Professional Corporation Package for Nevada

Description

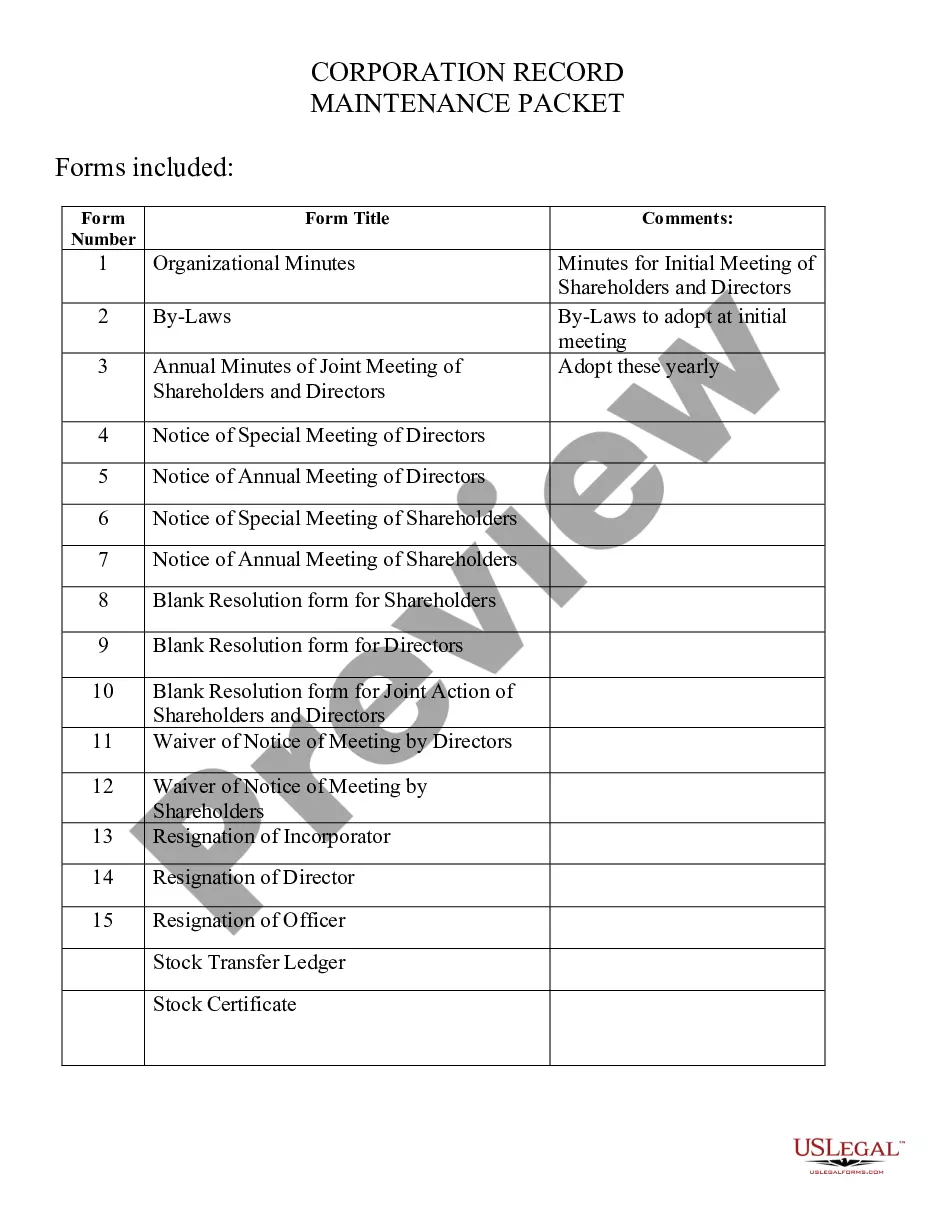

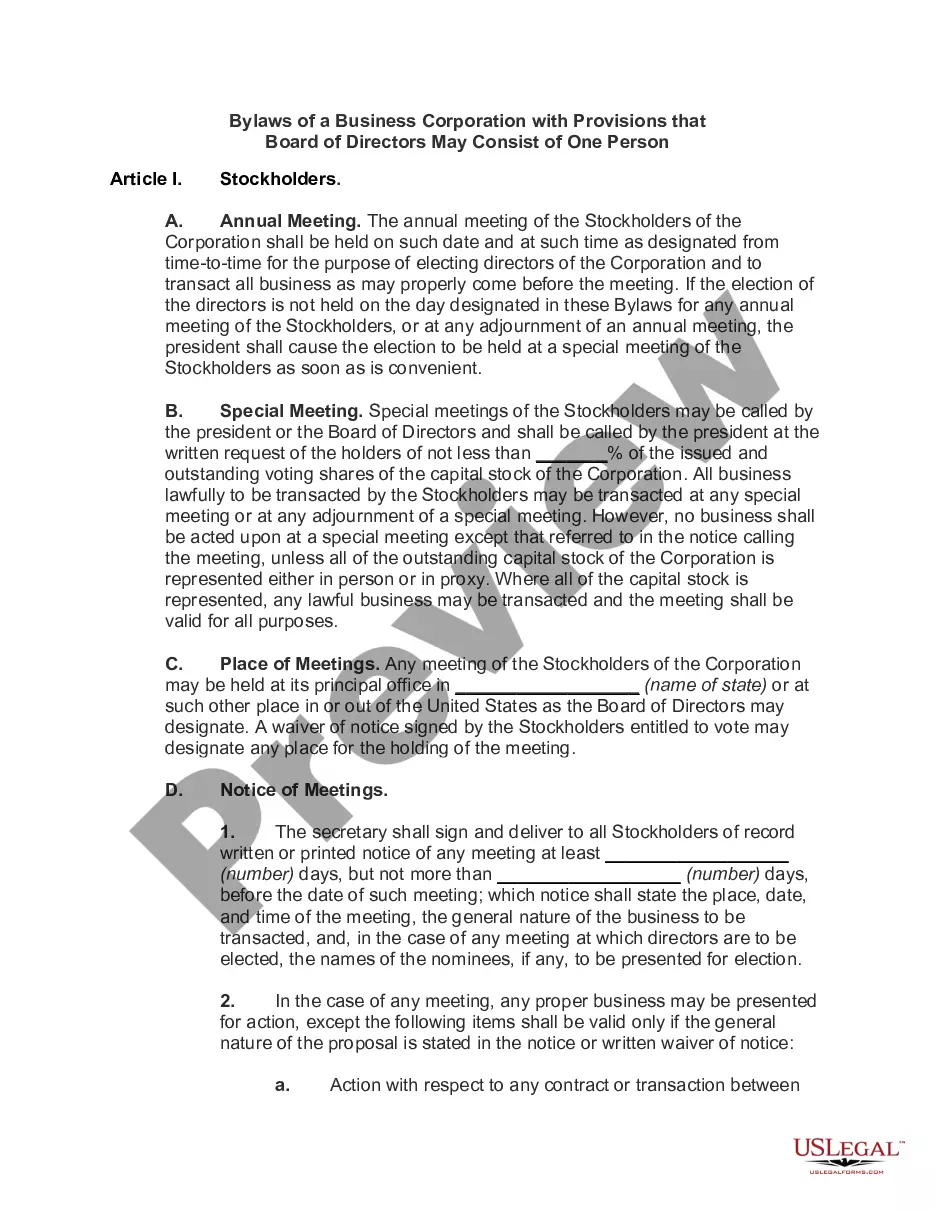

How to fill out Professional Corporation Package For Nevada?

Among countless paid and free examples that you can find online, you can't be sure about their reliability. For example, who made them or if they are qualified enough to deal with what you require those to. Keep calm and use US Legal Forms! Get Professional Corporation Package for Nevada templates developed by skilled legal representatives and avoid the costly and time-consuming procedure of looking for an lawyer or attorney and after that paying them to write a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button next to the file you are searching for. You'll also be able to access all of your previously saved documents in the My Forms menu.

If you are making use of our website the first time, follow the instructions below to get your Professional Corporation Package for Nevada with ease:

- Make sure that the file you find is valid in your state.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another template utilizing the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

When you’ve signed up and bought your subscription, you can use your Professional Corporation Package for Nevada as often as you need or for as long as it remains valid in your state. Revise it in your preferred editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Incorporating in the state of Nevada offers business owners significant benefits, such as no corporate income tax, no taxes on corporate shares and no annual franchise tax. Additionally, Nevada corporation law was based on the Delaware model to minimize the time, cost and risks of commercial litigation.

