New Mexico Qualified Written RESPA Request to Dispute or Validate Debt

Description

How to fill out New Mexico Qualified Written RESPA Request To Dispute Or Validate Debt?

Are you in a placement that you require papers for either business or individual reasons just about every time? There are plenty of legitimate file templates available online, but getting ones you can rely on isn`t simple. US Legal Forms delivers a huge number of type templates, such as the New Mexico Qualified Written RESPA Request to Dispute or Validate Debt, that are created in order to meet state and federal demands.

When you are currently knowledgeable about US Legal Forms site and have a merchant account, merely log in. Following that, you may obtain the New Mexico Qualified Written RESPA Request to Dispute or Validate Debt template.

Unless you have an accounts and would like to begin using US Legal Forms, follow these steps:

- Get the type you want and ensure it is for your right metropolis/state.

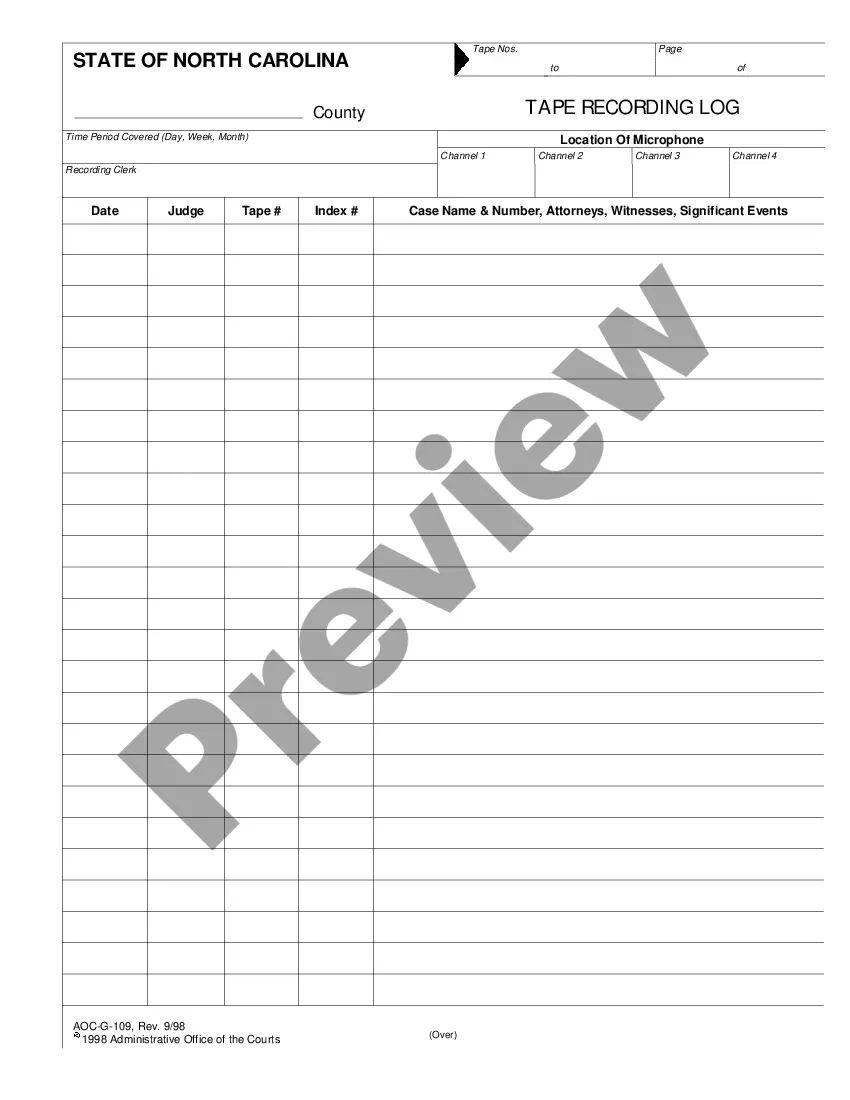

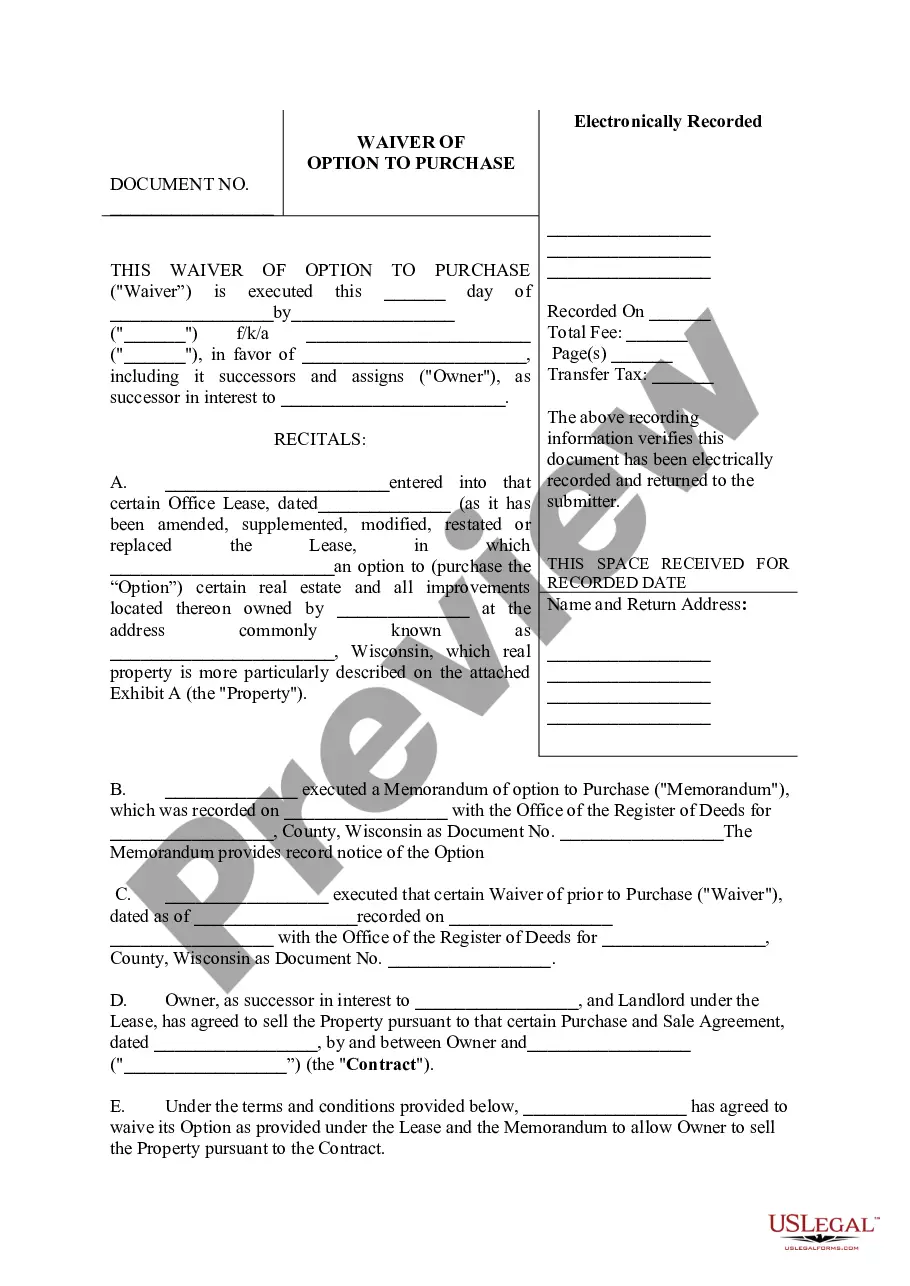

- Use the Review key to check the form.

- Read the explanation to ensure that you have selected the right type.

- In the event the type isn`t what you are looking for, take advantage of the Research discipline to find the type that fits your needs and demands.

- When you discover the right type, click Purchase now.

- Opt for the costs plan you need, submit the required info to make your money, and buy your order using your PayPal or charge card.

- Choose a handy file structure and obtain your version.

Locate all the file templates you might have purchased in the My Forms food selection. You may get a extra version of New Mexico Qualified Written RESPA Request to Dispute or Validate Debt anytime, if possible. Just go through the necessary type to obtain or printing the file template.

