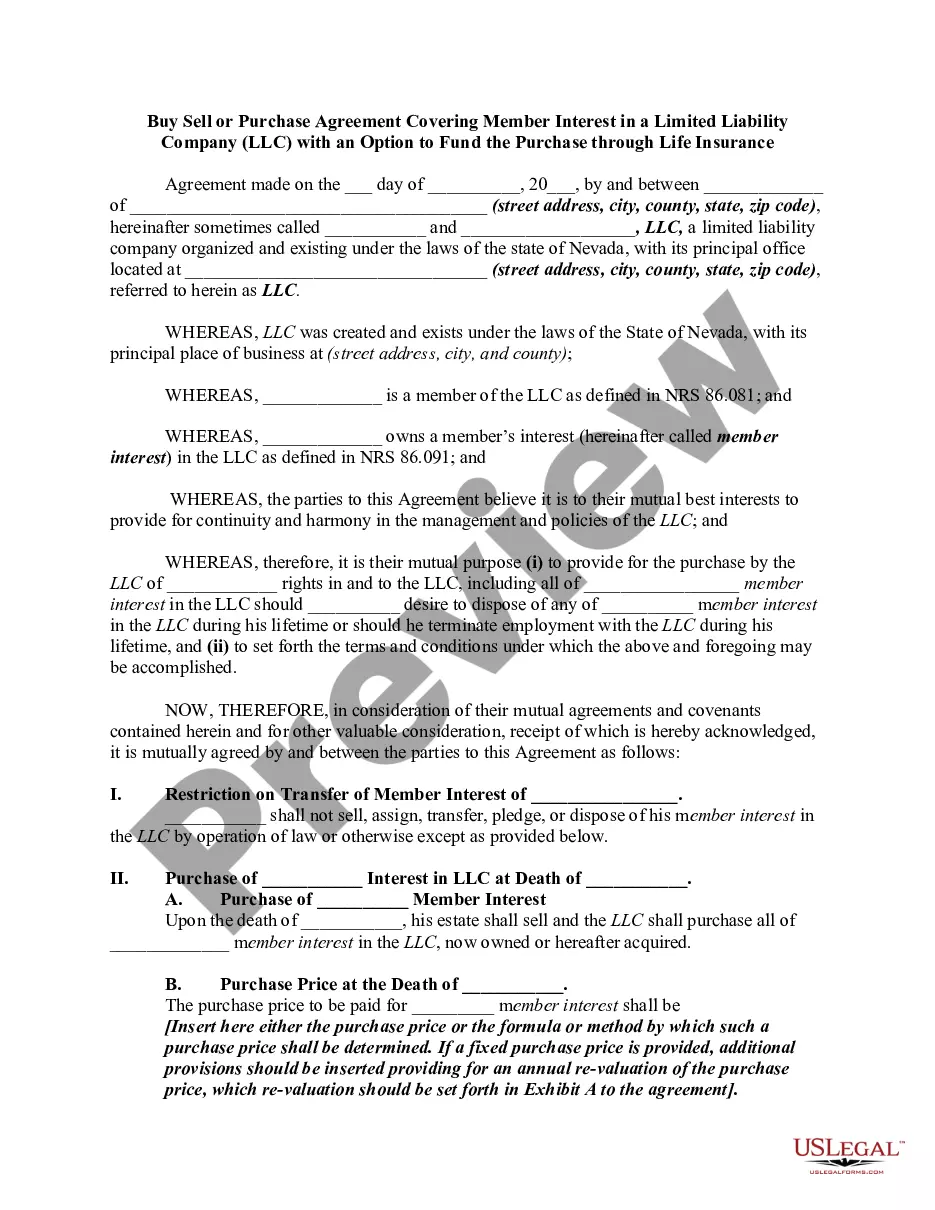

Nevada Buy Sell or Purchase Agreement Covering Member Interest in a Limited Liability Company - LLC with an Option to Fund the Purchase through Life Insurance

Description

How to fill out Nevada Buy Sell Or Purchase Agreement Covering Member Interest In A Limited Liability Company - LLC With An Option To Fund The Purchase Through Life Insurance?

US Legal Forms is a unique system to find any legal or tax form for completing, such as Nevada Buy Sell or Purchase Agreement Covering Member Interest in a Limited Liability Company - LLC with an Option to Fund the Purchase through Life Insurance. If you’re tired of wasting time looking for ideal examples and spending money on document preparation/legal professional service fees, then US Legal Forms is precisely what you’re seeking.

To enjoy all the service’s advantages, you don't need to download any software but simply pick a subscription plan and register an account. If you already have one, just log in and find the right sample, download it, and fill it out. Downloaded files are all kept in the My Forms folder.

If you don't have a subscription but need Nevada Buy Sell or Purchase Agreement Covering Member Interest in a Limited Liability Company - LLC with an Option to Fund the Purchase through Life Insurance, check out the instructions listed below:

- make sure that the form you’re checking out applies in the state you need it in.

- Preview the form its description.

- Simply click Buy Now to get to the register page.

- Pick a pricing plan and keep on registering by providing some information.

- Select a payment method to finish the registration.

- Save the file by choosing the preferred file format (.docx or .pdf)

Now, submit the file online or print out it. If you feel uncertain regarding your Nevada Buy Sell or Purchase Agreement Covering Member Interest in a Limited Liability Company - LLC with an Option to Fund the Purchase through Life Insurance sample, contact a lawyer to examine it before you send out or file it. Get started without hassles!

Form popularity

FAQ

Agreed value. You can set a value in the buy-sell agreement. Book value. Multiple of book value. Appraised value.

Life insurance is an effective tool that business owners can use to implement the provisions of a buy-sell agreement by providing liquidity at the death of an owner to both his or her business and family.

A buy-sell agreement consists of three common elements: a triggering event, a valuation method and a funding strategy.

Which of the following is a likely outcome if a buy-sell agreement in a two person partnership is not in place when one of the partners dies? Without a Buy-Sell Agreement in place, the surviving spouse of the deceased partner will likely step in as the new partner.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business.The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business.The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.

The premiums used to fund a buy-sell agreement are not tax deductible. The payment of premiums made by a business, where the shareholder or the owner is the insured, are not considered taxable income.

Using a buy/sell agreement to establish the value of a business interest. A buy/sell agreement is a contract between the members of an LLC that provides for the sale (or offer to sell) of a member's interest in the business to the other members or to the LLC when a specified event or events occur.

Most Common Uses of a Buy-Sell Agreement The buyout agreement stipulates what types of events trigger the contract. Each agreement is laid out to best meet the needs of each particular company. It can include specifications about who can buy stocks and the type of life situation that would trigger a buyout.