This form is a Quitclaim Deed where the Grantor is an Individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Nevada Quitclaim Deed - Individual to a Trust

Description

How to fill out Nevada Quitclaim Deed - Individual To A Trust?

US Legal Forms is a unique system to find any legal or tax form for completing, such as Nevada Quitclaim Deed - Individual to a Trust. If you’re tired with wasting time looking for ideal examples and paying money on papers preparation/attorney service fees, then US Legal Forms is precisely what you’re searching for.

To enjoy all the service’s benefits, you don't have to install any software but just select a subscription plan and register an account. If you already have one, just log in and find an appropriate template, save it, and fill it out. Downloaded files are kept in the My Forms folder.

If you don't have a subscription but need to have Nevada Quitclaim Deed - Individual to a Trust, check out the instructions below:

- Double-check that the form you’re considering applies in the state you want it in.

- Preview the form its description.

- Click on Buy Now button to reach the register webpage.

- Pick a pricing plan and carry on signing up by providing some info.

- Select a payment method to complete the sign up.

- Download the file by selecting the preferred file format (.docx or .pdf)

Now, submit the file online or print it. If you feel uncertain concerning your Nevada Quitclaim Deed - Individual to a Trust template, speak to a attorney to check it before you send or file it. Get started hassle-free!

Form popularity

FAQ

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

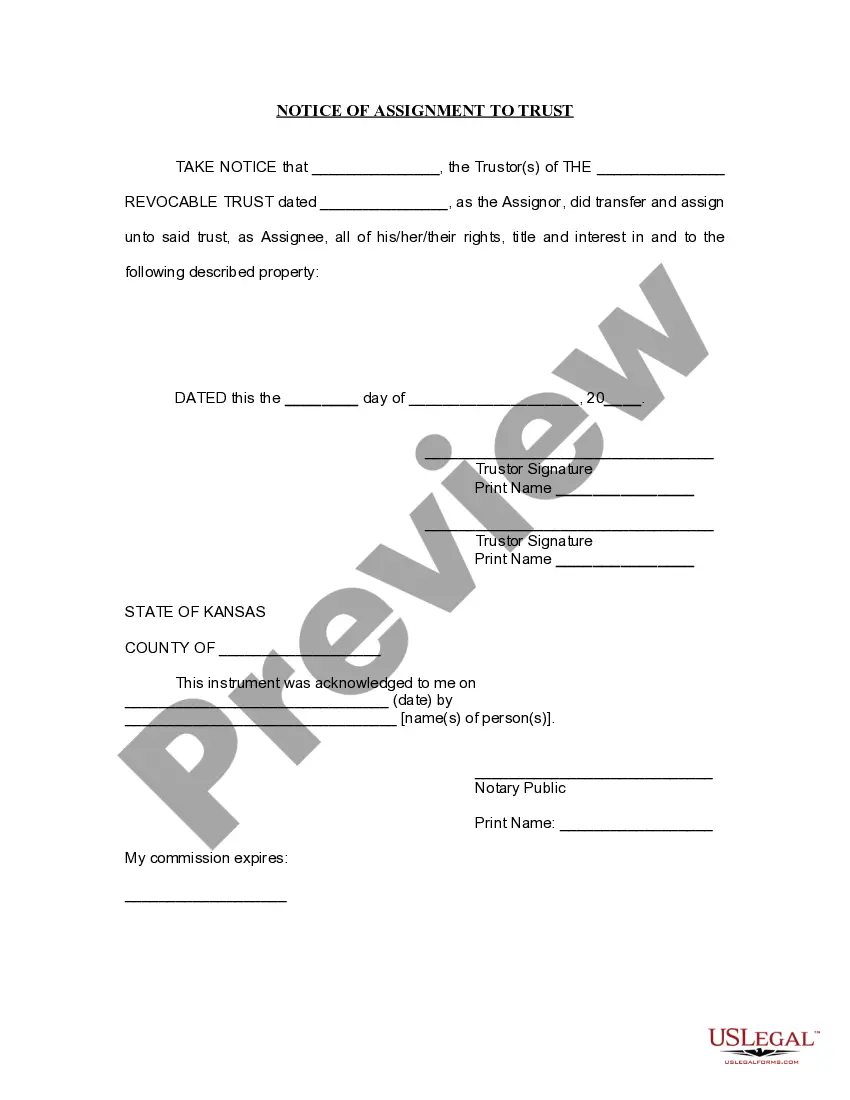

Take the signed and notarized quitclaim deed to your county recorder's office to complete the transfer of title into your revocable trust. Check in two to four weeks to ensure it has been recorded. Include the address of the property on the asset list addendum attached to your trust.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).