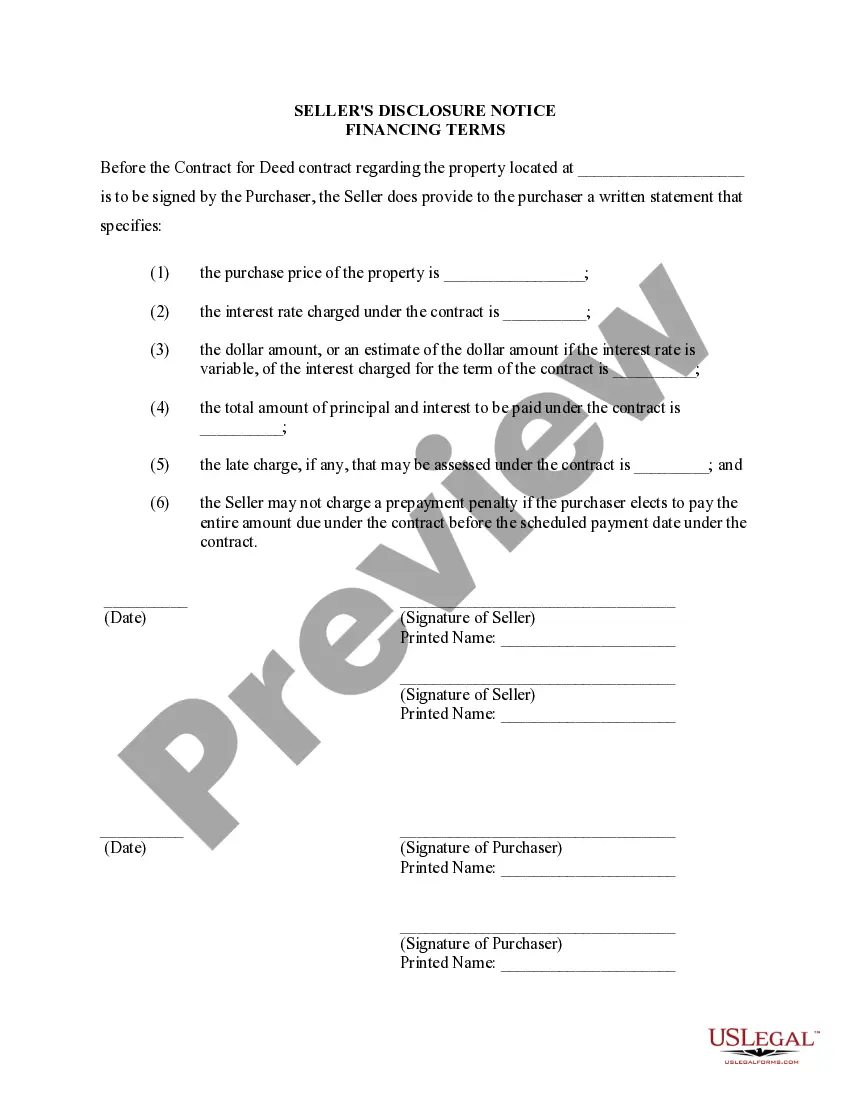

Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Use US Legal Forms to obtain a printable Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most comprehensive Forms library on the web and offers reasonably priced and accurate samples for consumers and lawyers, and SMBs. The documents are categorized into state-based categories and many of them can be previewed prior to being downloaded.

To download templates, customers must have a subscription and to log in to their account. Click Download next to any form you need and find it in My Forms.

For individuals who don’t have a subscription, follow the tips below to easily find and download Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract:

- Check out to ensure that you get the proper form in relation to the state it’s needed in.

