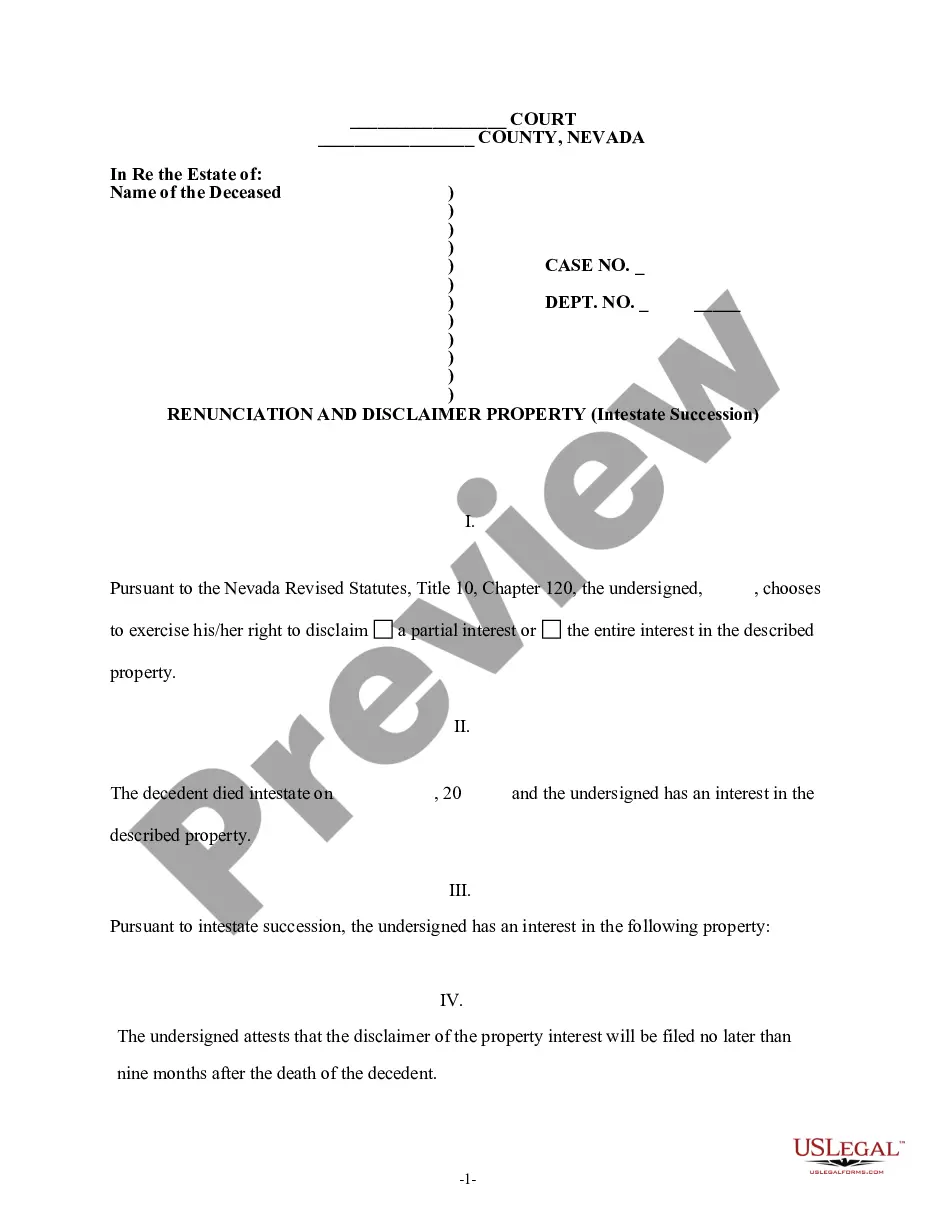

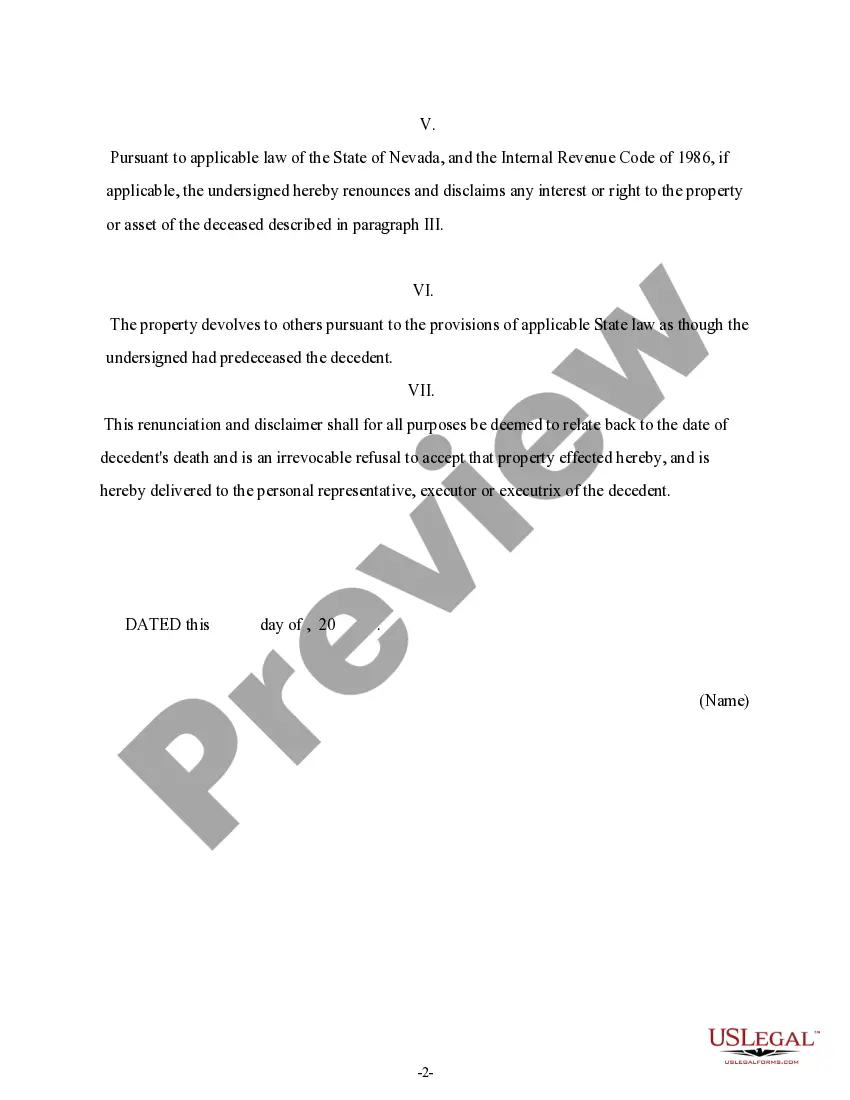

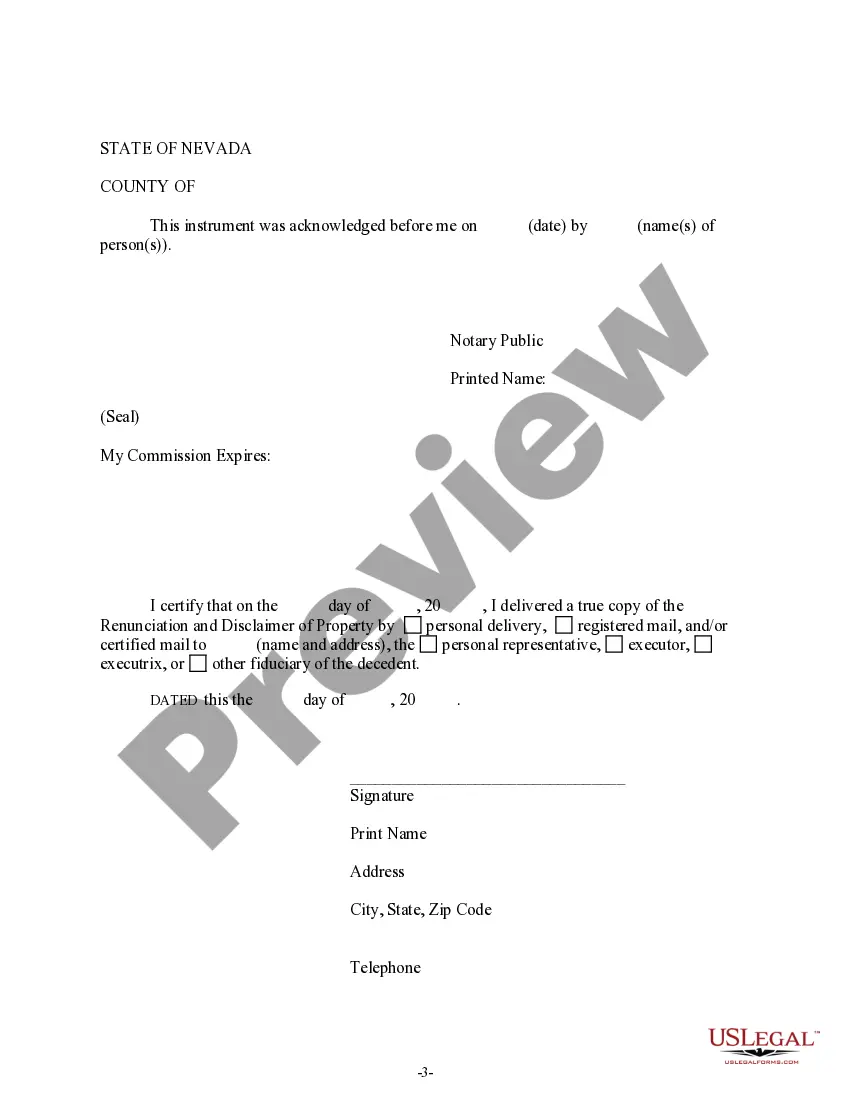

Nevada Renunciation And Disclaimer Property - Intestate Succession

Description Next Of Kin Affidavit

How to fill out Nevada Renunciation And Disclaimer Property - Intestate Succession?

US Legal Forms is a unique system to find any legal or tax form for filling out, including Nevada Renunciation And Disclaimer Property - Intestate Succession. If you’re fed up with wasting time seeking suitable examples and paying money on papers preparation/attorney service fees, then US Legal Forms is exactly what you’re seeking.

To experience all of the service’s advantages, you don't have to install any software but just select a subscription plan and register your account. If you have one, just log in and get the right template, download it, and fill it out. Downloaded files are all saved in the My Forms folder.

If you don't have a subscription but need Nevada Renunciation And Disclaimer Property - Intestate Succession, take a look at the guidelines listed below:

- check out the form you’re taking a look at applies in the state you want it in.

- Preview the sample its description.