Time to process your corporation or LLC formation varies by state with routine processing taking 4 - 6 weeks or even more in the slowest states. In states where it is available, Rush Processing will reduce the time to form your business to about 2 - 3 business days.

The combined state and federal corporate tax rate in Nevada now stands at 21 percent, representing a tie for the lowest levy among the 50 states and the District of Columbia, according to a new study from the Tax Foundation.

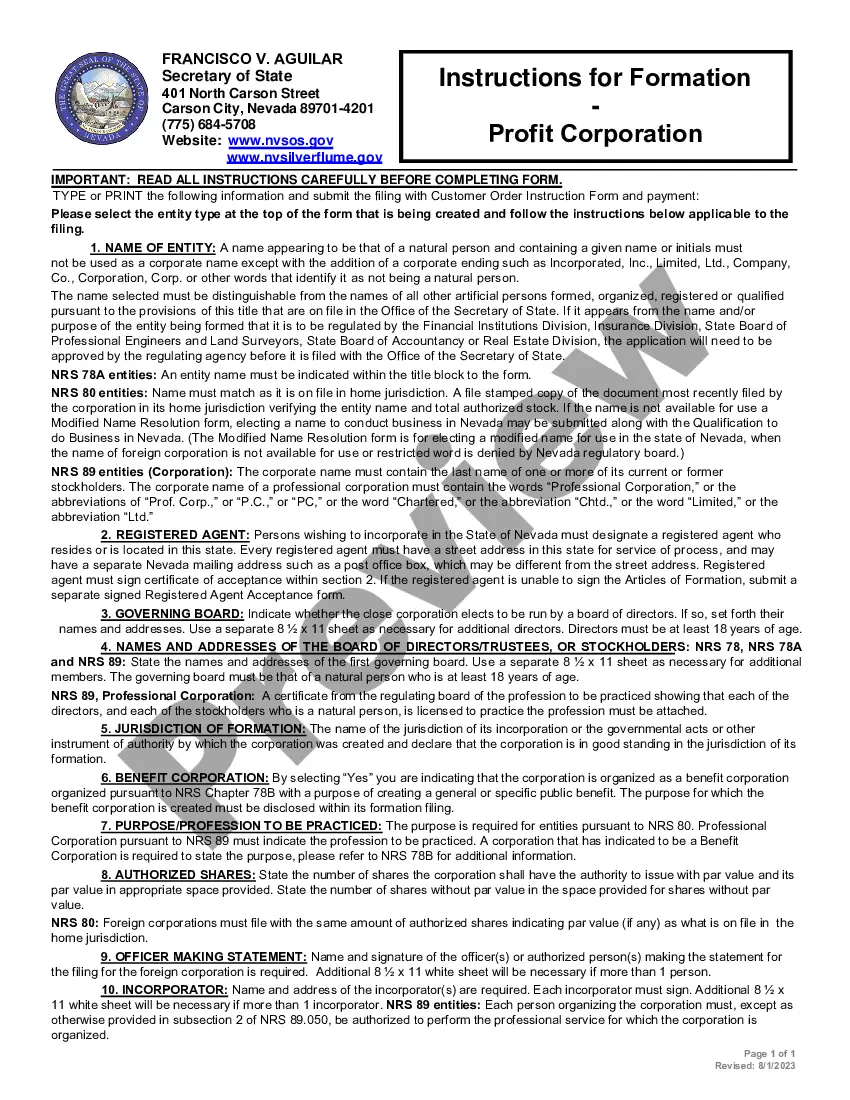

Nevada requires director names and addresses to be listed in the Articles of Incorporation. Nevada does not require officer names and addresses to be listed in the Articles of Incorporation.

There is a Nevada LLC forming fees of $75 (state fee). In order to form an LLC, you will be required to file the Articles of Organization and the state fee with the Secretary of State at 202 North Carson Street, Carson City, NV 89701-4201.

The cost of incorporating in Nevada is low, and the entire process is easy. The initial expense is for the Articles of Organization form that you must file with the Secretary of State. The fees for the individual articles are $75, $125, and $200, respectively. Filing fees are subject to change at any time.

Nevada offers a wide range of benefits as a state of incorporation, including its ease of registration, relatively low corporate taxes and lack of state taxes. Nevada also offers strong privacy protections to business owners and a business-friendly environment.