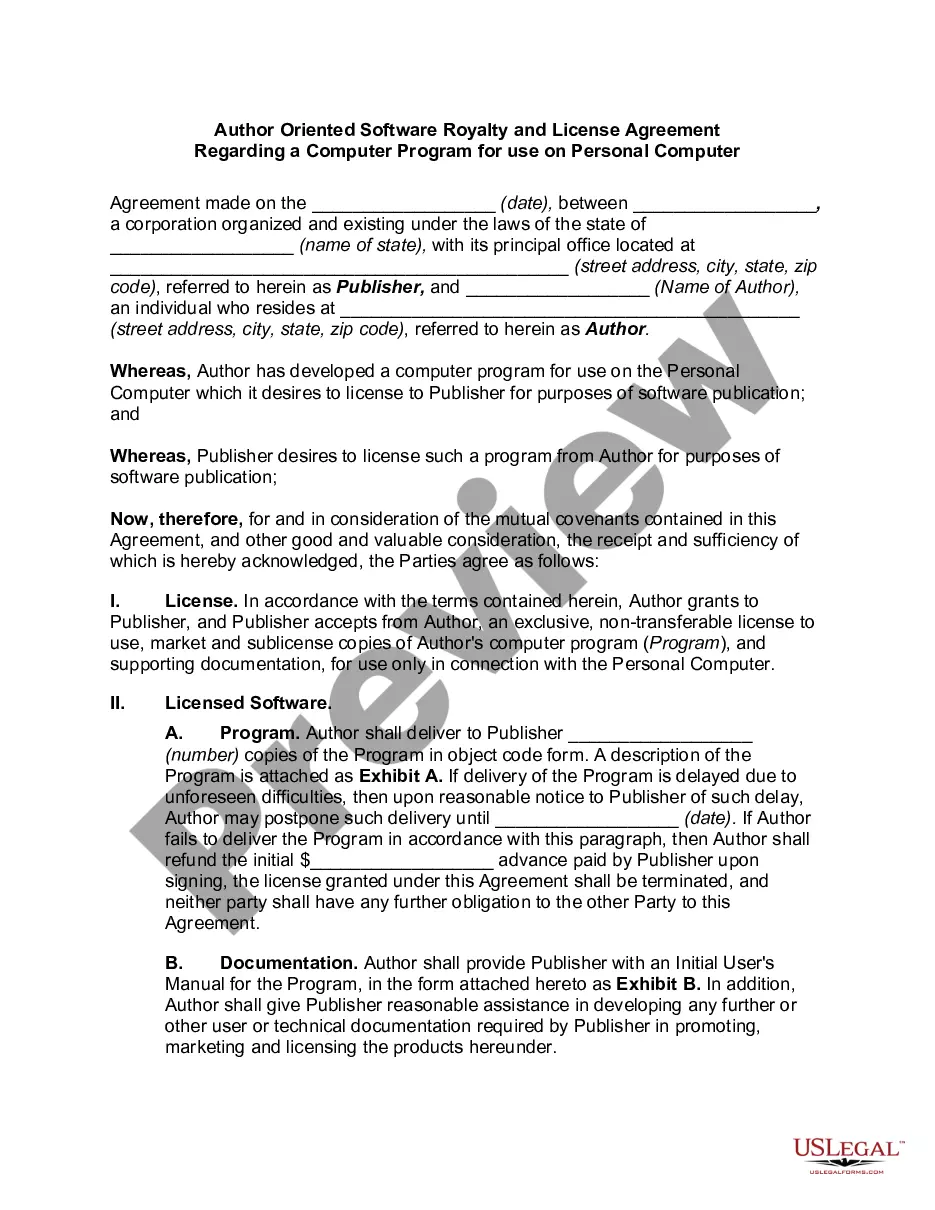

This form is a clause regarding additional rent element of an office lease providing for tax increases. The tax increases pertain to assessments and special assessments levied, assessed or imposed upon the building and/or the land under, including any land(s) dedicated to the use of, the building, by any governmental bodies or authorities.