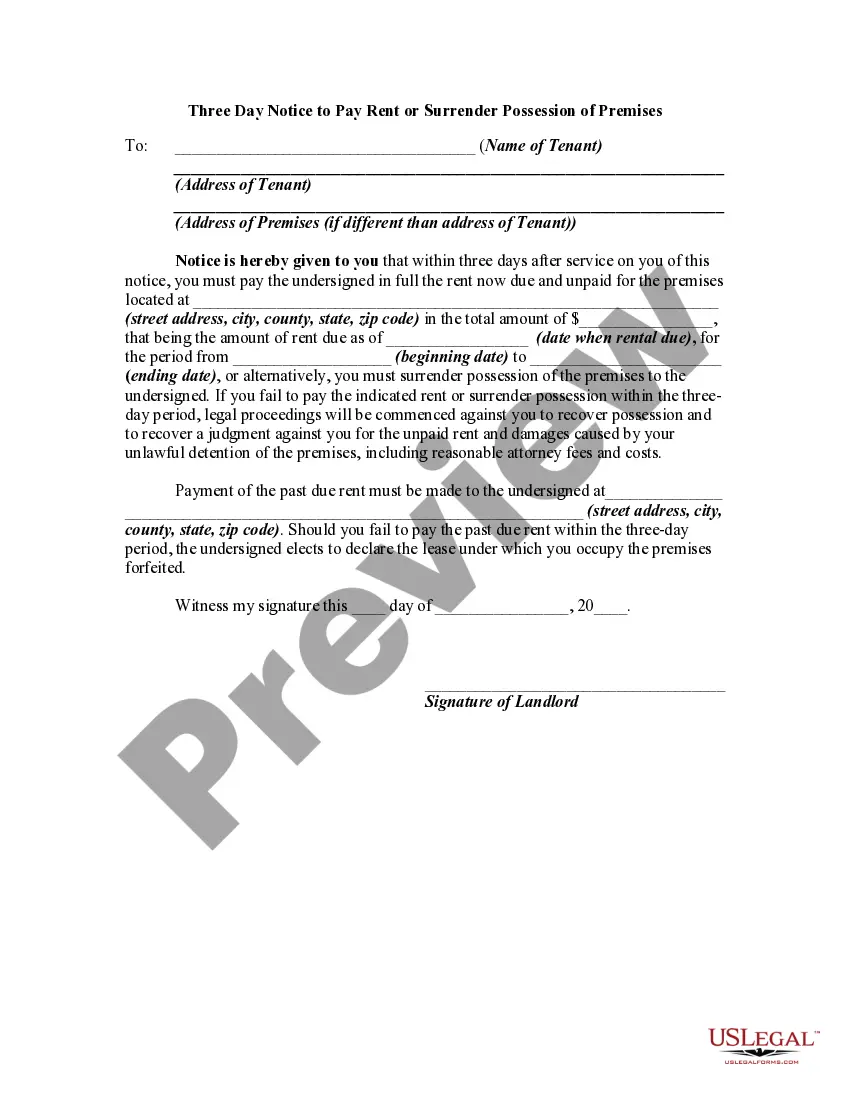

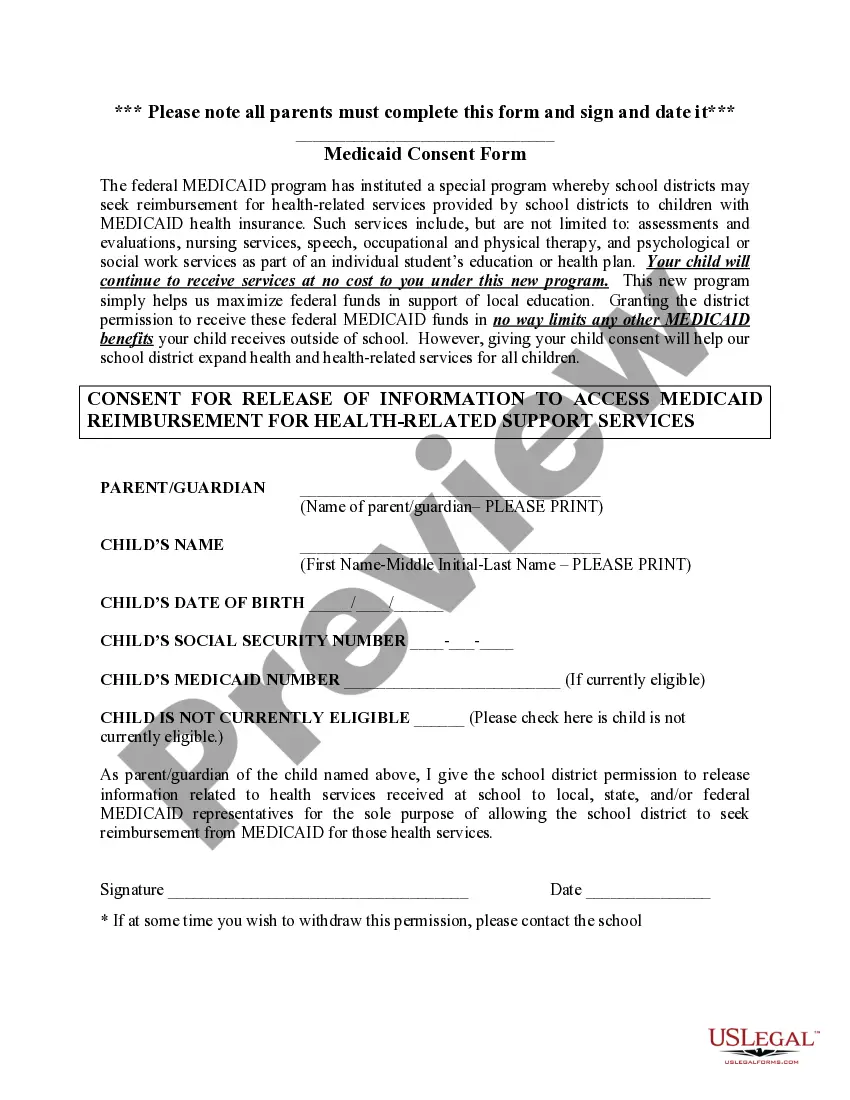

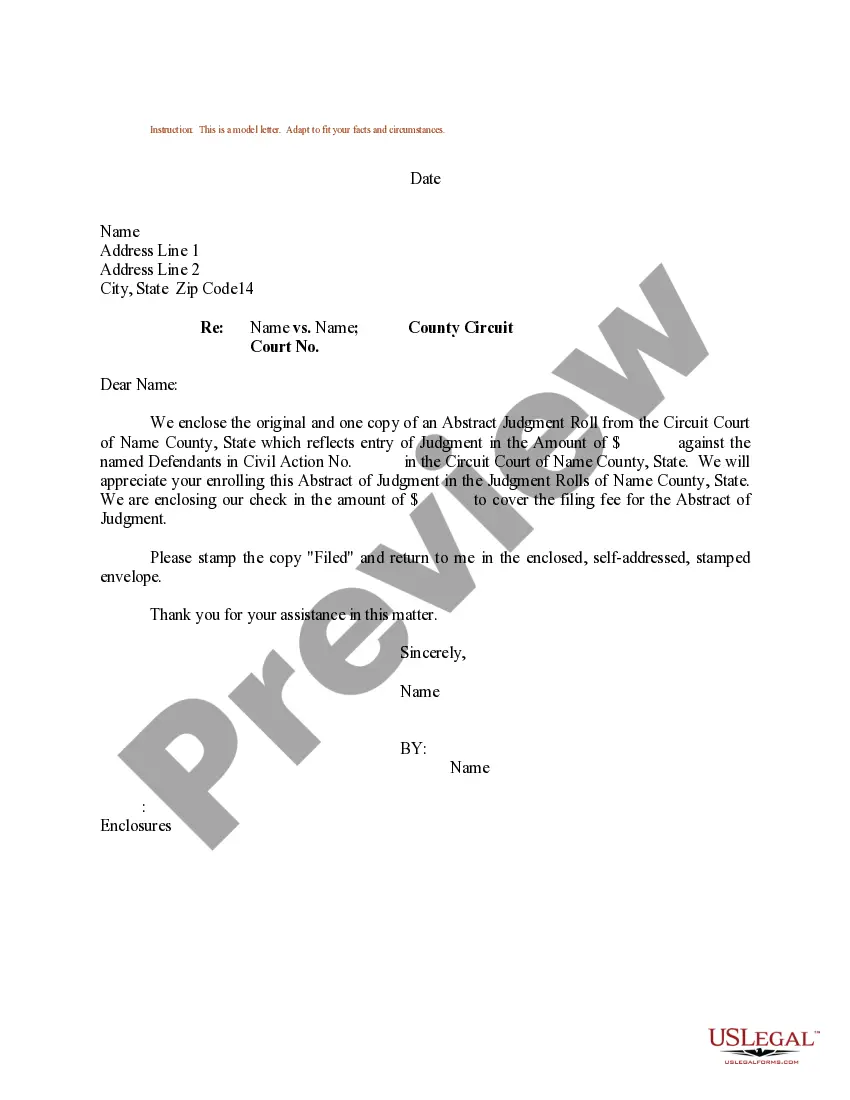

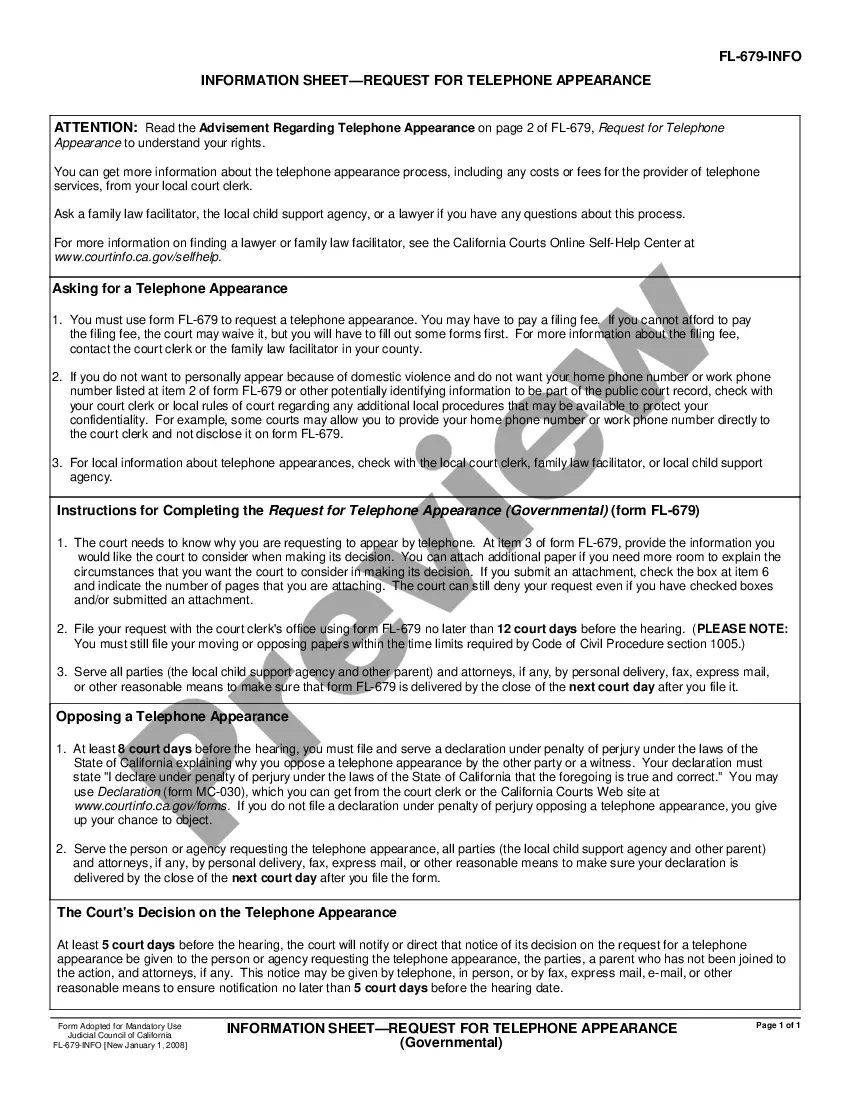

- Review the form by looking through the description and using the Preview feature.

- Press Buy Now if it is the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search field if you want to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. More than three million users have utilized our platform successfully. Choose your subscription plan and have high-quality documents in just a few clicks.

Form popularity

FAQ

California mainly uses two types of deeds: the grant deed and the quitclaim deed. Most other deeds you will see, such as the common interspousal transfer deed, are versions of grant or quitclaim deeds customized for specific circumstances.

