Nevada Heirship Affidavit - Descent

What is this form?

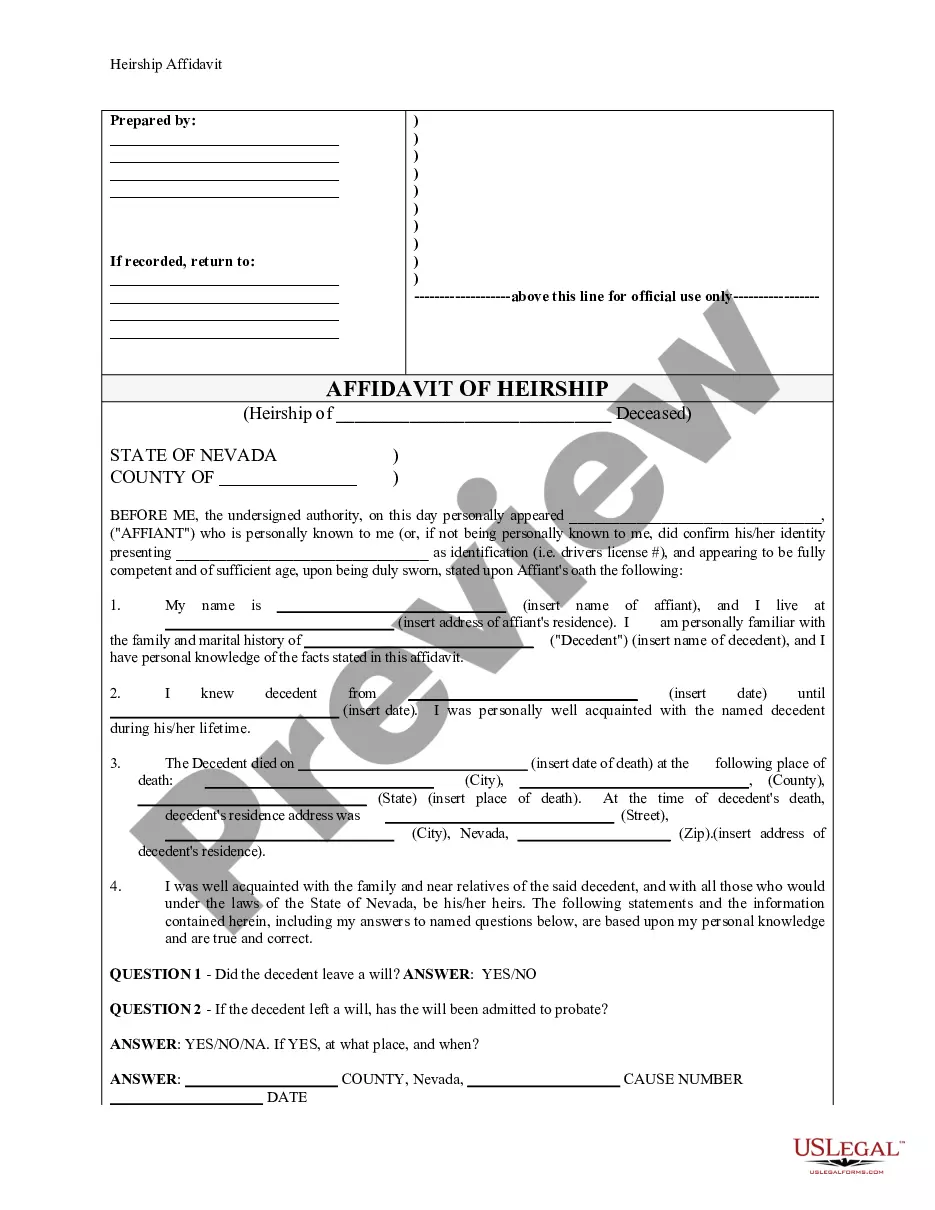

The Heirship Affidavit - Descent is a legal document used to declare the heirs of a deceased individual. This form is typically employed to establish rightful ownership of both personal and real property when the deceased did not leave a will. Unlike other estate documents, the Heirship Affidavit is particularly useful for individuals looking to provide clear evidence of heirship for property transfers or inheritances.