New Mexico Tax Increase Clause

Description

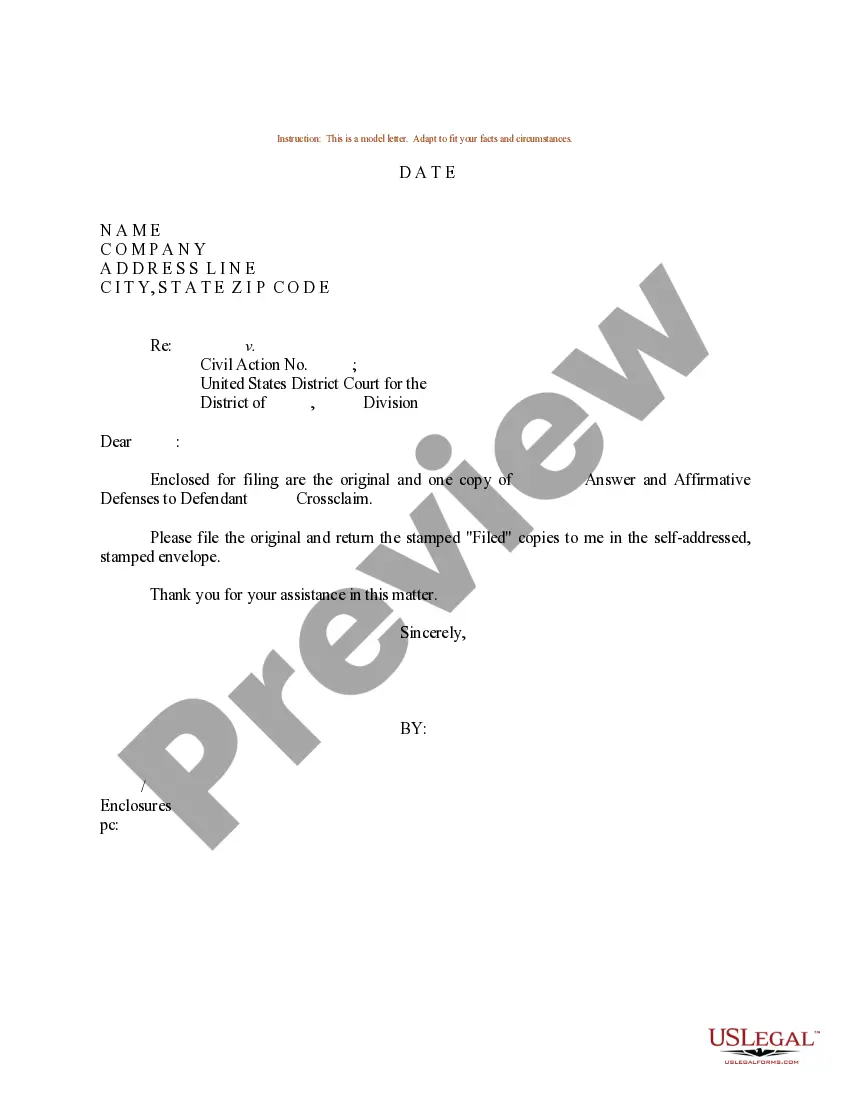

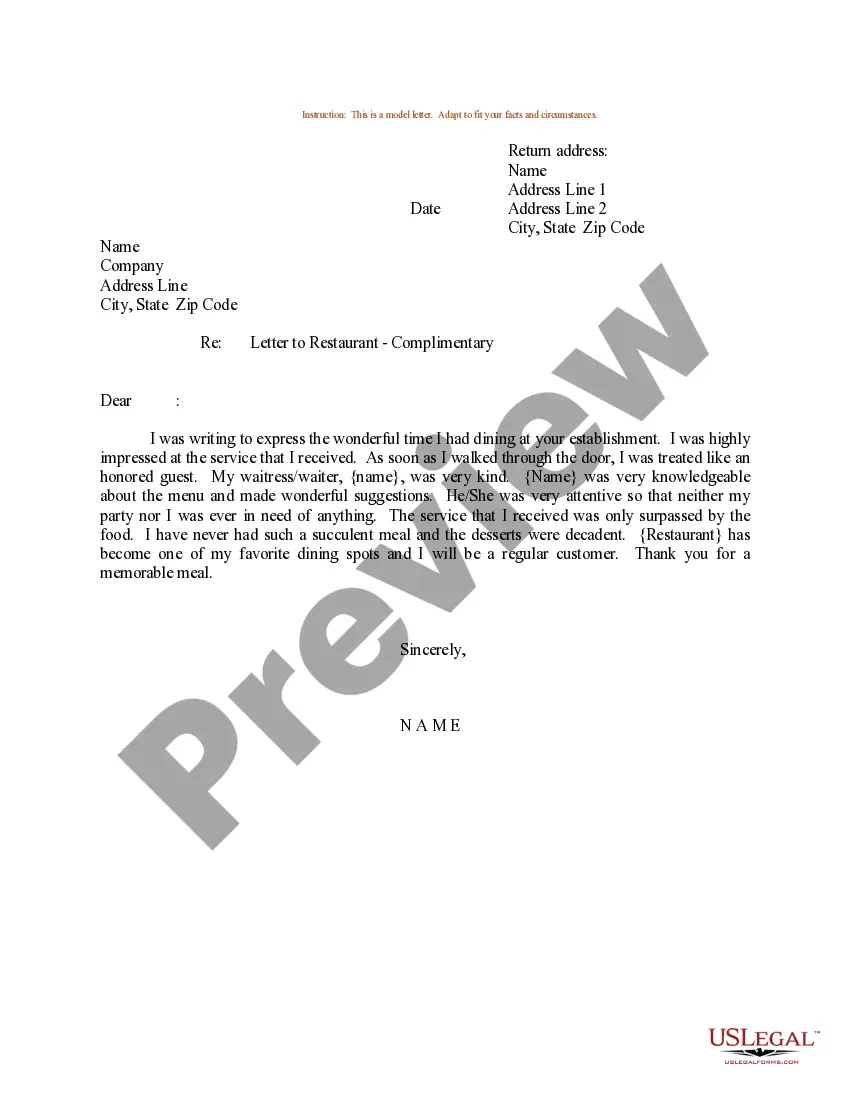

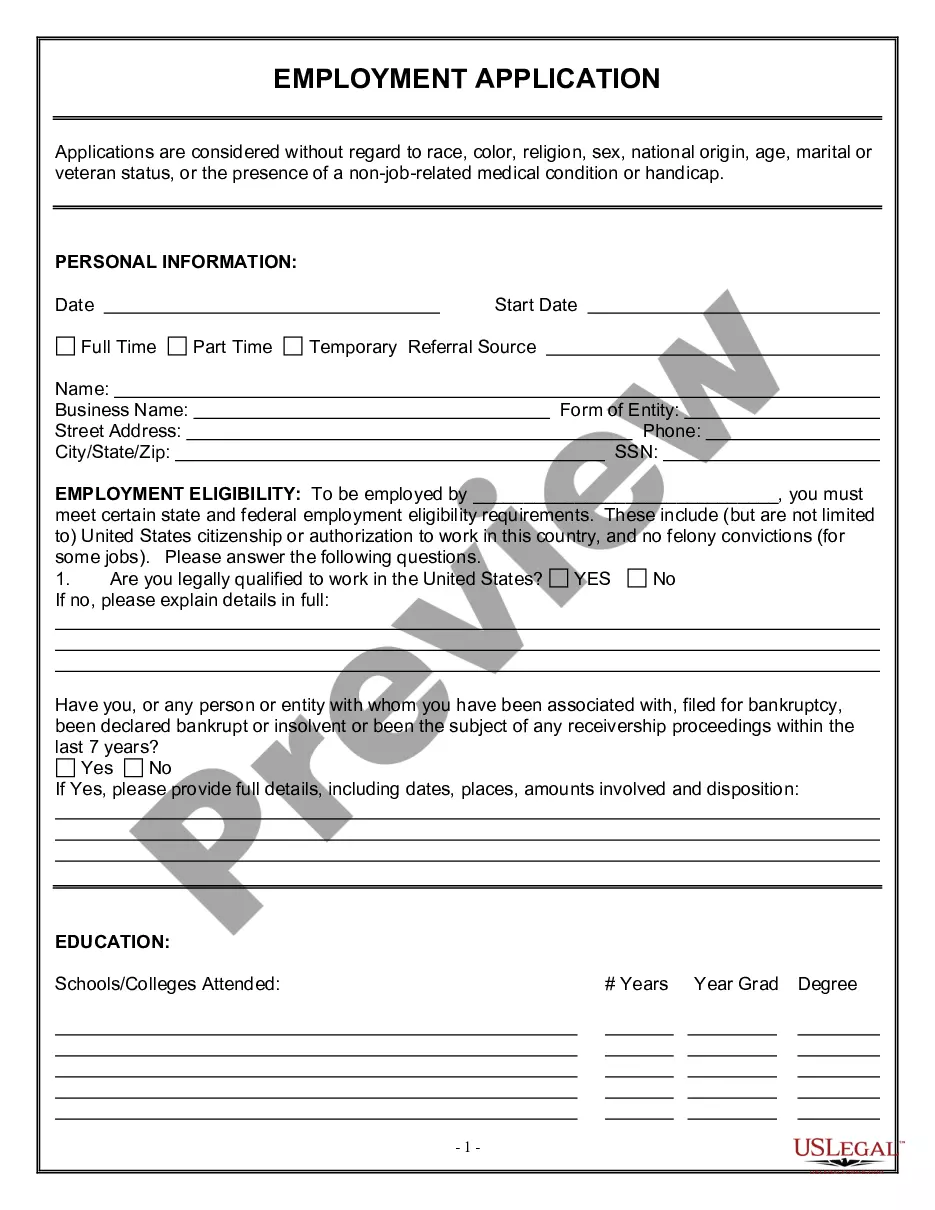

How to fill out Tax Increase Clause?

Are you in a placement in which you need to have paperwork for either company or specific functions just about every working day? There are a variety of lawful document layouts available online, but discovering ones you can trust isn`t easy. US Legal Forms gives 1000s of develop layouts, much like the New Mexico Tax Increase Clause, that are created to satisfy federal and state specifications.

Should you be presently knowledgeable about US Legal Forms web site and have a merchant account, simply log in. After that, you are able to download the New Mexico Tax Increase Clause design.

If you do not come with an accounts and wish to begin to use US Legal Forms, follow these steps:

- Obtain the develop you require and make sure it is to the proper metropolis/county.

- Take advantage of the Review key to review the shape.

- Browse the explanation to actually have chosen the right develop.

- In case the develop isn`t what you`re searching for, use the Search field to obtain the develop that suits you and specifications.

- If you find the proper develop, click on Purchase now.

