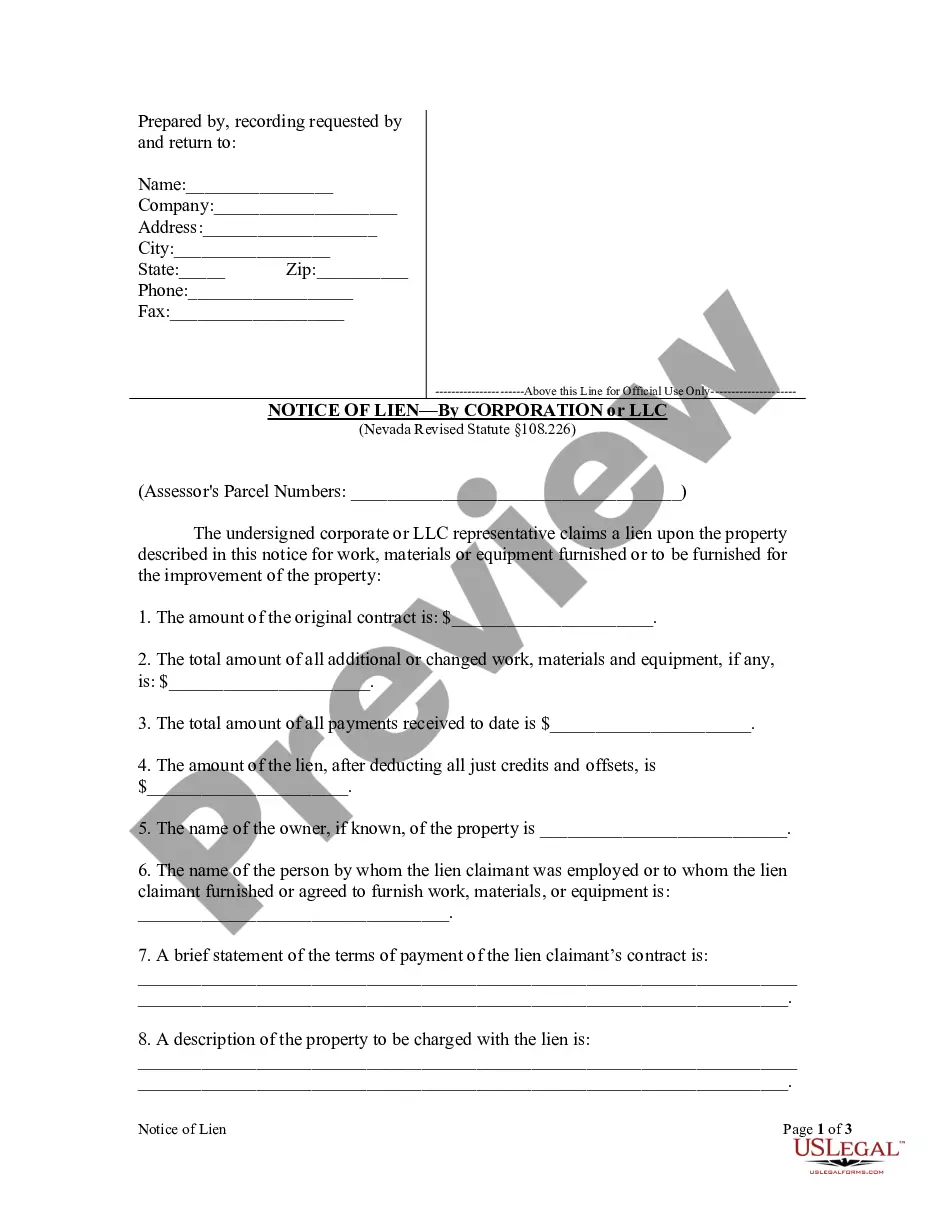

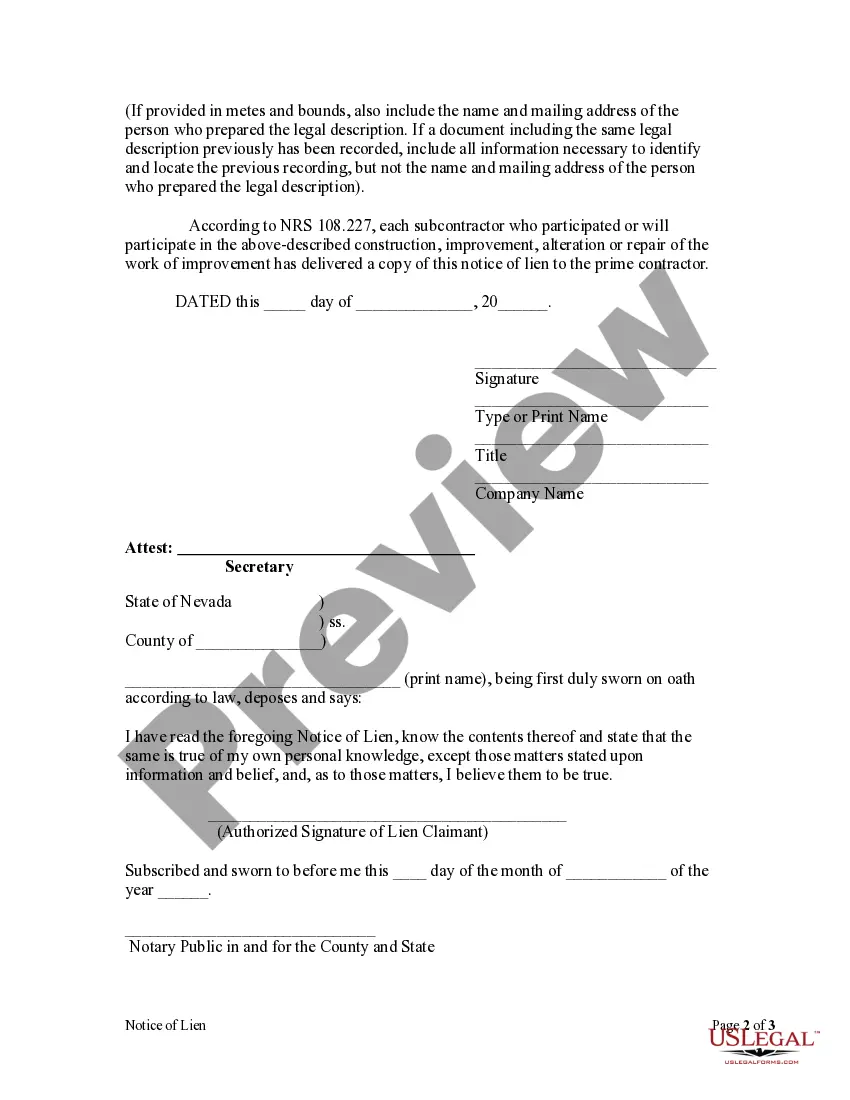

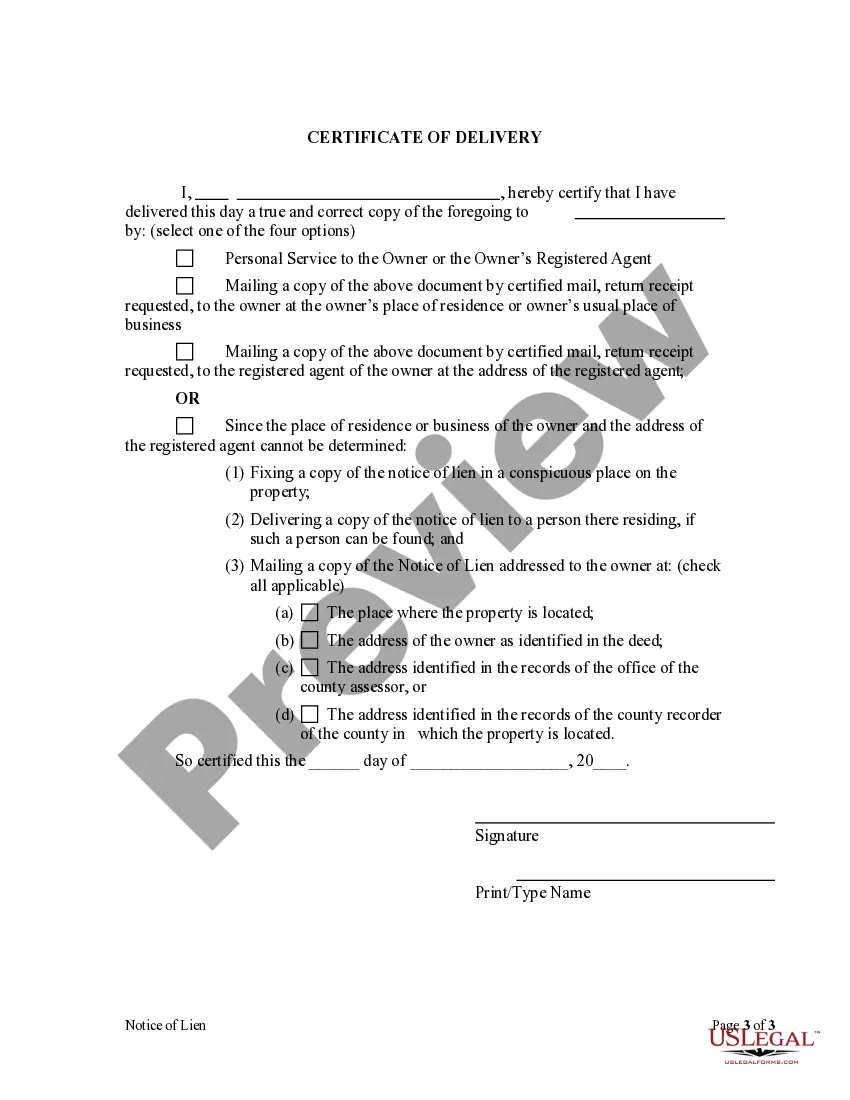

This notice, properly filed, serves to put all parties with an interest in a piece of property that has been improved on notice that the corporate lien claimant has a claim for the value of labor or materials expended in the improvement.

Nevada Notice of Lien - Corporation

Description Notice Lien Form

How to fill out Limited Liability Company Pdf?

US Legal Forms is really a special platform to find any legal or tax document for submitting, including Nevada Notice of Lien - Corporation or LLC. If you’re tired with wasting time looking for ideal examples and paying money on file preparation/legal professional charges, then US Legal Forms is precisely what you’re looking for.

To reap all of the service’s advantages, you don't have to install any software but simply select a subscription plan and create your account. If you have one, just log in and look for an appropriate template, save it, and fill it out. Downloaded files are saved in the My Forms folder.

If you don't have a subscription but need Nevada Notice of Lien - Corporation or LLC, check out the instructions below:

- Double-check that the form you’re looking at applies in the state you want it in.

- Preview the example its description.

- Click on Buy Now button to reach the sign up webpage.

- Choose a pricing plan and proceed registering by providing some info.

- Decide on a payment method to finish the sign up.

- Download the file by selecting the preferred file format (.docx or .pdf)

Now, fill out the file online or print it. If you feel unsure about your Nevada Notice of Lien - Corporation or LLC template, contact a attorney to examine it before you decide to send or file it. Begin hassle-free!

