Nevada Quitclaim Deed by Two Individuals to Husband and Wife

Description

Key Concepts & Definitions

Quitclaim Deed: A legal instrument used to transfer interest in real property. The grantor (transferor) terminates any right and claim to the property, allowing the right or claim to transfer to the grantee (receiver), but without any warranty of title. Warranty Deed: Contrary to quitclaim deeds, a warranty deed guarantees that the grantor holds clear title to a property and has a right to sell it. Joint Tenants: A form of co-ownership where property is owned by two or more individuals equally. If one owner dies, the property automatically passes to the surviving co-owners. Tenants Common: Another form of co-ownership where each party owns a specified fraction of the entire property and can dispose of their own interest as they choose.

Step-by-Step Guide on Using a Quitclaim Deed By Two Individuals to Husband

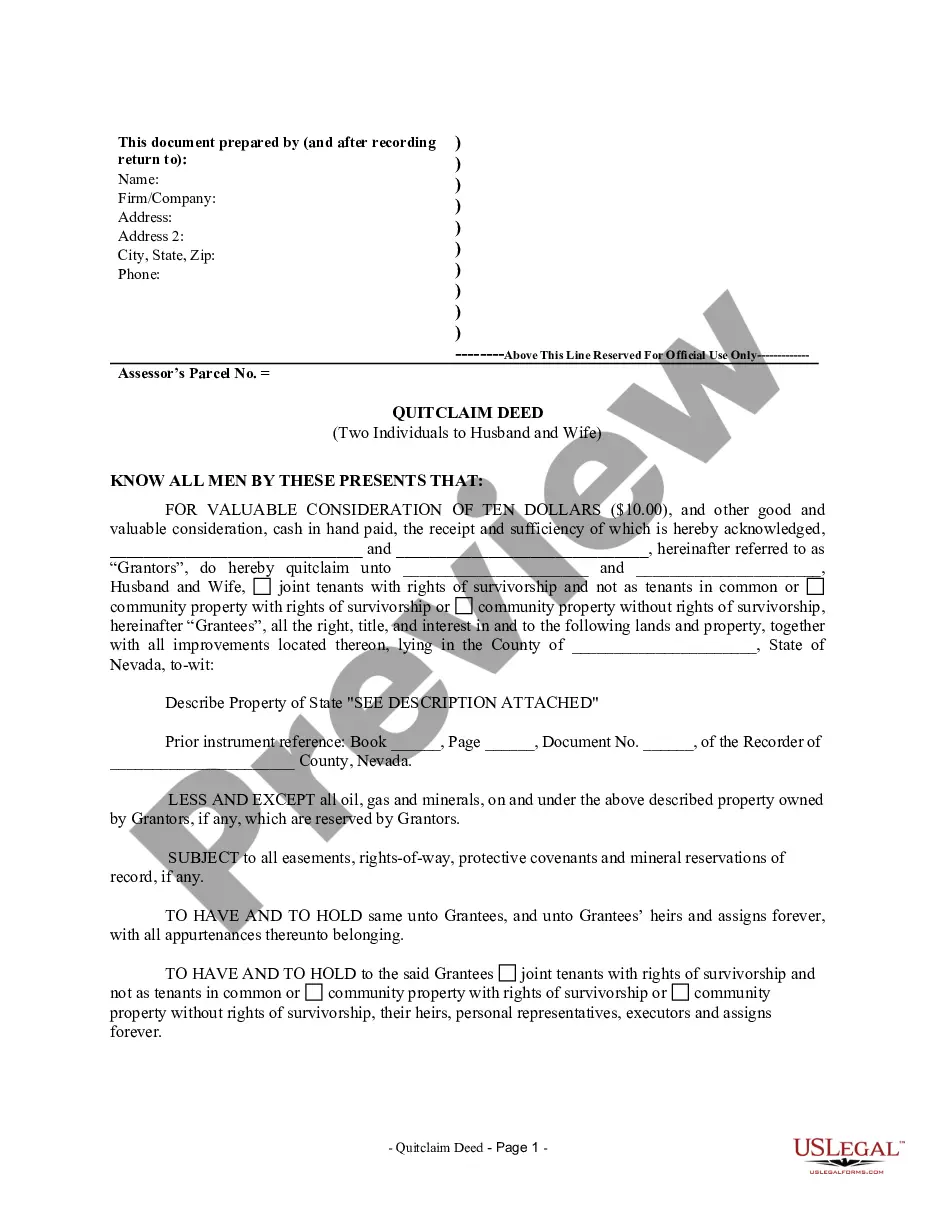

- Prepare the Quitclaim Deed Form: Start by obtaining a proper form, which can typically be found online or sourced through legal assistance service.

