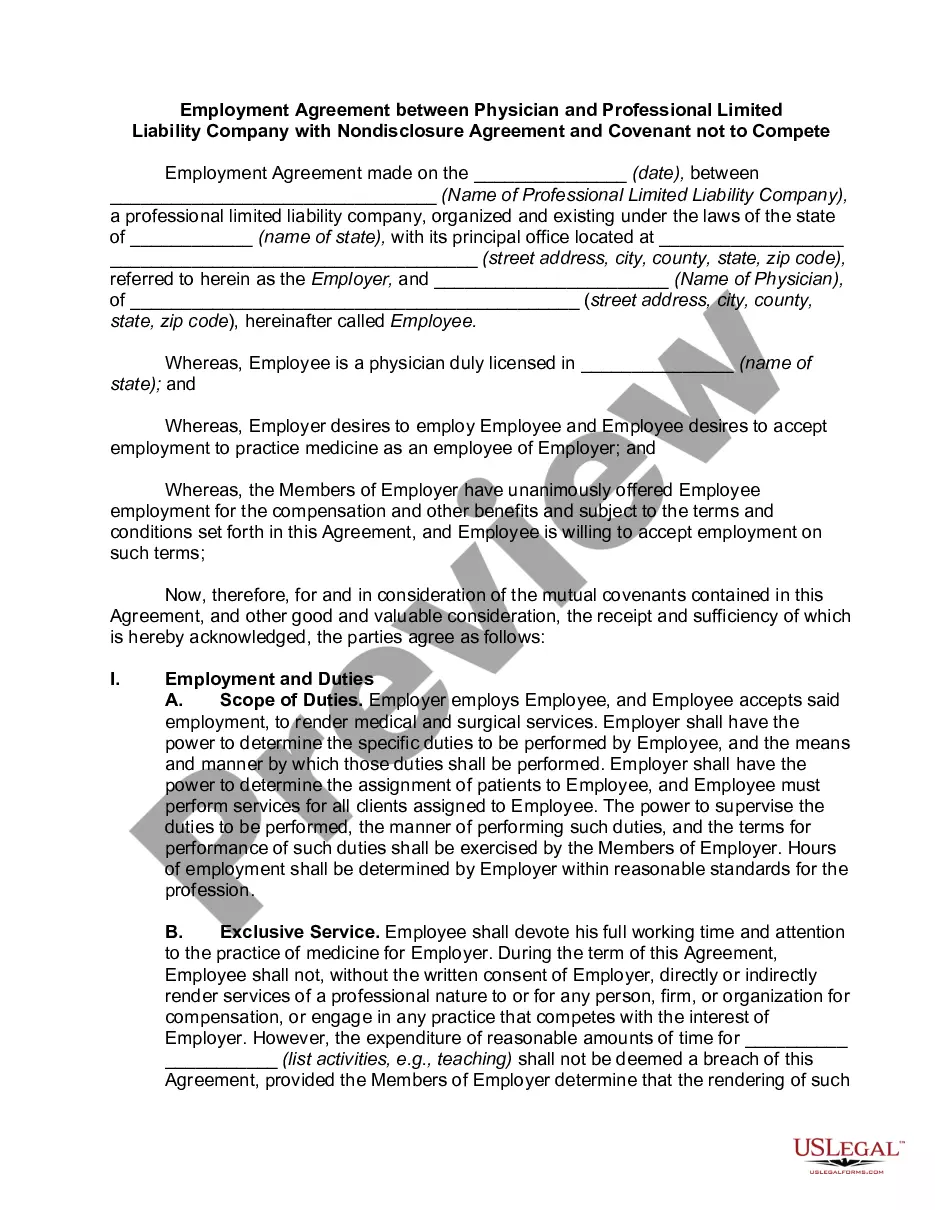

The New Mexico General Agreement is an important legal document that outlines a wide range of provisions and agreements between parties involved in various business transactions or legal matters within the state of New Mexico. This agreement serves as a comprehensive framework for parties to establish mutual understandings, obligations, and rights, ensuring a smooth and transparent process in their interactions. There are different types of New Mexico General Agreements, each tailored to specific scenarios and sectors, such as: 1. New Mexico General Agreement for Real Estate: This agreement is commonly used in real estate transactions, whether for buying or selling properties, leasing agreements, or handling property management. It clearly outlines the responsibilities, terms, and conditions that both parties must adhere to, including payment schedules, insurance requirements, rights to access, and dispute resolution mechanisms. 2. New Mexico General Agreement for Employment: This agreement governs the relationship between employers and employees within the state of New Mexico. It covers essential aspects such as job descriptions, compensation and benefits, working hours, probationary periods, confidentiality clauses, termination conditions, and non-compete agreements. This type of agreement ensures that both parties have a clear understanding of their obligations and rights throughout the employment relationship. 3. New Mexico General Agreement for Business Partnerships: This agreement is designed for businesses or individuals looking to enter into a partnership or joint venture in New Mexico. It outlines the terms and conditions including profit and loss sharing, decision-making processes, responsibilities of each partner, dispute resolution procedures, and the mechanism for the dissolution of the partnership. 4. New Mexico General Agreement for Contracts: This broadly covers general business contracts in New Mexico, encompassing various industries such as technology, manufacturing, services, and more. It details the specific terms and conditions agreed upon by both parties, including payment terms, delivery schedules, warranties, intellectual property rights, indemnification, and liabilities. This agreement helps prevent misunderstandings and disputes by ensuring clear communication and agreement between all parties involved. In conclusion, the New Mexico General Agreement provides a structured framework for parties involved in different types of transactions within the state. These agreements serve as vital legal instruments to establish the necessary guidelines, responsibilities, and rights that ensure smooth, transparent, and mutually beneficial relationships in various sectors.