Corporation Llc Form Form popularity

Nv Notice Lien Other Form Names

Notice Lien Form Nevada FAQ

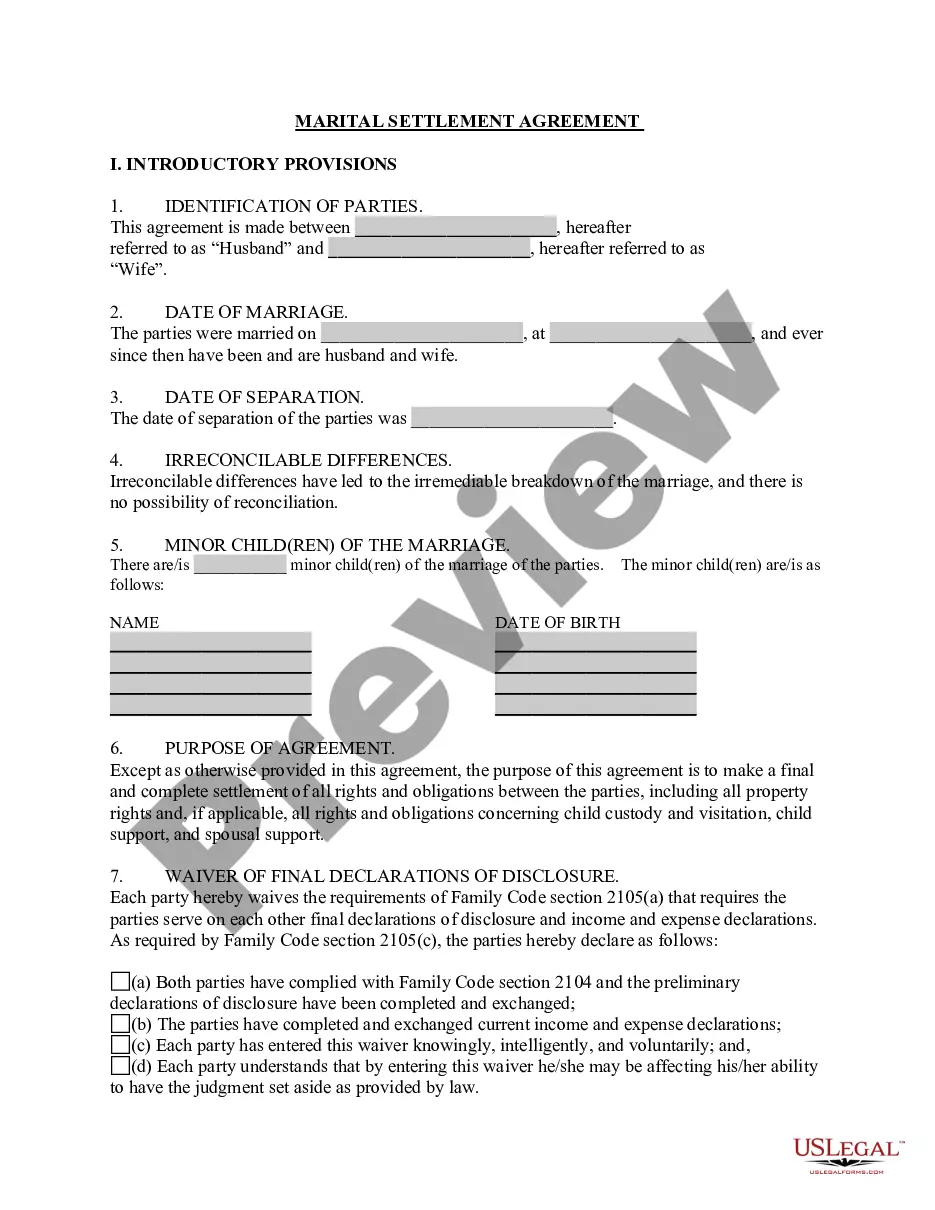

Satisfy Your Debt: This is the most straightforward option. Once you have paid off the balance of your debt, in full, you can file a Release of Lien form. This acts as evidence that the debt has been paid and will effectively remove the lien from your property.

Invalid Liens A lien stays in the county records and on your property title until you take action to remove it.If the contractor, subcontractor, laborer, or material supplier fails to follow any of the specific time frames, you can petition the court to remove the lien.

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

What Is a Fraudulent Lien?the claimant is owed money on another job by the same general contractor or property owner, but didn't file a lien on that project before time expired; or. the claimant wants to file a lien because of personal reasons generally related to the identity of the property owner.

The Indian Contract Act, 1872 classifies the Right of Lien into two types: Particular Lien and General Lien. Section 170 of the aforesaid Act gives the exact definition of Particular Lien which states that the Bailee is free to hold control of a precise property with position to the charge which is due.

If a creditor gets a judgment against you, it can then place a lien on your property. The lien gives the creditor an interest in your property so that it can get paid for the debt you owe.And in some cases, the lien gives the creditor the right to force a sale of your property in order to get paid.

Depending on state laws, paper titles are generally mailed and electronic titles and/or liens are released to the motor vehicle agency approximately 10 business days after the payoff is received. Allow 15-30 days for receipt of your title based on mail time and/or motor vehicle agency process.

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

Be licensed, if required, to perform the work; Timely provide a Notice of Right to Lien if he does not have a direct contract with the homeowner; Provide a Notice of Intent To Lien fifteen (15) days before recording his mechanics lien; Timely record his mechanics lien (formally called a Notice of Lien); and.