Use US Legal Forms, the most extensive selection of legitimate varieties, to conserve efforts and prevent mistakes. The services delivers appropriately made legitimate file templates which can be used for a selection of reasons. Generate a merchant account on US Legal Forms and start creating your daily life easier.

Form popularity

FAQ

According to the above FDCPA Section, Debt Validation is defined as the debt collector contacting the original creditor to affirm the debt amount being requested is correct. It is highly doubtful the debt collector ever contacts the original creditor for any debt validation purposes.

If you believe you do not owe the debt or that it's not even your debt, send a written request to the debt collector and dispute the debt. You can also send a written request to the debt collector to receive more information about the debt.

Failing to respond to a Debt Validation Letter while continuing to collect on the debt is a direct violation of the FDCPA. You can report a debt collector's failure to respond to your state's attorney general, the Consumer Financial Protection Bureau (CFPB), or the FTC.

§ 1006.34 Notice for validation of debts.Deceased consumers.Bankruptcy proofs of claim.In general.Subsequent debt collectors.Last statement date.Last payment date.Transaction date.Assumed receipt of validation information.More items...

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

The name of the creditor seeking payment. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact. A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail.

How to Write a Debt Verification LetterDetermine the exact amounts you owe.Gather documents that verify your debt.Get information on who you owe.Determine how old the debt is.Place a pause on the collection proceedings.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.