This form is a Gift Deed where the Grantor is an individual and the Grantee ia also an Individual. Grantor grants and conveys the described property to Grantee. This deed complies with all state statutory 0laws.

Nevada Gift Deed - Individual to Individual

Description Individual Estate Form

How to fill out Deed Estate Form?

US Legal Forms is actually a unique platform to find any legal or tax form for submitting, including Nevada Gift Deed - Individual to Individual. If you’re fed up with wasting time seeking ideal samples and paying money on file preparation/attorney service fees, then US Legal Forms is exactly what you’re seeking.

To enjoy all of the service’s advantages, you don't need to download any software but just pick a subscription plan and register your account. If you already have one, just log in and look for the right sample, download it, and fill it out. Downloaded documents are all saved in the My Forms folder.

If you don't have a subscription but need to have Nevada Gift Deed - Individual to Individual, check out the guidelines below:

- Double-check that the form you’re looking at is valid in the state you need it in.

- Preview the sample and look at its description.

- Simply click Buy Now to access the register webpage.

- Pick a pricing plan and proceed signing up by entering some info.

- Select a payment method to complete the registration.

- Download the file by selecting the preferred file format (.docx or .pdf)

Now, fill out the file online or print out it. If you are unsure regarding your Nevada Gift Deed - Individual to Individual sample, contact a attorney to check it before you decide to send or file it. Start hassle-free!

Nv Gift Form Form popularity

Nv Form Nevada Other Form Names

Gift Real Download FAQ

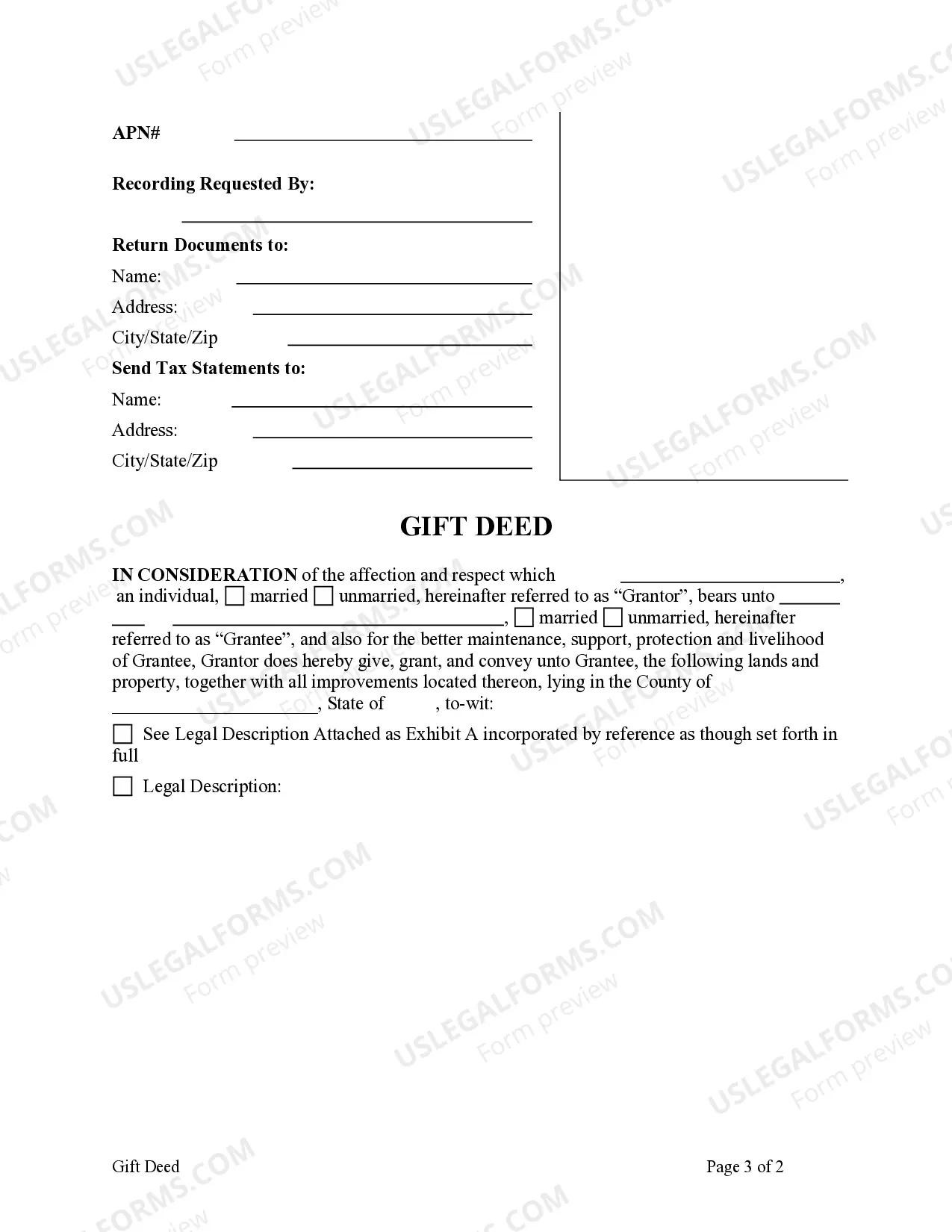

Place and date on which the deed is to be executed. Relevant information regarding the donor and the donee, such as their names, address, relationship, date of birth and signatures. Complete details about the property. Two witnesses to bear testimony and their signatures.

