This form is used when, as a result of continuous production from the Lease and Lands, payout, as defined in an Assignment, has occurred, and Declarant is entitled to elect to convert the Override to a Working Interest, as provided for in the Assignment.

New Mexico Declaration of Election to Convert Overriding Royalty Interest to Working Interest

Description

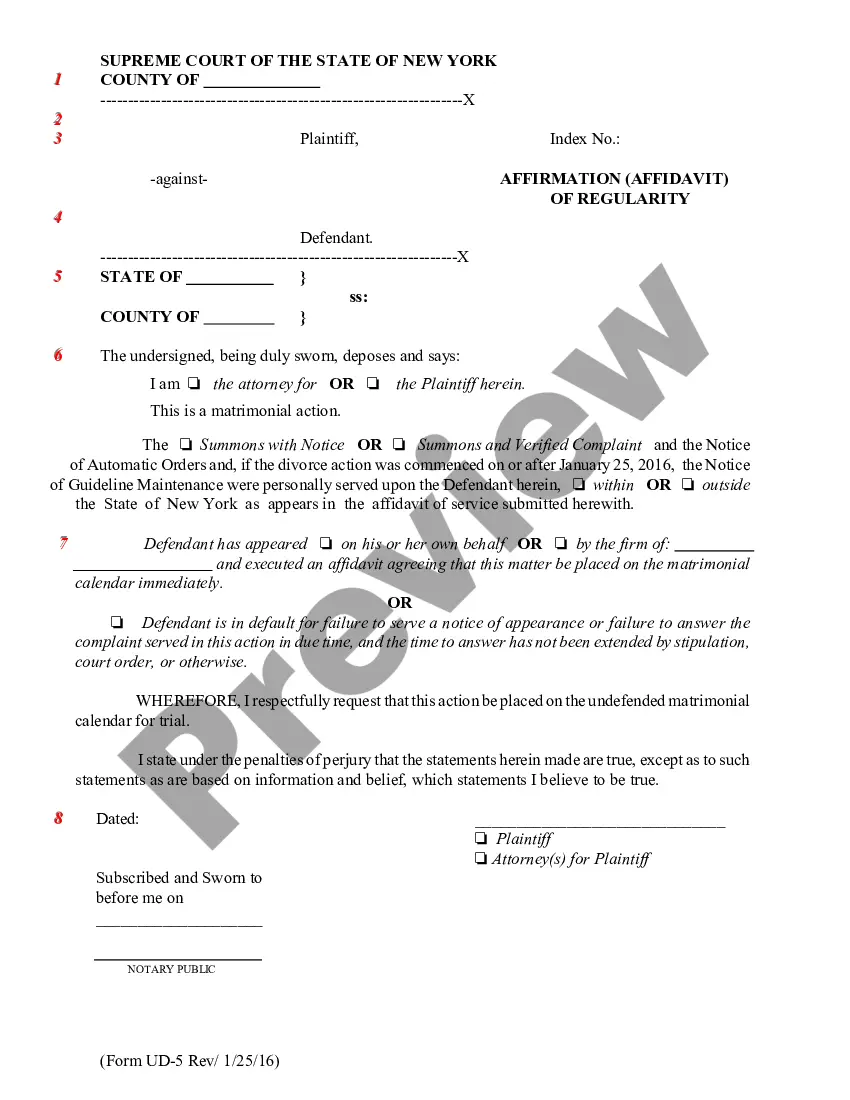

How to fill out Declaration Of Election To Convert Overriding Royalty Interest To Working Interest?

US Legal Forms - one of the most significant libraries of legitimate types in America - delivers a wide array of legitimate record templates it is possible to acquire or print. Using the web site, you may get 1000s of types for company and person functions, sorted by types, states, or keywords and phrases.You can get the newest versions of types much like the New Mexico Declaration of Election to Convert Overriding Royalty Interest to Working Interest within minutes.

If you already possess a membership, log in and acquire New Mexico Declaration of Election to Convert Overriding Royalty Interest to Working Interest from the US Legal Forms local library. The Obtain option will appear on each and every type you look at. You gain access to all previously delivered electronically types inside the My Forms tab of the account.

If you wish to use US Legal Forms the very first time, listed here are simple guidelines to obtain started out:

- Make sure you have selected the proper type to your metropolis/region. Click the Preview option to examine the form`s content material. Look at the type information to ensure that you have selected the proper type.

- In case the type doesn`t satisfy your needs, make use of the Lookup field on top of the monitor to find the one who does.

- When you are satisfied with the form, verify your option by clicking on the Acquire now option. Then, select the rates program you like and give your references to sign up for an account.

- Method the financial transaction. Make use of your credit card or PayPal account to complete the financial transaction.

- Select the file format and acquire the form in your product.

- Make modifications. Fill out, edit and print and sign the delivered electronically New Mexico Declaration of Election to Convert Overriding Royalty Interest to Working Interest.

Each template you included in your bank account does not have an expiration day and is also your own property eternally. So, in order to acquire or print another version, just visit the My Forms section and click on around the type you will need.

Gain access to the New Mexico Declaration of Election to Convert Overriding Royalty Interest to Working Interest with US Legal Forms, the most substantial local library of legitimate record templates. Use 1000s of expert and status-certain templates that satisfy your small business or person demands and needs.

Form popularity

FAQ

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

If there is more than one mineral owner, multiply the net revenue by the fractional interest of each owner to determine their respective royalty interest.