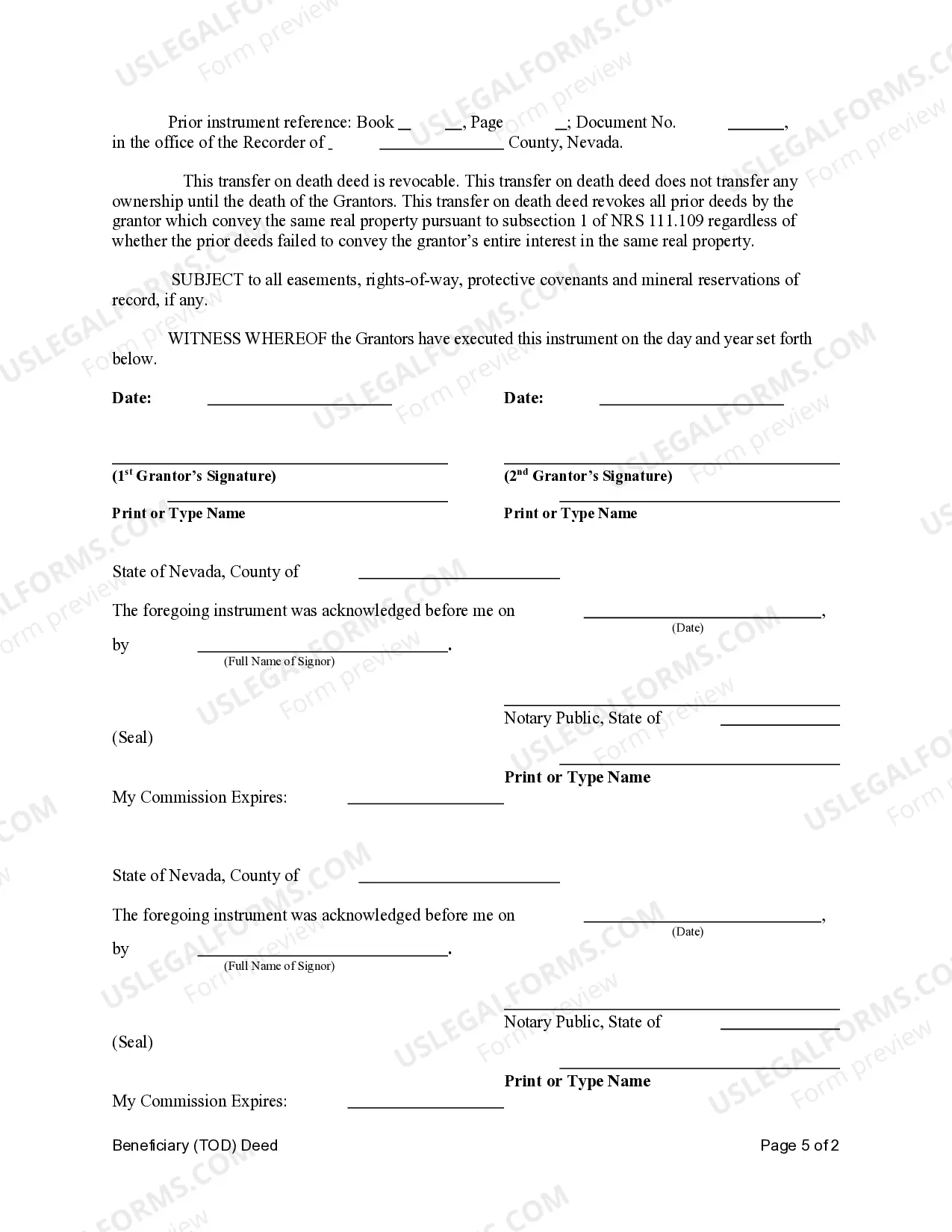

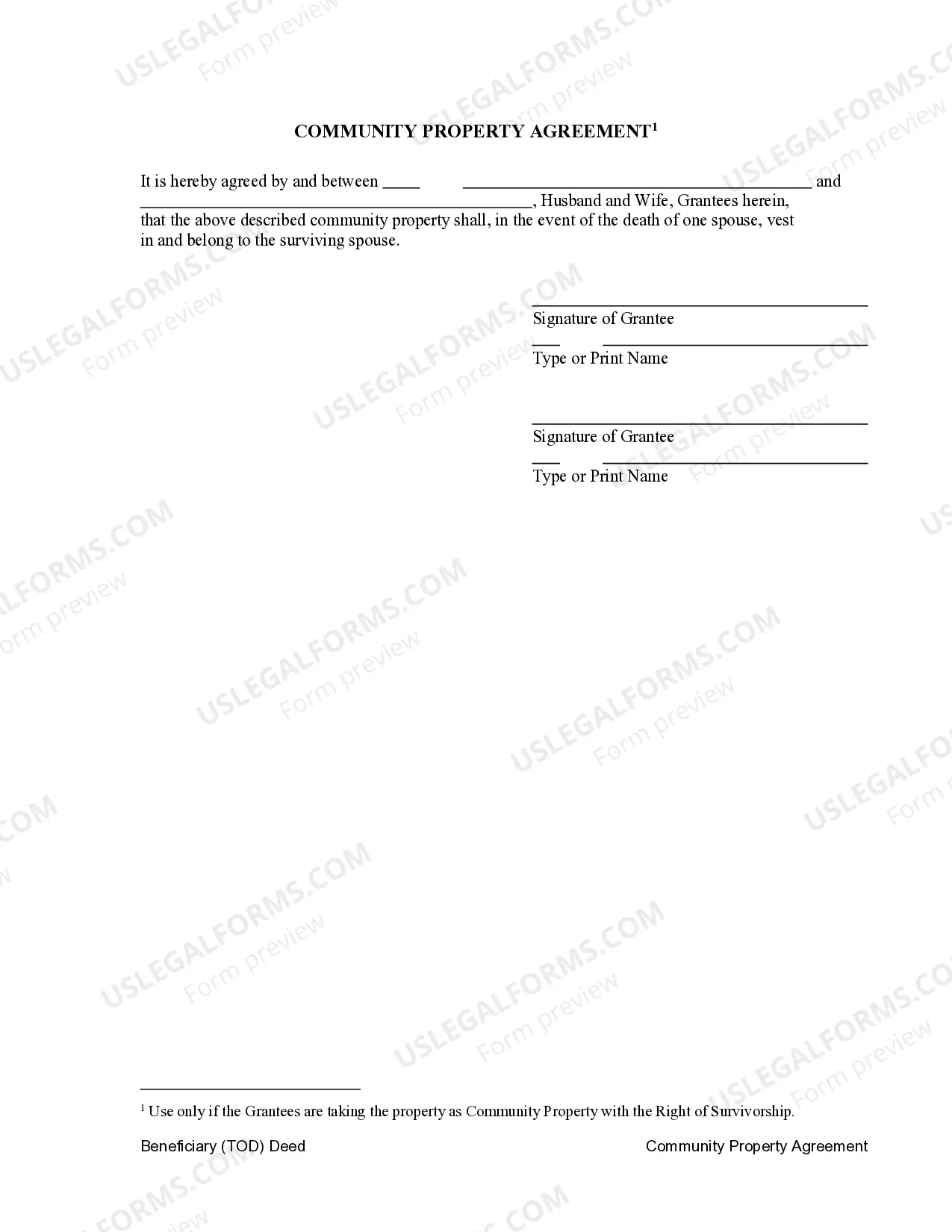

Transfer on Death Deed - Beneficiary Deed - Nevada - Husband and Wife Two Individuals to Husband and Wife / Two Individuals. This deed is used to transfer the ownership or title of a parcel of land upon the death of the Grantors to the Grantees. It does not transfer any present ownership interest in the property and is revocable at any time. Therefore, it is commonly used to avoid probate upon death.

A Nevada Transfer on Death Deed (TOD) or Beneficiary Deed from Husband and Wife / Two Individuals to Husband and Wife / Two Individuals is a legal document that is used to transfer the ownership of real estate in Nevada from one party to another after the death of the original owner. The Nevada TOD Deed allows the original owner to designate a beneficiary or beneficiaries who will receive the real estate upon the original owner's death without going through the probate process. This document is also known as a Beneficiary Deed or Survivorship Deed. There are two types of Nevada Transfer on Death Deeds or TOD — Beneficiary Deeds from Husband and Wife / Two Individuals to Husband and Wife / Two Individuals: a Joint TOD Deed and an Individual TOD Deed. The Joint TOD Deed allows two people to transfer their real estate to each other upon the death of either of them, while the Individual TOD Deed allows an individual to transfer their real estate to another individual upon their death. Both types of Nevada Transfer on Death Deeds or TOD — Beneficiary Deeds from Husband and Wife / Two Individuals to Husband and Wife / Two Individuals are legally binding and require the signature of both parties in order to be valid.