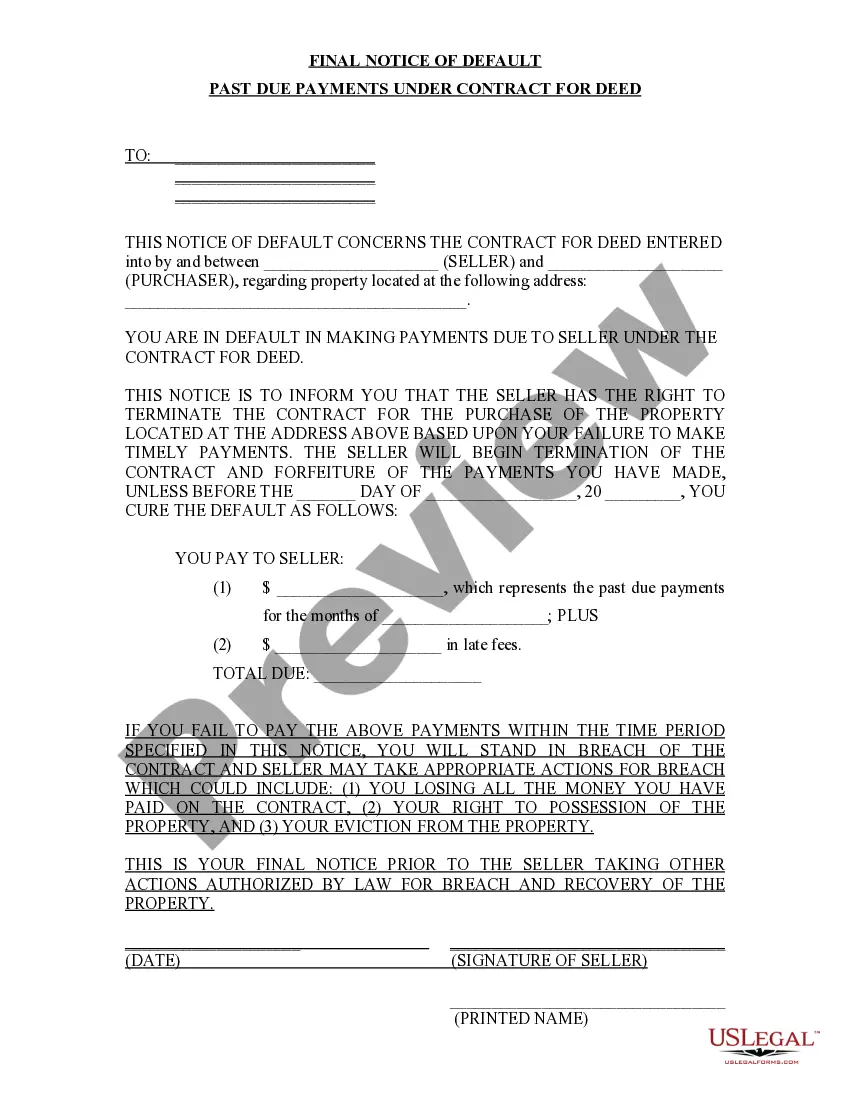

Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Nevada Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Use US Legal Forms to get a printable Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most extensive Forms catalogue online and provides affordable and accurate templates for customers and legal professionals, and SMBs. The templates are categorized into state-based categories and many of them can be previewed before being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Click Download next to any template you need and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to quickly find and download Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed:

- Check to ensure that you get the correct template with regards to the state it’s needed in.

- Review the form by reading the description and using the Preview feature.

- Press Buy Now if it is the document you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you need to get another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Nevada Final Notice of Default for Past Due Payments in connection with Contract for Deed. More than three million users already have utilized our platform successfully. Choose your subscription plan and get high-quality forms in just a few clicks.

Form popularity

FAQ

A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. (Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.)

The notice of default doesn't affect your credit file, but when the account defaults this will be recorded.If the debt is regulated by the Consumer Credit Act, you must be sent a default notice warning letter and have time to act on it before the default is recorded on your credit file.

You can bring your loan current and stave off the foreclosure sale filing by paying the past due amount, plus penalties.You typically have to reinstate at least five days before the lender's deadline or risk the lender rejecting your payment and proceeding with a sale.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

Write to the agency making the claim. Present evidence of why the NOD was improperly issued or why you legitimately cannot make payments. Ask the agency in the letter if they will take a lower monthly payment, total settlement or a payment plan. Send a copy of your letter by certified mail.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

After the lender files the Notice of Default, you get 90 days to bring your past-due bill current. After the 90 days pass, the lender files a Notice of Sale with the clerk. The Notice of Sale displays the location, date and time of the sale. It lists the trustee's name and contact information.

The foreclosure process is defined by California civil code 2924 and begins with the filing of a Notice of Default (NOD) with the county recorder. Once a borrower is at least 90 days behind in making mortgage payments, the lender will file a Notice of Default with the court of the county where the property is located.