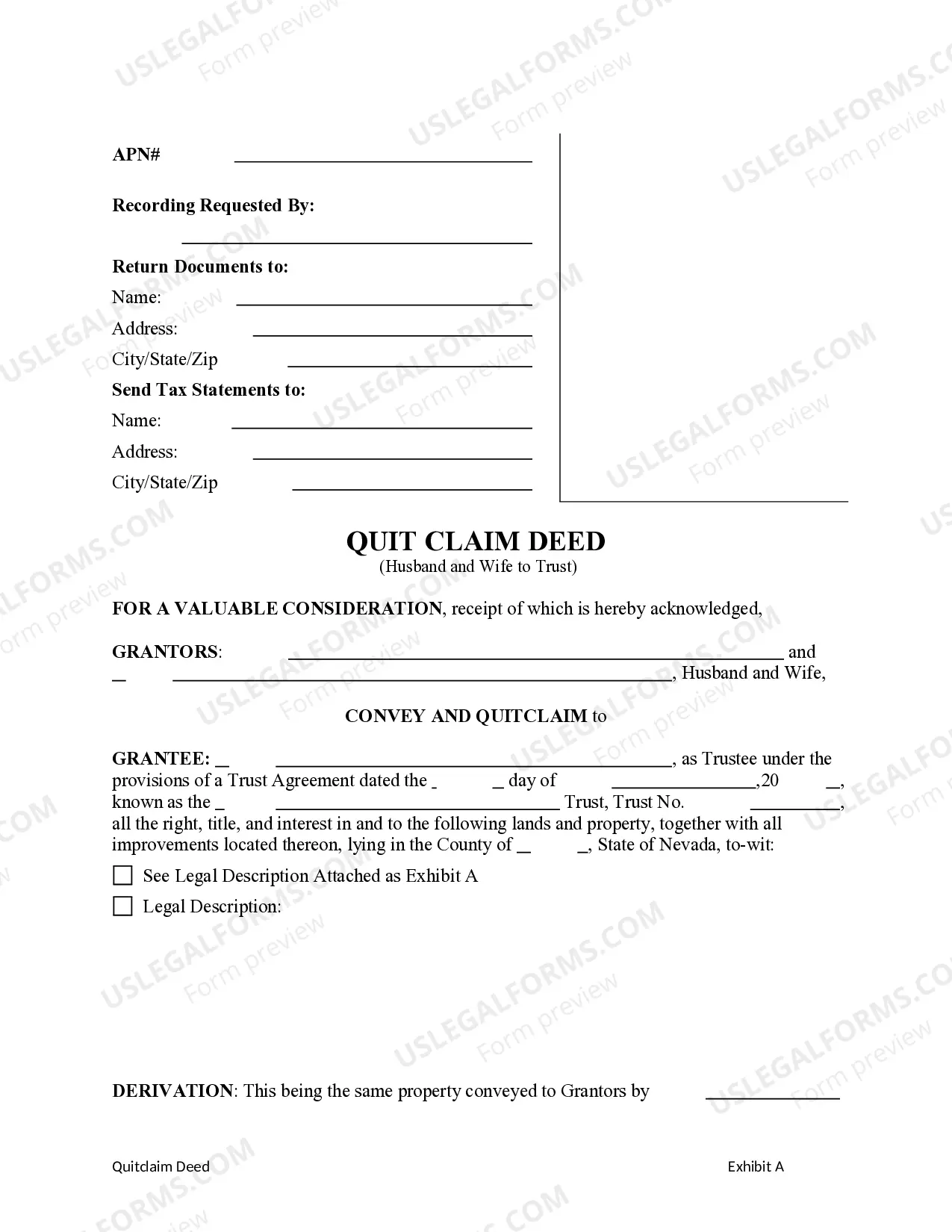

This form is a Quitclaim Deed where the grantors are husband and wife and the grantee is the trustee of a trust. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Nevada Quitclaim Deed - Husband and Wife to Trust

Description

How to fill out Nevada Quitclaim Deed - Husband And Wife To Trust?

US Legal Forms is a unique system where you can find any legal or tax template for filling out, including Nevada Quitclaim Deed - Husband and Wife to Trust. If you’re sick and tired of wasting time looking for suitable examples and paying money on record preparation/attorney service fees, then US Legal Forms is precisely what you’re looking for.

To enjoy all of the service’s advantages, you don't need to download any software but just select a subscription plan and register an account. If you already have one, just log in and find the right template, download it, and fill it out. Downloaded documents are saved in the My Forms folder.