By law, you must receive a copy of your Closing Disclosure three business days prior to closing. Contact your lender or closing agent (title company, escrow officer, or attorney) at least a week before closing to find out how you will receive your Closing Disclosure.

What happens once I sign the Closing Disclosure? Once you sign the Closing Disclosure, your mortgage paperwork will be prepared and all involved parties should prepare for the loan to close in 3 business days at the earliest.

To comply with the TILA-RESPA Integrated Disclosures rule, both the buyer and seller must receive Closing Disclosures that provide details of the transaction.If a lender decides to provide the seller's Closing Disclosure, the settlement agent must be aware of this process and ensure accuracy.

The Closing Disclosure is a five-page form that a lender provides to a home buyer at least 3 business days before their loan closes. It outlines the final terms and costs of the mortgage. It's one of the most important pieces of paperwork you'll receive, so check it over carefully.

Just two closing documents among many Lots and lots of them. But these two legally binding and required documents bookend the loan process: The Loan Estimate comes after you submit an application with a lender, and the Closing Disclosure form arrives when you're nearing the get-a-mortgage finish line.

Quitclaim Deed. Deed of Trust. Warranty Deed. Grant Deed. Bargain and Sale Deed. Mortgage Deed.

There are three instances where a change can trigger the issuance of a revised Closing Disclosure and a new three-day waiting period: A change in the annual percentage rate the APR for your loan.Switching your loan product; for example, moving from a fixed to an adjustable-rate mortgage.

When committing to a general warranty deed, the seller is promising there are no liens against the property, and if there were, the seller would compensate the buyer for those claims. Mainly for this reason, general warranty deeds are the most commonly used type of deed in real estate sales.