New Mexico Actor - Actress Employment Agreement - Self-Employed Independent Contractor

Description

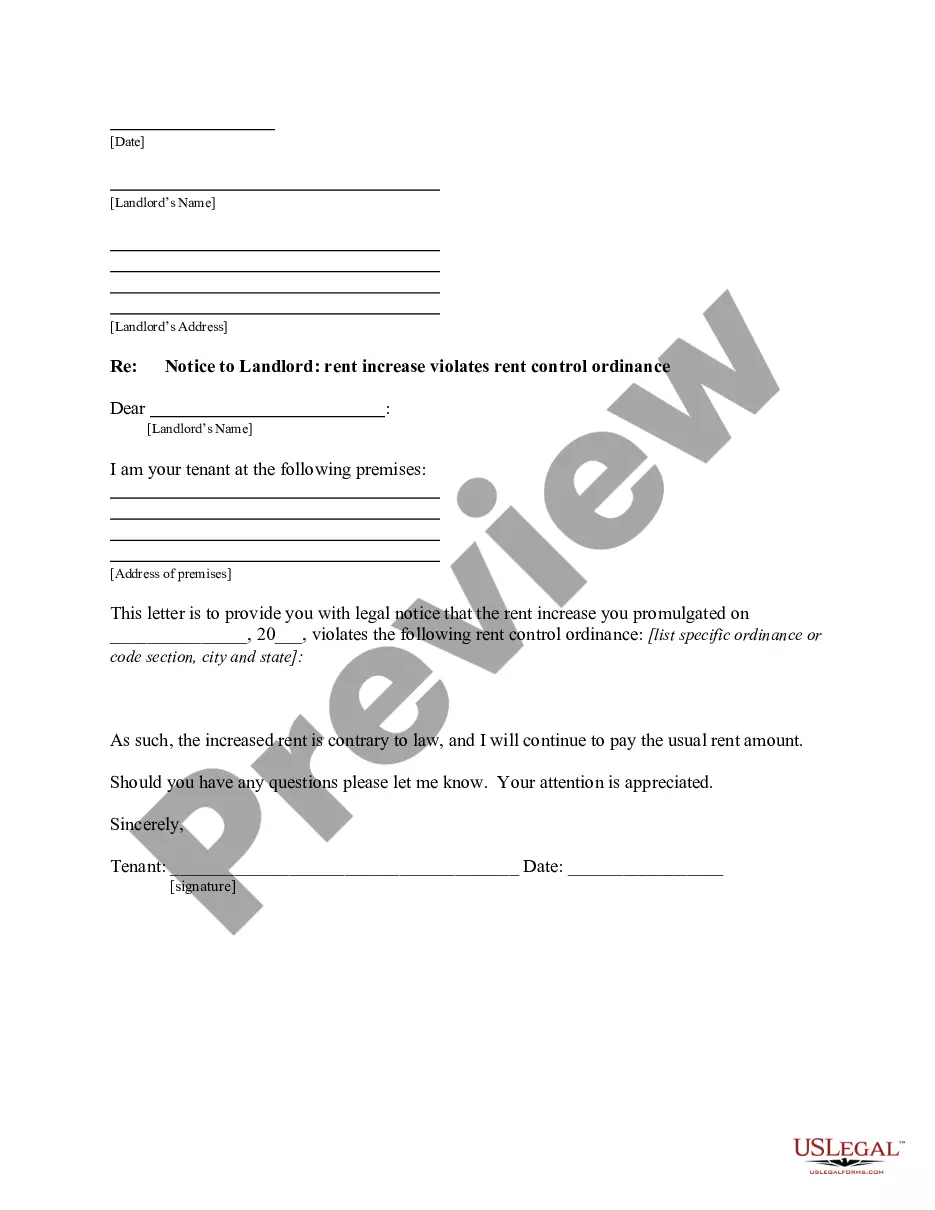

How to fill out New Mexico Actor - Actress Employment Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most significant libraries of legal forms in the States - provides an array of legal document layouts you may download or produce. While using site, you will get a huge number of forms for company and person functions, categorized by groups, claims, or search phrases.You can find the newest types of forms such as the New Mexico Actor - Actress Employment Agreement - Self-Employed Independent Contractor in seconds.

If you currently have a subscription, log in and download New Mexico Actor - Actress Employment Agreement - Self-Employed Independent Contractor in the US Legal Forms local library. The Down load option will show up on each develop you look at. You have access to all formerly delivered electronically forms within the My Forms tab of your respective account.

If you would like use US Legal Forms for the first time, here are easy recommendations to obtain started off:

- Ensure you have selected the correct develop for the metropolis/county. Click on the Preview option to examine the form`s content. See the develop explanation to ensure that you have selected the right develop.

- In case the develop doesn`t suit your needs, make use of the Search field towards the top of the screen to get the the one that does.

- When you are happy with the form, verify your decision by clicking the Purchase now option. Then, opt for the prices prepare you prefer and offer your accreditations to sign up on an account.

- Approach the deal. Utilize your Visa or Mastercard or PayPal account to accomplish the deal.

- Select the formatting and download the form on the gadget.

- Make changes. Fill up, change and produce and sign the delivered electronically New Mexico Actor - Actress Employment Agreement - Self-Employed Independent Contractor.

Every format you added to your account lacks an expiry day and is also your own forever. So, if you want to download or produce another version, just visit the My Forms area and click around the develop you need.

Gain access to the New Mexico Actor - Actress Employment Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most substantial local library of legal document layouts. Use a huge number of specialist and status-particular layouts that meet up with your company or person requirements and needs.

Form popularity

FAQ

There are certain essential elements that go into a contract, and most of them have to do with the intention behind the contract. These elements include the offer, acceptance, mutual assent (also known as meeting of the minds), consideration, capacity, legality and other provisions.

It's often difficult to determine which classification to use. The IRS view is that most crew members, actors, and others working on a film production should be classified as employees, not independent contractors, and that taxes should thus be withheld.

Every actor contract should include a section on expenses. This means an actor will be compensated for travel, accommodation, food, or anything else that's relevant to the production. A production company may specify whether they offer such amenities on-set or at shooting locations, or provide monetary equivalent.

Are actors considered self-employed? An actor is considered self-employed if they work for themselves as a sole proprietor, an LLC, or an S corporation or C corporation. Some actors are employees and some actors are self-employed. Self-employed people work for themselves and aren't considered employees of anyone else.

Whether the Actor Must Give Up Their Name and Likeness: The contract will request that the actor provide rights to the employer to use the actor's name and image for the acting job, as well as for any other promotional or merchandising purposes.

An actor is considered self-employed if they work for themselves as a sole proprietor, an LLC, or an S corporation or C corporation. Some actors are employees and some actors are self-employed. Self-employed people work for themselves and aren't considered employees of anyone else.

However, for the most part, under the Federal regulations (and most states including California), a crew member on a film or other similar type production should never be categorized as an independent contractor they are really employees and are subject to federal and state withholding (from their paychecks) as

Musicians are considered employees by the National Labor Relations Board (NLRB), not independent contractors.

As a performer you should avoid using an ABN (Australian Business Number) however, simply quoting an ABN doesn't automatically make someone an independent contractor. If an employer asks a performer to use an ABN they are potentially in breach of the Act.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.