A New Mexico Term Sheet — Six Month Promissory Note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower for a six-month period in the state of New Mexico. This particular type of promissory note is commonly used for short-term loans, providing a structured framework for repayment and ensuring legal protection for both parties involved. The New Mexico Term Sheet — Six Month Promissory Note typically includes essential information such as the names and contact details of the borrower and lender, the principal amount of the loan, the interest rate, repayment terms, and any applicable fees or penalties. It serves as evidence of the loan and the borrower's commitment to repay the amount borrowed within the agreed-upon timeframe. These term sheets can vary based on the specific conditions set forth by the lender or borrower. However, they generally include provisions regarding the payment schedule (monthly, bi-weekly, or other arrangements), acceptable forms of payment, late payment penalties, and any additional terms or conditions the parties wish to include. In addition to the standard New Mexico Term Sheet — Six Month Promissory Note, there may be variations or customized versions available to cater to specific loan purposes or unique situations. For example, there could be term sheets specifically designed for business loans, personal loans, or loans secured with collateral. These variations may have additional clauses addressing specific loan aspects such as repayment guarantee, security agreements, or the rights and obligations of the parties involved. It is important for both borrowers and lenders to carefully review and understand the terms outlined in the New Mexico Term Sheet — Six Month Promissory Note before signing. If any issues or discrepancies arise, it is advisable to seek legal counsel to ensure a fair and transparent agreement. Additionally, it is crucial to keep a copy of the fully executed promissory note for future reference and potential legal disputes.

New Mexico Term Sheet - Six Month Promissory Note

Description

How to fill out New Mexico Term Sheet - Six Month Promissory Note?

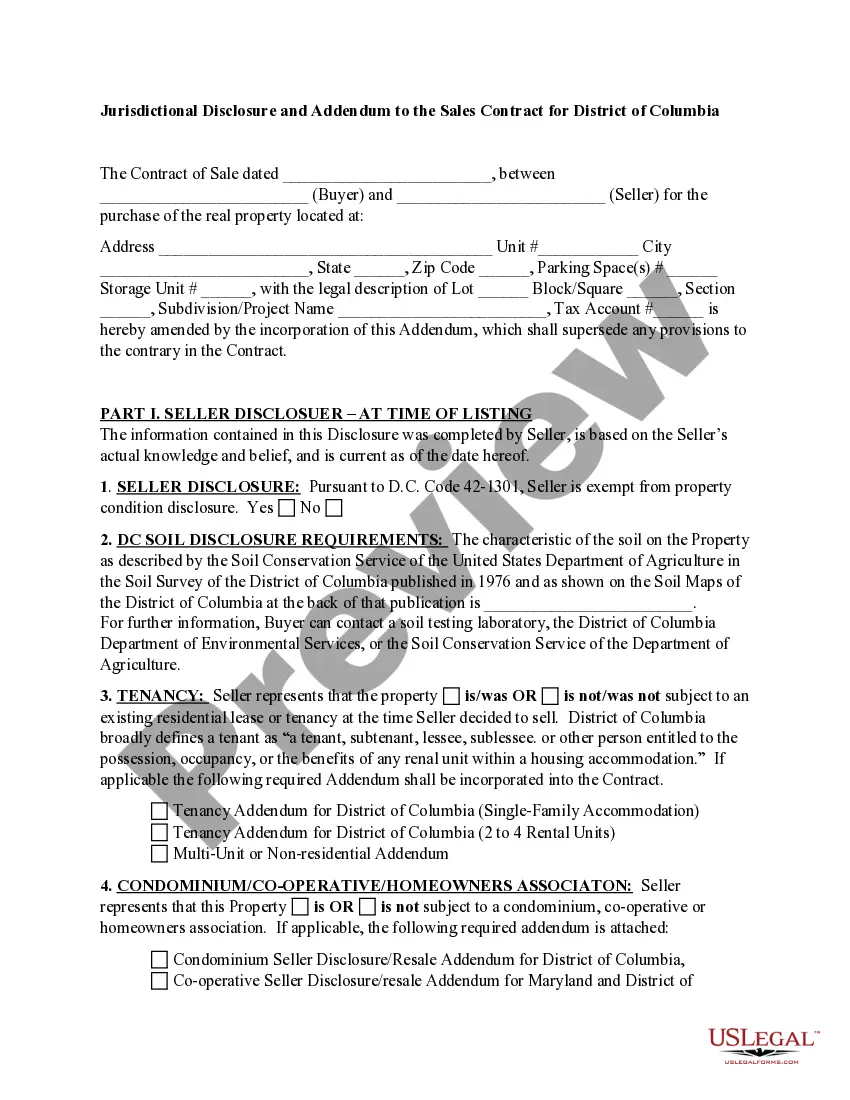

Are you currently inside a situation where you need to have documents for sometimes company or personal reasons almost every time? There are a lot of legitimate record web templates available on the Internet, but getting versions you can depend on isn`t easy. US Legal Forms delivers a huge number of kind web templates, like the New Mexico Term Sheet - Six Month Promissory Note, that are published to meet state and federal requirements.

In case you are currently acquainted with US Legal Forms web site and get your account, simply log in. After that, you are able to download the New Mexico Term Sheet - Six Month Promissory Note format.

Should you not have an accounts and need to begin using US Legal Forms, follow these steps:

- Get the kind you will need and make sure it is to the right town/county.

- Use the Preview key to examine the form.

- Browse the outline to ensure that you have chosen the proper kind.

- In the event the kind isn`t what you are seeking, take advantage of the Lookup field to get the kind that meets your needs and requirements.

- Whenever you discover the right kind, click Get now.

- Opt for the costs strategy you would like, submit the necessary info to generate your account, and pay money for the transaction with your PayPal or bank card.

- Decide on a practical file file format and download your version.

Find each of the record web templates you have purchased in the My Forms menus. You can get a further version of New Mexico Term Sheet - Six Month Promissory Note at any time, if required. Just select the necessary kind to download or print out the record format.

Use US Legal Forms, the most substantial collection of legitimate forms, to save time and avoid errors. The services delivers professionally made legitimate record web templates that you can use for a variety of reasons. Make your account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.

Anyone lending money (like home sellers, credit unions, mortgage lenders and banks, for instance) can issue a promissory note. But specific to real estate and the mortgage process, promissory notes serve as an agreement that the borrower will repay their mortgage loan by the maturity date.

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.