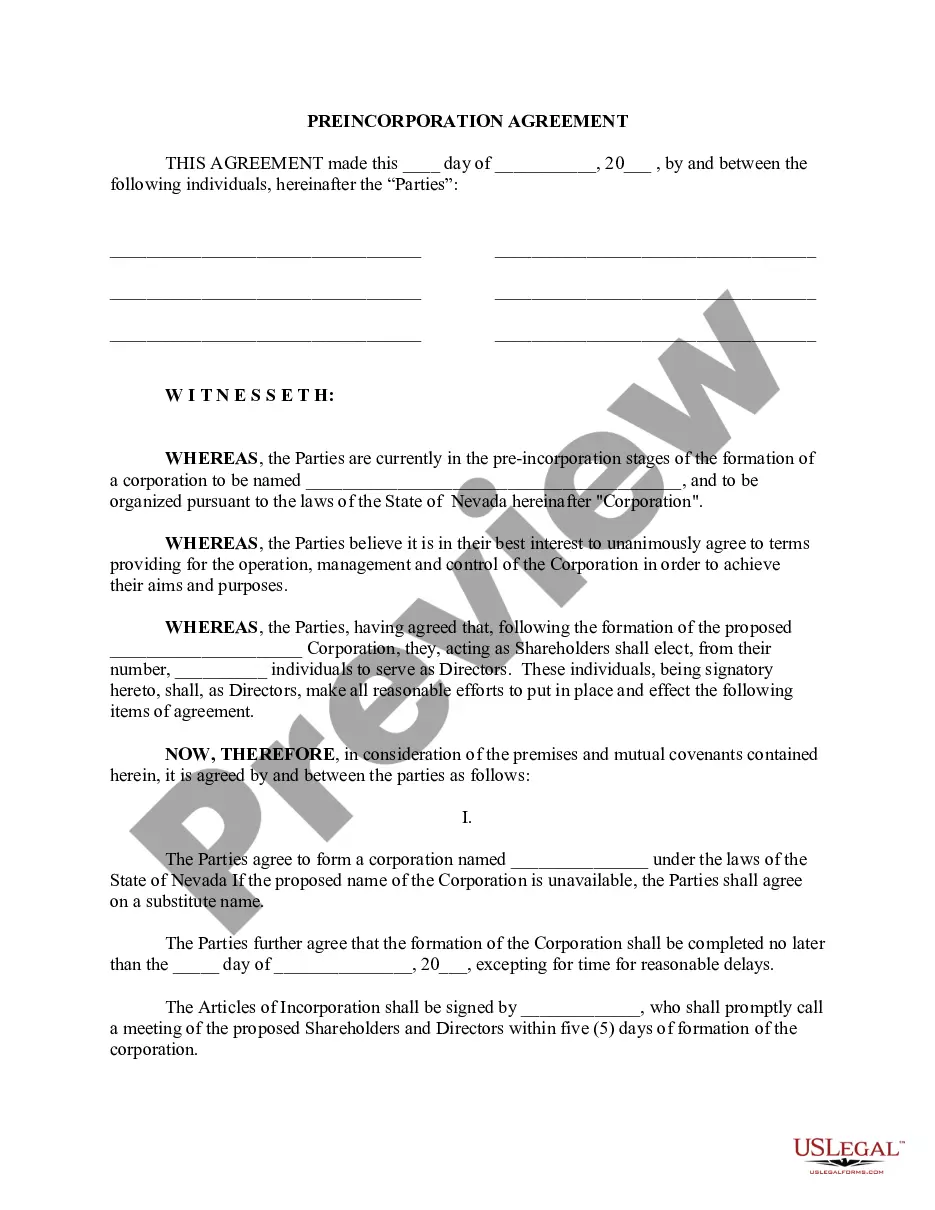

Nevada Pre-Incorporation Agreement, Shareholders Agreement and Confidentiality Agreement