A Deed of Gift is a formal legal document used to give a gift of property or money to another person. It transfers the money or ownership of property (or share in a property) to another person without payment is demanded in return.Giving a gift to someone can have some Inheritance Tax implications.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court. Registration of gift deed is not required in case of transfer of moveable property.Gift of immovable property which is not registered is not a valid as per law and cannot pass any title to the donee.

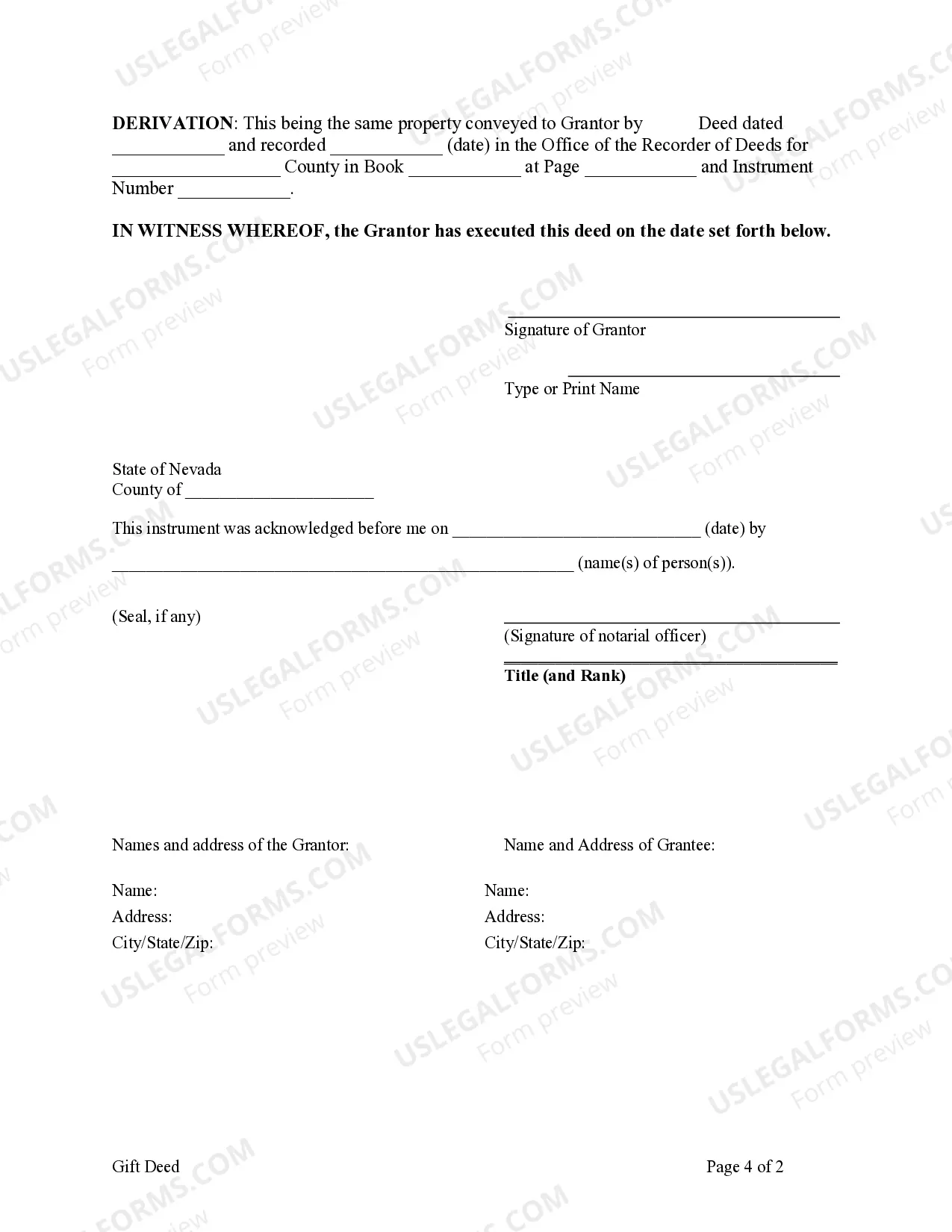

For the purpose of making a gift of immovable property, the transfer must be registered, signed by or on behalf of the donor, and attested by at least two witnesses. The stamp duty, calculated on the basis of the market value of the property (differing from state to state), must be paid at the time of registration.

Any person of sound mind, and above the age of 18 can be a witness. any least two witnesses should attest in the gift deed . - Since, the said property is self acquired property of your grandfather , then he is having his right to gift you without the interfere of any other legal heirs like your father etc.

Place and date on which the deed is to be executed. Relevant information regarding the donor and the donee, such as their names, address, relationship, date of birth and signatures. Complete details about the property. Two witnesses to bear testimony and their signatures.

You made the right choice in seeking advise about gifting. Although you are entitled the the same small annual exclusion as a U.S. Person a non-resident alien has no lifetime gift exclusion.

To sign over property ownership to another person, you'll use one of two deeds: a quitclaim deed or a warranty deed.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court. Registration of gift deed is not required in case of transfer of moveable property.Gift of immovable property which is not registered is not a valid as per law and cannot pass any title to the donee.