- Simply click Buy Now to get to the register webpage.

- Select a pricing plan and keep on signing up by providing some information.

- Decide on a payment method to complete the sign up.

- Download the document by choosing your preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you feel unsure regarding your Nevada Renunciation And Disclaimer Property - Intestate Succession sample, contact a legal professional to check it before you decide to send out or file it. Begin without hassles!

Intestate Succession Texas Form popularity

Intestate Succession Nevada Other Form Names

FAQ

Children - if there is no surviving married or civil partnerIf there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

Who Inherits When There's No Will? Intestate succession laws determine how to distribute assets among them when no will is in place. This varies between states. Generally, a spouse receives most of the assets and property, followed by children, parents, grandparents, and other blood relatives of the deceased.

How Is Next of Kin Determined? To determine next of kin in California, go down the list until someone exists in the category listed.For example, if decedent had no surviving spouse or registered domestic partner, but was survived by adult children, then the adult children would be next of kin.

In Nevada, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

If you die without a will, you are considered to have died "intestate." Typically, your spouse and children will serve as your next of kin. If you have no spouse or children, then your parents and siblings often qualify as next of kin, though this will differ depending on the state.

If you pass away without a last will, you are said to have died intestate. Under these circumstances, the probate court is required to distribute your assets under the intestate succession laws. In Nevada, your spouse would get everything if you have no children.

In Nevada, if the total amount of the deceased person's assets exceeds $20,000, or if real estate is involved, probate (or administration) will be required and there is normally no reason to delay starting the process.The petitioner will receive a court order directing the distribution of the estate property.

Inheritance. Inheritance automatically goes to your legal next of kin -- your spouse -- if you die, but your will can change this. You might opt to leave some things to your spouse and others to your children or parents.