This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

New Mexico Surface Damage Payments

Description

How to fill out Surface Damage Payments?

You may commit several hours on the Internet searching for the legitimate record design that meets the state and federal demands you require. US Legal Forms provides a huge number of legitimate varieties that are examined by experts. You can easily download or produce the New Mexico Surface Damage Payments from my support.

If you currently have a US Legal Forms accounts, you can log in and click the Obtain option. Next, you can full, revise, produce, or indication the New Mexico Surface Damage Payments. Each and every legitimate record design you purchase is yours eternally. To acquire one more copy for any bought type, check out the My Forms tab and click the corresponding option.

Should you use the US Legal Forms website for the first time, stick to the easy guidelines beneath:

- Initial, make sure that you have chosen the right record design to the region/town of your choice. Look at the type description to make sure you have picked the appropriate type. If readily available, make use of the Review option to check from the record design also.

- If you want to locate one more edition of the type, make use of the Research field to find the design that suits you and demands.

- When you have found the design you desire, just click Get now to proceed.

- Choose the rates strategy you desire, enter your references, and sign up for a free account on US Legal Forms.

- Complete the deal. You may use your bank card or PayPal accounts to cover the legitimate type.

- Choose the file format of the record and download it for your gadget.

- Make modifications for your record if possible. You may full, revise and indication and produce New Mexico Surface Damage Payments.

Obtain and produce a huge number of record templates using the US Legal Forms website, which offers the biggest assortment of legitimate varieties. Use expert and status-distinct templates to deal with your company or individual requires.

Form popularity

FAQ

Does an employer have to give lunch breaks, coffee breaks, or rest periods? No. There is no statute that requires an employer to provide such breaks; however, deductions cannot be made from wages if less than 30 minutes is allowed for the breaks.

When does an employer have to pay final wages to a terminated employee? If the wages owed are a fixed and definite amount, the employer shall pay such wages to the employee within five days of such discharge. Task, piece, and commission wages must be paid within ten days of such discharge.

Whoever commits criminal damage to property is guilty of a petty misdemeanor, except that when the damage to the property amounts to more than one thousand dollars ($1,000) he is guilty of a fourth degree felony.

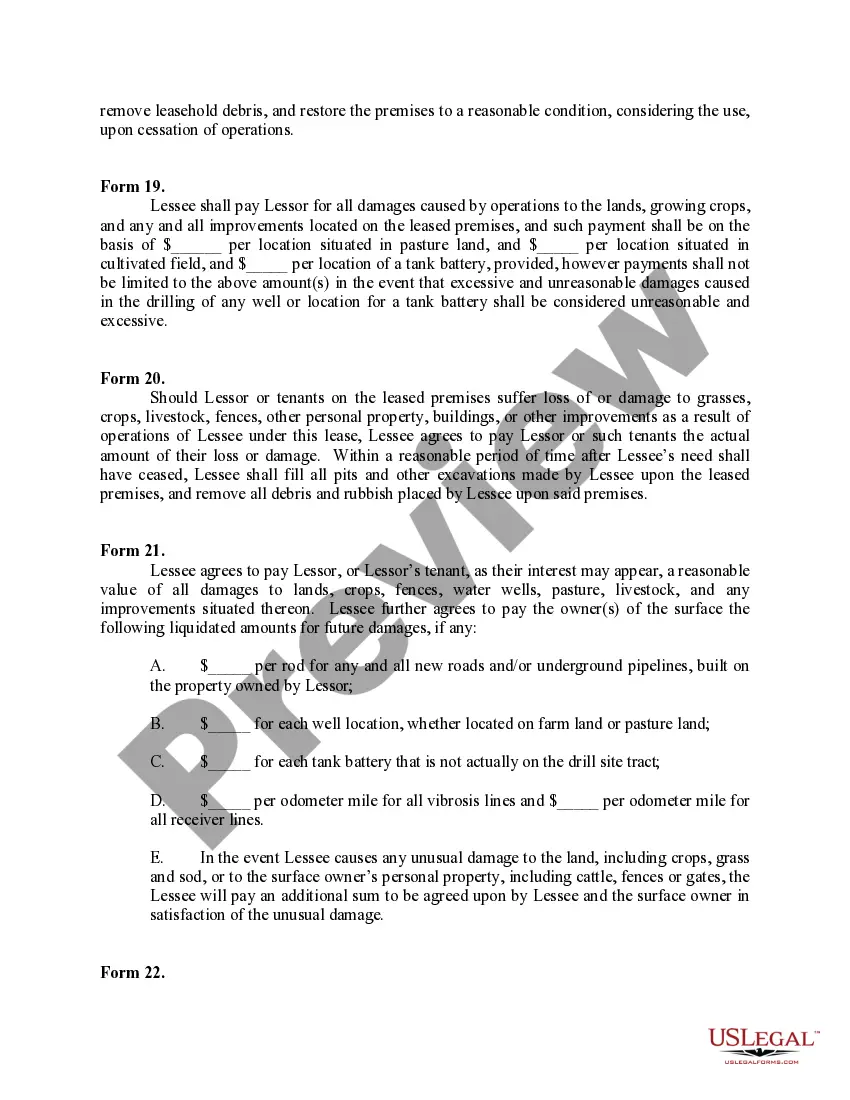

SOPA creates an obligation to pay damages where oil and gas operations result in any loss of: land value; agricultural production or income; use; access; or improvements.

New Mexico Wage Payment Timing Law Typically, New Mexico employers are required to pay employees their wages on regular paydays. These paydays can not be more than 16 days apart. More specifically, wages earned between the 1st and 15th day of a calendar month must be paid by the 25th of that month.

The oil and gas proceeds derived from the sale of production from any well producing oil, gas or related hydrocarbons in New Mexico shall be paid to all persons legally entitled to such payments, commencing not later than six months after the first day of the month following the date of first sale and thereafter not ...

An employer shall provide an employee with a written receipt that identifies the employer and sets forth the employee's gross pay, the number of hours worked by the employee, the total wages and benefits earned by the employee and an itemized listing of all deductions withheld from the employee's gross pay.

Not required by state law. Employers are not required by law to pay unused employee benefits. Nevertheless, if an employer has a PTO policy that allows for accruing vacation or other PTO, any unused amount is considered earned wages and must be paid in the final paycheck.