If you don't have a subscription but need to have Nevada Quitclaim Deed - Husband and Wife to Trust, have a look at the recommendations below:

- make sure that the form you’re checking out applies in the state you need it in.

- Preview the sample its description.

- Click on Buy Now button to reach the sign up page.

- Choose a pricing plan and continue registering by providing some information.

- Select a payment method to complete the sign up.

- Download the file by choosing your preferred file format (.docx or .pdf)

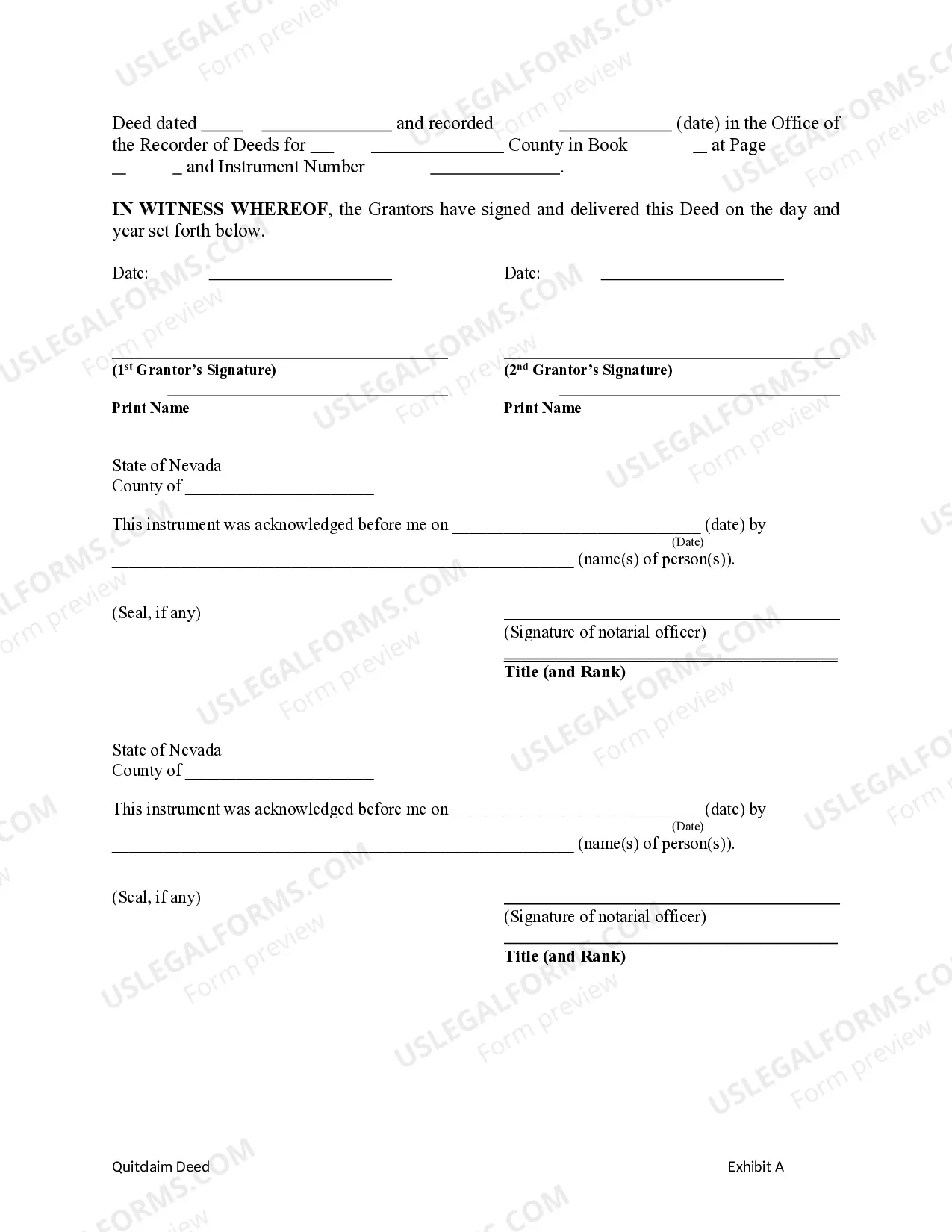

Now, fill out the document online or print it. If you feel unsure about your Nevada Quitclaim Deed - Husband and Wife to Trust template, speak to a lawyer to check it before you send or file it. Start hassle-free!

Form popularity

FAQ

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

Once your mortgage loan closes and the trust deed is signed, you cannot simply add another person as a borrower. You need to refinance the loan to accomplish this. Talk to the other person about his current financial situation.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.