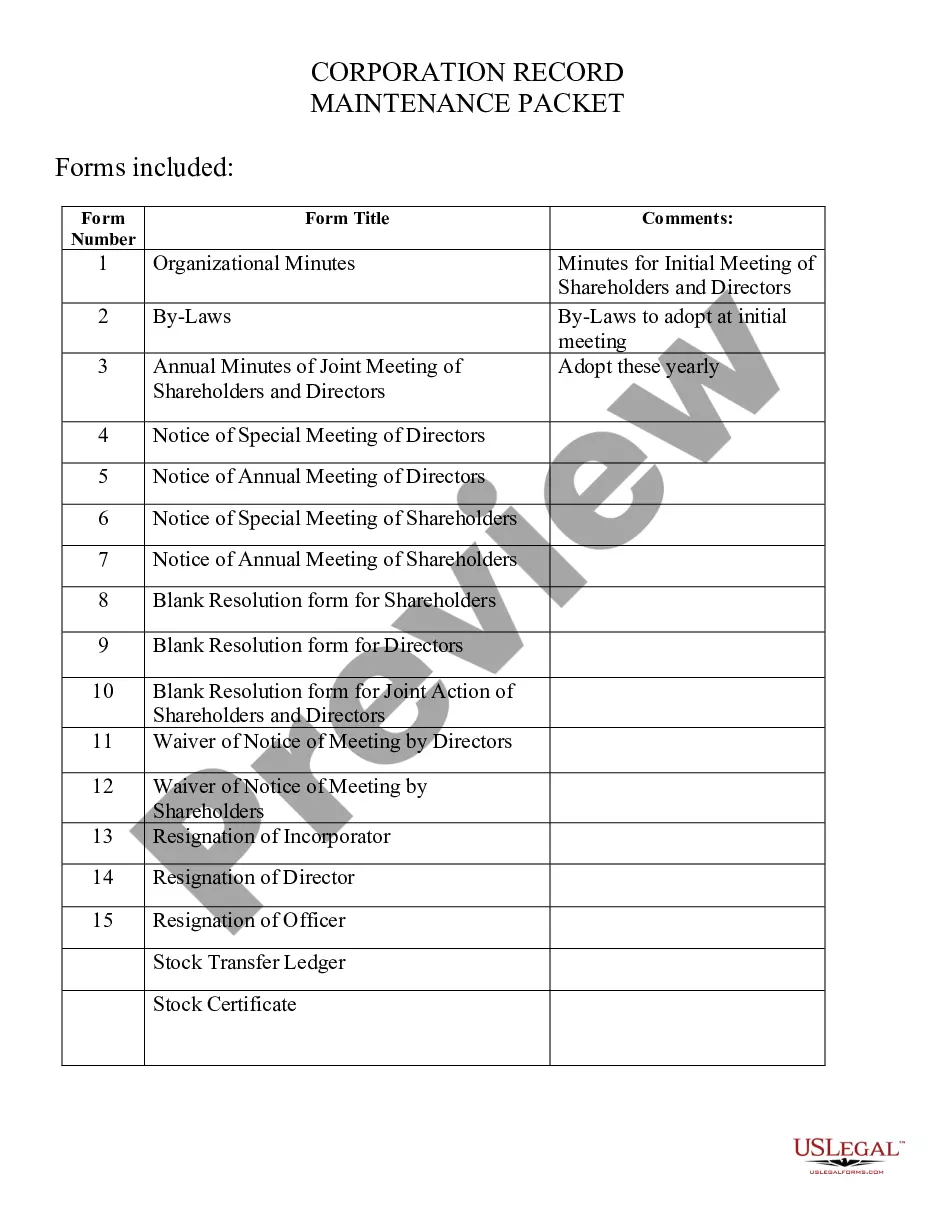

Description

How to fill out Nevada Pre-Incorporation Agreement, Shareholders Agreement And Confidentiality Agreement?

US Legal Forms is really a special platform to find any legal or tax document for submitting, including Nevada Pre-Incorporation Agreement, Shareholders Agreement and Confidentiality Agreement. If you’re fed up with wasting time searching for ideal examples and spending money on papers preparation/legal professional charges, then US Legal Forms is exactly what you’re trying to find.

To reap all the service’s advantages, you don't have to download any software but just choose a subscription plan and sign up an account. If you have one, just log in and look for a suitable sample, download it, and fill it out. Downloaded files are stored in the My Forms folder.

If you don't have a subscription but need Nevada Pre-Incorporation Agreement, Shareholders Agreement and Confidentiality Agreement, have a look at the recommendations listed below:

- make sure that the form you’re taking a look at is valid in the state you need it in.

- Preview the example and read its description.

- Click on Buy Now button to get to the sign up page.

- Choose a pricing plan and continue signing up by providing some info.

- Decide on a payment method to finish the sign up.

- Save the file by selecting your preferred file format (.docx or .pdf)

Now, fill out the file online or print out it. If you are unsure concerning your Nevada Pre-Incorporation Agreement, Shareholders Agreement and Confidentiality Agreement form, contact a lawyer to check it before you send out or file it. Get started without hassles!

Form popularity

FAQ

Who needs to sign the Shareholders' Agreement? Each shareholder must sign the Shareholders' Agreement. In addition, a representative of the company should sign.

A shareholders' agreement is an agreement entered into between all or some of the shareholders in a company. It regulates the relationship between the shareholders, the management of the company, ownership of the shares and the protection of the shareholders. They also govern the way in which the company is run.

On starting a company with more than one shareholder, shareholders are often advised to make a Shareholders' Agreement, in order to further regulate the way business between them is to be conducted.

A shareholders' agreement is a legally binding contract among the shareholders that sets out their rights and obligations, maps out how the company should be managed, establishes share ownership and share transfer rules all in order to provide clear solutions to contentious scenarios that may arise in the future.

A shareholder's agreement establishes the rights of majority and minority shareholders of the corporation while also establishing the responsibilities of the board of directors and officers for that corporation. It is beneficial to have in place when the corporation only has a few shareholders.

If there is no shareholders agreement in place, for as long as shareholders agree with the way the company's affairs are managed and are happy with the relationships between themselves and the company, then no problems are likely to occur.

A Shareholders' Agreement can provide a mechanism which, where one shareholder wishes to sell their shares, effectively gives the other shareholders or the company (as the case may be) a right of first refusal over those shares. This can be used to try and restrict who may or may not acquire shares in the company.

The shareholders' agreement is intended to ensure that shareholders are treated fairly and their rights are protected.A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations.

A shareholders' agreement is an agreement entered into between all or some of the shareholders in a company. It regulates the relationship between the shareholders, the management of the company, ownership of the shares and the protection of the shareholders.