Nevada Articles of Incorporation for Domestic For-Profit Corporation

Description

How to fill out Nevada Articles Of Incorporation For Domestic For-Profit Corporation?

US Legal Forms is a unique system where you can find any legal or tax form for completing, including Nevada Articles of Incorporation for Domestic For-Profit Corporation. If you’re fed up with wasting time searching for ideal examples and paying money on document preparation/attorney charges, then US Legal Forms is exactly what you’re looking for.

To enjoy all the service’s advantages, you don't have to download any software but just select a subscription plan and sign up your account. If you have one, just log in and look for an appropriate template, save it, and fill it out. Downloaded documents are kept in the My Forms folder.

If you don't have a subscription but need to have Nevada Articles of Incorporation for Domestic For-Profit Corporation, have a look at the instructions below:

- make sure that the form you’re taking a look at applies in the state you need it in.

- Preview the form and look at its description.

- Simply click Buy Now to get to the register page.

- Select a pricing plan and proceed signing up by entering some info.

- Choose a payment method to complete the registration.

- Save the document by selecting the preferred format (.docx or .pdf)

Now, complete the document online or print it. If you feel uncertain concerning your Nevada Articles of Incorporation for Domestic For-Profit Corporation form, contact a legal professional to examine it before you decide to send out or file it. Get started without hassles!

Form popularity

FAQ

For details you may call (775) 684-5708, visit www.nvsos.gov, or write to the Secretary of State, 202 North Carson Street, Carson City, NV 89701-4201.

Nevada allows owners of foreign entities to convert or domesticate as Nevada based companies.You won't have to start from scratch with a new entity or worry about transferring your company's assets to a new entity either, although, in fairness, all liabilities remain as well.

The cost of incorporating in Nevada is low, and the entire process is easy. The initial expense is for the Articles of Organization form that you must file with the Secretary of State. The fees for the individual articles are $75, $125, and $200, respectively. Filing fees are subject to change at any time.

If you do not feel comfortable writing the articles of incorporation on your own, you can hire an attorney or an incorporation service to write the articles of incorporation and even file for the incorporation of your business for you.

To file your Articles of Incorporation, the Nevada Secretary of State charges a minimum filing fee of $75. You must also file the initial list of officers, which costs $150. All corporations doing business in Nevada must also file an annual business license fee, which is $500.

Nevada requires director names and addresses to be listed in the Articles of Incorporation. Nevada does not require officer names and addresses to be listed in the Articles of Incorporation.

If you want to structure your business as a corporation, one of the first formal steps you'll need to take is to file a special document with a particular state office. In most states, the document is known as the articles of incorporation, and in most states it needs to be filed with the Secretary of State.

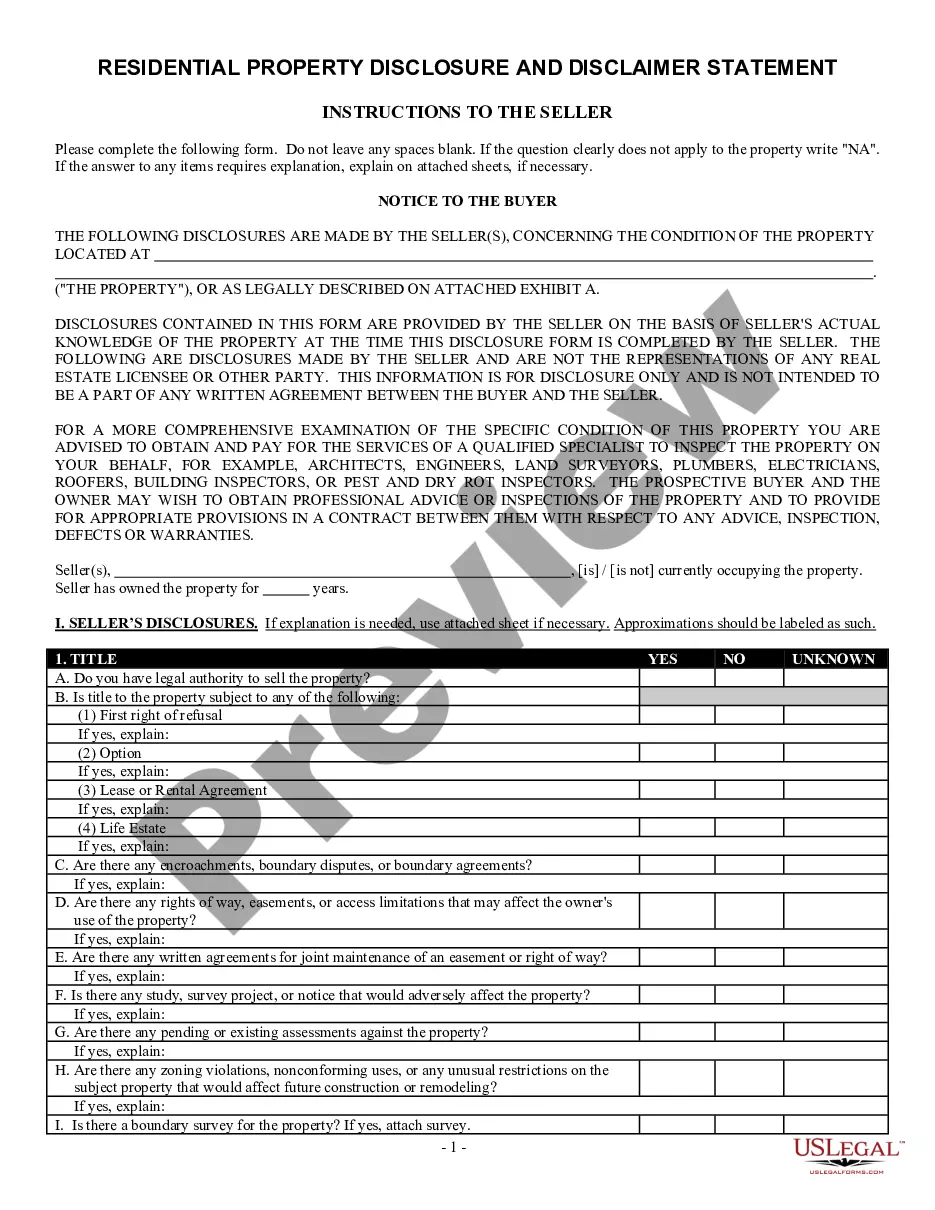

The name of your corporation. your corporation's principal place of business. the name and address of your corporation's registered agent. a statement of the corporation's purpose. the corporation's duration. information about the number of shares and classes of stock the corporation is authorized to issue.