New Mexico Documentation Required to Confirm Accredited Investor Status

Description

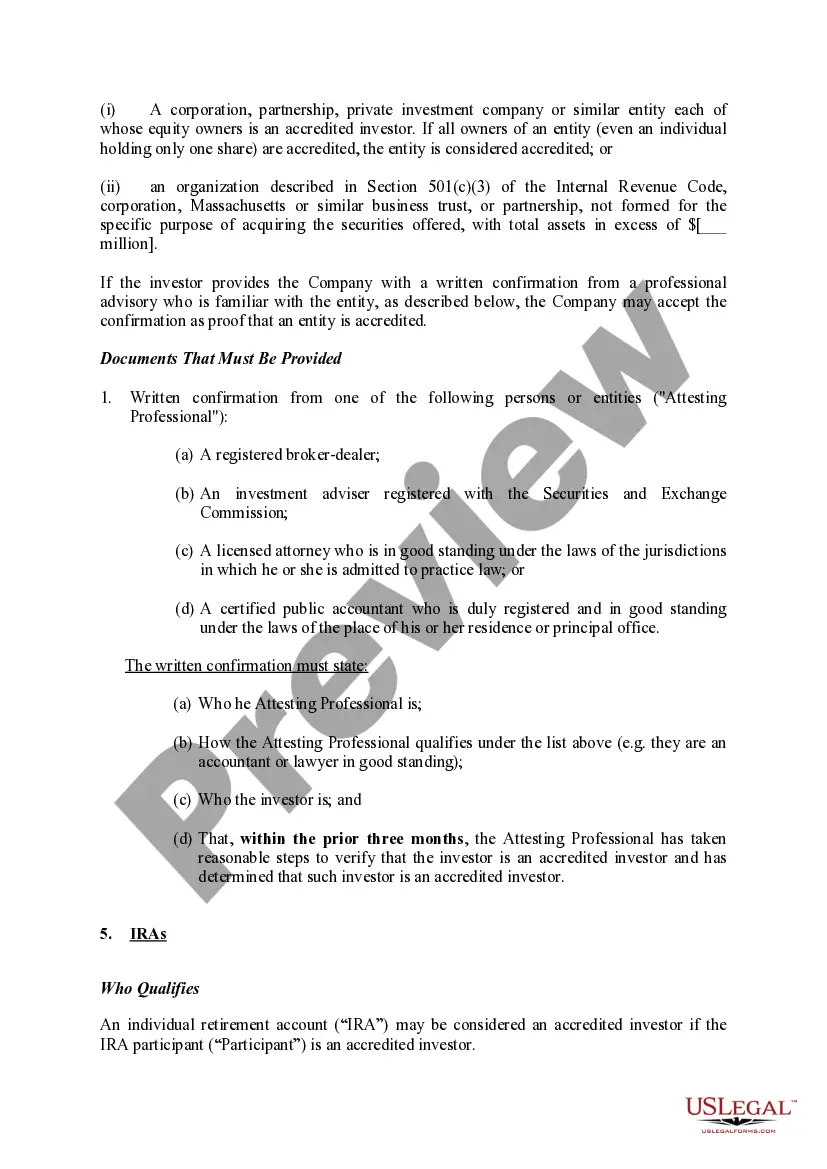

