New Mexico Medical Representative Agreement - Self-Employed Independent Contractor

Description

How to fill out New Mexico Medical Representative Agreement - Self-Employed Independent Contractor?

Are you presently in a place in which you need to have documents for both business or individual purposes virtually every day? There are tons of legitimate document layouts available on the Internet, but getting ones you can rely isn`t simple. US Legal Forms offers thousands of type layouts, much like the New Mexico Medical Representative Agreement - Self-Employed Independent Contractor, which are written to meet state and federal specifications.

In case you are previously acquainted with US Legal Forms site and possess a free account, just log in. After that, you may download the New Mexico Medical Representative Agreement - Self-Employed Independent Contractor web template.

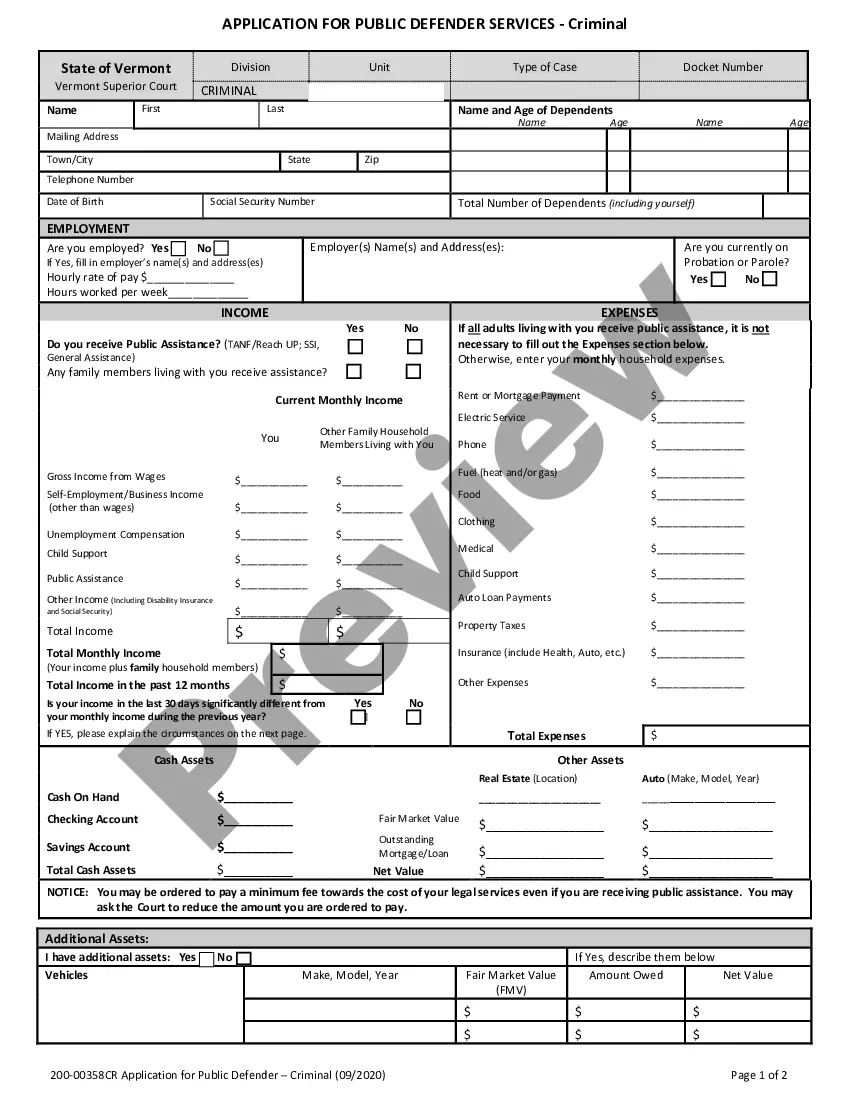

Unless you offer an bank account and would like to start using US Legal Forms, follow these steps:

- Find the type you need and make sure it is for that proper metropolis/county.

- Use the Preview button to analyze the shape.

- Read the outline to actually have chosen the right type.

- In the event the type isn`t what you are looking for, make use of the Search area to discover the type that meets your needs and specifications.

- When you get the proper type, click on Buy now.

- Choose the pricing prepare you desire, submit the specified info to make your bank account, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Decide on a practical data file structure and download your version.

