New Mexico Geologist Agreement - Self-Employed Independent Contractor

Description

How to fill out New Mexico Geologist Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest libraries of lawful types in America - gives an array of lawful file templates you are able to obtain or printing. While using web site, you can get a huge number of types for organization and person purposes, sorted by classes, says, or keywords and phrases.You can get the most up-to-date versions of types such as the New Mexico Geologist Agreement - Self-Employed Independent Contractor in seconds.

If you currently have a registration, log in and obtain New Mexico Geologist Agreement - Self-Employed Independent Contractor from your US Legal Forms library. The Obtain button will show up on every single kind you view. You get access to all earlier saved types inside the My Forms tab of your own accounts.

If you wish to use US Legal Forms for the first time, listed here are simple guidelines to obtain started out:

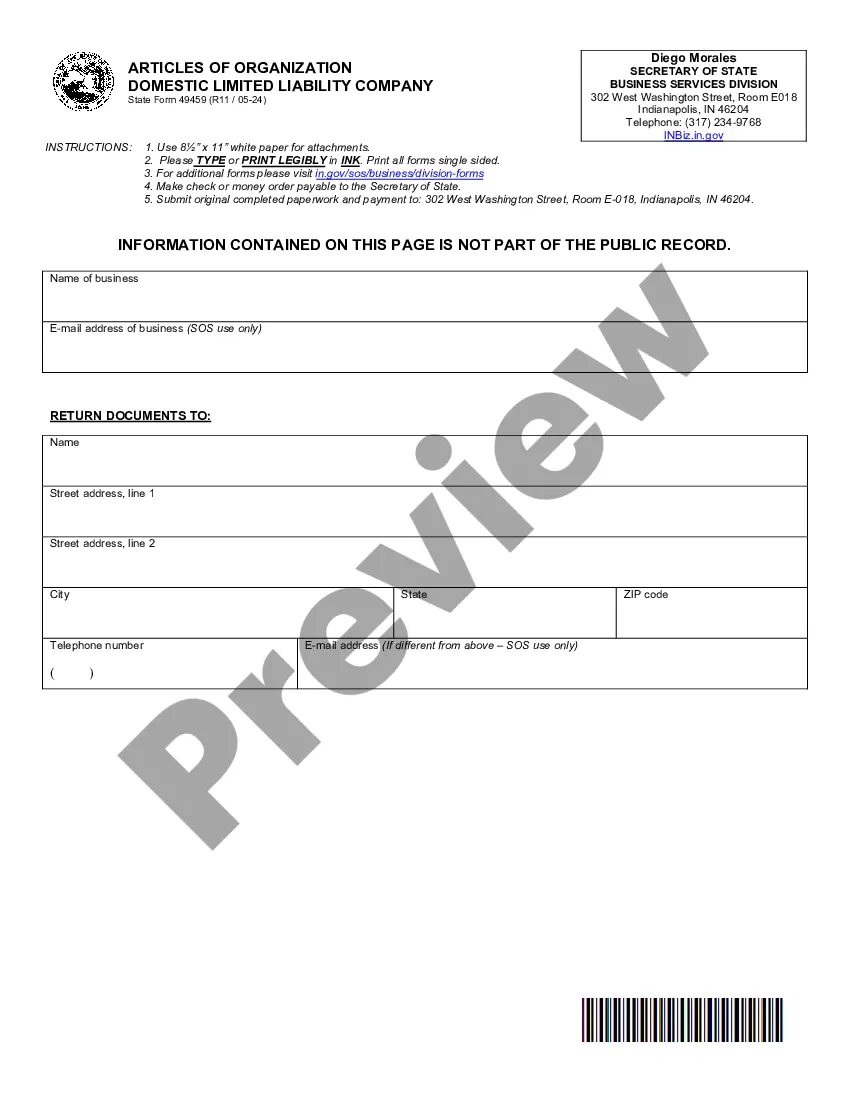

- Be sure you have picked the proper kind for the area/state. Select the Preview button to examine the form`s information. See the kind outline to ensure that you have selected the proper kind.

- In the event the kind does not match your demands, use the Look for industry at the top of the display screen to get the the one that does.

- Should you be content with the form, confirm your choice by simply clicking the Buy now button. Then, choose the costs plan you like and offer your accreditations to sign up for the accounts.

- Method the transaction. Make use of charge card or PayPal accounts to finish the transaction.

- Select the format and obtain the form on your own gadget.

- Make adjustments. Load, edit and printing and indication the saved New Mexico Geologist Agreement - Self-Employed Independent Contractor.

Every design you added to your money lacks an expiration particular date and is your own property eternally. So, if you would like obtain or printing yet another backup, just go to the My Forms section and click in the kind you need.

Get access to the New Mexico Geologist Agreement - Self-Employed Independent Contractor with US Legal Forms, probably the most substantial library of lawful file templates. Use a huge number of expert and status-specific templates that meet your organization or person requirements and demands.

Form popularity

FAQ

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?