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

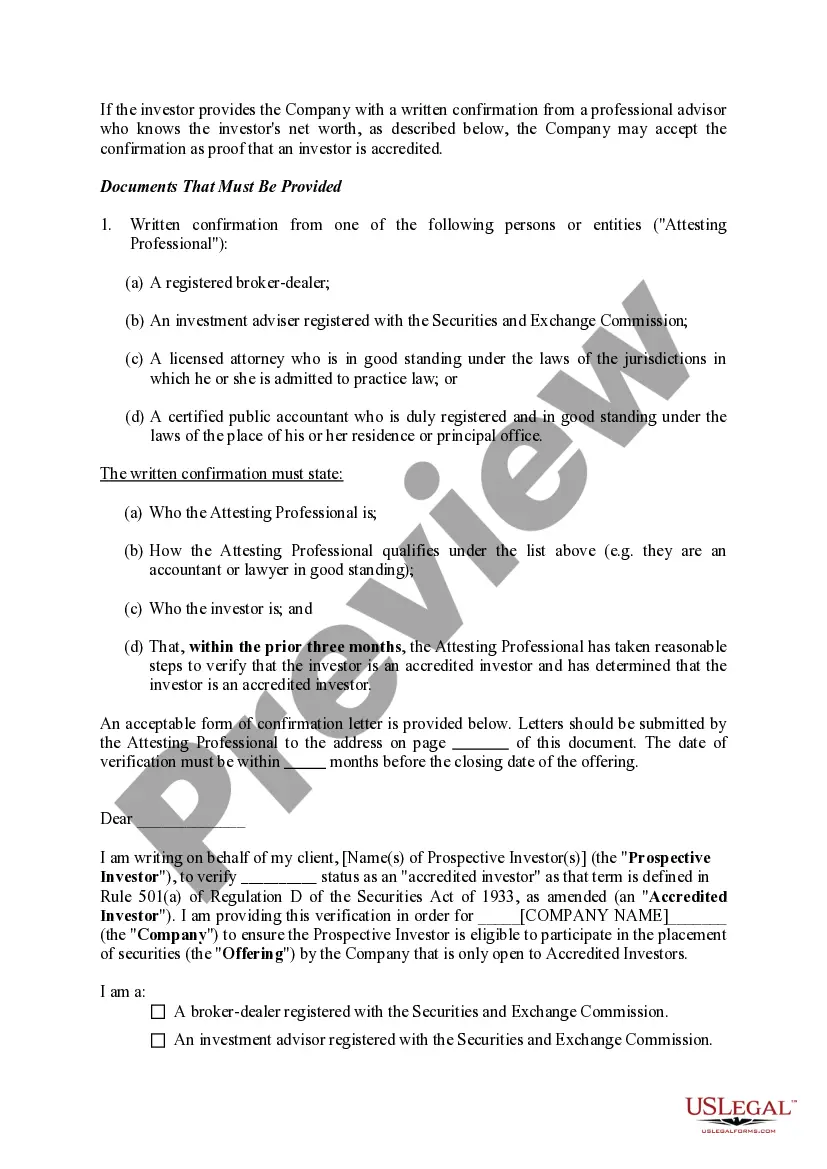