New Mexico General Agreement

Description

How to fill out New Mexico General Agreement?

It is possible to commit hours on the Internet searching for the lawful file design that meets the state and federal demands you require. US Legal Forms offers a huge number of lawful varieties which can be evaluated by experts. You can easily acquire or produce the New Mexico General Agreement from the support.

If you currently have a US Legal Forms profile, you may log in and click on the Down load option. After that, you may total, modify, produce, or signal the New Mexico General Agreement. Each and every lawful file design you buy is your own property forever. To obtain another version of any purchased type, proceed to the My Forms tab and click on the related option.

Should you use the US Legal Forms site for the first time, follow the basic instructions below:

- Initial, make sure that you have chosen the proper file design for your state/area that you pick. See the type description to ensure you have selected the proper type. If readily available, make use of the Preview option to check with the file design also.

- If you would like locate another edition of the type, make use of the Search industry to get the design that fits your needs and demands.

- When you have located the design you desire, click on Get now to proceed.

- Pick the costs prepare you desire, type your references, and register for your account on US Legal Forms.

- Comprehensive the financial transaction. You should use your Visa or Mastercard or PayPal profile to cover the lawful type.

- Pick the format of the file and acquire it to the system.

- Make adjustments to the file if required. It is possible to total, modify and signal and produce New Mexico General Agreement.

Down load and produce a huge number of file themes utilizing the US Legal Forms Internet site, that offers the biggest variety of lawful varieties. Use skilled and status-certain themes to deal with your organization or individual requirements.

Form popularity

FAQ

For tax years 2005 to present, file your amended return on the PIT-X form for that tax year. For example, to amend a return for the 2005 tax year, use Form 2005 PIT-X; to amend a return for tax year 2006, use Form 2006 PIT-X, etc. For tax years beginning prior to January 1, 2005, there is no special form.

To apply for a CRS ID number or for more information on the topic, visit NM's website at . The CRS ID may be entered under the State ID number in Setup > Firm > Settings tab. 11917: NM - CRS ID Number - Drake Software drakesoftware.com ? Site ? Browse ? NM-CRS... drakesoftware.com ? Site ? Browse ? NM-CRS...

You can apply for a Business Tax Identification Number Online at our website here. You will click ?Apply for a New Mexico Business Tax ID? and follow the prompts. Upon completion and approval of the online application you may log in with the credentials set up during the application. Who must register a business? newmexico.gov ? businesses ? who-must... newmexico.gov ? businesses ? who-must...

When requesting a refund, attach Form RPD-41373, Application for Refund of Tax Withheld From Pass-Through Entities, to the PTE return. To receive proper credit for withholding, all annual statements of income and withholding must be issued to the entity filing the New Mexico return.

Compensating tax is an excise tax imposed on persons using property or services in New Mexico, also called ?use tax? or ?buyer pays.? Compensating tax is reported on the Combined Reporting System, CRS-1 form. BUSINESS TAXES - Business Portal nm.gov ? maintain ? pay-state-taxes nm.gov ? maintain ? pay-state-taxes

A NMBTIN is a unique taxpayer ID issued by the New Mexico Department of Taxation and Revenue. It is used to report withholdings, gross receipt taxes, and any compensation you may receive. This is different from your Federal Employer Identification Number, which is also required for most business types.

File your Form(s) CRS-1 in ance with your filing status: i.e., monthly, quarterly, semi-annually. If you do not know your filing status, please contact your local district office. To e-file, visit the TRD web page at . You can register for online filing by clicking the "sign up now" link.

How to get a sales tax permit in New Mexico. You can register online or mail in form ACD-31015 (opens in PDF). Many local tax offices or town halls also allow taxpayers to apply for their permit. Check with your local government authorities if you prefer to register for a gross receipts tax permit in person. New Mexico Sales Tax Guide and Calculator 2022 - TaxJar taxjar.com ? sales-tax ? new-mexico taxjar.com ? sales-tax ? new-mexico