New Mexico Pre Incorporation Agreement

Description

How to fill out Pre Incorporation Agreement?

You are able to spend hours on-line trying to find the legitimate document format which fits the federal and state demands you will need. US Legal Forms provides 1000s of legitimate kinds that are evaluated by professionals. It is possible to down load or printing the New Mexico Pre Incorporation Agreement from your service.

If you already possess a US Legal Forms profile, you can log in and click on the Obtain key. After that, you can comprehensive, revise, printing, or indicator the New Mexico Pre Incorporation Agreement. Every single legitimate document format you acquire is the one you have forever. To have one more backup of the bought type, go to the My Forms tab and click on the related key.

If you work with the US Legal Forms website the very first time, stick to the easy directions below:

- Very first, make certain you have selected the right document format for the state/metropolis that you pick. Read the type information to ensure you have chosen the proper type. If readily available, make use of the Preview key to search from the document format at the same time.

- If you wish to locate one more edition in the type, make use of the Lookup industry to find the format that suits you and demands.

- Once you have located the format you need, simply click Buy now to carry on.

- Select the pricing program you need, enter your credentials, and sign up for your account on US Legal Forms.

- Comprehensive the financial transaction. You should use your credit card or PayPal profile to cover the legitimate type.

- Select the formatting in the document and down load it to the product.

- Make adjustments to the document if needed. You are able to comprehensive, revise and indicator and printing New Mexico Pre Incorporation Agreement.

Obtain and printing 1000s of document themes using the US Legal Forms site, which offers the largest selection of legitimate kinds. Use specialist and express-particular themes to take on your small business or specific requirements.

Form popularity

FAQ

'Any contract made in writing by a person professing to act as agent or trustee for a company not yet incorporated shall be capable of being ratified or adopted by or otherwise made binding upon and enforceable by such company after it has been duly incorporated as if it had been duly incorporated at the time when the ...

A shareholders' agreement is an agreement entered into between all or some of the shareholders in a company. It regulates the relationship between the shareholders, the management of the company, ownership of the shares and the protection of the shareholders. They also govern the way in which the company is run.

A shareholders' agreement is an instrument that sets out the limitation which the shareholders would want to control, as far as possible, in certain cases including but not limited to changes to the articles of association, alteration of share rights, increase or reduce the amount of share capital, etc.

In this case, the promoters of a hotel company entered into a pre-incorporation contract for the purchase of wine. Here, in this case, wine was consumed earlier and due to some reasons, the company went on liquidation. Another party to the contract sued the promoters for the non-payment of wine.

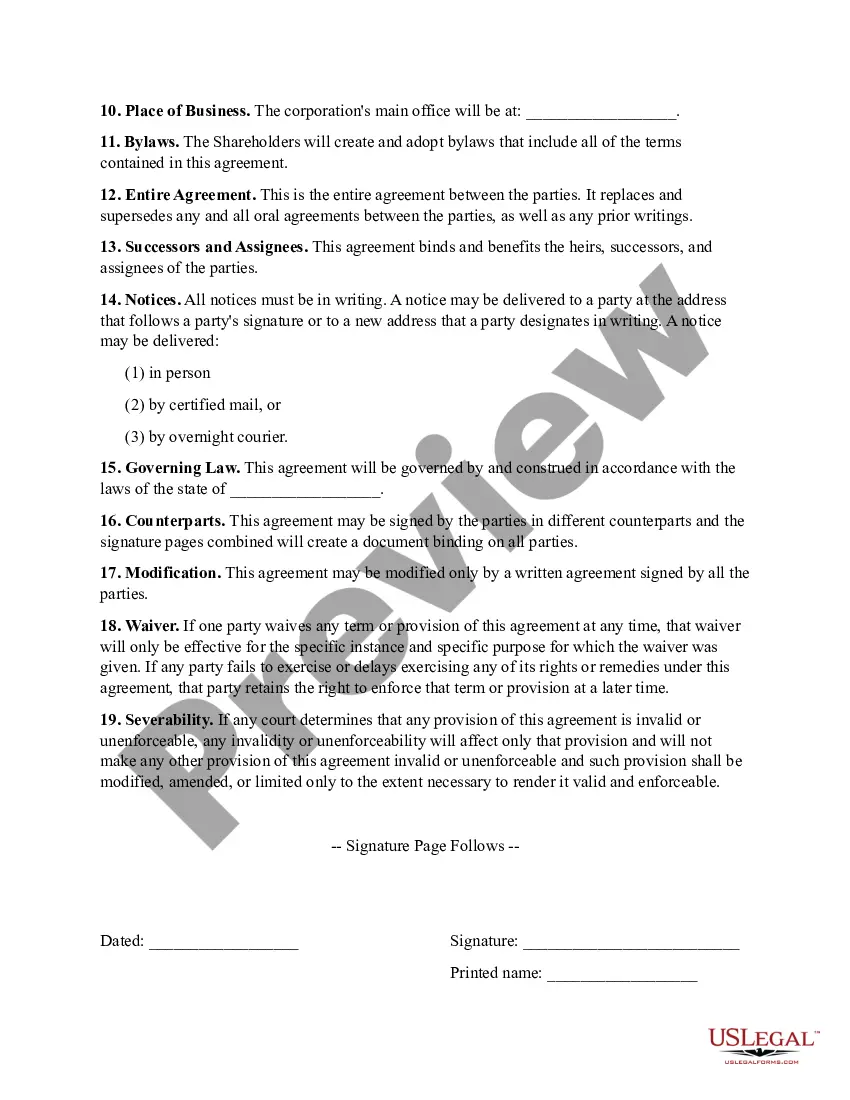

Purpose of shareholder agreement 1.2 The Shareholders are entering into this Shareholder Agreement to provide for the management and control of the affairs of the Corporation, including management of the business, division of profits, disposition of shares, and distribution of assets on liquidation.

There are various types of pre-incorporation contracts that can be made by a company ing to their need before incorporation, such as a lease agreement, employment agreement, founder's agreement, shareholder agreement, etc.