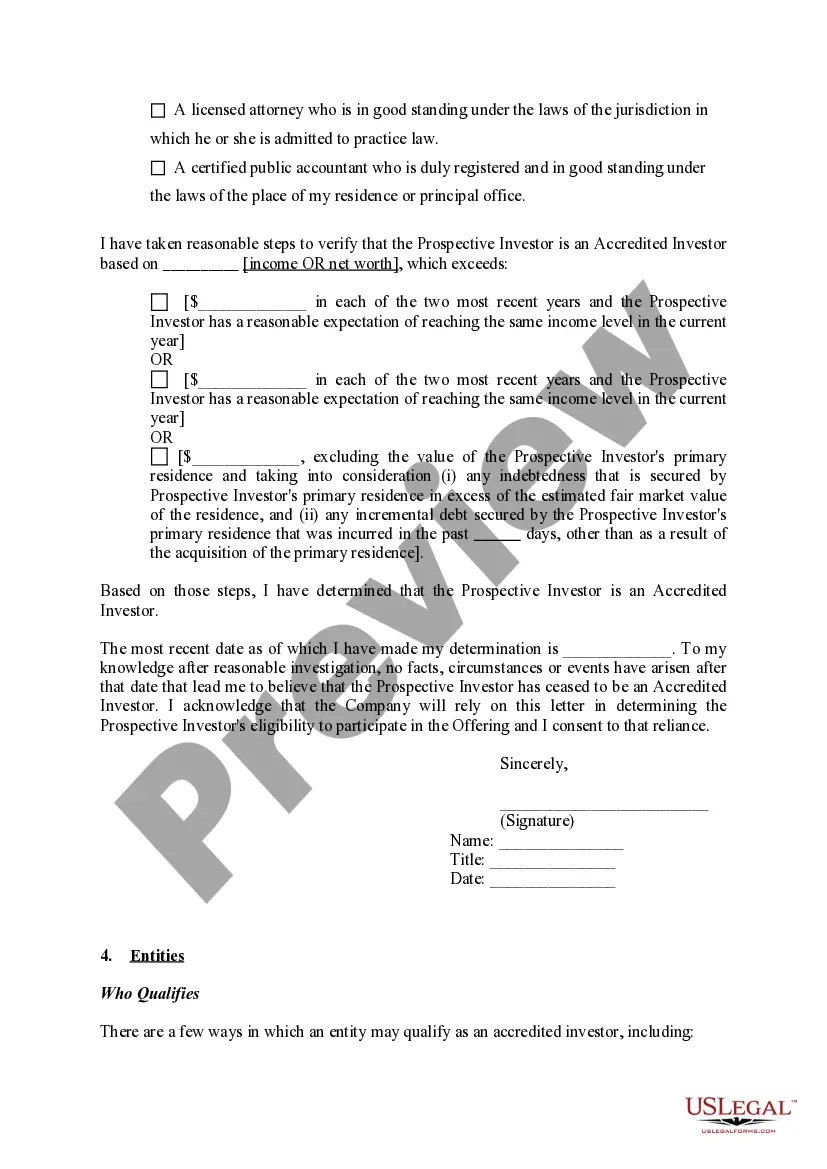

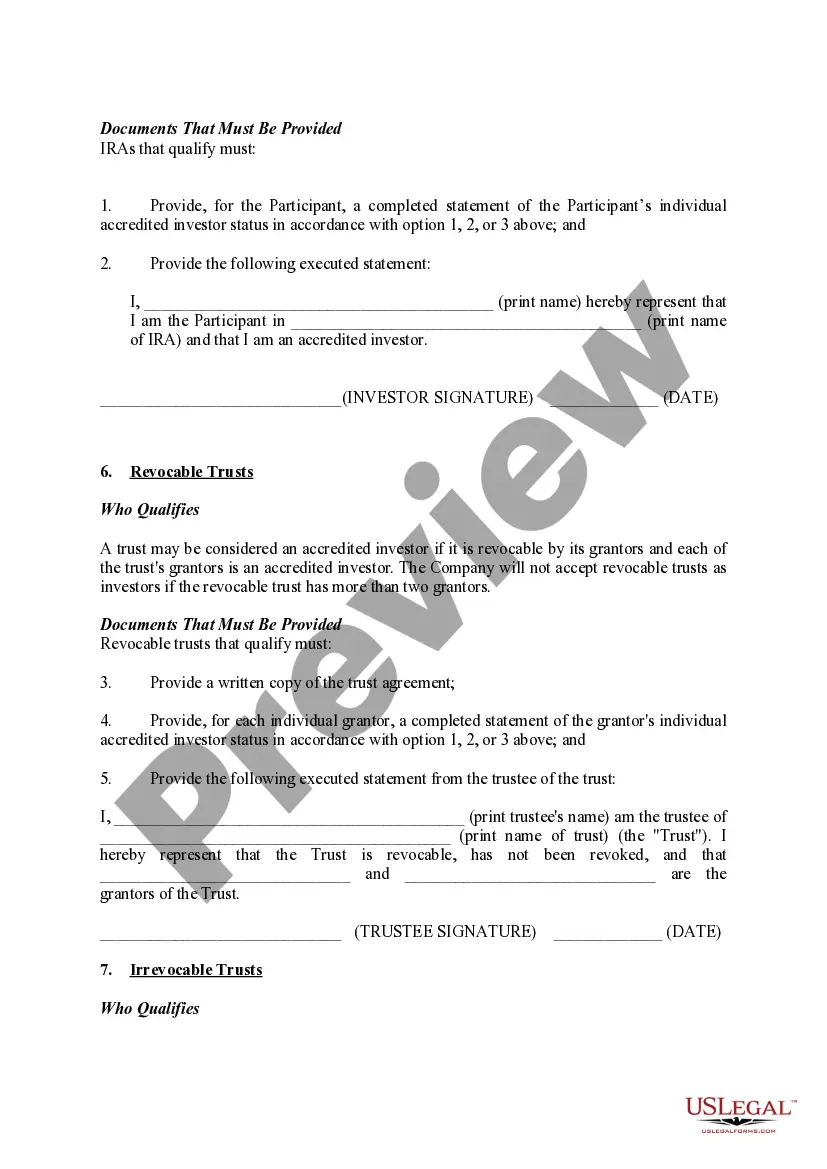

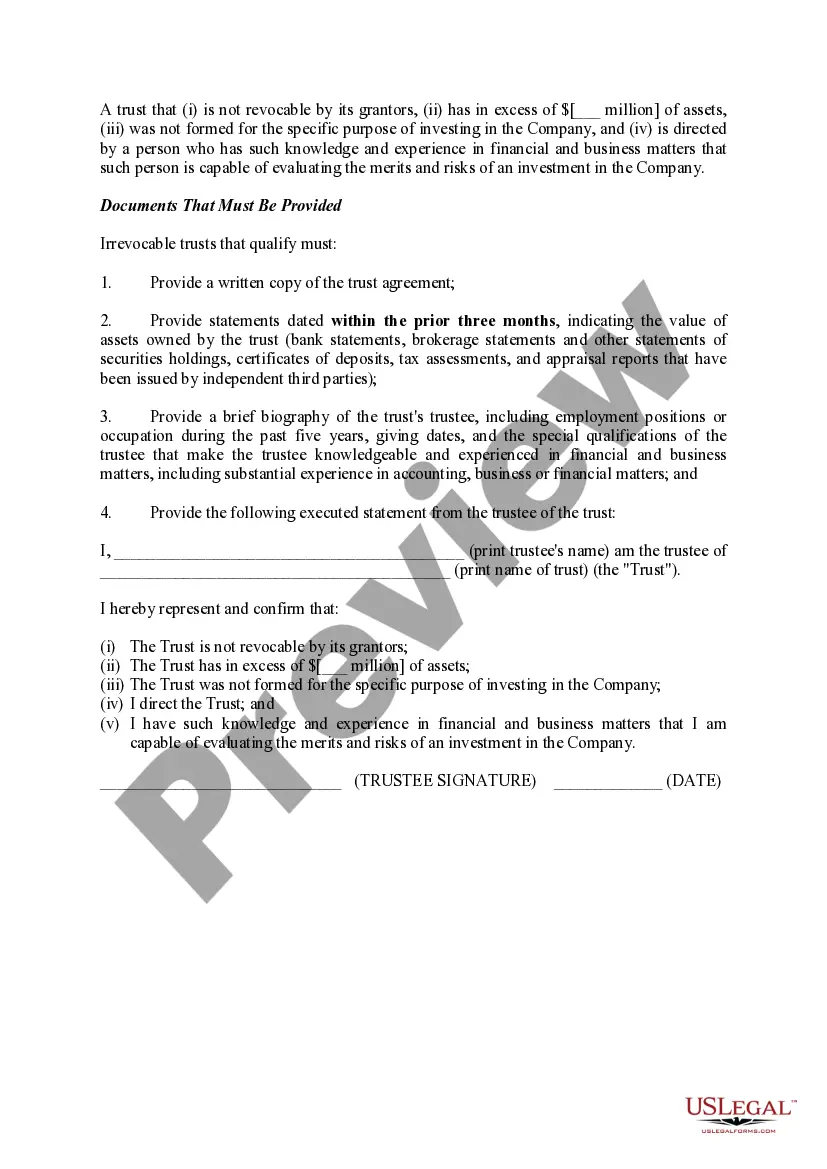

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Documentation Required To Confirm Accredited Investor Status?