- Complete the Form: Fill out the form, specifying the details of the property, the names of the grantors (the two individuals), and the grantee (the husband).

- Signatures: The deed must be signed by the grantors in the presence of a notary public to ensure the deed is legally binding.

- File the Deed: The signed deed should be filed with the local county recorder's office to make the transfer official and update the public record.

Risk Analysis

Using a quitclaim deed for transferring property ownership comes with risks. No Guarantee of Clear Title: The grantee receives no guarantees on the clarity of the property's title, potentially inheriting undisclosed liens or other encumbrances. Limited Recourse: If issues arise, the grantee's legal recourse against the grantors is limited, often making this a risky choice for high-value transactions.

Best Practices

- Seek Professional Advice: Consulting with legal professionals or using reputable online legal help platforms is crucial to navigate the complexities of property transfers.

- Understand the Types of Deeds: Be aware of the differences between quitclaim deeds and warranty deeds to choose the one that best suits your needs.

- Review Property Ownership Rights: Thoroughly understanding joint tenants and tenants in common can help decide how to structure the property ownership post-transfer.

Common Mistakes & How to Avoid Them

- Not Using the Correct Form: Always ensure to use the state-specific quitclaim deed form to avoid legal complications.

- Failing to Record the Deed: Immediately file the deed post-signature to ensure legal recognition and to avoid disputes.

- Overlooking Interspousal Transfers Rules: Depending on the state, different rules may apply to interspousal transfers, including potential tax implications.

FAQ

- What is a quitclaim deed by two individuals to husband? This refers to a situation where two individuals transfer their property interest to their spouse using a quitclaim deed.

- Is a quitclaim deed legally binding? Yes, once a quitclaim deed is properly signed and recorded, it is legally binding.

- Can a quitclaim deed be reversed? Generally, once executed, it is challenging to reverse unless all parties agree or if fraud is proven.

How to fill out Nevada Quitclaim Deed By Two Individuals To Husband And Wife?

US Legal Forms is a special system where you can find any legal or tax template for filling out, including Nevada Quitclaim Deed by Two Individuals to Husband and Wife. If you’re tired of wasting time seeking suitable samples and paying money on document preparation/lawyer fees, then US Legal Forms is exactly what you’re trying to find.

To experience all of the service’s advantages, you don't need to download any software but simply choose a subscription plan and create an account. If you have one, just log in and find an appropriate sample, download it, and fill it out. Downloaded files are all stored in the My Forms folder.

If you don't have a subscription but need Nevada Quitclaim Deed by Two Individuals to Husband and Wife, take a look at the recommendations below:

- make sure that the form you’re taking a look at applies in the state you need it in.

- Preview the example its description.

- Click on Buy Now button to get to the register webpage.

- Select a pricing plan and proceed registering by providing some information.

- Select a payment method to complete the registration.

- Download the file by selecting your preferred format (.docx or .pdf)

Now, submit the file online or print it. If you feel uncertain concerning your Nevada Quitclaim Deed by Two Individuals to Husband and Wife sample, contact a legal professional to review it before you decide to send or file it. Start hassle-free!

Form popularity

FAQ

In cases where a couple shares a home but only one spouse's name is on it, the home will not automatically pass to the surviving pass, if his or her name is not on the title.

The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner. The quitclaim deed must include the property's description, including its boundary lines.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

The names on the mortgage show who's responsible for paying back the loan, while the title shows who owns the property. You can put your spouse on the title without putting them on the mortgage; this would mean that they share ownership of the home but aren't legally responsible for making mortgage payments.

California married couples generally have three options to take title to their community (vs separate) property real estate: community property, joint tenancy or Community Property with Right of Survivorship. The latter coming into play in California July of 2001.

The Quit Claim Deed form uses the terms of Grantor (Seller or Owner of said property) and Grantee (Buyer of said property) for the two parties involved. First, the parties must fill in the date. Then, write in the name of the county and state in which the property is located.

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.