Locate every one of the document layouts you might have bought in the My Forms menus. You can obtain a more version of New Mexico Medical Representative Agreement - Self-Employed Independent Contractor anytime, if required. Just click the necessary type to download or printing the document web template.

Use US Legal Forms, probably the most comprehensive collection of legitimate forms, to conserve efforts and avoid faults. The service offers expertly produced legitimate document layouts that can be used for a variety of purposes. Create a free account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

The contract itself must include the following:Offer.Acceptance.Consideration.Parties who have the legal capacity.Lawful subject matter.Mutual agreement among both parties.Mutual understanding of the obligation.

What to Include in a ContractThe date the contract begins and when it expires.The names of all parties involved in the transaction.Any key terms and definitions.The products and services included in the transaction.Any payment amounts, project schedules, terms, and billing dates.More items...?

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

A 1099 employee is a contractor rather than a full-time employee. These employees may also be referred to as freelancers, self-employed workers, or independent contractors.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

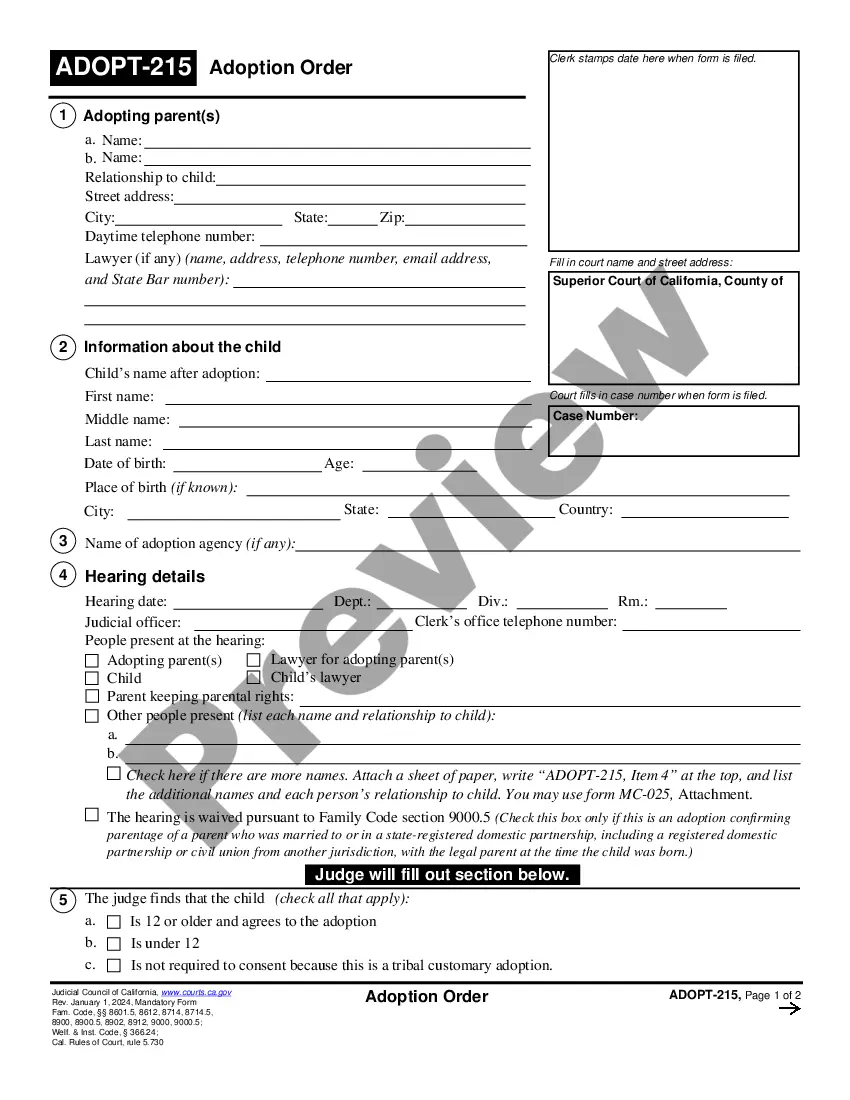

The independent contractor provision states that the relationship between the parties is that of an independent contractor, that the agreement does not create an employment relationship, and that under no circumstances is the independent contractor an agent of the company for which they provide services.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.