It is possible to commit several hours on the Internet searching for the legal file format that meets the state and federal specifications you need. US Legal Forms gives a huge number of legal kinds that are analyzed by pros. You can actually down load or print the New Mexico Documentation Required to Confirm Accredited Investor Status from the service.

If you already possess a US Legal Forms account, you may log in and click the Obtain option. Afterward, you may full, edit, print, or indicator the New Mexico Documentation Required to Confirm Accredited Investor Status. Each and every legal file format you acquire is your own property forever. To have one more duplicate associated with a obtained kind, go to the My Forms tab and click the corresponding option.

If you use the US Legal Forms internet site the first time, adhere to the straightforward directions beneath:

- Initially, ensure that you have selected the right file format for the area/town of your choice. Read the kind outline to make sure you have picked out the appropriate kind. If offered, make use of the Preview option to search through the file format at the same time.

- If you want to discover one more edition in the kind, make use of the Research field to get the format that suits you and specifications.

- Once you have located the format you desire, click Acquire now to continue.

- Select the pricing strategy you desire, key in your accreditations, and sign up for your account on US Legal Forms.

- Total the transaction. You should use your bank card or PayPal account to cover the legal kind.

- Select the structure in the file and down load it for your system.

- Make changes for your file if required. It is possible to full, edit and indicator and print New Mexico Documentation Required to Confirm Accredited Investor Status.

Obtain and print a huge number of file templates using the US Legal Forms Internet site, that offers the greatest variety of legal kinds. Use skilled and status-particular templates to deal with your organization or individual requirements.

Form popularity

FAQ

Examples of supporting documents Latest statement from brokerage houses showing net personal assets For net equity of property: Title deeds free of encumbrances. Latest housing loan statement For income: Salary Slip.

Accredited Individual Investor ? By Income IR8A/income tax form declaring personal income not less than S$300,000 (or an equivalent document) A copy of employment letter/contract stating position and income, salary payslip, and bank statement recording such income.

