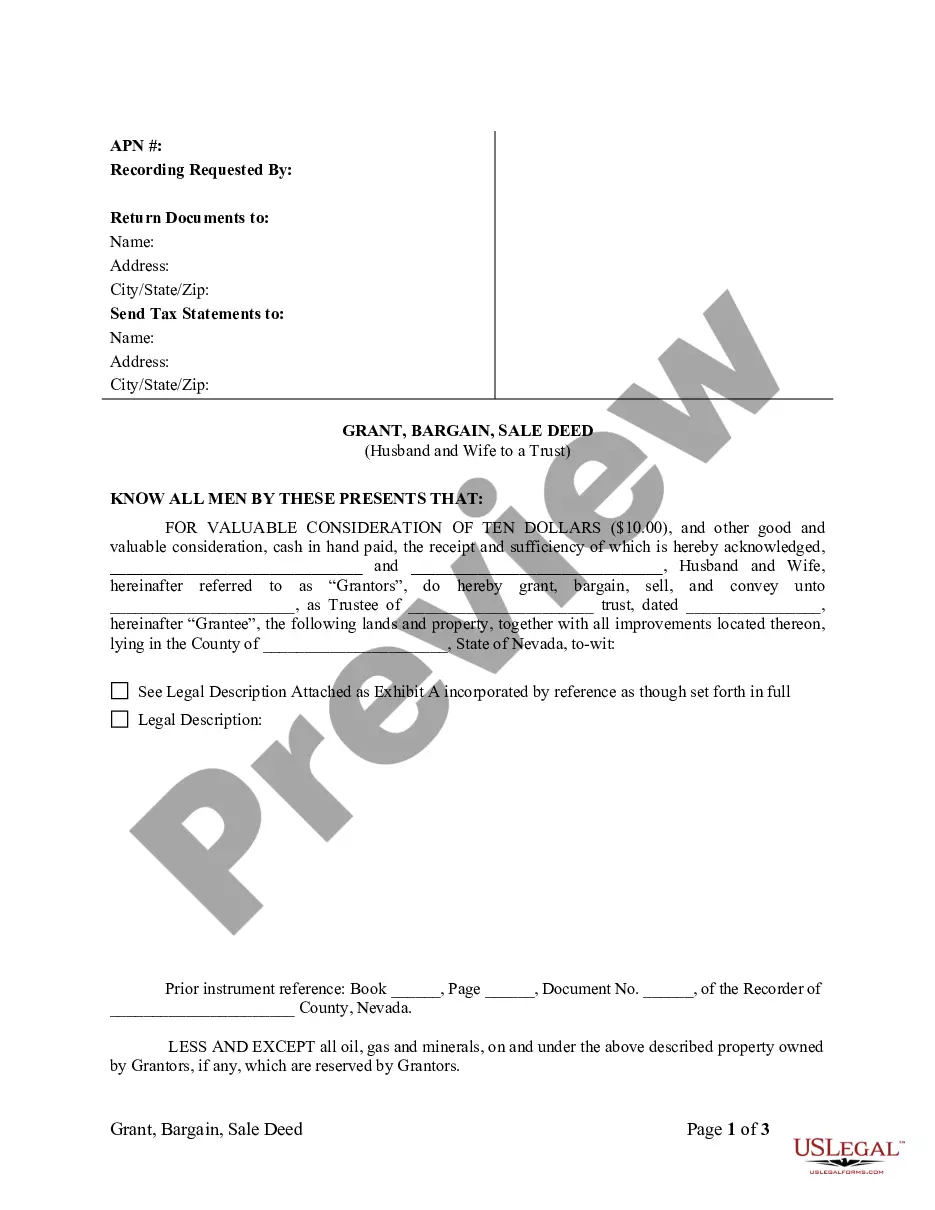

Nevada Grant, Bargain, Sale Deed from Husband and Wife to a Trust

Description Bargain Sale Deed

How to fill out Deed Husband Wife Print?

US Legal Forms is actually a special system to find any legal or tax form for submitting, including Nevada Grant, Bargain, Sale Deed from Husband and Wife to a Trust. If you’re fed up with wasting time searching for suitable examples and spending money on record preparation/lawyer charges, then US Legal Forms is exactly what you’re trying to find.

To reap all the service’s advantages, you don't have to download any software but just choose a subscription plan and sign up an account. If you already have one, just log in and look for a suitable sample, save it, and fill it out. Saved files are all saved in the My Forms folder.

If you don't have a subscription but need to have Nevada Grant, Bargain, Sale Deed from Husband and Wife to a Trust, take a look at the guidelines below:

- check out the form you’re looking at is valid in the state you want it in.

- Preview the form and look at its description.

- Click on Buy Now button to reach the sign up webpage.

- Choose a pricing plan and carry on registering by entering some info.

- Choose a payment method to complete the sign up.

- Download the document by choosing the preferred file format (.docx or .pdf)

Now, complete the file online or print out it. If you are unsure regarding your Nevada Grant, Bargain, Sale Deed from Husband and Wife to a Trust form, speak to a legal professional to analyze it before you decide to send out or file it. Start hassle-free!

Deed Wife Form Blank Form popularity

Nevada Sale Form Document Other Form Names

Sale Husband Wife FAQ

A grant, bargain, and sale deed is commonly used in Nevada for a conveyance of real property.A certificate of the acknowledgement or proof of execution, signed by the person taking the acknowledgment or proof, and under the seal or stamp of that person, will entitle the deed to be recorded (NRS 111.310).

A bargain and sale deed doesn't warrant against any encumbrances. It simply implies that the grantor holds title to the property.A bargain and sale deed is much like a quitclaim deed in this respect. It conveys property, but it makes no guarantees that no one else has a stake in that property.

The Nevada Deed Upon Death is like a regular deed you might use to transfer real estate located in Nevada, but with a crucial difference: It doesn't take effect until your death. At your death, the real estate goes automatically to the person you named to inherit it, without the need for probate court proceedings.

The Grantee and Grantor are jointly and severally liable for the payment of the tax. When all taxes and recording fees required are paid, the deed is recorded. Each County Recorder's Office: 1.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

Bargain and sale deeds are most often used when property is transferred pursuant to a foreclosure, tax sale, or settlement of the estate of a deceased person. They may also be used in the same situations as a quitclaim deed, although they give the grantee a little more protection.

Buying property with this type of deed is not necessarily a bad idea, but it is advisable to take some precautions. If possible, a title search should be conducted to look for any clouds on the title and to see how difficult it would be to release them.

The quitclaim deed provides no warranties; it conveys the interest the grantor had in the propertynothing more.The bargain and sale deed indicates that the grantor has title; but property might come with encumbrances and defects.

Bargain and sale deeds, as the term suggests, is used in a sale. Unlike a quitclaim, the bargain and sale deed indicates that the grantor has the title and can convey it to a buyer.The bargain and sale deed indicates that the grantor has title; but property might come with encumbrances and defects.