- Opt for the prices strategy you want, fill in the specified details to make your bank account, and pay money for the order with your PayPal or charge card.

- Select a handy file file format and download your backup.

Discover every one of the document layouts you have purchased in the My Forms menus. You can get a further backup of New Mexico Tax Increase Clause anytime, if needed. Just select the necessary develop to download or print the document design.

Use US Legal Forms, one of the most comprehensive collection of lawful kinds, to conserve some time and steer clear of faults. The service gives expertly produced lawful document layouts which you can use for a variety of functions. Create a merchant account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

Residential Property Value Cap A. Since 2001 the Legislature enacted a law that capped the amount of value increase for residential property at 3% per year or 6% every two years of the total value.

All New Mexico seniors at least 65 years old may claim a special exemption. See the instructions for PIT-ADJ.

The tax rate is 1% of the total home value and the rate can only increase a max of 2% per year.

EFFECTIVE July 1, 2023 The state portion of the gross receipts tax rate has been lowered from 5.000% to 4.875%, due to HB-163 from the 2022 legislative session. This change impacts all location codes across the state. Make sure to review the Gross Receipts and Compensating Tax Rate Schedule included in this packet.

The County Assessor establishes the assessed value and taxable value of each property. The assessed value is determined utilizing manual and computer assisted appraisal techniques. The taxable value is 1/3 of the assessed value less any exemptions for which the property owner qualifies.

SANTA FE, N.M. (KRQE) ? Changes to the state's Gross Receipts Tax are going into effect on July 1. The statewide portion of the tax will drop to 4.875%. The rate drop was signed into law by Governor Michelle Lujan Grisham in 2022 and will be the first GRT rate reduction in 40 years. The rate was previously 5.125%.

The state Taxation and Revenue Department will send $500 rebate checks to single filers and $1000 rebate checks to couples filing jointly. Who qualifies for a rebate? All New Mexico residents who filed a 2021 state income tax return and who were not declared as a dependent will receive the rebates automatically.

One reason property taxes in New Mexico are so low is that the state has capped the amount the taxable value of a property can increase in a year at 3%. That means that even when home prices are surging, property taxes will remain stable.