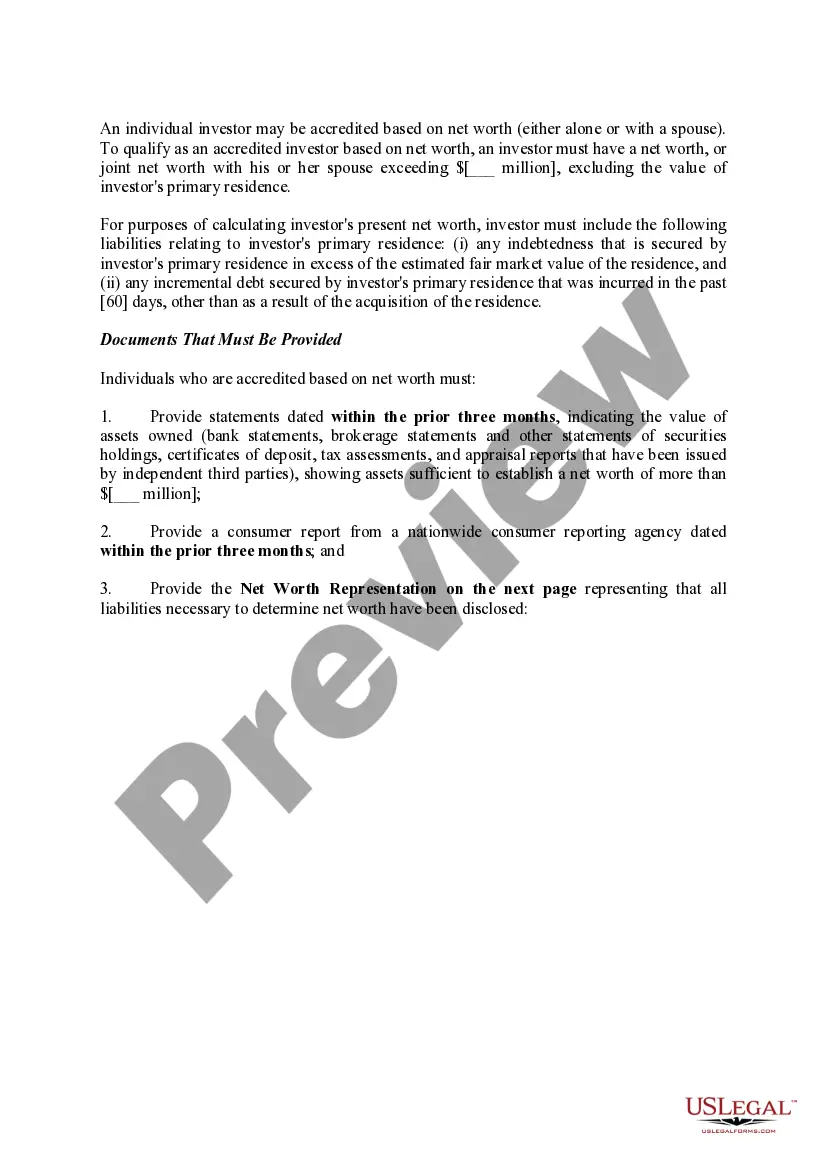

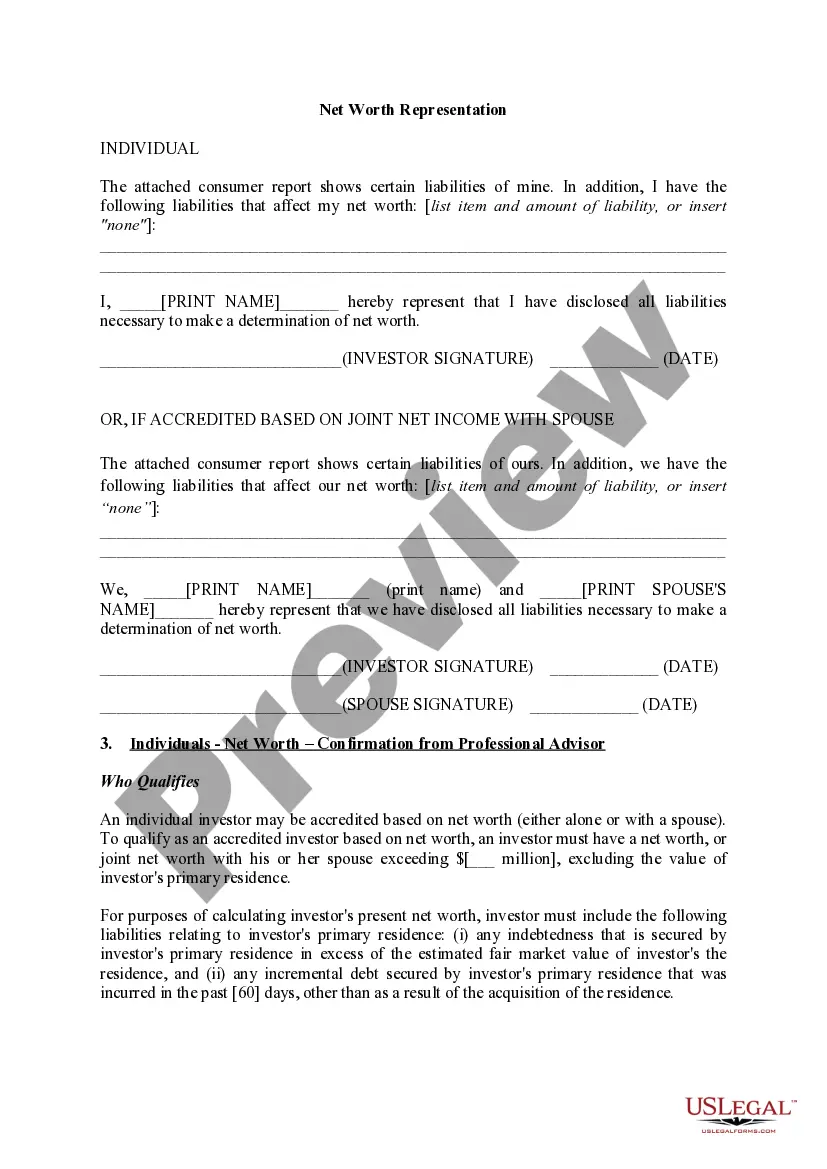

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

If that type of official documentation is not available, you may be able to provide evidence through earnings statements, pay stubs, a letter from your employer certifying your income, or perhaps bank statements that show that you receive that income.

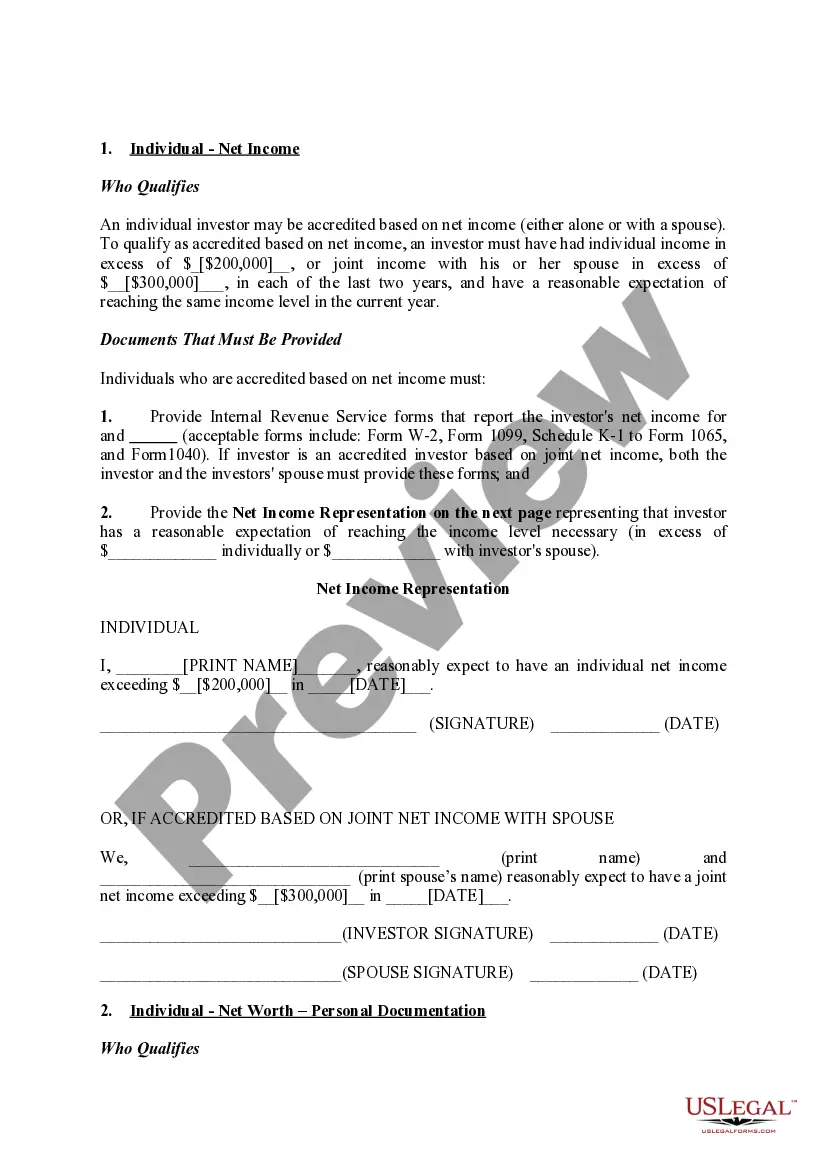

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

Requirements to Be an Accredited Investor A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

In the case of a successful verification, you'll get an attorney's letter certifying that you have been verified as an accredited investor pursuant to standards required by federal laws.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.