Key parts of this document

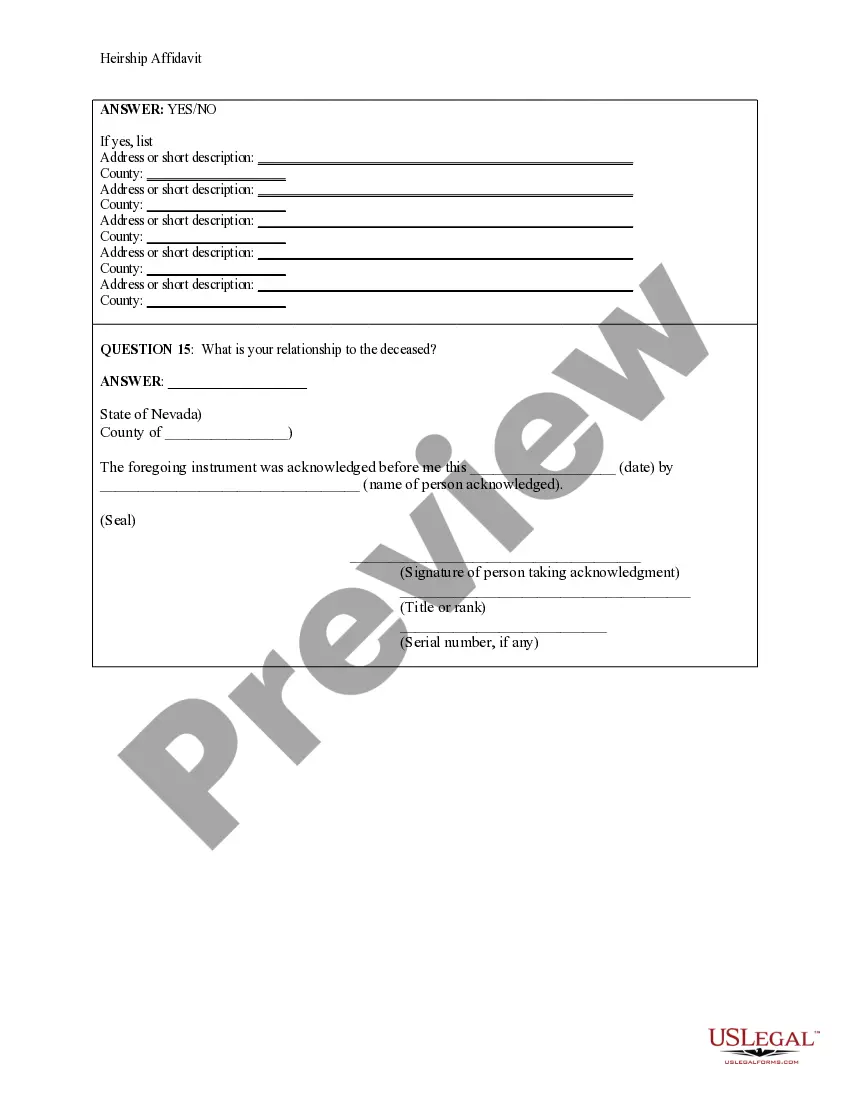

- Affiant's details: Name, address, and identification.

- Information about the deceased: Name, date of death, and place of residence.

- Questions regarding any existing wills and probate status.

