New Mexico Assignment of Overriding Royalty Interest for Multiple Leases — Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens In New Mexico, the Assignment of Overriding Royalty Interest for Multiple Leases is a legal document that allows the transfer of a specific percentage of royalty interest from the assignor to the assignee. This assignment is unique as it takes into account the existing leasehold burdens and calculates the difference between the assigned percentage and these burdens. The overriding royalty interest (ORRIS) is a share of the revenue generated from oil, gas, or other minerals extracted from the leased property. It is assigned to the assignee through this document, allowing them to receive a portion of the proceeds from the production. The "Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens" clause is significant in this assignment. It ensures that the assignee does not bear the burden of existing leasehold costs and receives their allocated royalty interest after deducting these burdens. The existing leasehold burdens may include expenses related to leasing, drilling, extracting, and maintaining the leased property. Different types of Assignment of Overriding Royalty Interest for Multiple Leases in New Mexico can be classified based on the specified percentage and the varying leasehold burdens. These can include: 1. Fixed Percentage Assignment: In this type, a specific percentage, such as 10%, is assigned to the assignee, regardless of any existing leasehold burdens. The assignee will receive this percentage share of royalties without any deductions. 2. Variable Percentage Assignment: This type allows for a changing percentage of overriding royalty interest depending on the existing leasehold burdens. The percentage assigned will be the difference between a specified percentage and the calculated burdens. For example, if the specified percentage is 15%, but the existing burdens amount to 3%, the assignee will receive a 12% overriding royalty interest. 3. Escalating Percentage Assignment: This type involves assigning a fixed percentage initially, which increases over time. The increase can be based on factors such as the production rate, commodity prices, or a predetermined schedule. The existing leasehold burdens will still be deducted before calculating the assigned percentage. 4. Negotiated Percentage Assignment: In certain cases, the assignee and assignor may negotiate a specific percentage that takes into account the existing leasehold burdens. This type allows for flexibility and customization based on the parties' agreement. In conclusion, the New Mexico Assignment of Overriding Royalty Interest for Multiple Leases — Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens is a legal document that facilitates the transfer of royalty interests while considering the financial burdens associated with the leases. The assignment can have various types, including fixed, variable, escalating, or negotiated percentages, depending on the specific circumstances of the assignment.

New Mexico Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens

Description

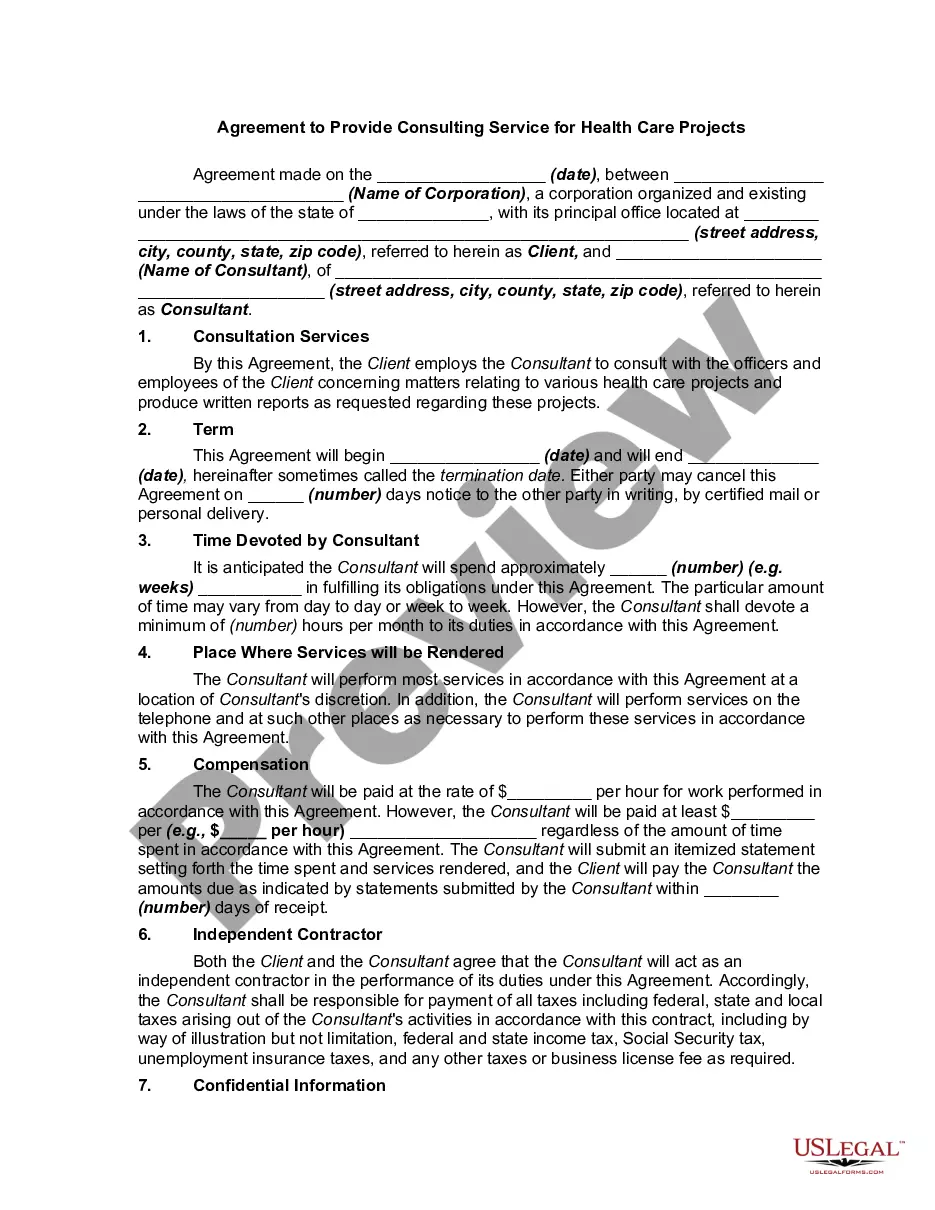

How to fill out New Mexico Assignment Of Overriding Royalty Interest For Multiple Leases - Interest Assigned Is Difference Between Specified Percentage And Existing Leasehold Burdens?

Are you currently within a situation where you will need papers for sometimes enterprise or personal purposes virtually every working day? There are plenty of legitimate papers themes available on the Internet, but getting versions you can rely is not easy. US Legal Forms gives a huge number of type themes, much like the New Mexico Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens, which are published in order to meet federal and state specifications.

If you are previously familiar with US Legal Forms website and possess a merchant account, merely log in. After that, you can down load the New Mexico Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens design.

If you do not have an accounts and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the type you require and ensure it is for the proper city/state.

- Take advantage of the Preview switch to review the shape.

- See the explanation to actually have chosen the correct type.

- When the type is not what you are seeking, take advantage of the Search industry to obtain the type that meets your requirements and specifications.

- Once you obtain the proper type, click on Buy now.

- Opt for the pricing prepare you desire, submit the required information to make your money, and pay money for the order with your PayPal or Visa or Mastercard.

- Choose a hassle-free data file formatting and down load your copy.

Find each of the papers themes you possess purchased in the My Forms food list. You can get a additional copy of New Mexico Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens any time, if necessary. Just select the necessary type to down load or print out the papers design.

Use US Legal Forms, by far the most substantial collection of legitimate types, to save lots of efforts and avoid mistakes. The service gives skillfully made legitimate papers themes that you can use for a selection of purposes. Generate a merchant account on US Legal Forms and start creating your lifestyle a little easier.