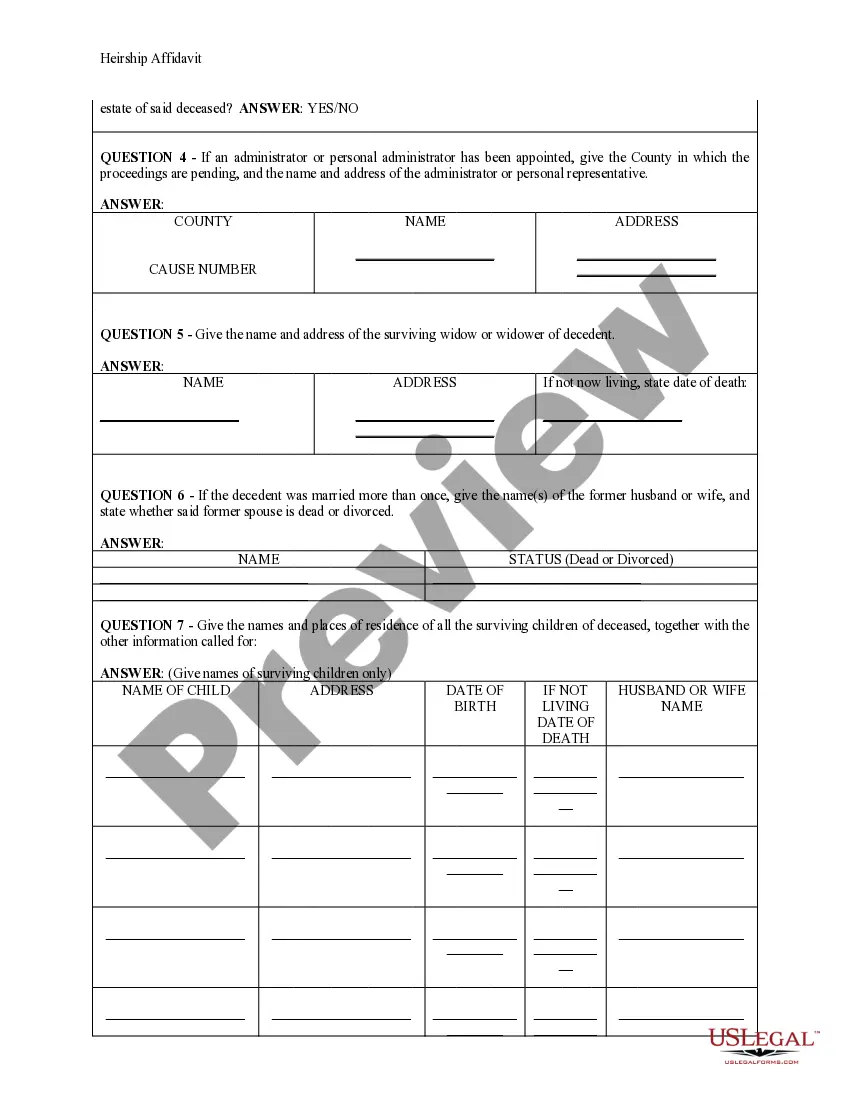

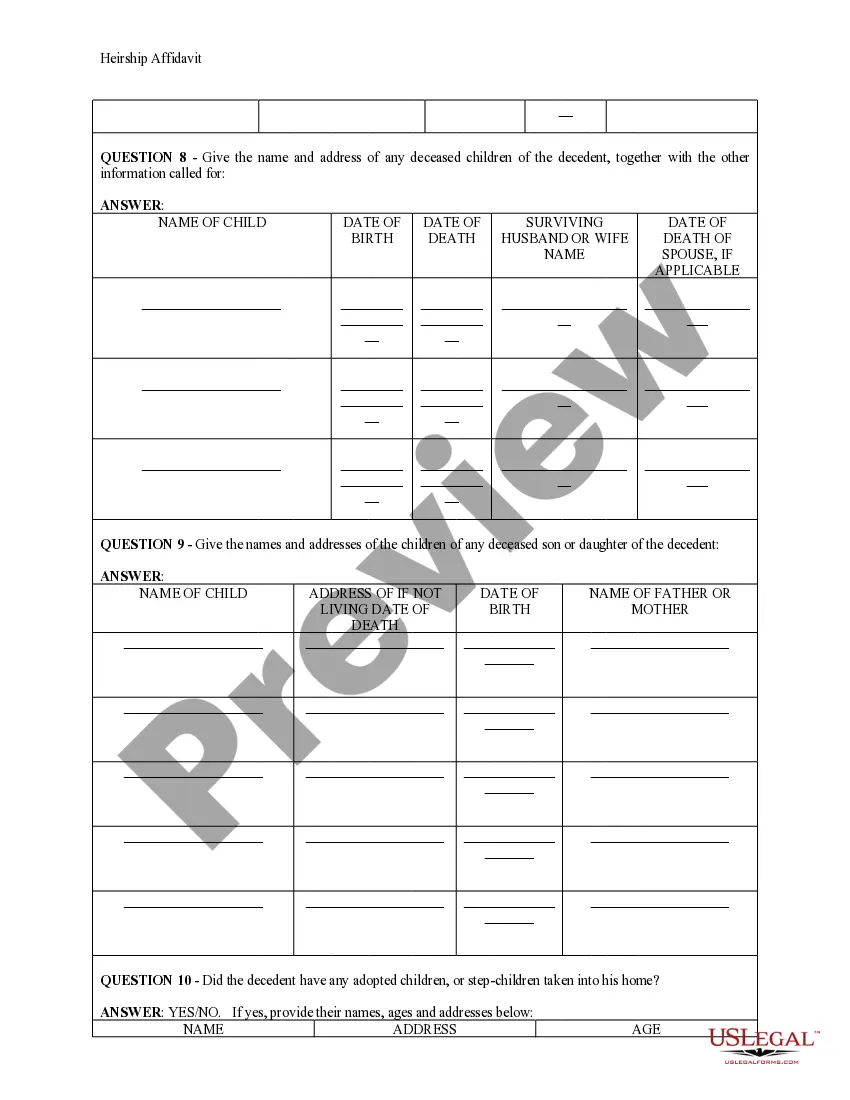

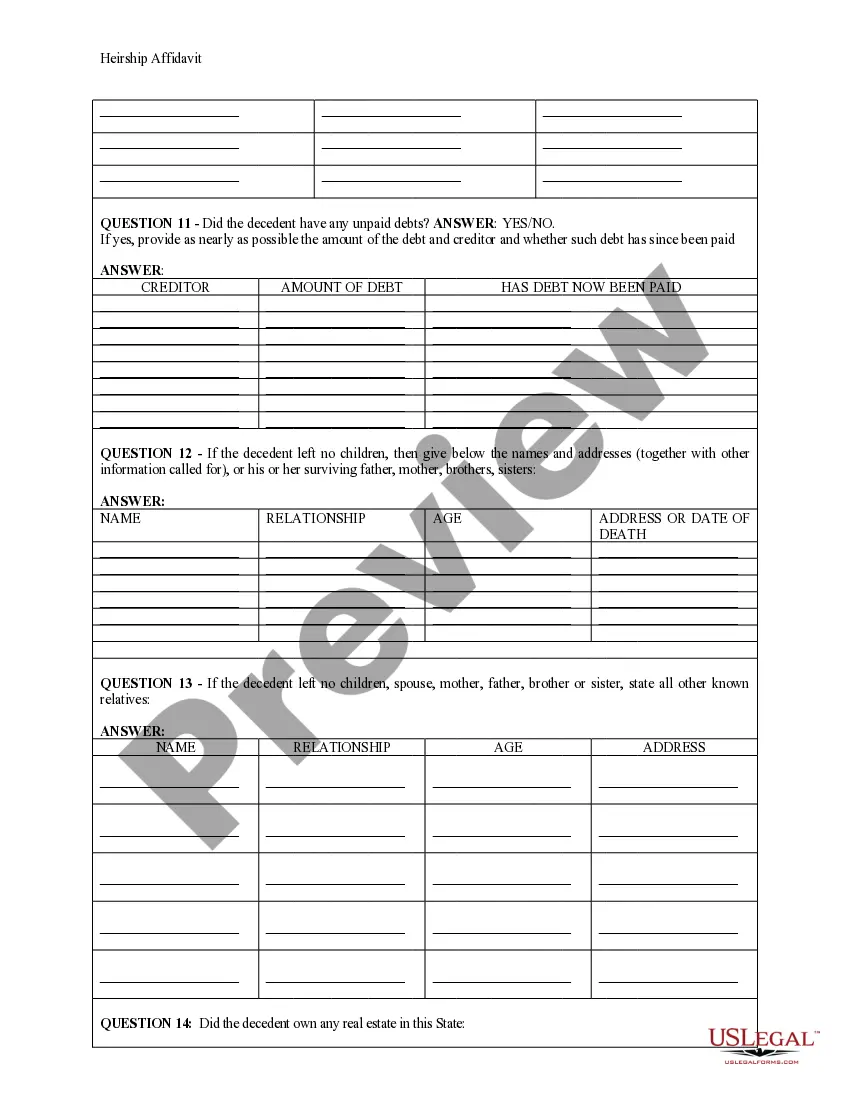

- Details of the deceased's surviving family members and heirs.

- Confirmation of any real estate owned by the deceased.

Common use cases

This form should be used when someone dies without a will, and there is a need to establish the heirs to their property. It is particularly relevant if the heirs wish to sell or transfer the deceased's property, as the affidavit can be recorded with official land records to demonstrate ownership.

Who needs this form

- Family members of the deceased who need to prove their heirship.

- Individuals involved in the sale or transfer of property owned by a deceased relative.

- Trustees or representatives managing the deceased's estate on behalf of heirs.

Steps to complete this form

- Provide the affiant's personal information, including name and address.

- Fill in details about the deceased, such as their full name and date of death.

- Answer questions regarding any wills and the probate process.

- List all surviving relatives and their respective details, such as names and addresses.

- Sign the affidavit in the presence of a notary public to ensure it's legally binding.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to sign the affidavit in front of a notary.

- Omitting necessary details about surviving relatives.

- Incorrectly answering questions regarding existing wills or probate status.

- Not providing the correct address of the deceased.

Advantages of online completion

- Convenience of downloading the form anytime and anywhere.

- Editable fields to ensure all information is accurate and up-to-date.

- Reliable templates drafted by licensed attorneys to ensure legal compliance.

Looking for another form?

Form popularity

FAQ

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

When a person who owns real property dies intestate, and there is no survivor mentioned in the deed, the heirs of the decedent, must file an affidavit of descent to establish their chain of title to the property. This affidavit, is known as an affidavit of descent.

Step 1 At the top, write in the name of the decedent. Step 2 Under Section 1, write in the date of birth, the date of death, the residential address of decedent. Step 3 In Section 2, check the box that describes you as the person filling out the affidavit.

The transfer by affidavit process can be used to close a person's estate when the deceased has $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.